Thirty One Tax Form

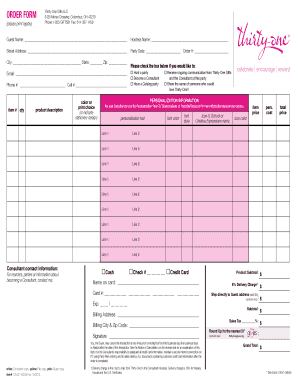

What is the thirty one tax form?

The thirty one tax form, commonly referred to as the thirty one 1099, is a crucial document used in the United States for reporting various types of income other than wages, salaries, and tips. This form is typically issued to independent contractors, freelancers, and other non-employees who receive payments from a business. It serves to inform the Internal Revenue Service (IRS) about the income earned by these individuals, ensuring that all income is accurately reported for tax purposes.

How to use the thirty one tax form

Using the thirty one tax form involves several steps to ensure compliance with IRS regulations. First, the payer must gather all necessary information about the recipient, including their name, address, and taxpayer identification number (TIN). Next, the payer fills out the form by detailing the amount paid during the tax year. Once completed, the payer must provide a copy of the thirty one 1099 to the recipient and submit the form to the IRS by the designated deadline. It is essential to keep accurate records of all transactions to avoid discrepancies.

Steps to complete the thirty one tax form

Completing the thirty one tax form requires careful attention to detail. Follow these steps:

- Gather recipient information, including name, address, and TIN.

- Determine the total amount paid to the recipient during the tax year.

- Fill out the form, ensuring all information is accurate and complete.

- Provide copies to the recipient and submit the form to the IRS.

- Retain a copy for your records for future reference.

Legal use of the thirty one tax form

The thirty one tax form must be used in accordance with IRS guidelines to ensure its legality. This includes accurately reporting all income and ensuring that the form is submitted by the appropriate deadlines. Failure to comply with these regulations can result in penalties for both the payer and the recipient. It is essential to understand the legal implications of the form and to use it responsibly to avoid any issues with tax compliance.

Filing deadlines / important dates

Filing deadlines for the thirty one tax form are critical to ensure compliance with IRS regulations. Generally, the form must be filed with the IRS by the end of January for the previous tax year. Recipients should also receive their copy by this date. It is important to stay informed about any changes to these deadlines, as they can vary from year to year. Missing the deadline can lead to penalties and interest on unpaid taxes.

Who issues the form?

The thirty one tax form is typically issued by businesses or individuals who pay non-employees for services rendered. This includes companies hiring freelancers, independent contractors, or any other service providers. It is the responsibility of the payer to ensure that the form is accurately completed and submitted to the IRS, as well as provided to the recipient. Understanding who is responsible for issuing the form is essential for proper tax reporting.

Quick guide on how to complete thirty one tax form

Complete Thirty One Tax Form effortlessly on any device

Digital document management has gained traction among businesses and individuals alike. It offers an ideal environmentally friendly alternative to conventional printed and signed papers, as you can obtain the required form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents swiftly without interruptions. Handle Thirty One Tax Form on any platform with airSlate SignNow Android or iOS applications and enhance any document-focused process today.

How to edit and eSign Thirty One Tax Form with ease

- Obtain Thirty One Tax Form and then click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Mark important sections of your documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and has the same legal validity as a conventional wet ink signature.

- Review all the information and then click on the Done button to save your changes.

- Select your preferred method to share your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form navigation, or mistakes that require printing new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device you prefer. Edit and eSign Thirty One Tax Form to ensure effective communication at all stages of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the thirty one tax form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a thirty one 1099 form?

The thirty one 1099 form is a tax document used to report various types of income other than wages, salaries, or tips. It's commonly utilized by freelancers and independent contractors to report earnings to the IRS. Using airSlate SignNow can simplify the process of sending and eSigning these important documents.

-

How does airSlate SignNow help with thirty one 1099 forms?

airSlate SignNow allows businesses to easily create, send, and eSign thirty one 1099 forms electronically. This eliminates the need for paper, making the entire process faster and more efficient. Using our solution, you can ensure that your 1099 forms are securely signed and properly managed.

-

What are the pricing options for airSlate SignNow related to thirty one 1099?

airSlate SignNow offers various pricing tiers depending on your business needs, making it a cost-effective solution for managing thirty one 1099 forms. You can choose from monthly or annual plans that fit your budget. Check our website for the latest offers and detailed pricing information.

-

Can I integrate other software with airSlate SignNow for thirty one 1099 management?

Absolutely! airSlate SignNow seamlessly integrates with popular accounting and payroll software, making it easier to manage your thirty one 1099 forms. By connecting your existing systems, you can streamline the workflow from document creation to eSigning, ensuring efficiency in your operations.

-

What features does airSlate SignNow offer for thirty one 1099 forms?

Key features of airSlate SignNow for managing thirty one 1099 forms include customizable templates, secure eSigning, and real-time tracking. You can also set reminders for document completion, which helps ensure your forms are filed on time. These features enhance the overall user experience, making it simpler for businesses to manage their documents.

-

Is airSlate SignNow secure for handling thirty one 1099 forms?

Yes, airSlate SignNow employs industry-leading security measures to ensure that your thirty one 1099 forms and sensitive information are protected. With encryption, secure cloud storage, and compliance with regulations, you can trust that your documents remain safe. Our commitment to security makes us a reliable choice for businesses.

-

How quickly can I send thirty one 1099 forms using airSlate SignNow?

You can send thirty one 1099 forms within minutes using airSlate SignNow. The platform's user-friendly interface allows for quick document creation and eSigning. Once your forms are ready, you can easily distribute them to recipients via email, ensuring that the process is both fast and efficient.

Get more for Thirty One Tax Form

Find out other Thirty One Tax Form

- Can I eSign Washington Charity LLC Operating Agreement

- eSign Wyoming Charity Living Will Simple

- eSign Florida Construction Memorandum Of Understanding Easy

- eSign Arkansas Doctors LLC Operating Agreement Free

- eSign Hawaii Construction Lease Agreement Mobile

- Help Me With eSign Hawaii Construction LLC Operating Agreement

- eSign Hawaii Construction Work Order Myself

- eSign Delaware Doctors Quitclaim Deed Free

- eSign Colorado Doctors Operating Agreement Computer

- Help Me With eSign Florida Doctors Lease Termination Letter

- eSign Florida Doctors Lease Termination Letter Myself

- eSign Hawaii Doctors Claim Later

- eSign Idaho Construction Arbitration Agreement Easy

- eSign Iowa Construction Quitclaim Deed Now

- How Do I eSign Iowa Construction Quitclaim Deed

- eSign Louisiana Doctors Letter Of Intent Fast

- eSign Maine Doctors Promissory Note Template Easy

- eSign Kentucky Construction Claim Online

- How Can I eSign Maine Construction Quitclaim Deed

- eSign Colorado Education Promissory Note Template Easy