Form 38 Fiduciary Income Tax Return Nd

What is the Form 38 Fiduciary Income Tax Return Nd

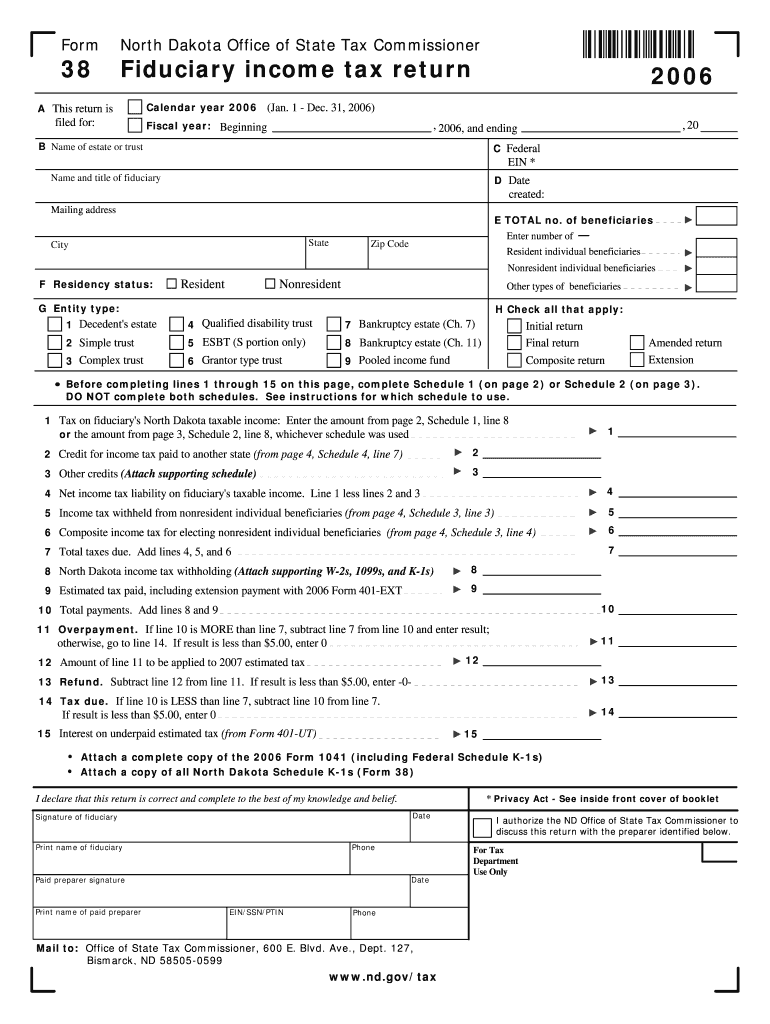

The Form 38 Fiduciary Income Tax Return Nd is a tax form used by fiduciaries in the state of North Dakota to report income, deductions, and tax liability for estates and trusts. This form is essential for ensuring that fiduciaries comply with state tax laws and fulfill their responsibilities regarding the management of trust or estate assets. It is specifically designed to capture the unique financial activities associated with fiduciary entities, allowing for accurate reporting and tax calculation.

How to use the Form 38 Fiduciary Income Tax Return Nd

Using the Form 38 Fiduciary Income Tax Return Nd involves several key steps. First, gather all necessary financial information related to the estate or trust, including income earned, deductions, and any tax credits applicable. Next, accurately complete each section of the form, ensuring that all figures are correctly reported. After completing the form, review it thoroughly for accuracy before submitting it to the appropriate tax authority. It is important to keep a copy of the submitted form for your records.

Steps to complete the Form 38 Fiduciary Income Tax Return Nd

Completing the Form 38 Fiduciary Income Tax Return Nd requires careful attention to detail. Follow these steps:

- Gather all financial documents related to the estate or trust, including income statements and expense receipts.

- Fill out the identification section, providing the name and tax identification number of the estate or trust.

- Report all sources of income, including interest, dividends, and capital gains, in the income section.

- List all allowable deductions, such as administrative expenses and distributions to beneficiaries.

- Calculate the total tax liability based on the net income reported.

- Sign and date the form, certifying that the information provided is accurate.

Filing Deadlines / Important Dates

Filing deadlines for the Form 38 Fiduciary Income Tax Return Nd are critical to avoid penalties. Generally, the form must be filed by the fifteenth day of the fourth month following the close of the tax year. For estates and trusts operating on a calendar year, this typically means an April deadline. It is advisable to check for any specific state regulations or extensions that may apply to your situation.

Required Documents

To successfully complete the Form 38 Fiduciary Income Tax Return Nd, certain documents are required. These typically include:

- Financial statements detailing income and expenses for the estate or trust.

- Records of distributions made to beneficiaries.

- Documentation of any deductions claimed, such as receipts for administrative costs.

- Prior year tax returns, if applicable, to ensure consistency in reporting.

Who Issues the Form

The Form 38 Fiduciary Income Tax Return Nd is issued by the North Dakota Office of State Tax Commissioner. This office is responsible for overseeing tax compliance and providing necessary forms for fiduciaries managing estates and trusts within the state. It is important to ensure that you are using the most current version of the form, as tax regulations may change periodically.

