CT 186 Final Return Amended Return Employer Identification Number Staple Forms Here New York State Department of Taxation and Fi

Understanding the CT 186 Final Return

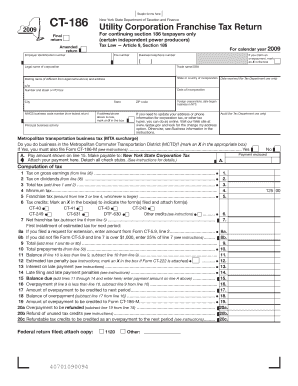

The CT 186 Final Return is a crucial tax document for utility corporations operating under New York State's franchise tax regulations. This form is specifically designed for continuing Section 186 taxpayers, allowing them to report their financial activities and tax obligations accurately. It serves as both a final return and an amended return, ensuring that all necessary information is captured for compliance with state tax laws. The form requires an Employer Identification Number (EIN), which is essential for identification purposes in tax filings.

Steps to Complete the CT 186 Final Return

Completing the CT 186 Final Return involves several steps to ensure accuracy and compliance. First, gather all relevant financial records, including income statements, expenses, and previous tax returns. Next, fill out the form with precise information regarding your corporation's financial activities for the tax year. Pay special attention to sections that require detailed reporting of income and deductions. After completing the form, review it thoroughly for any errors or omissions before submitting it to the New York State Department of Taxation and Finance.

Required Documents for Filing the CT 186 Final Return

When preparing to file the CT 186 Final Return, certain documents are necessary to support your submission. These include:

- Financial statements for the reporting period

- Previous tax returns, if applicable

- Documentation of any deductions claimed

- Employer Identification Number (EIN)

Having these documents ready will facilitate a smoother filing process and help ensure compliance with state regulations.

Filing Methods for the CT 186 Final Return

The CT 186 Final Return can be submitted through various methods, providing flexibility for taxpayers. Options include:

- Online submission via the New York State Department of Taxation and Finance website

- Mailing a paper copy of the completed form to the appropriate tax office

- In-person submission at designated tax offices

Each method has its own guidelines and deadlines, so it is important to choose the one that best suits your needs.

Penalties for Non-Compliance with the CT 186 Final Return

Failing to file the CT 186 Final Return or submitting inaccurate information can result in significant penalties. These may include:

- Monetary fines based on the amount of tax owed

- Interest on unpaid taxes

- Potential legal action for continued non-compliance

Understanding these penalties emphasizes the importance of timely and accurate filing to avoid unnecessary financial burdens.

Eligibility Criteria for Filing the CT 186 Final Return

To be eligible to file the CT 186 Final Return, corporations must meet specific criteria set forth by the New York State Department of Taxation and Finance. Primarily, the corporation must be classified as a utility corporation and be subject to the franchise tax under Section 186. Additionally, the corporation must be in compliance with all previous tax obligations to qualify for filing this return.

Quick guide on how to complete ct 186 final return amended return employer identification number staple forms here new york state department of taxation and

Effortlessly Prepare [SKS] on Any Device

Digital document management has gained traction among businesses and individuals alike. It serves as an ideal environmentally friendly alternative to conventional printed and signed papers, allowing you to locate the appropriate form and securely keep it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents promptly without any delays. Manage [SKS] on any device with airSlate SignNow's Android or iOS applications and streamline any document-related process today.

How to Modify and Electronically Sign [SKS] with Ease

- Retrieve [SKS] and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize important sections of the documents or redact sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Generate your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose the method for sending your form, whether by email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes requiring new document copies. airSlate SignNow meets your document management needs in just a few clicks from your preferred device. Edit and electronically sign [SKS] to ensure seamless communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the ct 186 final return amended return employer identification number staple forms here new york state department of taxation and

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the process for filing a CT 186 Final Return Amended Return?

The process for filing a CT 186 Final Return Amended Return involves completing the necessary forms and ensuring you include your Employer Identification Number. You can easily find CT 186 Final Return Amended Return Employer Identification Number Staple Forms Here New York State Department Of Taxation And Finance, which will guide you through the filing steps effectively.

-

How can businesses benefit from using airSlate SignNow for their CT 186 Final Returns?

Businesses can benefit from using airSlate SignNow by streamlining the document signing process for their CT 186 Final Return Amended Return. With a user-friendly interface, businesses can ensure compliance while saving time on paperwork, thereby allowing them to focus on their core operations.

-

Are there any integrations available with airSlate SignNow for filing CT 186 forms?

Yes, airSlate SignNow offers integrations with various accounting and tax software that can assist in filing CT 186 Final Return Amended Return. This ensures businesses can seamlessly connect their existing systems and simplify their workflows regarding tax compliance.

-

What features does airSlate SignNow provide that are relevant to CT 186 tax filing?

airSlate SignNow provides features such as template creation for CT 186 Final Return Amended Return, real-time tracking of document status, and secure storage for sensitive information. These features ensure that businesses can manage their tax filing requirements efficiently and safely.

-

Is there customer support available for questions about the CT 186 Final Return?

Yes, airSlate SignNow offers dedicated customer support to assist with any inquiries related to CT 186 Final Return Amended Return. Whether you have questions about form completion or document management, our support team is here to help you navigate the process with ease.

-

What pricing options are available for using airSlate SignNow for tax filings?

airSlate SignNow offers various pricing plans designed to meet different business needs, ensuring access to essential features for filing CT 186 Final Return Amended Return. Each plan provides flexibility and scalability, allowing businesses to choose the one that best fits their operational requirements.

-

How does airSlate SignNow ensure the security of CT 186 documents?

Security is a priority at airSlate SignNow, which uses advanced encryption and secure protocols to protect your CT 186 Final Return Amended Return documents. This commitment to security ensures that your sensitive Employer Identification Number and other personal details are well protected throughout the filing process.

Get more for CT 186 Final Return Amended Return Employer Identification Number Staple Forms Here New York State Department Of Taxation And Fi

Find out other CT 186 Final Return Amended Return Employer Identification Number Staple Forms Here New York State Department Of Taxation And Fi

- Can I eSignature Louisiana Education Document

- Can I eSignature Massachusetts Education Document

- Help Me With eSignature Montana Education Word

- How To eSignature Maryland Doctors Word

- Help Me With eSignature South Dakota Education Form

- How Can I eSignature Virginia Education PDF

- How To eSignature Massachusetts Government Form

- How Can I eSignature Oregon Government PDF

- How Can I eSignature Oklahoma Government Document

- How To eSignature Texas Government Document

- Can I eSignature Vermont Government Form

- How Do I eSignature West Virginia Government PPT

- How Do I eSignature Maryland Healthcare / Medical PDF

- Help Me With eSignature New Mexico Healthcare / Medical Form

- How Do I eSignature New York Healthcare / Medical Presentation

- How To eSignature Oklahoma Finance & Tax Accounting PPT

- Help Me With eSignature Connecticut High Tech Presentation

- How To eSignature Georgia High Tech Document

- How Can I eSignature Rhode Island Finance & Tax Accounting Word

- How Can I eSignature Colorado Insurance Presentation