Schedule KS for Form 60 S Corporation Income Tax Return Nd

What is the Schedule KS For Form 60 S Corporation Income Tax Return Nd

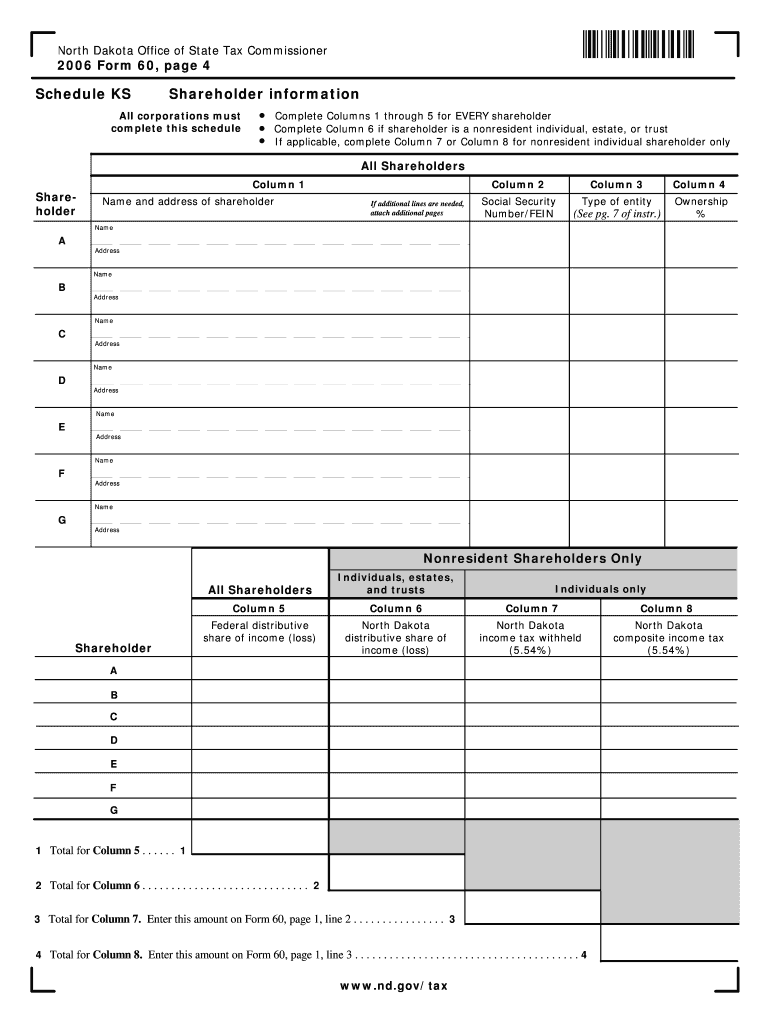

The Schedule KS for Form 60 is a specific tax form used by S corporations in North Dakota to report income, deductions, and credits. This form is essential for S corporations as it allows them to provide detailed information about their financial activities to the North Dakota tax authorities. By accurately completing Schedule KS, S corporations can ensure compliance with state tax regulations and facilitate the proper distribution of income and deductions to shareholders.

How to use the Schedule KS For Form 60 S Corporation Income Tax Return Nd

Using the Schedule KS for Form 60 involves several key steps. First, gather all necessary financial records, including income statements, expense reports, and documentation of any credits or deductions. Next, complete the form by entering relevant financial data in the appropriate sections. It's important to ensure that all figures are accurate and reflect the corporation's financial activities for the tax year. Once completed, the form should be submitted along with Form 60 to the North Dakota tax authorities by the designated deadline.

Steps to complete the Schedule KS For Form 60 S Corporation Income Tax Return Nd

Completing the Schedule KS for Form 60 requires careful attention to detail. Here are the steps to follow:

- Gather financial documents, including income and expense records.

- Fill out the corporation's identifying information at the top of the form.

- Report total income from all sources, including sales and services.

- Deduct allowable expenses to determine the net income.

- Include any applicable tax credits.

- Double-check all entries for accuracy and completeness.

- Sign and date the form before submission.

Key elements of the Schedule KS For Form 60 S Corporation Income Tax Return Nd

The Schedule KS includes several key elements that are crucial for accurate reporting. These elements typically include:

- Identification section for the S corporation, including name and tax identification number.

- Income section to report total revenue from business operations.

- Deduction section to list all allowable business expenses.

- Credit section to claim any available state tax credits.

- Signature section for authorized representatives of the corporation.

Filing Deadlines / Important Dates

Filing deadlines for the Schedule KS and Form 60 are critical for compliance. Generally, S corporations must submit their tax returns by the fifteenth day of the third month following the end of their fiscal year. For corporations operating on a calendar year, this means the due date is March 15. It is essential to be aware of any extensions or changes in deadlines that may occur, as these can affect the timely submission of tax forms.

Penalties for Non-Compliance

Failure to comply with the filing requirements for Schedule KS and Form 60 can result in various penalties. These may include monetary fines, interest on unpaid taxes, and potential legal consequences. Additionally, inaccuracies or omissions on the form can lead to audits or further scrutiny from tax authorities. It is crucial for S corporations to ensure that all information is filed correctly and on time to avoid these penalties.