Quick guide on how to complete form 38 fiduciary income tax return nd

Accomplish [SKS] effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to locate the correct form and securely house it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents quickly without delays. Handle [SKS] on any device with the airSlate SignNow Android or iOS applications and simplify any document-based task today.

The easiest method to modify and electronically sign [SKS] with ease

- Obtain [SKS] and then click Get Form to initiate.

- Utilize the tools we provide to complete your document.

- Emphasize relevant sections of the documents or black out sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Create your electronic signature with the Sign feature, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click the Done button to save your modifications.

- Choose your preferred method of delivering your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns around lost or misplaced files, tedious form searches, or mistakes that necessitate generating new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device of your choosing. Modify and electronically sign [SKS] and ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Form 38 Fiduciary Income Tax Return Nd

Create this form in 5 minutes!

How to create an eSignature for the form 38 fiduciary income tax return nd

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Form 38 Fiduciary Income Tax Return Nd?

The Form 38 Fiduciary Income Tax Return Nd is a tax form used in North Dakota to report income earned by estates and trusts. This form enables fiduciaries to accurately report income, deductions, and credits, ensuring compliance with state tax laws. By using airSlate SignNow, you can easily eSign and manage your Form 38 electronically.

-

How can airSlate SignNow help with completing the Form 38 Fiduciary Income Tax Return Nd?

airSlate SignNow simplifies the process of completing the Form 38 Fiduciary Income Tax Return Nd by providing an easy-to-use platform for filling out, signing, and submitting documents. You can create templates, gather necessary information from clients, and ensure all signatures are safely captured electronically. This streamlines the tax preparation process signNowly.

-

What features does airSlate SignNow offer for managing the Form 38 Fiduciary Income Tax Return Nd?

airSlate SignNow offers multiple features for managing the Form 38 Fiduciary Income Tax Return Nd, including template creation, customizable workflows, and secure electronic signatures. You can also track the status of documents in real-time and set reminders for important tax deadlines. These features enhance productivity and reduce the risk of errors.

-

Is airSlate SignNow a cost-effective solution for handling the Form 38 Fiduciary Income Tax Return Nd?

Yes, airSlate SignNow is a cost-effective solution for handling the Form 38 Fiduciary Income Tax Return Nd. Our pricing plans are designed to accommodate different business needs, ensuring you get maximum value for your investment. Plus, the time saved through efficient document management can lead to additional cost savings.

-

Can I integrate airSlate SignNow with other tools for easier management of the Form 38 Fiduciary Income Tax Return Nd?

Absolutely! airSlate SignNow seamlessly integrates with various applications to enhance your workflow for the Form 38 Fiduciary Income Tax Return Nd. Whether it’s accounting software or customer relationship management tools, these integrations help create a comprehensive system for managing all your tax-related documents efficiently.

-

What are the benefits of using airSlate SignNow for estate and trust filings like the Form 38 Fiduciary Income Tax Return Nd?

Using airSlate SignNow for estate and trust filings, such as the Form 38 Fiduciary Income Tax Return Nd, offers signNow benefits like increased efficiency, enhanced security, and better organization of documents. With electronic signatures, the process is faster and minimizes the risk of misplaced papers. These advantages lead to a more streamlined approach to tax preparation.

-

How secure is airSlate SignNow for submitting the Form 38 Fiduciary Income Tax Return Nd?

airSlate SignNow prioritizes security, implementing strong encryption and secure access controls for documents, including the Form 38 Fiduciary Income Tax Return Nd. Compliance with regulations ensures that your sensitive information remains protected throughout the eSigning process. You can submit your forms with peace of mind.

Get more for Form 38 Fiduciary Income Tax Return Nd

Find out other Form 38 Fiduciary Income Tax Return Nd

- Electronic signature Wisconsin Education POA Free

- Electronic signature Wyoming Education Moving Checklist Secure

- Electronic signature North Carolina Insurance Profit And Loss Statement Secure

- Help Me With Electronic signature Oklahoma Insurance Contract

- Electronic signature Pennsylvania Insurance Letter Of Intent Later

- Electronic signature Pennsylvania Insurance Quitclaim Deed Now

- Electronic signature Maine High Tech Living Will Later

- Electronic signature Maine High Tech Quitclaim Deed Online

- Can I Electronic signature Maryland High Tech RFP

- Electronic signature Vermont Insurance Arbitration Agreement Safe

- Electronic signature Massachusetts High Tech Quitclaim Deed Fast

- Electronic signature Vermont Insurance Limited Power Of Attorney Easy

- Electronic signature Washington Insurance Last Will And Testament Later

- Electronic signature Washington Insurance Last Will And Testament Secure

- Electronic signature Wyoming Insurance LLC Operating Agreement Computer

- How To Electronic signature Missouri High Tech Lease Termination Letter

- Electronic signature Montana High Tech Warranty Deed Mobile

- Electronic signature Florida Lawers Cease And Desist Letter Fast

- Electronic signature Lawers Form Idaho Fast

- Electronic signature Georgia Lawers Rental Lease Agreement Online