Form 58 22209 Nd

What is the Form 58 22209 Nd

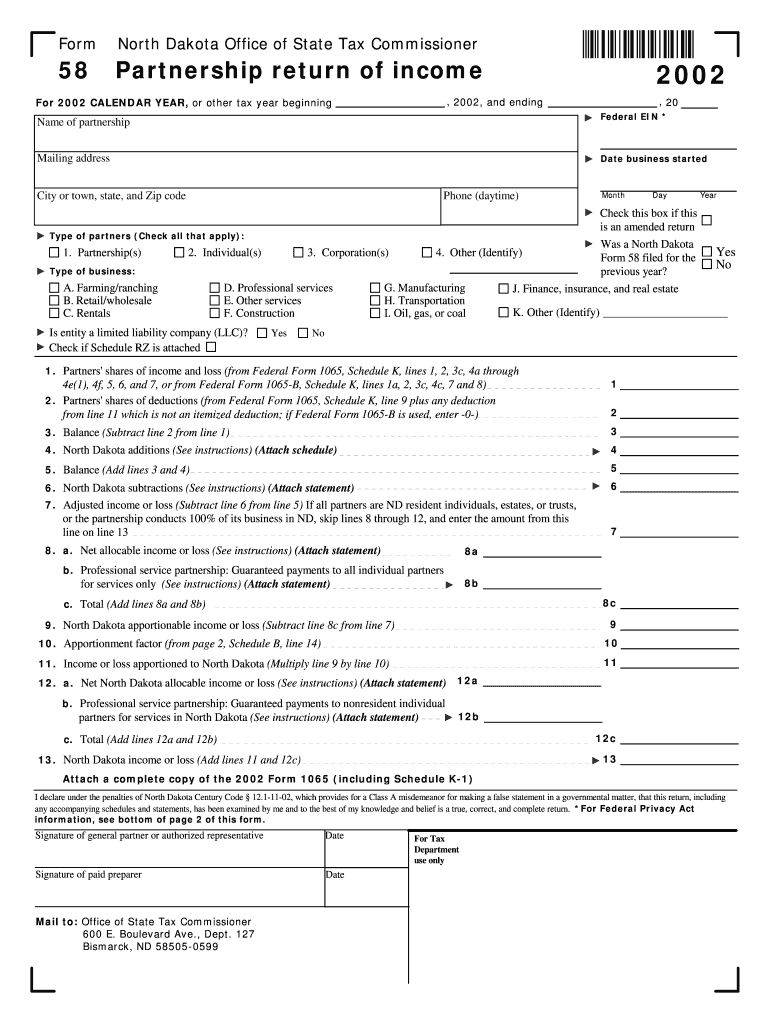

The Form 58 22209 Nd is a specific document used in various legal and administrative processes. This form is often required for certain applications, filings, or compliance measures within the state of North Dakota. Understanding its purpose is essential for individuals and businesses to ensure they are meeting legal obligations effectively.

How to use the Form 58 22209 Nd

Using the Form 58 22209 Nd involves several steps to ensure proper completion and submission. First, individuals must gather all necessary information and documents required to fill out the form accurately. Next, the form should be completed with attention to detail, ensuring that all sections are filled out as instructed. Finally, once the form is completed, it must be submitted through the appropriate channels, which may include online submission, mailing, or in-person delivery.

Steps to complete the Form 58 22209 Nd

Completing the Form 58 22209 Nd requires careful attention to detail. Here are the steps to follow:

- Review the form instructions thoroughly to understand each section.

- Gather any required documents that support the information you will provide.

- Fill out the form accurately, ensuring that all information is current and correct.

- Double-check the form for any errors or omissions before submission.

- Submit the form according to the specified guidelines, whether online, by mail, or in person.

Legal use of the Form 58 22209 Nd

The Form 58 22209 Nd serves a legal purpose within the framework of North Dakota law. It may be used for various applications, including permits, licenses, or compliance declarations. It is crucial to understand the legal implications of the form and ensure that it is used correctly to avoid potential legal issues.

Required Documents

When filling out the Form 58 22209 Nd, certain documents may be required to support your application. Commonly required documents include:

- Proof of identity, such as a driver's license or state ID.

- Supporting documentation relevant to the specific purpose of the form.

- Any previous forms or records that may be necessary for context.

Form Submission Methods

The Form 58 22209 Nd can be submitted through various methods, depending on the requirements set forth by the issuing authority. Common submission methods include:

- Online submission via the designated government portal.

