31, , or Fiscal Year Beginning Name of Trust or Estate it 205 T , 19 Tax Ny Form

What is the 31, , Or Fiscal Year Beginning Name Of Trust or Estate IT 205 T , 19 Tax Ny

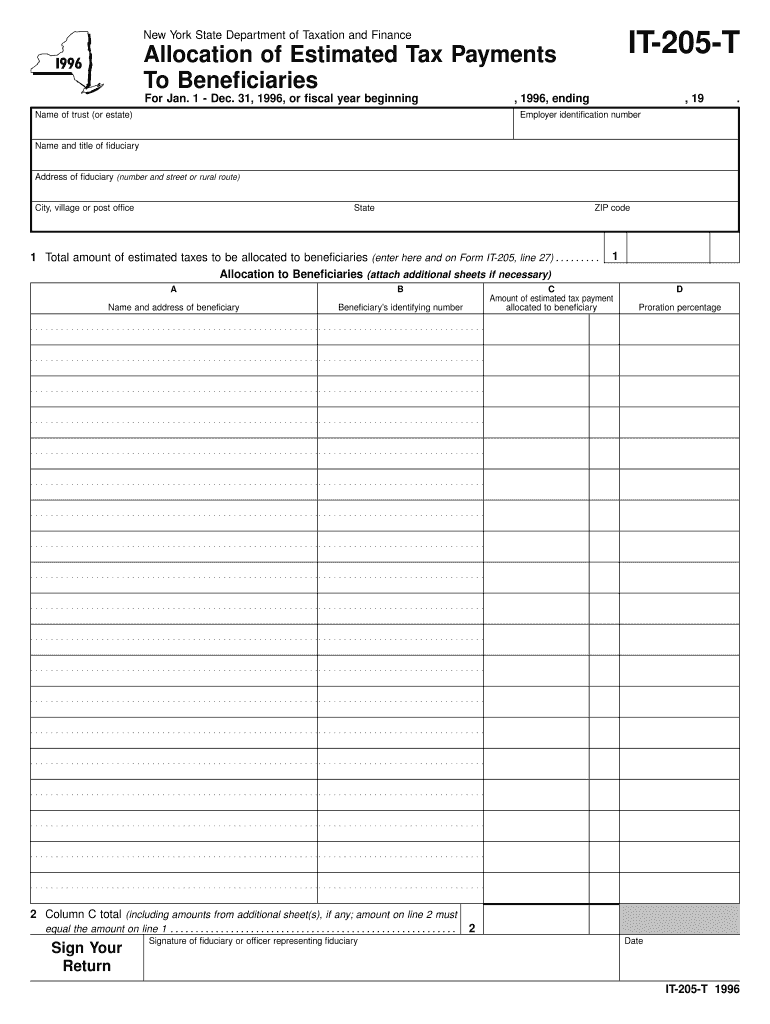

The form 31, , Or Fiscal Year Beginning Name Of Trust or Estate IT 205 T , 19 Tax Ny is a tax document used in New York for reporting income generated by trusts or estates. This form is essential for fiduciaries managing the financial affairs of a trust or estate, allowing them to report income, deductions, and tax liabilities accurately. The form is specifically designed for entities that operate on a fiscal year basis, which may differ from the calendar year. Understanding this form is crucial for compliance with state tax regulations and for ensuring that all income is reported correctly to avoid penalties.

How to use the 31, , Or Fiscal Year Beginning Name Of Trust or Estate IT 205 T , 19 Tax Ny

Using the 31, , Or Fiscal Year Beginning Name Of Trust or Estate IT 205 T , 19 Tax Ny involves several steps to ensure accurate completion and submission. First, gather all necessary financial information regarding the trust or estate, including income, expenses, and deductions. Next, fill out the form by entering the required details in the designated sections. It is important to follow the instructions carefully to avoid errors that could lead to delays or penalties. Once completed, the form can be submitted either electronically or via mail, depending on the preference and requirements of the New York State Department of Taxation and Finance.

Steps to complete the 31, , Or Fiscal Year Beginning Name Of Trust or Estate IT 205 T , 19 Tax Ny

Completing the 31, , Or Fiscal Year Beginning Name Of Trust or Estate IT 205 T , 19 Tax Ny involves a systematic approach:

- Gather all relevant financial documents, including income statements and expense records.

- Begin filling out the form by entering the name of the trust or estate and the fiscal year beginning date.

- Report all sources of income, ensuring to categorize them accurately.

- List any deductions that apply to the trust or estate, such as administrative expenses.

- Calculate the total tax liability based on the reported income and deductions.

- Review the completed form for accuracy and completeness.

- Submit the form by the specified deadline, either electronically or by mail.

Key elements of the 31, , Or Fiscal Year Beginning Name Of Trust or Estate IT 205 T , 19 Tax Ny

Several key elements are essential when dealing with the 31, , Or Fiscal Year Beginning Name Of Trust or Estate IT 205 T , 19 Tax Ny. These include:

- Trust or Estate Name: The legal name of the trust or estate must be clearly stated.

- Fiscal Year Dates: Accurate fiscal year beginning and ending dates are crucial for reporting.

- Income Reporting: All income sources must be documented, including interest, dividends, and capital gains.

- Deductions: Eligible deductions should be itemized to reduce taxable income.

- Signature of Fiduciary: The form must be signed by the fiduciary responsible for managing the trust or estate.

