Utility Services Tax Return Gross Operating Income Tax Ny Form

What is the Utility Services Tax Return Gross Operating Income Tax Ny

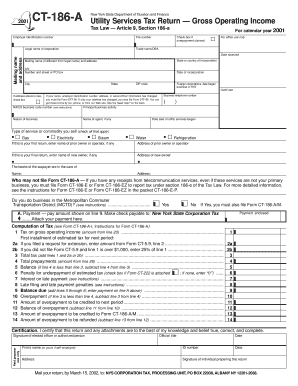

The Utility Services Tax Return Gross Operating Income Tax in New York is a tax imposed on utility companies based on their gross operating income. This tax is applicable to various utility services, including electricity, gas, and telecommunications. The primary purpose of this tax is to generate revenue for the state while ensuring that utility companies contribute fairly based on their earnings from operations within New York. Understanding this tax is crucial for utility providers to maintain compliance and manage their financial obligations effectively.

Steps to complete the Utility Services Tax Return Gross Operating Income Tax Ny

Completing the Utility Services Tax Return involves several key steps:

- Gather financial records: Collect all relevant financial documents that detail gross operating income from utility services.

- Determine taxable income: Calculate the gross operating income by including all revenue generated from utility services.

- Fill out the tax return form: Accurately complete the Utility Services Tax Return form, ensuring all sections are filled out according to the instructions provided.

- Review and verify: Double-check all calculations and information entered on the form to avoid errors.

- Submit the form: File the completed tax return by the specified deadline, either electronically or by mail.

Required Documents

To successfully file the Utility Services Tax Return, certain documents are essential:

- Financial statements: These should include income statements and balance sheets that reflect the utility company's financial performance.

- Revenue records: Detailed records of all income generated from utility services are necessary to calculate gross operating income.

- Previous tax returns: Having copies of past tax returns can assist in ensuring consistency and accuracy in reporting.

- Supporting documentation: Any additional documents that substantiate the reported income, such as contracts or invoices, may be required.

Filing Deadlines / Important Dates

Staying informed about filing deadlines is critical for compliance. The Utility Services Tax Return typically has specific due dates that vary based on the reporting period. Generally, returns must be filed annually, and the deadline is usually set for the end of the first quarter following the close of the tax year. It is advisable to check the New York State Department of Taxation and Finance website for the most current deadlines and any updates that may affect filing schedules.

Penalties for Non-Compliance

Failure to comply with the Utility Services Tax Return requirements can result in significant penalties. These may include:

- Late filing penalties: If the return is not submitted by the deadline, a penalty may be assessed based on the amount of tax due.

- Interest on unpaid taxes: Any taxes not paid by the due date may accrue interest until they are settled.

- Potential legal action: Continued non-compliance may lead to further legal consequences, including audits or enforcement actions by tax authorities.

Legal use of the Utility Services Tax Return Gross Operating Income Tax Ny

The legal framework surrounding the Utility Services Tax Return Gross Operating Income Tax in New York is established by state tax laws. Utility companies are required to adhere to these laws to ensure they are operating within legal parameters. Compliance not only helps avoid penalties but also contributes to the overall regulatory environment governing utility services. It is essential for businesses to stay updated on any changes in legislation that may impact their tax obligations.

Quick guide on how to complete utility services tax return gross operating income tax ny

Effortlessly prepare [SKS] on any device

Digital document management has become increasingly popular among businesses and individuals. It offers a perfect eco-friendly substitute to traditional printed and signed documents, as you can locate the necessary form and securely store it online. airSlate SignNow provides all the resources you require to create, modify, and electronically sign your documents swiftly and without delays. Manage [SKS] on any device with the airSlate SignNow applications for Android or iOS and streamline any document-based procedure today.

The easiest way to modify and electronically sign [SKS] without hassle

- Find [SKS] and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize pertinent sections of the documents or conceal sensitive information with tools specifically offered by airSlate SignNow for that purpose.

