0306 NYS ST 100 Tax Ny Form

What is the 0306 NYS ST 100 Tax Ny

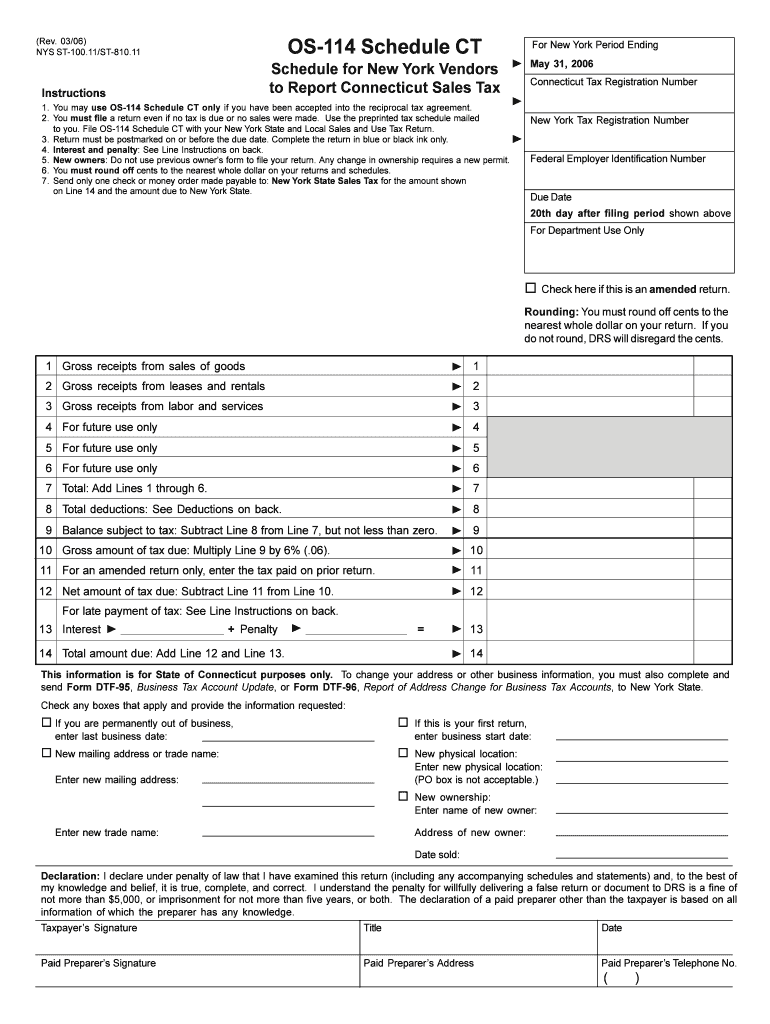

The 0306 NYS ST 100 Tax Ny is a tax form used in New York State for reporting sales and use tax. This form is essential for businesses that sell goods or services subject to sales tax. It provides the state with necessary information regarding the sales made, the tax collected, and any exemptions that may apply. Understanding this form is crucial for compliance with state tax laws and for avoiding potential penalties.

How to use the 0306 NYS ST 100 Tax Ny

Using the 0306 NYS ST 100 Tax Ny requires careful attention to detail. Businesses must accurately fill out the form, detailing their sales transactions and the corresponding tax amounts. It is important to ensure that all sections are completed, including any exemptions claimed. After filling out the form, businesses can submit it electronically or via mail, depending on their preference and the guidelines provided by the state.

Steps to complete the 0306 NYS ST 100 Tax Ny

Completing the 0306 NYS ST 100 Tax Ny involves several key steps:

- Gather all sales records and receipts for the reporting period.

- Calculate the total sales and the total sales tax collected.

- Fill out the required sections of the form, ensuring accuracy.

- Review the form for any errors or omissions.

- Submit the form electronically or by mail by the designated deadline.

Key elements of the 0306 NYS ST 100 Tax Ny

Key elements of the 0306 NYS ST 100 Tax Ny include:

- Business identification information, including name and address.

- Total sales amount for the reporting period.

- Total sales tax collected and any adjustments.

- Details of any exemptions claimed.

- Signature of the authorized person certifying the accuracy of the information.

Filing Deadlines / Important Dates

It is essential to be aware of the filing deadlines for the 0306 NYS ST 100 Tax Ny to avoid penalties. Generally, the form must be filed quarterly, with specific due dates depending on the business's reporting schedule. Keeping track of these dates ensures compliance with state tax regulations and helps maintain a good standing with tax authorities.

Form Submission Methods (Online / Mail / In-Person)

The 0306 NYS ST 100 Tax Ny can be submitted through various methods. Businesses have the option to file online, which is often faster and more efficient. Alternatively, the form can be mailed to the appropriate tax authority or submitted in person at designated locations. Each method has its own guidelines and requirements, so it is important to choose the one that best suits the business's needs.

Quick guide on how to complete 0306 nys st 100 tax ny

Effortlessly prepare [SKS] on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed documents, as you can locate the appropriate form and securely save it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents quickly without delays. Manage [SKS] on any device using airSlate SignNow’s Android or iOS applications and enhance any document-centric process today.

How to modify and eSign [SKS] effortlessly

- Obtain [SKS] and then click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize important sections of the documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes moments and has the same legal validity as a traditional wet ink signature.

- Review all the details and then click on the Done button to save your modifications.

- Choose how you want to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device you prefer. Edit and eSign [SKS] and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to 0306 NYS ST 100 Tax Ny

Create this form in 5 minutes!

How to create an eSignature for the 0306 nys st 100 tax ny

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 0306 NYS ST 100 Tax NY form?

The 0306 NYS ST 100 Tax NY form is a tax document required by businesses in New York for sales tax purposes. It is essential for properly reporting and remitting sales tax collected, ensuring compliance with state regulations. airSlate SignNow makes it easy to fill out and eSign this important form efficiently.

-

How can airSlate SignNow help with the 0306 NYS ST 100 Tax NY form?

airSlate SignNow streamlines the process of completing the 0306 NYS ST 100 Tax NY form by providing tools for easy document preparation and secure eSigning. Our platform enhances productivity by reducing the time spent on paperwork, and you can manage your tax documents all in one place. Get started today to simplify your tax filing experience.

-

What features does airSlate SignNow provide for tax-related documents like the 0306 NYS ST 100 Tax NY?

airSlate SignNow offers a variety of features for tax-related documents, including customizable templates, automated workflows, and secure eSignature options. With these tools, users can efficiently manage forms like the 0306 NYS ST 100 Tax NY, ensuring accuracy and compliance. Our user-friendly interface makes document handling seamless.

-

Is airSlate SignNow cost-effective for small businesses needing to file the 0306 NYS ST 100 Tax NY?

Yes, airSlate SignNow is designed to be a cost-effective solution for small businesses, making it easier to manage important documents like the 0306 NYS ST 100 Tax NY. Our pricing models are competitive, providing great value for the features offered. Sign up to discover how you can save time and money with our platform.

-

Can I integrate airSlate SignNow with other software for tax management?

Absolutely! airSlate SignNow integrates with various accounting and tax management software to enhance your workflow. This integration allows users to conveniently access the 0306 NYS ST 100 Tax NY form alongside other financial tools. Streamlining your processes helps in maintaining compliance effortlessly.

-

What are the benefits of using airSlate SignNow for eSigning the 0306 NYS ST 100 Tax NY?

Using airSlate SignNow for eSigning your 0306 NYS ST 100 Tax NY provides several benefits, including speed, security, and convenience. Our secure eSignature technology ensures that your signed documents are legally binding and safely stored. Experience the efficiency of electronic signatures and improve your project turnaround time today.

-

How secure is the information when using airSlate SignNow for the 0306 NYS ST 100 Tax NY?

airSlate SignNow prioritizes security, employing advanced encryption and compliance protocols to protect your information. When you use our platform to manage the 0306 NYS ST 100 Tax NY form or any document, you can trust that your data remains confidential. Our commitment to security reassures users about their sensitive tax information.

Get more for 0306 NYS ST 100 Tax Ny

Find out other 0306 NYS ST 100 Tax Ny

- How To eSignature Oklahoma Finance & Tax Accounting PPT

- Help Me With eSignature Connecticut High Tech Presentation

- How To eSignature Georgia High Tech Document

- How Can I eSignature Rhode Island Finance & Tax Accounting Word

- How Can I eSignature Colorado Insurance Presentation

- Help Me With eSignature Georgia Insurance Form

- How Do I eSignature Kansas Insurance Word

- How Do I eSignature Washington Insurance Form

- How Do I eSignature Alaska Life Sciences Presentation

- Help Me With eSignature Iowa Life Sciences Presentation

- How Can I eSignature Michigan Life Sciences Word

- Can I eSignature New Jersey Life Sciences Presentation

- How Can I eSignature Louisiana Non-Profit PDF

- Can I eSignature Alaska Orthodontists PDF

- How Do I eSignature New York Non-Profit Form

- How To eSignature Iowa Orthodontists Presentation

- Can I eSignature South Dakota Lawers Document

- Can I eSignature Oklahoma Orthodontists Document

- Can I eSignature Oklahoma Orthodontists Word

- How Can I eSignature Wisconsin Orthodontists Word