Filing Deadlines / Important Dates

Filing deadlines for the 31, , Or Fiscal Year Beginning Name Of Trust or Estate IT 205 T , 19 Tax Ny are critical for compliance. Generally, the form must be filed by the fifteenth day of the fourth month following the end of the fiscal year. For example, if the fiscal year ends on December 31, the form is due by April 15 of the following year. It is important to be aware of any changes to deadlines or additional requirements that may arise, so regularly checking the New York State Department of Taxation and Finance website can be beneficial.

Who Issues the Form

The 31, , Or Fiscal Year Beginning Name Of Trust or Estate IT 205 T , 19 Tax Ny is issued by the New York State Department of Taxation and Finance. This department is responsible for overseeing tax compliance and ensuring that trusts and estates adhere to state tax laws. The issuance of this form is part of their broader efforts to facilitate accurate reporting and collection of taxes owed by trusts and estates operating within New York.

Quick guide on how to complete 31 or fiscal year beginning name of trust or estate it 205 t 19 tax ny

Complete [SKS] effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed documents, as you can locate the right form and securely keep it online. airSlate SignNow provides all the tools you need to create, modify, and eSign your documents swiftly without delays. Manage [SKS] on any device using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

How to modify and eSign [SKS] without any hassle

- Locate [SKS] and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of the documents or hide sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature with the Sign feature, which only takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Choose how you want to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or errors that necessitate reprinting new document copies. airSlate SignNow fulfills your document management needs with just a few clicks from any device you prefer. Modify and eSign [SKS] and ensure excellent communication during every phase of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to 31, , Or Fiscal Year Beginning Name Of Trust or Estate IT 205 T , 19 Tax Ny

Create this form in 5 minutes!

How to create an eSignature for the 31 or fiscal year beginning name of trust or estate it 205 t 19 tax ny

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the purpose of the 31, , Or Fiscal Year Beginning Name Of Trust or Estate IT 205 T, 19 Tax Ny?

The 31, , Or Fiscal Year Beginning Name Of Trust or Estate IT 205 T, 19 Tax Ny is a tax form used to report the income and expenses related to a trust or estate. This form ensures that the entity complies with New York tax laws, providing necessary financial transparency.

-

How can airSlate SignNow help with eSigning the 31, , Or Fiscal Year Beginning Name Of Trust or Estate IT 205 T, 19 Tax Ny?

Using airSlate SignNow, you can easily eSign the 31, , Or Fiscal Year Beginning Name Of Trust or Estate IT 205 T, 19 Tax Ny. Our platform streamlines the signing process, allowing you to quickly complete and send documents securely, reducing paperwork hassles.

-

What are the pricing options for airSlate SignNow?

AirSlate SignNow offers competitive pricing tailored for businesses of all sizes. We provide different plans that cater to various needs, ensuring you have access to the features required for handling documents like the 31, , Or Fiscal Year Beginning Name Of Trust or Estate IT 205 T, 19 Tax Ny.

-

What features does airSlate SignNow provide for handling tax forms?

AirSlate SignNow includes features like document creation, templates, eSigning, and secure storage. These tools make it easier to manage tax forms such as the 31, , Or Fiscal Year Beginning Name Of Trust or Estate IT 205 T, 19 Tax Ny while ensuring compliance and accountability.

-

Can airSlate SignNow integrate with other software for tax management?

Yes, airSlate SignNow offers seamless integrations with various accounting and financial software. This allows for a smooth workflow when managing documents like the 31, , Or Fiscal Year Beginning Name Of Trust or Estate IT 205 T, 19 Tax Ny and ensures all your tax-related data is organized and accessible.

-

Is airSlate SignNow secure for signing sensitive tax documents?

Absolutely, airSlate SignNow prioritizes security with features like encryption and secure storage. When signing sensitive documents such as the 31, , Or Fiscal Year Beginning Name Of Trust or Estate IT 205 T, 19 Tax Ny, our platform ensures that your information is protected and confidential.

-

How does airSlate SignNow enhance collaboration on tax documents?

AirSlate SignNow enhances collaboration through features such as shared access and real-time commenting. This makes it ideal for teams working on the 31, , Or Fiscal Year Beginning Name Of Trust or Estate IT 205 T, 19 Tax Ny, as multiple stakeholders can provide input efficiently.

Get more for 31, , Or Fiscal Year Beginning Name Of Trust or Estate IT 205 T , 19 Tax Ny

Find out other 31, , Or Fiscal Year Beginning Name Of Trust or Estate IT 205 T , 19 Tax Ny

- Can I eSignature Oregon Orthodontists LLC Operating Agreement

- How To eSignature Rhode Island Orthodontists LLC Operating Agreement

- Can I eSignature West Virginia Lawers Cease And Desist Letter

- eSignature Alabama Plumbing Confidentiality Agreement Later

- How Can I eSignature Wyoming Lawers Quitclaim Deed

- eSignature California Plumbing Profit And Loss Statement Easy

- How To eSignature California Plumbing Business Letter Template

- eSignature Kansas Plumbing Lease Agreement Template Myself

- eSignature Louisiana Plumbing Rental Application Secure

- eSignature Maine Plumbing Business Plan Template Simple

- Can I eSignature Massachusetts Plumbing Business Plan Template

- eSignature Mississippi Plumbing Emergency Contact Form Later

- eSignature Plumbing Form Nebraska Free

- How Do I eSignature Alaska Real Estate Last Will And Testament

- Can I eSignature Alaska Real Estate Rental Lease Agreement

- eSignature New Jersey Plumbing Business Plan Template Fast

- Can I eSignature California Real Estate Contract

- eSignature Oklahoma Plumbing Rental Application Secure

- How Can I eSignature Connecticut Real Estate Quitclaim Deed

- eSignature Pennsylvania Plumbing Business Plan Template Safe