- Generate your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all details and click the Done button to save your changes.

- Select how you wish to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious document searches, or errors requiring new copies to be printed. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you prefer. Modify and electronically sign [SKS] to ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Utility Services Tax Return Gross Operating Income Tax Ny

Create this form in 5 minutes!

How to create an eSignature for the utility services tax return gross operating income tax ny

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Utility Services Tax Return Gross Operating Income Tax NY?

The Utility Services Tax Return Gross Operating Income Tax NY is a tax levied on the gross operating income of utility services providers in New York. This tax helps fund local municipalities and ensure infrastructure development. Businesses in this sector must file returns accurately to comply with state regulations.

-

How can airSlate SignNow help with my Utility Services Tax Return Gross Operating Income Tax NY?

airSlate SignNow streamlines the process of preparing and submitting your Utility Services Tax Return Gross Operating Income Tax NY by allowing you to easily create, sign, and manage your tax documents online. Our user-friendly platform ensures that you can efficiently handle all your tax-related paperwork without hassle.

-

What features does airSlate SignNow offer for managing tax documents?

airSlate SignNow offers features such as customizable templates, real-time document tracking, and secure eSigning, specifically designed to simplify the management of your Utility Services Tax Return Gross Operating Income Tax NY documents. These tools help ensure your submissions are accurate and timely, reducing the risk of penalties.

-

Is airSlate SignNow cost-effective for businesses filing taxes?

Yes, airSlate SignNow provides a cost-effective solution for businesses dealing with the Utility Services Tax Return Gross Operating Income Tax NY. With competitive pricing plans that cater to different business sizes, you can access a suite of features that enhance your tax filing process without breaking the bank.

-

Can airSlate SignNow integrate with other financial software for tax preparation?

Absolutely, airSlate SignNow integrates seamlessly with various financial software solutions that you may use for preparing your Utility Services Tax Return Gross Operating Income Tax NY. This integration helps synchronize your financial data, ensuring accuracy when filing taxes and streamlining workflow.

-

What benefits does eSigning provide for tax return submissions?

eSigning through airSlate SignNow offers numerous benefits for submitting your Utility Services Tax Return Gross Operating Income Tax NY, including enhanced security, faster processing times, and reduced paperwork. eSignatures are legally binding and ensure that your documents are finalized promptly, preventing delays in compliance.

-

How secure is airSlate SignNow for handling sensitive tax information?

airSlate SignNow prioritizes security by employing advanced encryption and compliance with industry standards, making it a safe choice for handling your Utility Services Tax Return Gross Operating Income Tax NY documents. You can trust that your sensitive tax information is protected throughout the signing and submitting process.

Get more for Utility Services Tax Return Gross Operating Income Tax Ny

Find out other Utility Services Tax Return Gross Operating Income Tax Ny

- Can I eSignature Tennessee Police Form

- How Can I eSignature Vermont Police Presentation

- How Do I eSignature Pennsylvania Real Estate Document

- How Do I eSignature Texas Real Estate Document

- How Can I eSignature Colorado Courts PDF

- Can I eSignature Louisiana Courts Document

- How To Electronic signature Arkansas Banking Document

- How Do I Electronic signature California Banking Form

- How Do I eSignature Michigan Courts Document

- Can I eSignature Missouri Courts Document

- How Can I Electronic signature Delaware Banking PDF

- Can I Electronic signature Hawaii Banking Document

- Can I eSignature North Carolina Courts Presentation

- Can I eSignature Oklahoma Courts Word

- How To Electronic signature Alabama Business Operations Form

- Help Me With Electronic signature Alabama Car Dealer Presentation

- How Can I Electronic signature California Car Dealer PDF

- How Can I Electronic signature California Car Dealer Document

- How Can I Electronic signature Colorado Car Dealer Form

- How To Electronic signature Florida Car Dealer Word