Staple Forms Here CT 184 M Amended Return Employer Identification Number New York State Department of Taxation and Finance Trans

Understanding the Staple Forms Here CT 184 M Amended Return

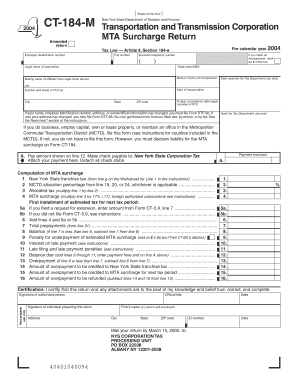

The Staple Forms Here CT 184 M Amended Return is a specific tax form used by employers in New York State. This form is essential for reporting and amending previously submitted information related to the MTA surcharge, which is governed by Tax Law Article 9, Section 184-a. Businesses that fall under the Transportation and Transmission Corporation category must utilize this form to ensure compliance with state tax regulations. The form requires the Employer Identification Number (EIN) for proper identification and processing by the New York State Department of Taxation and Finance.

Steps to Complete the CT 184 M Amended Return

Completing the CT 184 M Amended Return involves several key steps:

- Gather necessary documentation, including your original filed return and any supporting documents.

- Clearly indicate the amendments being made on the form, ensuring all changes are accurately reflected.

- Provide your Employer Identification Number (EIN) at the top of the form for identification purposes.

- Review the completed form for accuracy before submission.

- Submit the form to the New York State Department of Taxation and Finance via the preferred method.

Legal Use of the CT 184 M Amended Return

The CT 184 M Amended Return is legally required for employers who need to correct or update their previously filed MTA surcharge returns. Failing to submit this form when necessary can lead to penalties or fines. It is crucial for businesses to understand their legal obligations under New York State tax law to avoid non-compliance issues.

Obtaining the CT 184 M Amended Return

Employers can obtain the CT 184 M Amended Return from the New York State Department of Taxation and Finance website or through their local tax office. The form is typically available in a downloadable PDF format, allowing for easy access and printing. Ensure you are using the most current version of the form to comply with any updates in tax law.

Key Elements of the CT 184 M Amended Return

Important elements of the CT 184 M Amended Return include:

- Employer Identification Number (EIN)

- File number associated with the original return

- Detailed explanation of the amendments being made

- Signature of the authorized representative

Filing Deadlines for the CT 184 M Amended Return

Filing deadlines for the CT 184 M Amended Return are critical to avoid penalties. Generally, amended returns should be filed as soon as discrepancies are identified. It is advisable to check the New York State Department of Taxation and Finance website for specific deadlines, especially if they vary based on the tax year or specific circumstances of the business.

Quick guide on how to complete staple forms here ct 184 m amended return employer identification number new york state department of taxation and finance

Effortlessly Prepare [SKS] on Any Device

Digital document management is gaining traction among businesses and individuals alike. It offers a superb eco-friendly substitute for traditional printed and signed papers, as you can find the suitable form and securely save it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents quickly without any hold-ups. Manage [SKS] on any platform with airSlate SignNow’s Android or iOS applications and enhance any document-related process today.

How to Modify and eSign [SKS] with Ease

- Obtain [SKS] and click on Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Emphasize relevant sections of your documents or redact sensitive information with tools that airSlate SignNow provides specifically for this task.

- Create your eSignature using the Sign feature, which takes moments and carries the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Select your preferred method to deliver your form, via email, SMS, or invite link, or download it to your computer.

Say goodbye to lost or misplaced papers, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you choose. Modify and eSign [SKS] and ensure effective communication at every stage of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the staple forms here ct 184 m amended return employer identification number new york state department of taxation and finance

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the process to file the Staple Forms Here CT 184 M Amended Return for the Employer Identification Number?

To file the Staple Forms Here CT 184 M Amended Return for your Employer Identification Number, you must complete the necessary forms accurately. Ensure that all updates or corrections are clearly stated, and follow the New York State Department Of Taxation And Finance guidelines. Submitting the form on time can prevent penalties and challenges with your MTA surcharge return.