- Mailing the completed form to the appropriate office.

- In-person submission at designated locations.

Quick guide on how to complete form 58 22209 nd

Complete [SKS] effortlessly on any device

Digital document management has become increasingly popular among companies and individuals. It serves as an ideal eco-friendly substitute for conventional printed and signed paperwork, allowing you to locate the suitable form and securely save it online. airSlate SignNow equips you with all the tools necessary to create, edit, and eSign your documents quickly without delays. Handle [SKS] on any device using airSlate SignNow's Android or iOS apps and streamline any document-related process today.

How to edit and eSign [SKS] effortlessly

- Locate [SKS] and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of your documents or obscure sensitive data with tools that airSlate SignNow provides for that purpose.

- Create your eSignature using the Sign feature, which takes mere seconds and holds the same legal validity as a traditional ink signature.

- Review all the information and click on the Done button to save your changes.

- Select your preferred method to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate issues with lost or misplaced files, tedious form searches, or errors that require new document copies to be printed. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Modify and eSign [SKS] to ensure excellent communication at any point in your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Form 58 22209 Nd

Create this form in 5 minutes!

How to create an eSignature for the form 58 22209 nd

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form 58 22209 Nd?

Form 58 22209 Nd is a crucial document used for specific business transactions. airSlate SignNow enables users to easily create, send, and eSign Form 58 22209 Nd, streamlining the process for a more efficient experience.

-

How does airSlate SignNow help with Form 58 22209 Nd?

With airSlate SignNow, you can effortlessly manage Form 58 22209 Nd by utilizing its eSignature features. This platform simplifies document workflows, ensuring your forms are signed securely and quickly, minimizing delays.

-

What are the pricing options for airSlate SignNow when handling Form 58 22209 Nd?

airSlate SignNow offers flexible pricing plans to accommodate businesses of all sizes managing Form 58 22209 Nd. You can choose from basic to advanced packages, ensuring you find a plan that meets your specific needs and budget.

-

Can I integrate airSlate SignNow with other tools for managing Form 58 22209 Nd?

Yes, airSlate SignNow offers various integrations with popular tools like Google Workspace, Microsoft Office, and CRMs. These integrations enhance your ability to manage Form 58 22209 Nd seamlessly across your existing technology stack.

-

What benefits does airSlate SignNow provide for eSigning Form 58 22209 Nd?

Using airSlate SignNow to eSign Form 58 22209 Nd offers several benefits, including increased security, ease of use, and faster turnaround times. This streamlined process helps eliminate the need for physical paperwork and reduces administrative costs.

-

Is airSlate SignNow user-friendly for completing Form 58 22209 Nd?

Absolutely! airSlate SignNow is designed with user experience in mind, making it easy to complete and eSign Form 58 22209 Nd. Even users with limited technical skills can navigate the platform effortlessly.

-

How can I ensure my Form 58 22209 Nd is secure with airSlate SignNow?

airSlate SignNow prioritizes security, employing encryption and secure storage protocols for all documents, including Form 58 22209 Nd. You can rest assured that your sensitive information is protected throughout the eSignature process.

Get more for Form 58 22209 Nd

Find out other Form 58 22209 Nd

- eSignature Colorado Medical Power of Attorney Template Fast

- Help Me With eSignature Florida Medical Power of Attorney Template

- eSignature Iowa Medical Power of Attorney Template Safe

- eSignature Nevada Medical Power of Attorney Template Secure

- eSignature Arkansas Nanny Contract Template Secure

- eSignature Wyoming New Patient Registration Mobile

- eSignature Hawaii Memorandum of Agreement Template Online

- eSignature Hawaii Memorandum of Agreement Template Mobile

- eSignature New Jersey Memorandum of Agreement Template Safe

- eSignature Georgia Shareholder Agreement Template Mobile

- Help Me With eSignature Arkansas Cooperative Agreement Template

- eSignature Maryland Cooperative Agreement Template Simple

- eSignature Massachusetts Redemption Agreement Simple

- eSignature North Carolina Redemption Agreement Mobile

- eSignature Utah Equipment Rental Agreement Template Now

- Help Me With eSignature Texas Construction Contract Template

- eSignature Illinois Architectural Proposal Template Simple

- Can I eSignature Indiana Home Improvement Contract

- How Do I eSignature Maryland Home Improvement Contract

- eSignature Missouri Business Insurance Quotation Form Mobile