Small Business Corporation Income Tax Return Nd Form

What is the Small Business Corporation Income Tax Return Nd

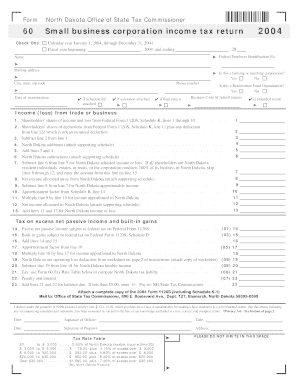

The Small Business Corporation Income Tax Return Nd is a specific form used by small business corporations to report their income, deductions, and credits to the Internal Revenue Service (IRS). This form is essential for determining the corporation's tax liability. Small business corporations, often classified as S corporations, must file this return annually to comply with federal tax regulations. The form captures various financial details, including revenue, expenses, and shareholder distributions, ensuring accurate tax reporting and compliance.

Steps to Complete the Small Business Corporation Income Tax Return Nd

Completing the Small Business Corporation Income Tax Return Nd involves several key steps:

- Gather financial records: Collect all necessary documents, including income statements, expense receipts, and prior tax returns.

- Complete the form: Fill out the required sections, detailing income, deductions, and credits. Be thorough to avoid errors.

- Review for accuracy: Double-check all entries to ensure accuracy and completeness. Mistakes can lead to delays or penalties.

- Attach necessary schedules: Include any additional schedules or forms that may be required based on your corporation's financial activities.

- Sign and date the return: Ensure that the form is signed by an authorized officer of the corporation.

Filing Deadlines / Important Dates

Filing deadlines for the Small Business Corporation Income Tax Return Nd are crucial for compliance. Typically, the return must be filed by the 15th day of the third month following the end of the corporation's tax year. For corporations operating on a calendar year, this means the return is due by March 15. If the deadline falls on a weekend or holiday, it is extended to the next business day. Corporations may also request an extension, but this does not extend the time to pay any taxes owed.

Required Documents

To successfully complete the Small Business Corporation Income Tax Return Nd, several documents are necessary:

- Income statements detailing revenue generated during the tax year.

- Expense receipts to substantiate deductions claimed.

- Previous year's tax return for reference and consistency.

- Shareholder information, including distributions and ownership percentages.

- Any applicable schedules or forms related to specific deductions or credits.

IRS Guidelines

The IRS provides specific guidelines for completing the Small Business Corporation Income Tax Return Nd. These guidelines include instructions on how to report various types of income, allowable deductions, and credits. It is essential for corporations to adhere to these guidelines to ensure compliance and avoid potential audits. The IRS also updates these guidelines periodically, so staying informed about any changes is crucial for accurate reporting.

Form Submission Methods

The Small Business Corporation Income Tax Return Nd can be submitted through various methods:

- Online filing through IRS-approved e-filing software, which often simplifies the process and reduces errors.

- Mailing a paper copy of the completed form to the appropriate IRS address, based on the corporation's location.

- In-person submission at designated IRS offices, although this method is less common.

Quick guide on how to complete small business corporation income tax return nd

Complete [SKS] effortlessly on any device

Online document management has gained signNow traction among businesses and individuals. It serves as an ideal environmentally friendly alternative to conventional printed and signed papers, allowing you to access the necessary forms and securely store them online. airSlate SignNow equips you with all the tools required to create, edit, and eSign your documents swiftly without delays. Manage [SKS] on any device using airSlate SignNow's Android or iOS applications and enhance any document-centric workflow today.

How to update and eSign [SKS] with ease

- Obtain [SKS] and then click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize pertinent parts of your files or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional ink signature.

- Review the information and then click on the Done button to finalize your changes.

- Select your preferred method to share your document via email, text message (SMS), or invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, exhausting form searches, or mistakes that require new document copies. airSlate SignNow meets all your document management requirements in just a few clicks from your chosen device. Alter and eSign [SKS] and guarantee effective communication throughout every stage of the document preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Small Business Corporation Income Tax Return Nd

Create this form in 5 minutes!

How to create an eSignature for the small business corporation income tax return nd

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a Small Business Corporation Income Tax Return Nd?

A Small Business Corporation Income Tax Return Nd refers to the tax filing specifically for small corporations operating in North Dakota. It outlines the corporation's earnings and expenses, ensuring compliance with state tax laws. Properly filing this return is essential for avoiding penalties and ensuring eligible deductions are claimed.

-

How does airSlate SignNow help with Small Business Corporation Income Tax Return Nd?

airSlate SignNow streamlines the process of collecting signatures and managing documents related to the Small Business Corporation Income Tax Return Nd. With its user-friendly interface, businesses can easily prepare and send tax-related documents for eSignature. This expedites the filing process and helps ensure compliance with state regulations.

-

What features does airSlate SignNow offer for tax document management?

airSlate SignNow offers a range of features for managing tax documents, including eSigning, document templates, and secure storage. Businesses can customize templates specifically for the Small Business Corporation Income Tax Return Nd, making it easier to prepare and track submissions. These features signNowly reduce paperwork and enhance efficiency.

-

Is airSlate SignNow cost-effective for small businesses filing taxes?

Yes, airSlate SignNow is designed to be a cost-effective solution for small businesses handling their Small Business Corporation Income Tax Return Nd. By reducing the need for physical paperwork and streamlining the signing process, businesses can lower overhead costs and save time. This affordability allows small corporations to allocate resources effectively.

-

Can I integrate airSlate SignNow with accounting software for tax preparation?

Absolutely! airSlate SignNow integrates seamlessly with various accounting software platforms, enhancing the efficiency of preparing your Small Business Corporation Income Tax Return Nd. This integration allows you to sync financial data directly, ensuring accuracy and reducing duplication of efforts. You can easily import tax-related documents for eSigning.

-

How secure is airSlate SignNow for important tax documents?

Security is a top priority for airSlate SignNow when handling tax documents, including the Small Business Corporation Income Tax Return Nd. The platform employs industry-standard encryption and compliance with data protection regulations to ensure that your sensitive information remains safe. Users can confidently send and receive documents without security concerns.

-

What are the benefits of using airSlate SignNow for my corporation's tax filing?

Using airSlate SignNow for your Small Business Corporation Income Tax Return Nd provides numerous benefits, including increased efficiency, reduced errors, and enhanced compliance. The platform simplifies document management and enables faster turnaround times for signature collection. These advantages ultimately lead to a smoother tax filing experience.

Get more for Small Business Corporation Income Tax Return Nd

Find out other Small Business Corporation Income Tax Return Nd

- eSign Hawaii Expense Statement Fast

- eSign Minnesota Share Donation Agreement Simple

- Can I eSign Hawaii Collateral Debenture

- eSign Hawaii Business Credit Application Mobile

- Help Me With eSign California Credit Memo

- eSign Hawaii Credit Memo Online

- Help Me With eSign Hawaii Credit Memo

- How Can I eSign Hawaii Credit Memo

- eSign Utah Outsourcing Services Contract Computer

- How Do I eSign Maryland Interview Non-Disclosure (NDA)

- Help Me With eSign North Dakota Leave of Absence Agreement

- How To eSign Hawaii Acknowledgement of Resignation

- How Can I eSign New Jersey Resignation Letter

- How Do I eSign Ohio Resignation Letter

- eSign Arkansas Military Leave Policy Myself

- How To eSign Hawaii Time Off Policy

- How Do I eSign Hawaii Time Off Policy

- Help Me With eSign Hawaii Time Off Policy

- How To eSign Hawaii Addressing Harassement

- How To eSign Arkansas Company Bonus Letter