-

How can airSlate SignNow simplify the filing of the Staple Forms Here CT 184 M Amended Return?

airSlate SignNow streamlines the process of submitting your Staple Forms Here CT 184 M Amended Return by providing an easy-to-use platform for document management and electronic signatures. You can fill out forms online, securely sign them, and ensure timely submission. This efficiency helps you stay compliant with the New York State Department Of Taxation And Finance requirements.

-

What are the pricing options available for using airSlate SignNow to file Staple Forms Here CT 184 M?

airSlate SignNow offers various pricing plans to accommodate different business needs, allowing you to choose a cost-effective solution for filing Staple Forms Here CT 184 M. Each plan includes features tailored to help manage your documentation effectively, including templates and signature tracking. Contact our sales team to find a plan that suits your budget and requirements.

-

What features does airSlate SignNow provide for users filing the MTA Surcharge Return?

With airSlate SignNow, users can access features such as customizable templates, real-time collaboration, and secure document storage that simplify the filing of the MTA Surcharge Return. Users can also electronically sign documents, ensuring compliance with Tax Law Article 9, Section 184 a. These features help streamline the process while enhancing accuracy and efficiency.

-

Is airSlate SignNow compliant with New York State tax filing regulations?

Yes, airSlate SignNow is designed to help users comply with New York State tax filing regulations, including the requirements for the Staple Forms Here CT 184 M Amended Return. The platform ensures that your documents meet the standards set by the New York State Department Of Taxation And Finance. Regular updates help maintain compliance with changes in tax law.

-

Can I integrate airSlate SignNow with other software I use for financial management?

Absolutely! airSlate SignNow offers integrations with various financial management software, enhancing your workflow while filing Staple Forms Here CT 184 M Amended Return. Integrating with tools like QuickBooks or Salesforce allows for seamless data transfer and improved efficiency in your tax-related processes. Explore our integration options to maximize productivity.

-

What are the benefits of using airSlate SignNow for tax document management?

Using airSlate SignNow for tax document management offers numerous benefits, including increased efficiency, enhanced security, and improved collaboration. The platform allows for quick access to your Staple Forms Here CT 184 M Amended Return and other essential documents, ensuring a smooth filing process. This streamlined approach ultimately saves you time and reduces stress during tax season.

Get more for Staple Forms Here CT 184 M Amended Return Employer Identification Number New York State Department Of Taxation And Finance Trans

Find out other Staple Forms Here CT 184 M Amended Return Employer Identification Number New York State Department Of Taxation And Finance Trans

- eSign Massachusetts Plumbing Job Offer Mobile

- How To eSign Pennsylvania Orthodontists Letter Of Intent

- eSign Rhode Island Orthodontists Last Will And Testament Secure

- eSign Nevada Plumbing Business Letter Template Later

- eSign Nevada Plumbing Lease Agreement Form Myself

- eSign Plumbing PPT New Jersey Later

- eSign New York Plumbing Rental Lease Agreement Simple

- eSign North Dakota Plumbing Emergency Contact Form Mobile

- How To eSign North Dakota Plumbing Emergency Contact Form

- eSign Utah Orthodontists Credit Memo Easy

- How To eSign Oklahoma Plumbing Business Plan Template

- eSign Vermont Orthodontists Rental Application Now

- Help Me With eSign Oregon Plumbing Business Plan Template

- eSign Pennsylvania Plumbing RFP Easy

- Can I eSign Pennsylvania Plumbing RFP

- eSign Pennsylvania Plumbing Work Order Free

- Can I eSign Pennsylvania Plumbing Purchase Order Template

- Help Me With eSign South Carolina Plumbing Promissory Note Template

- How To eSign South Dakota Plumbing Quitclaim Deed

- How To eSign South Dakota Plumbing Affidavit Of Heirship