Schedules 3 & 4 for Form 38 Fiduciary Income Tax Return Nd

Understanding Schedules 3 & 4 for Form 38 Fiduciary Income Tax Return

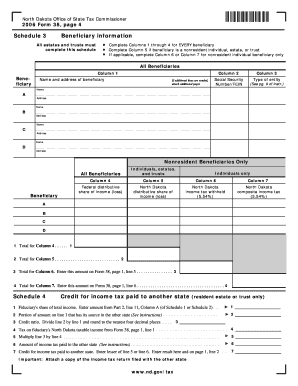

Schedules 3 and 4 are essential components of the Form 38 Fiduciary Income Tax Return, specifically designed for fiduciaries managing estates or trusts. Schedule 3 focuses on the income generated by the estate or trust, detailing various income sources such as dividends, interest, and capital gains. Schedule 4, on the other hand, is dedicated to the deductions that can be claimed against that income, including expenses related to the administration of the estate or trust. Together, these schedules provide a comprehensive overview of the financial activities of the fiduciary entity, ensuring accurate reporting to the IRS.

Steps to Complete Schedules 3 & 4 for Form 38

Completing Schedules 3 and 4 for Form 38 involves several key steps. First, gather all relevant financial documents, including statements that outline income and expenses related to the trust or estate. Next, fill out Schedule 3 by listing all sources of income, ensuring to categorize each type correctly. After completing Schedule 3, proceed to Schedule 4, where you will enter eligible deductions. It is important to keep thorough records to support the amounts reported. Finally, review both schedules for accuracy before submitting the entire Form 38 to the IRS.

Obtaining Schedules 3 & 4 for Form 38

Schedules 3 and 4 can be obtained directly from the IRS website or through tax preparation software that supports Form 38. They are typically included as part of the complete Form 38 package. Additionally, tax professionals can provide these schedules as part of their services. It is crucial to ensure you are using the most current version of the schedules, as updates may occur annually.

Legal Use of Schedules 3 & 4 for Form 38

The legal use of Schedules 3 and 4 is governed by IRS regulations concerning fiduciary income tax returns. These schedules must be accurately completed and filed to comply with federal tax laws. Failure to do so may result in penalties or audits. It is essential for fiduciaries to understand their obligations and ensure that all income and deductions are reported in accordance with IRS guidelines.

Key Elements of Schedules 3 & 4 for Form 38

Key elements of Schedules 3 and 4 include detailed sections for reporting various types of income and allowable deductions. Schedule 3 requires fiduciaries to report income from sources such as rental properties, interest, and dividends. Schedule 4 outlines permissible deductions, including administrative costs and legal fees. Understanding these elements is vital for accurate reporting and compliance with tax laws.

Filing Deadlines for Schedules 3 & 4

Filing deadlines for Schedules 3 and 4 coincide with the due date for Form 38, which is typically the fifteenth day of the fourth month following the close of the tax year. For estates and trusts operating on a calendar year, this means the deadline is April 15. It is important to file on time to avoid penalties and interest on any taxes owed.

Examples of Using Schedules 3 & 4 for Form 38

Examples of using Schedules 3 and 4 can help clarify their application. For instance, if a trust earns $10,000 in interest income, this amount would be reported on Schedule 3. If the trust incurs $2,000 in legal fees for estate administration, this expense would be recorded on Schedule 4 as a deduction. These examples illustrate how to accurately report income and deductions, ensuring compliance with IRS requirements.

Quick guide on how to complete schedules 3 amp 4 for form 38 fiduciary income tax return nd

Complete [SKS] effortlessly on any device

Managing documents online has gained popularity among businesses and individuals. It serves as a perfect eco-friendly substitute for conventional printed and signed papers, as you can access the appropriate form and securely store it online. airSlate SignNow provides all the tools necessary to create, modify, and eSign your documents swiftly without delays. Manage [SKS] on any platform using airSlate SignNow's Android or iOS applications and enhance any document-related task today.

How to modify and eSign [SKS] with ease

- Acquire [SKS] and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize pertinent sections of the documents or conceal sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Produce your signature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Choose how you wish to send your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searching, or errors that necessitate re-printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Alter and eSign [SKS] and ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Schedules 3 & 4 For Form 38 Fiduciary Income Tax Return Nd

Create this form in 5 minutes!

How to create an eSignature for the schedules 3 amp 4 for form 38 fiduciary income tax return nd

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are Schedules 3 & 4 for Form 38 Fiduciary Income Tax Return ND?

Schedules 3 & 4 for Form 38 Fiduciary Income Tax Return ND are essential components for reporting income and expenses for trusts and estates. These schedules help to delineate the forms of income received and the deductions allowed under North Dakota tax law. Understanding these schedules is vital for accurate tax reporting.

-

How can airSlate SignNow help with Schedules 3 & 4 for Form 38 Fiduciary Income Tax Return ND?

airSlate SignNow streamlines the document signing process, allowing you to easily share and eSign Schedules 3 & 4 for Form 38 Fiduciary Income Tax Return ND. The platform ensures compliance while enabling efficient handling of essential tax documents, helping you save time and reduce errors.

-

What features does airSlate SignNow offer for tax document management?

airSlate SignNow provides various features for tax document management, including templates for Schedules 3 & 4 for Form 38 Fiduciary Income Tax Return ND, automatic reminders, and secure cloud storage. These tools enhance collaboration and ensure your tax documents are always accessible when needed.

-

What are the pricing options for using airSlate SignNow for tax forms?

airSlate SignNow offers flexible pricing plans designed to accommodate different needs, whether you're an individual or a business. With competitive rates, you can effectively manage Schedules 3 & 4 for Form 38 Fiduciary Income Tax Return ND without breaking the bank. Check our website for the latest pricing details.

-

Is airSlate SignNow compliant with North Dakota tax regulations?

Yes, airSlate SignNow is designed to comply with North Dakota tax regulations, including those related to Schedules 3 & 4 for Form 38 Fiduciary Income Tax Return ND. We ensure that our platform adheres to legal requirements, so you can confidently manage and sign your tax documents.

-

Can I track the status of my tax documents with airSlate SignNow?

Absolutely! airSlate SignNow allows you to track the status of your tax documents in real-time. This feature is particularly useful for Schedules 3 & 4 for Form 38 Fiduciary Income Tax Return ND, as you can see who has viewed or signed the documents, ensuring nothing falls through the cracks.

-

Does airSlate SignNow integrate with accounting software for tax reporting?

Yes, airSlate SignNow offers integrations with various accounting software programs, making it easier to manage Schedules 3 & 4 for Form 38 Fiduciary Income Tax Return ND. This seamless integration helps streamline your workflow and ensures that your tax documentation stays organized and up-to-date.

Get more for Schedules 3 & 4 For Form 38 Fiduciary Income Tax Return Nd

Find out other Schedules 3 & 4 For Form 38 Fiduciary Income Tax Return Nd

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors