Fs Form 5336 2018

What is the FS Form 5336

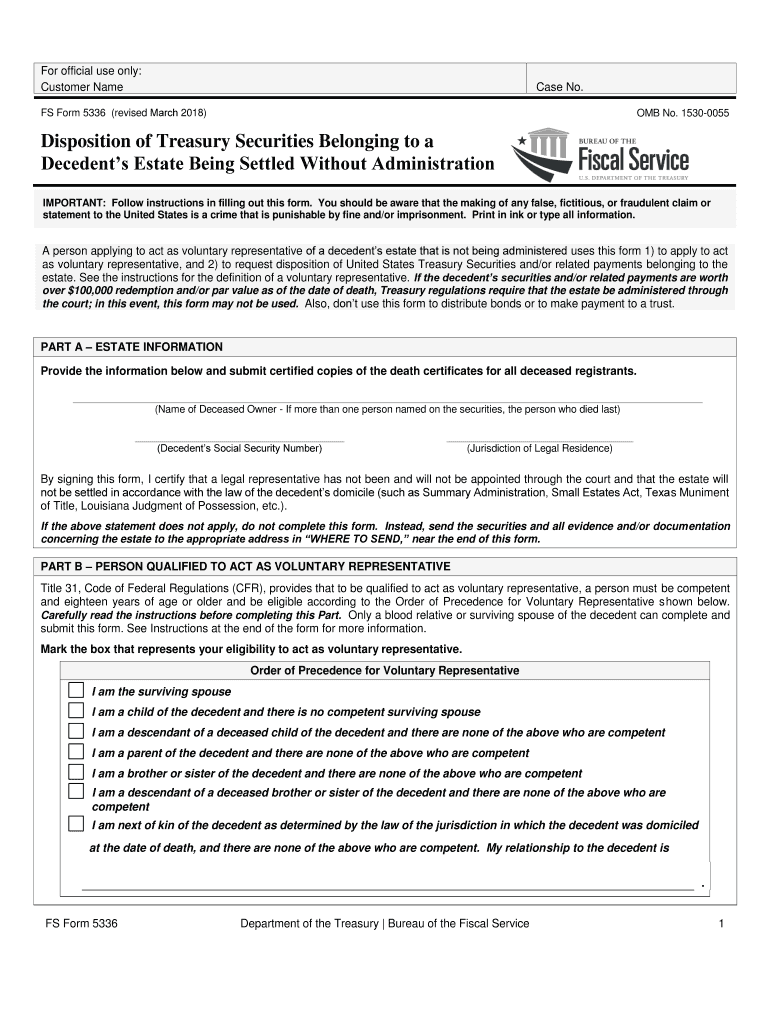

The FS Form 5336, also known as the treasury form fs 5336, is a document used primarily for the management of U.S. savings bonds. This form is essential for individuals and institutions that need to report transactions related to savings bonds, such as transfers, redemptions, or changes in ownership. It is issued by the Department of the Treasury and plays a crucial role in ensuring that all transactions comply with federal regulations.

How to use the FS Form 5336

Using the FS Form 5336 involves several straightforward steps. First, identify the specific transaction you are reporting, such as a redemption or transfer of savings bonds. Next, gather all necessary information, including the bond details and the personal information of the bondholder. After filling out the form accurately, ensure that all required fields are completed to avoid delays. Finally, submit the form according to the specified submission methods, which may include online, mail, or in-person options.

Steps to complete the FS Form 5336

Completing the FS Form 5336 requires attention to detail. Follow these steps:

- Download the form from the official treasury website or obtain a physical copy.

- Fill in your personal information, including name, address, and Social Security number.

- Provide details about the savings bonds involved, including serial numbers and denominations.

- Clearly state the purpose of the form, whether it is for redemption, transfer, or another action.

- Review the form for accuracy and completeness before submission.

Legal use of the FS Form 5336

The FS Form 5336 must be used in accordance with U.S. federal laws governing savings bonds. It is important to ensure that the information provided is accurate and up to date, as the use of obsolete or incorrect forms can lead to legal complications. The form is legally binding once submitted, and any discrepancies can result in penalties or delays in processing. Always check for the latest version of the form to ensure compliance with current regulations.

Form Submission Methods

The FS Form 5336 can be submitted through various methods, depending on the preferences of the submitting party. Options typically include:

- Online Submission: If permitted, this method allows for a quick and secure way to submit the form electronically.

- Mail: The completed form can be sent to the designated address provided by the Department of the Treasury.

- In-Person: Submitting the form in person may be an option at certain Treasury locations or financial institutions.

Who Issues the Form

The FS Form 5336 is issued by the U.S. Department of the Treasury. This agency is responsible for managing federal finances, including the issuance and regulation of savings bonds. The form is part of the Treasury's efforts to ensure proper handling and reporting of savings bond transactions, maintaining the integrity of the savings bond program.

Quick guide on how to complete help filing form fs 5336 treasury dept 2018 2019

Discover the most efficient method to complete and endorse your Fs Form 5336

Are you still spending time creating your official documents on paper instead of completing them online? airSlate SignNow offers a superior approach to complete and endorse your Fs Form 5336 and related forms for public services. Our advanced eSignature platform equips you with all the necessary tools to handle documents swiftly and in compliance with official standards - robust PDF editing, managing, safeguarding, signing, and sharing utilities, all conveniently located within a user-friendly interface.

