Oklahoma Individual Estimated Tax ITE April 17, Oklahoma Tax Ok Form

Understanding the Oklahoma Individual Estimated Tax ITE

The Oklahoma Individual Estimated Tax ITE is a crucial form for residents who expect to owe tax of $1,000 or more when filing their annual return. This form allows individuals to make estimated tax payments throughout the year, helping to avoid penalties for underpayment. It is essential for self-employed individuals, retirees, and anyone with significant income not subject to withholding.

Steps to Complete the Oklahoma Individual Estimated Tax ITE

Completing the Oklahoma Individual Estimated Tax ITE involves several steps:

- Determine your expected income for the year, including wages, dividends, and other sources.

- Calculate your estimated tax liability using the current tax rates.

- Divide your total estimated tax by four to determine quarterly payments.

- Fill out the ITE form with your personal information and estimated tax amounts.

- Submit the form by the due date, typically April 15 for the first quarter payment.

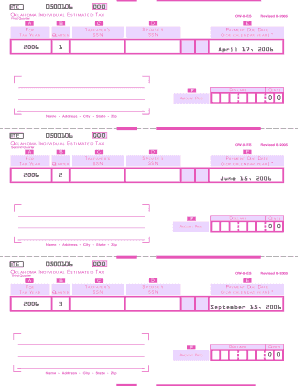

Filing Deadlines for the Oklahoma Individual Estimated Tax ITE

It is important to adhere to specific deadlines when filing the Oklahoma Individual Estimated Tax ITE. Payments are generally due on the following dates:

- First quarter: April 15

- Second quarter: June 15

- Third quarter: September 15

- Fourth quarter: January 15 of the following year

Required Documents for the Oklahoma Individual Estimated Tax ITE

To successfully complete the Oklahoma Individual Estimated Tax ITE, you will need several documents:

- Your previous year's tax return for reference.

- Documentation of all income sources, including W-2s and 1099s.

- Records of any deductions or credits you plan to claim.

Legal Use of the Oklahoma Individual Estimated Tax ITE

The Oklahoma Individual Estimated Tax ITE is legally binding and must be filed according to state tax laws. Failure to file or pay estimated taxes can result in penalties and interest. It is crucial to ensure that all information is accurate and submitted on time to avoid legal complications.

Examples of Using the Oklahoma Individual Estimated Tax ITE

Individuals often use the Oklahoma Individual Estimated Tax ITE in various scenarios:

- A self-employed individual who earns income from freelance work.

- A retiree receiving pension payments and investment income.

- A person with rental property generating significant income.

Quick guide on how to complete oklahoma individual estimated tax ite april 17 oklahoma tax ok

Finish [SKS] effortlessly on any device

Online document management has gained popularity among companies and individuals alike. It offers an exceptional eco-friendly substitute for traditional printed and signed papers, allowing you to obtain the correct format and securely store it online. airSlate SignNow provides you with all the resources necessary to create, modify, and electronically sign your documents quickly and without issues. Handle [SKS] on any device using airSlate SignNow's Android or iOS applications and ease any document-related task today.

Ways to modify and electronically sign [SKS] without hassle

- Find [SKS] and then click Get Form to begin.

- Utilize the tools available to complete your document.

- Emphasize important sections of the documents or redact sensitive details with the tools that airSlate SignNow provides for that purpose.

- Generate your signature using the Sign feature, which takes moments and carries the same legal validity as a conventional wet ink signature.

- Review all the details and then click the Done button to preserve your changes.

- Select how you wish to send your form, either by email, SMS, invite link, or download it to your computer.

Say goodbye to lost or misdirected files, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Alter and electronically sign [SKS] to ensure excellent communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Oklahoma Individual Estimated Tax ITE April 17, Oklahoma Tax Ok

Create this form in 5 minutes!

How to create an eSignature for the oklahoma individual estimated tax ite april 17 oklahoma tax ok

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the deadline for filing Oklahoma Individual Estimated Tax ITE?

The deadline for filing Oklahoma Individual Estimated Tax ITE is April 17. Ensure that you gather all necessary documents to meet the Oklahoma Tax Ok requirements and avoid penalties. Filing on time is crucial for maintaining good standing with the Oklahoma tax authorities.

-

How can airSlate SignNow assist with Oklahoma Individual Estimated Tax ITE submissions?

airSlate SignNow simplifies the process of preparing and submitting your Oklahoma Individual Estimated Tax ITE. With our easy-to-use eSignature tools, you can quickly sign and send documents securely, ensuring compliance with Oklahoma Tax Ok regulations. This saves you time and streamlines your tax submission process.

-

Are there any fees associated with using airSlate SignNow for Oklahoma Individual Estimated Tax ITE?

Using airSlate SignNow for your Oklahoma Individual Estimated Tax ITE involves a subscription-based pricing model, which is cost-effective. The pricing plans are designed to cater to various business needs, ensuring that you get the best value while managing your Oklahoma Tax Ok documents efficiently.

-

What features does airSlate SignNow offer to support Oklahoma Individual Estimated Tax ITE filers?

airSlate SignNow offers a range of features tailored for Oklahoma Individual Estimated Tax ITE filers, including customizable templates, secure document storage, and real-time tracking of signatures. These features ensure that your documents are not only professional but also compliant with Oklahoma Tax Ok standards.

-

Can I integrate airSlate SignNow with other accounting software for Oklahoma Individual Estimated Tax ITE?

Yes, airSlate SignNow seamlessly integrates with various accounting and tax preparation software, which can facilitate your Oklahoma Individual Estimated Tax ITE submissions. This integration means you can manage your documents and tax filings in one platform, aligning with Oklahoma Tax Ok procedures efficiently.

-

How secure is the information shared with airSlate SignNow for Oklahoma Individual Estimated Tax ITE?

The security of your information is paramount at airSlate SignNow. We utilize advanced encryption and security protocols to protect the sensitive data shared during the Oklahoma Individual Estimated Tax ITE process. This commitment to security ensures that your documents comply with Oklahoma Tax Ok guidelines safely.

-

What are the benefits of using airSlate SignNow for tax document management?

Using airSlate SignNow for tax document management, particularly for Oklahoma Individual Estimated Tax ITE, offers numerous benefits, including increased efficiency and reduced paper usage. You'll also enjoy faster turnaround times for signatures, enabling you to meet Oklahoma Tax Ok deadlines swiftly and effectively.

Get more for Oklahoma Individual Estimated Tax ITE April 17, Oklahoma Tax Ok

Find out other Oklahoma Individual Estimated Tax ITE April 17, Oklahoma Tax Ok

- eSign Mississippi Sponsorship Agreement Free

- eSign North Dakota Copyright License Agreement Free

- How Do I eSign Idaho Medical Records Release

- Can I eSign Alaska Advance Healthcare Directive

- eSign Kansas Client and Developer Agreement Easy

- eSign Montana Domain Name Registration Agreement Now

- eSign Nevada Affiliate Program Agreement Secure

- eSign Arizona Engineering Proposal Template Later

- eSign Connecticut Proforma Invoice Template Online

- eSign Florida Proforma Invoice Template Free

- Can I eSign Florida Proforma Invoice Template

- eSign New Jersey Proforma Invoice Template Online

- eSign Wisconsin Proforma Invoice Template Online

- eSign Wyoming Proforma Invoice Template Free

- eSign Wyoming Proforma Invoice Template Simple

- How To eSign Arizona Agreement contract template

- eSign Texas Agreement contract template Fast

- eSign Massachusetts Basic rental agreement or residential lease Now

- How To eSign Delaware Business partnership agreement

- How Do I eSign Massachusetts Business partnership agreement