Formulario 480

What is the Formulario 480

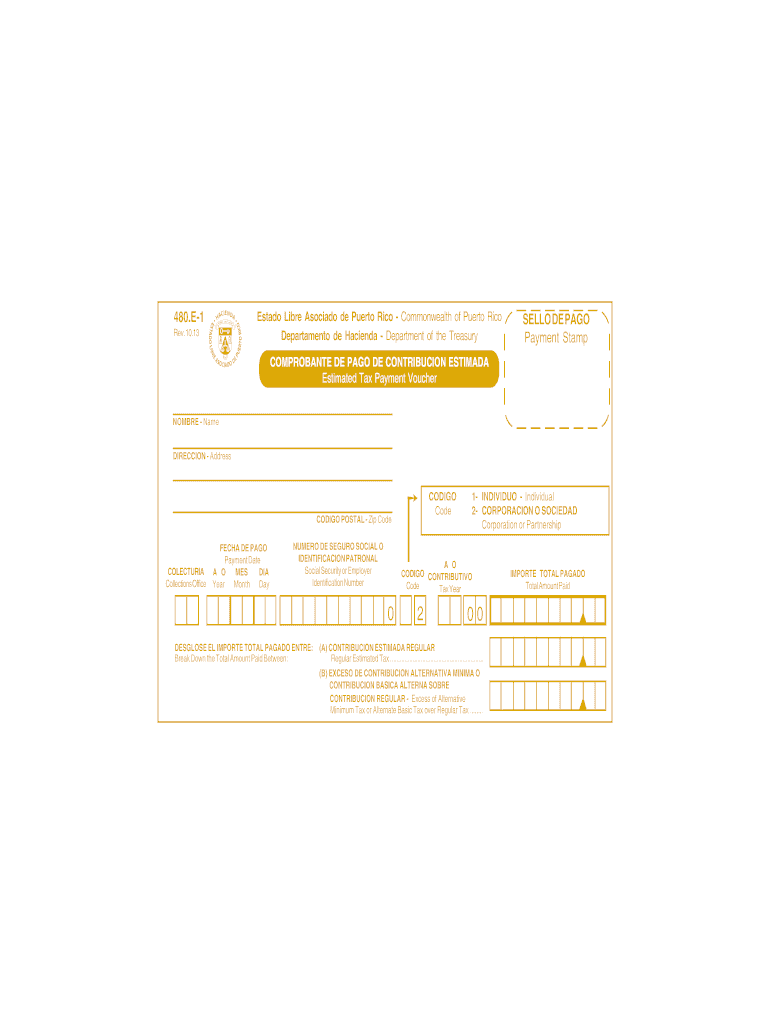

The Formulario 480, also known as the informativa 480, is a tax form used in Puerto Rico for reporting various types of income. This form is essential for individuals and businesses that need to report income received from professional services, interest, dividends, and other sources. The informativa 480 is particularly important for ensuring compliance with local tax regulations and is required for accurate tax filings.

How to use the Formulario 480

Using the Formulario 480 involves several key steps. First, gather all necessary financial documents that detail the income you need to report. Next, accurately fill out the form, ensuring that all income sources are included. It is crucial to provide correct information to avoid penalties. After completing the form, you can submit it according to the guidelines provided by the Puerto Rico Department of Treasury.

Steps to complete the Formulario 480

Completing the Formulario 480 requires careful attention to detail. Follow these steps:

- Collect all relevant income documentation, such as invoices and payment records.

- Obtain the latest version of the Formulario 480 from the appropriate tax authority.

- Fill out the form, ensuring to report all income accurately.

- Review the form for any errors or omissions.

- Submit the completed form by the designated deadline.

Legal use of the Formulario 480

The legal use of the Formulario 480 is governed by tax regulations in Puerto Rico. It serves as an official document for reporting income and must be filed accurately to ensure compliance with local tax laws. Failure to submit this form can result in penalties, including fines or additional scrutiny from tax authorities. It is essential to understand the legal implications of this form to avoid any potential issues.

Filing Deadlines / Important Dates

Filing deadlines for the Formulario 480 are critical to ensure compliance. Typically, the deadline falls on the 15th day of the fourth month following the end of the tax year. For individuals and businesses, it is essential to be aware of these dates to avoid late fees or penalties. Keeping track of these deadlines helps in maintaining good standing with the tax authorities.

Required Documents

To complete the Formulario 480, several documents are required. These include:

- Proof of income, such as invoices or payment statements.

- Previous tax returns, if applicable.

- Any additional documentation that supports income claims.

Having these documents ready will streamline the process of filling out the form and ensure accuracy.

Who Issues the Form

The Formulario 480 is issued by the Puerto Rico Department of Treasury. This government agency is responsible for providing the necessary forms and guidelines for tax compliance. It is important to obtain the form directly from this official source to ensure you are using the most current version, as regulations and requirements may change.