Only a few steps are needed to finish filling out and endorsing your Fs Form 5336:

- Upload the editable template to the editor using the Get Form button.

- Review the information you need to include in your Fs Form 5336.

- Navigate through the fields using the Next option to avoid missing anything.

- Utilize Text, Check, and Cross features to complete the fields with your details.

- Modify the content with Text boxes or Images from the upper toolbar.

- Emphasize what is signNow or Hide fields that are no longer relevant.

- Click on Sign to create a legally recognized eSignature using your preferred method.

- Add the Date beside your signature and conclude your task with the Done button.

Store your completed Fs Form 5336 in the Documents section of your profile, download it, or transfer it to your chosen cloud storage. Our service also provides adaptable file sharing options. There’s no need to print your documents when you can submit them directly to the relevant public office - do so via email, fax, or by requesting a USPS “snail mail” delivery from your account. Give it a go today!

Create this form in 5 minutes or less

Find and fill out the correct help filing form fs 5336 treasury dept 2018 2019

Create this form in 5 minutes!

How to create an eSignature for the help filing form fs 5336 treasury dept 2018 2019

How to create an eSignature for the Help Filing Form Fs 5336 Treasury Dept 2018 2019 in the online mode

How to make an electronic signature for your Help Filing Form Fs 5336 Treasury Dept 2018 2019 in Chrome

How to create an eSignature for signing the Help Filing Form Fs 5336 Treasury Dept 2018 2019 in Gmail

How to create an electronic signature for the Help Filing Form Fs 5336 Treasury Dept 2018 2019 from your mobile device

How to generate an electronic signature for the Help Filing Form Fs 5336 Treasury Dept 2018 2019 on iOS

How to generate an eSignature for the Help Filing Form Fs 5336 Treasury Dept 2018 2019 on Android OS

People also ask

-

What is the treasury form FS 5336?

The treasury form FS 5336 is a document used for managing federal payments and disbursements. This form assists businesses and individuals in submitting claims for federal funds. Understanding how to properly fill out treasury form FS 5336 can streamline the payment process.

-

How can airSlate SignNow help with the treasury form FS 5336?

AirSlate SignNow provides a convenient platform for electronically signing and sending the treasury form FS 5336. Our solution ensures that your documents are securely stored and easily accessible. With airSlate SignNow, you can complete the treasury form FS 5336 quickly and efficiently.

-

What are the key features of airSlate SignNow for handling the treasury form FS 5336?

Key features of airSlate SignNow include an intuitive interface, customizable templates, and robust security measures. These features enable you to easily manage the treasury form FS 5336 and other important documents. The platform’s eSignature capabilities ensure compliance with federal regulations.

-

Is there a cost associated with using airSlate SignNow for the treasury form FS 5336?

Yes, airSlate SignNow offers competitive pricing plans that suit various business needs. Subscribing to our service allows you to efficiently manage forms like the treasury form FS 5336 without the hassle of paper documents. Contact us for a detailed pricing structure tailored to your needs.

-

How secure is my data when using airSlate SignNow for the treasury form FS 5336?

Security is a top priority at airSlate SignNow. All your data, including documents like the treasury form FS 5336, is encrypted and protected with advanced security protocols. You can trust that your sensitive information is safe with us.

-

Can I integrate airSlate SignNow with other applications for managing the treasury form FS 5336?

Absolutely! airSlate SignNow can integrate seamlessly with various applications, enhancing your workflow for the treasury form FS 5336. This allows for better document management and collaboration across platforms, making it easier to handle federal forms.

-

What benefits does airSlate SignNow offer for eSigning the treasury form FS 5336?

Using airSlate SignNow to eSign the treasury form FS 5336 accelerates the signing process and reduces turnaround time. Additionally, it provides a clear audit trail and improves overall efficiency in managing federal documents. Experience the convenience of electronic signatures with airSlate SignNow.

Get more for Fs Form 5336

- Room condition report template form

- Changing the background colors of fields fillable adobe partners form

- Abt 6001 form

- New dog license application for rancho palos verdes residents form

- Good standing letter sample for doctors form

- Get the commercial plan submittal application 200 1st form

- Ethnicity is the student hispaniclatino form

- Firefighterparamedic application checklist form

Find out other Fs Form 5336

- eSign Vermont Finance & Tax Accounting Emergency Contact Form Simple

- eSign Delaware Government Stock Certificate Secure

- Can I eSign Vermont Finance & Tax Accounting Emergency Contact Form

- eSign Washington Finance & Tax Accounting Emergency Contact Form Safe

- How To eSign Georgia Government Claim

- How Do I eSign Hawaii Government Contract

- eSign Hawaii Government Contract Now

- Help Me With eSign Hawaii Government Contract

- eSign Hawaii Government Contract Later

- Help Me With eSign California Healthcare / Medical Lease Agreement

- Can I eSign California Healthcare / Medical Lease Agreement

- How To eSign Hawaii Government Bill Of Lading

- How Can I eSign Hawaii Government Bill Of Lading

- eSign Hawaii Government Promissory Note Template Now

- eSign Hawaii Government Work Order Online

- eSign Delaware Healthcare / Medical Living Will Now

- eSign Healthcare / Medical Form Florida Secure

- eSign Florida Healthcare / Medical Contract Safe

- Help Me With eSign Hawaii Healthcare / Medical Lease Termination Letter

- eSign Alaska High Tech Warranty Deed Computer