Form 60 Small Business Corporation Income Tax Return Nd

What is the Form 60 Small Business Corporation Income Tax Return Nd

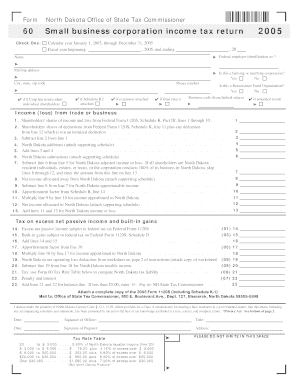

The Form 60 Small Business Corporation Income Tax Return Nd is a tax document specifically designed for small business corporations operating in North Dakota. This form is used to report income, deductions, and credits for the corporation, ensuring compliance with state tax regulations. It serves as a crucial tool for small businesses to accurately report their financial activities and determine their tax obligations. Understanding the purpose of this form is essential for small business owners to maintain good standing with the state tax authority.

How to obtain the Form 60 Small Business Corporation Income Tax Return Nd

To obtain the Form 60 Small Business Corporation Income Tax Return Nd, small business owners can visit the North Dakota Office of State Tax Commissioner’s website. The form is typically available for download in a PDF format, allowing for easy access and printing. Additionally, businesses may request a physical copy of the form by contacting the tax office directly. Ensuring you have the correct version of the form is important for accurate filing and compliance.

Steps to complete the Form 60 Small Business Corporation Income Tax Return Nd

Completing the Form 60 Small Business Corporation Income Tax Return Nd involves several key steps:

- Gather all necessary financial documents, including income statements, expense records, and previous tax returns.

- Fill out the identification section, including the corporation's name, address, and tax identification number.

- Report total income and allowable deductions in the appropriate sections of the form.

- Calculate the tax liability based on the provided tax rates and any applicable credits.

- Review the completed form for accuracy and ensure all required signatures are included.

Legal use of the Form 60 Small Business Corporation Income Tax Return Nd

The legal use of the Form 60 Small Business Corporation Income Tax Return Nd is mandated by North Dakota state law. Small business corporations are required to file this form annually to report their income and pay any taxes owed. Failure to file the form can result in penalties and interest charges. It is important for businesses to understand their legal obligations regarding tax reporting and to ensure timely submission of the form to avoid any legal repercussions.

Filing Deadlines / Important Dates

Filing deadlines for the Form 60 Small Business Corporation Income Tax Return Nd typically align with the end of the corporation's fiscal year. Corporations must file the form by the 15th day of the fourth month following the end of their fiscal year. For example, if a corporation's fiscal year ends on December 31, the form is due by April 15 of the following year. It is crucial for businesses to be aware of these deadlines to avoid late fees and maintain compliance with state tax laws.

Required Documents

When preparing to file the Form 60 Small Business Corporation Income Tax Return Nd, several documents are required:

- Income statements detailing revenue generated during the tax year.

- Expense records, including receipts and invoices for business-related costs.

- Previous tax returns for reference and consistency.

- Any supporting documentation for deductions and credits claimed.

Quick guide on how to complete form 60 small business corporation income tax return nd

Complete [SKS] effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed documentation, as you can easily locate the required form and store it securely online. airSlate SignNow provides you with all the tools necessary to create, edit, and eSign your documents quickly and without interruptions. Manage [SKS] on any platform using airSlate SignNow's Android or iOS applications and simplify any document-related process today.

The simplest method to modify and eSign [SKS] without hassle

- Find [SKS] and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize signNow sections of the documents or redact sensitive information with the tools that airSlate SignNow offers specifically for this purpose.

- Generate your signature with the Sign tool, which only takes a few seconds and has the same legal authority as a conventional wet ink signature.

- Review all the details and click the Done button to save your modifications.

- Choose how you want to send your form, whether by email, SMS, invitation link, or download it to your computer.

Wave goodbye to lost or misplaced documents, tedious form searches, or errors that require printing new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device of your preference. Edit and eSign [SKS] to guarantee exceptional communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Form 60 Small Business Corporation Income Tax Return Nd

Create this form in 5 minutes!