Quick guide on how to complete formulario 480

Complete Formulario 480 effortlessly on any device

Online document management has gained traction among businesses and individuals alike. It offers a perfect eco-friendly substitute to conventional printed and signed paperwork, as you can easily locate the right form and securely keep it online. airSlate SignNow equips you with all the necessary tools to create, edit, and eSign your documents quickly and without delays. Handle Formulario 480 on any platform using the airSlate SignNow Android or iOS applications and simplify any document-driven process today.

The easiest way to modify and eSign Formulario 480 with ease

- Find Formulario 480 and click Get Form to begin.

- Use the tools we provide to fill out your form.

- Highlight pertinent sections of the documents or redact sensitive information with tools specifically designed for that function by airSlate SignNow.

- Create your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Verify all the details and click on the Done button to save your changes.

- Choose how you wish to send your form, whether by email, SMS, an invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced files, tedious form searching, or errors that require printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device of your choice. Edit and eSign Formulario 480 and maintain excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the formulario 480

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are informativas 480 and how can airSlate SignNow help with them?

Informativas 480 are essential documents needed for tax purposes in certain jurisdictions. airSlate SignNow provides an efficient platform to easily eSign and send these documents securely. With its user-friendly features, you can ensure your informativas 480 are completed quickly and accurately.

-

What are the pricing plans for using airSlate SignNow for informativas 480?

airSlate SignNow offers various pricing plans to accommodate businesses of all sizes. Depending on your needs for managing informativas 480, you can choose a plan that fits your budget without compromising on features. Each plan provides essential tools to streamline document management and eSigning.

-

Can I integrate airSlate SignNow with my existing software for handling informativas 480?

Yes, airSlate SignNow offers seamless integrations with popular software applications. This capability allows you to manage informativas 480 more efficiently by connecting your existing systems. With these integrations, you can automate your workflows, saving time and reducing errors.

-

What are the main features of airSlate SignNow related to informativas 480?

Key features of airSlate SignNow that benefit informativas 480 include secure eSigning, document tracking, and customizable templates. These features help streamline your document processes, ensuring that informativas 480 are handled with precision. The platform also allows for collaboration, making it easier to gather signatures and approvals.

-

Is airSlate SignNow compliant with regulations regarding informativas 480?

Absolutely! airSlate SignNow is designed to comply with industry regulations, ensuring that your informativas 480 are managed securely and in accordance with legal standards. This compliance provides peace of mind, knowing that your sensitive information is protected.

-

How does airSlate SignNow enhance the efficiency of managing informativas 480?

By using airSlate SignNow for your informativas 480, businesses can signNowly enhance their document management efficiency. The platform automates repetitive tasks, reduces turnaround times, and allows for real-time tracking of document statuses. This results in a streamlined process and quicker access to completed documents.

-

Can multiple users collaborate on informativas 480 in airSlate SignNow?

Yes, airSlate SignNow allows for easy collaboration among multiple users on informativas 480. You can invite team members to review and sign documents, ensuring that everyone involved is on the same page. This collaborative feature can speed up the completion of critical documents.

Get more for Formulario 480

- Collateral receipt form

- Indigent form 268558000

- Ar4506 request for copies of arkansas tax returns dfa arkansas form

- Softball quick line up rotation form

- Form 1 nrpy mass nonresidentpart year resident tax

- Florida annual resale certificate for sales t 701403194 form

- Chapter 12 26 form

- Form 1 nrpy massachusetts nonresidentpart year tax

Find out other Formulario 480

- Sign Alaska Orthodontists Business Plan Template Free

- Sign North Carolina Life Sciences Purchase Order Template Computer

- Sign Ohio Non-Profit LLC Operating Agreement Secure

- Can I Sign Ohio Non-Profit LLC Operating Agreement

- Sign South Dakota Non-Profit Business Plan Template Myself

- Sign Rhode Island Non-Profit Residential Lease Agreement Computer

- Sign South Carolina Non-Profit Promissory Note Template Mobile

- Sign South Carolina Non-Profit Lease Agreement Template Online

- Sign Oregon Life Sciences LLC Operating Agreement Online

- Sign Texas Non-Profit LLC Operating Agreement Online

- Can I Sign Colorado Orthodontists Month To Month Lease

- How Do I Sign Utah Non-Profit Warranty Deed

- Help Me With Sign Colorado Orthodontists Purchase Order Template

- Sign Virginia Non-Profit Living Will Fast

- How To Sign Virginia Non-Profit Lease Agreement Template

- How To Sign Wyoming Non-Profit Business Plan Template

- How To Sign Wyoming Non-Profit Credit Memo

- Sign Wisconsin Non-Profit Rental Lease Agreement Simple

- Sign Wisconsin Non-Profit Lease Agreement Template Safe

- Sign South Dakota Life Sciences Limited Power Of Attorney Mobile