Quick guide on how to complete schedule ks for form 60 s corporation income tax return nd

Complete [SKS] effortlessly on any device

Digital document management has become increasingly popular among organizations and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow provides all the resources needed to create, modify, and eSign your documents swiftly without delays. Handle [SKS] on any device with airSlate SignNow's Android or iOS applications and simplify any document-centric process today.

The easiest way to modify and eSign [SKS] effortlessly

- Locate [SKS] and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of your documents or obscure sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Create your signature using the Sign feature, which takes just moments and carries the same legal validity as a traditional ink signature.

- Review all information thoroughly and click on the Done button to save your modifications.

- Select your preferred method to share your form, whether via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from your chosen device. Modify and eSign [SKS] and ensure effective communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Schedule KS For Form 60 S Corporation Income Tax Return Nd

Create this form in 5 minutes!

How to create an eSignature for the schedule ks for form 60 s corporation income tax return nd

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Schedule KS for Form 60 S Corporation Income Tax Return Nd?

Schedule KS for Form 60 S Corporation Income Tax Return Nd is a crucial tax form that helps S corporations in North Dakota report their income, deductions, and credits. It provides detailed information on the corporation's financial activities, ensuring compliance with state tax laws. Using airSlate SignNow can streamline the process of preparing and submitting this important document.

-

How does airSlate SignNow help with filing Schedule KS for Form 60 S Corporation Income Tax Return Nd?

airSlate SignNow offers features that simplify the electronic signing and filing processes for Schedule KS for Form 60 S Corporation Income Tax Return Nd. With an intuitive interface, you can easily manage documents, gather eSignatures, and ensure timely submissions. This automation reduces the risk of errors and enhances efficiency for your tax filing needs.

-

What are the pricing options for using airSlate SignNow for Schedule KS for Form 60 S Corporation Income Tax Return Nd?

airSlate SignNow provides a range of pricing plans tailored to fit businesses of all sizes, making it cost-effective for filing Schedule KS for Form 60 S Corporation Income Tax Return Nd. You can choose from monthly or annual subscriptions, ensuring you only pay for what you need. Consider starting with a free trial to evaluate its suitability for your requirements.

-

Are there any integration options available for airSlate SignNow when preparing Schedule KS for Form 60 S Corporation Income Tax Return Nd?

Yes, airSlate SignNow seamlessly integrates with various software and platforms to enhance your workflow while preparing Schedule KS for Form 60 S Corporation Income Tax Return Nd. Whether you use cloud storage services or accounting software, these integrations allow for easy access and management of your documents. This connectivity boosts productivity and helps keep your processes organized.

-

What features does airSlate SignNow offer to aid in completing Schedule KS for Form 60 S Corporation Income Tax Return Nd?

airSlate SignNow includes essential features like templates, document sharing, and eSigning, which are vital for completing Schedule KS for Form 60 S Corporation Income Tax Return Nd. These tools help you create error-free documents quickly and ensure that all signers can easily access and review the paperwork. Additionally, you can track the status of your documents in real time.

-

What benefits do businesses gain from using airSlate SignNow for Schedule KS for Form 60 S Corporation Income Tax Return Nd?

Using airSlate SignNow for Schedule KS for Form 60 S Corporation Income Tax Return Nd offers signNow benefits, including time savings and improved accuracy in your tax filing process. The easy-to-use platform reduces the complexity associated with document management, making it accessible for users with varying levels of expertise. This approach allows for faster turnaround times and helps to minimize compliance risks.

-

Can airSlate SignNow assist with any common challenges in filing Schedule KS for Form 60 S Corporation Income Tax Return Nd?

Absolutely! airSlate SignNow addresses common challenges such as disorganized documentation and obtaining multiple eSignatures efficiently when filing Schedule KS for Form 60 S Corporation Income Tax Return Nd. Its structured document management system ensures that all necessary information is in one place, reducing the chances of missing critical details. This minimizes delays and errors during the filing process.

Get more for Schedule KS For Form 60 S Corporation Income Tax Return Nd

- Ccsd forms

- Ntruhs internship rules form

- Taste of herbs flavor wheel pdf form

- Spray tanning release form

- Reference request form example

- Sample letter of medical necessity for hoyer lift form

- 103 revised january to be accomplished in quadruplicate remarksannotation republic of the philippines office of the civil form

- Pratt d d good teaching one size fits all form

Find out other Schedule KS For Form 60 S Corporation Income Tax Return Nd

- How Can I eSignature Colorado Real estate purchase contract template

- How To eSignature Mississippi Real estate purchase contract template

- eSignature California Renter's contract Safe

- eSignature Florida Renter's contract Myself

- eSignature Florida Renter's contract Free

- eSignature Florida Renter's contract Fast

- eSignature Vermont Real estate sales contract template Later

- Can I eSignature Texas New hire forms

- How Can I eSignature California New hire packet

- How To eSignature South Carolina Real estate document

- eSignature Florida Real estate investment proposal template Free

- How To eSignature Utah Real estate forms

- How Do I eSignature Washington Real estate investment proposal template

- Can I eSignature Kentucky Performance Contract

- eSignature Nevada Performance Contract Safe

- eSignature California Franchise Contract Secure

- How To eSignature Colorado Sponsorship Proposal Template

- eSignature Alabama Distributor Agreement Template Secure

- eSignature California Distributor Agreement Template Later

- eSignature Vermont General Power of Attorney Template Easy