How to create an eSignature for the form 60 small business corporation income tax return nd

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Form 60 Small Business Corporation Income Tax Return Nd?

The Form 60 Small Business Corporation Income Tax Return Nd is a tax document specifically designed for small businesses in North Dakota. It allows corporations to report their income, deductions, and tax liability while ensuring compliance with state regulations. Utilizing this form helps ensure proper financial reporting and can assist in maximizing potential tax benefits.

-

How can airSlate SignNow help with Form 60 Small Business Corporation Income Tax Return Nd?

airSlate SignNow provides a seamless electronic signature solution for completing and submitting the Form 60 Small Business Corporation Income Tax Return Nd. By using our platform, businesses can easily prepare documents, collect necessary signatures, and submit their returns securely and efficiently. This eliminates paperwork hassles and speeds up the filing process.

-

Is there a cost associated with using airSlate SignNow for Form 60 Small Business Corporation Income Tax Return Nd?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs, including features that support Form 60 Small Business Corporation Income Tax Return Nd. Our competitive pricing ensures that even small businesses can access essential e-signature capabilities without breaking the bank. Consider the value of time saved and enhanced compliance when evaluating the cost.

-

What features does airSlate SignNow offer for processing Form 60 Small Business Corporation Income Tax Return Nd?

airSlate SignNow offers a range of features specifically beneficial for handling the Form 60 Small Business Corporation Income Tax Return Nd. These include customizable templates, audit trails for document security, and in-app reminders to ensure timely submissions. Our user-friendly interface makes document preparation and signing simple and intuitive.

-

Can airSlate SignNow integrate with accounting software for Form 60 Small Business Corporation Income Tax Return Nd?

Yes, airSlate SignNow can integrate with various accounting and tax software to streamline the preparation of the Form 60 Small Business Corporation Income Tax Return Nd. This integration facilitates the automatic transfer of financial data, reducing errors and saving time for accountants and business owners alike. Enhancing workflow through these integrations makes managing taxes easier.

-

What are the benefits of using airSlate SignNow for signing documents related to Form 60 Small Business Corporation Income Tax Return Nd?

Using airSlate SignNow to sign documents related to the Form 60 Small Business Corporation Income Tax Return Nd offers numerous benefits. It enhances the speed and efficiency of obtaining necessary signatures, ensures compliance with legal requirements, and provides a secure platform for sensitive tax documents. Additionally, the automated process reduces the risk of lost paperwork.

-

How secure is airSlate SignNow when dealing with Form 60 Small Business Corporation Income Tax Return Nd?

airSlate SignNow prioritizes security when managing Form 60 Small Business Corporation Income Tax Return Nd. Our platform uses advanced encryption protocols and complies with industry standards to protect sensitive information. With secure document storage and access controls, businesses can trust that their tax information is handled with the utmost care.

Get more for Form 60 Small Business Corporation Income Tax Return Nd

Find out other Form 60 Small Business Corporation Income Tax Return Nd

- How Can I Electronic signature North Dakota Legal Word

- How To Electronic signature Ohio Legal PDF

- How To Electronic signature Ohio Legal Document

- How To Electronic signature Oklahoma Legal Document

- How To Electronic signature Oregon Legal Document

- Can I Electronic signature South Carolina Life Sciences PDF

- How Can I Electronic signature Rhode Island Legal Document

- Can I Electronic signature South Carolina Legal Presentation

- How Can I Electronic signature Wyoming Life Sciences Word

- How To Electronic signature Utah Legal PDF

- How Do I Electronic signature Arkansas Real Estate Word

- How Do I Electronic signature Colorado Real Estate Document

- Help Me With Electronic signature Wisconsin Legal Presentation

- Can I Electronic signature Hawaii Real Estate PPT

- How Can I Electronic signature Illinois Real Estate Document

- How Do I Electronic signature Indiana Real Estate Presentation

- How Can I Electronic signature Ohio Plumbing PPT

- Can I Electronic signature Texas Plumbing Document

- How To Electronic signature Michigan Real Estate Form

- How To Electronic signature Arizona Police PDF