Form CT 186 , Utility Corporation Franchise Tax Return, CT186 Tax Ny

Understanding Form CT 186, Utility Corporation Franchise Tax Return

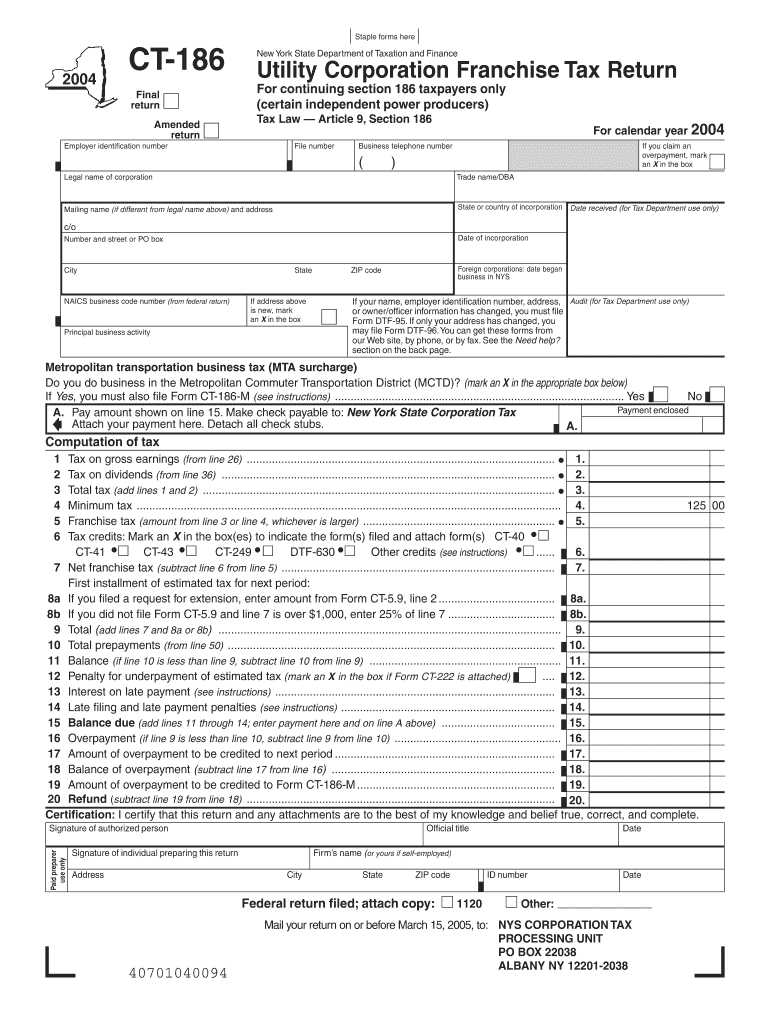

Form CT 186, also known as the Utility Corporation Franchise Tax Return, is a crucial document for utility corporations operating in New York. This form is used to report the franchise tax based on the corporation's gross income. It is specifically designed for utility companies, including those involved in electric, gas, and water services. Understanding this form is essential for compliance with state tax regulations and ensuring that the corporation meets its financial obligations.

Steps to Complete Form CT 186

Completing Form CT 186 requires careful attention to detail. Here are the essential steps:

- Gather necessary financial documents, including income statements and balance sheets.

- Calculate the corporation's gross income accurately, as this figure will determine the tax owed.

- Fill out the form, ensuring all sections are completed, including identification information and financial data.

- Review the completed form for accuracy before submission.

- Submit the form by the specified deadline to avoid penalties.

Obtaining Form CT 186

Form CT 186 can be obtained through the New York State Department of Taxation and Finance website. It is available in a downloadable format, allowing businesses to print and complete it manually. Additionally, businesses may also request a physical copy through the department's offices if needed. Ensuring that you have the most current version of the form is vital for compliance.

Legal Use of Form CT 186

The legal use of Form CT 186 is essential for utility corporations to fulfill their tax obligations in New York. Filing this form accurately and on time helps avoid legal repercussions, including fines and penalties. It is important for corporations to understand the legal implications of the information provided on the form, as inaccuracies can lead to audits or other legal challenges.

Filing Deadlines for Form CT 186

Filing deadlines for Form CT 186 are crucial for compliance. Typically, the form must be filed annually, with specific due dates set by the New York State Department of Taxation and Finance. Corporations should be aware of these deadlines to ensure timely submission and avoid late fees. Keeping track of these dates is essential for maintaining good standing with state tax authorities.

Penalties for Non-Compliance with Form CT 186

Failure to file Form CT 186 or inaccuracies in the submitted information can result in significant penalties. These may include monetary fines, interest on unpaid taxes, and potential legal action. It is important for utility corporations to prioritize compliance with filing requirements to mitigate these risks. Understanding the consequences of non-compliance can help ensure that businesses remain in good standing with tax authorities.

Quick guide on how to complete form ct 186 utility corporation franchise tax return ct186 tax ny

Complete [SKS] seamlessly on any device

Online document management has become increasingly favored by businesses and individuals alike. It offers an ideal environmentally friendly substitute to traditional printed and signed documents, as you can locate the appropriate form and securely save it online. airSlate SignNow equips you with all the resources you need to create, modify, and eSign your documents quickly without any delays. Handle [SKS] on any device using airSlate SignNow's Android or iOS applications and enhance any document-centered task today.

The easiest way to modify and eSign [SKS] effortlessly

- Find [SKS] and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize relevant sections of the documents or redact sensitive information using the tools specifically offered by airSlate SignNow.

- Create your eSignature with the Sign tool, which only takes seconds and carries the same legal validity as a traditional handwritten signature.

- Review the information and click the Done button to save your changes.

- Choose how you wish to share your form, via email, SMS, or invitation link, or download it to your PC.

Forget about lost or misplaced files, tedious form searching, or errors that require reprinting new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and eSign [SKS] and ensure effective communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form ct 186 utility corporation franchise tax return ct186 tax ny

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form CT 186, Utility Corporation Franchise Tax Return?

Form CT 186, Utility Corporation Franchise Tax Return, is a tax document required for utility corporations operating in New York. This form must be filed annually, outlining the corporation's income, expenses, and tax obligations to ensure compliance with state laws. Accurately completing this form is crucial for maintaining your business's good standing.

-

Who needs to file the CT186 Tax in New York?

Any utility corporation that operates in New York must file Form CT 186, Utility Corporation Franchise Tax Return, to report their taxable income. This includes electric, gas, water, and other utility service providers. It is essential to determine your compliance needs and file on time to avoid penalties.

-

What are the penalties for not filing Form CT 186 on time?

Failing to file Form CT 186, Utility Corporation Franchise Tax Return, by the deadline can result in signNow penalties and interest on any unpaid taxes. Additionally, persistent non-compliance can lead to legal issues and hinder your corporation's ability to operate effectively in New York. It's crucial to understand your filing obligations and adhere to deadlines.

-

How can airSlate SignNow help with filing Form CT 186?

airSlate SignNow offers an easy-to-use platform for eSigning and sending documents, including Form CT 186, Utility Corporation Franchise Tax Return. Our service streamlines the document preparation and submission process, ensuring that all necessary forms are completed accurately and efficiently. This simplifies your tax filing and helps maintain your compliance with state regulations.

-

What features does airSlate SignNow provide for handling tax forms?

airSlate SignNow includes features such as document templates, eSignature capabilities, and secure storage, making it effective for handling tax forms like Form CT 186, Utility Corporation Franchise Tax Return. These tools enhance productivity and ensure that all tax-related forms are signed and stored securely, reducing the risk of errors in submission.

-

Is there a cost associated with using airSlate SignNow for tax filing?

Yes, there is a cost associated with airSlate SignNow's services, but the investment is relatively low compared to the potential savings in time and labor. Pricing plans vary based on usage and features, making it a cost-effective solution for businesses looking to efficiently manage documents like Form CT 186, Utility Corporation Franchise Tax Return. Contact us for detailed pricing information.

-

Can I integrate airSlate SignNow with other tax software?

airSlate SignNow offers integration capabilities with various tax software, enhancing your document management process. This allows you to efficiently handle Form CT 186, Utility Corporation Franchise Tax Return, while utilizing your existing tools for accounting and tax preparation. Check our integrations page for a complete list of compatible software.

Get more for Form CT 186 , Utility Corporation Franchise Tax Return, CT186 Tax Ny

- Associate member application choptx form

- We are pleased to bring you the preferred customer account credit form

- Lawn mow contract template form

- Lawn service contract template form

- Lawncare contract template form

- Lawn service lawn care contract template form

- Lawyer contract template form

- Layaway contract template 787752522 form

Find out other Form CT 186 , Utility Corporation Franchise Tax Return, CT186 Tax Ny

- Help Me With Sign Wyoming High Tech Presentation

- How Do I Sign Florida Insurance PPT

- How To Sign Indiana Insurance Document

- Can I Sign Illinois Lawers Form

- How To Sign Indiana Lawers Document

- How To Sign Michigan Lawers Document

- How To Sign New Jersey Lawers PPT

- How Do I Sign Arkansas Legal Document

- How Can I Sign Connecticut Legal Document

- How Can I Sign Indiana Legal Form

- Can I Sign Iowa Legal Document

- How Can I Sign Nebraska Legal Document

- How To Sign Nevada Legal Document

- Can I Sign Nevada Legal Form

- How Do I Sign New Jersey Legal Word

- Help Me With Sign New York Legal Document

- How Do I Sign Texas Insurance Document

- How Do I Sign Oregon Legal PDF

- How To Sign Pennsylvania Legal Word

- How Do I Sign Wisconsin Legal Form