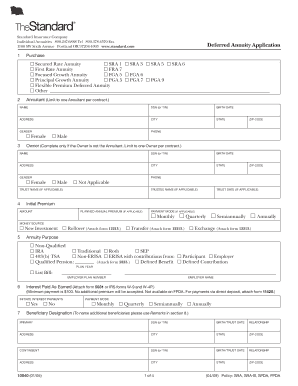

Com Deferred Annuity Application 1 Purchase G Secured Rate Annuity G SRA 1 G SRA 3 G SRA 5 G SRA 6 G First Rate Annuity G FRA 7 Form

Understanding the Com Deferred Annuity Application

The Com Deferred Annuity Application is a critical document for individuals looking to invest in various annuity products, including the G Secured Rate Annuity, G SRA series, G First Rate Annuity, and G Focused Growth Annuity. This application serves as a formal request to purchase these financial products, which are designed to provide a steady income stream during retirement. Each annuity type offers unique features, such as guaranteed returns and growth potential, catering to different investment goals and risk tolerances.

Steps to Complete the Application

Completing the Com Deferred Annuity Application involves several key steps. First, gather all necessary personal information, including your Social Security number, contact details, and financial background. Next, select the specific annuity products you wish to purchase, such as the G SRA 1 or G PGA 9. Ensure you read the terms and conditions associated with each product, as they outline important details regarding fees, withdrawal options, and payout structures. After filling out the application, review it for accuracy before submitting it to the issuing company.

Key Elements of the Application

Several essential components must be included in the Com Deferred Annuity Application. These include personal identification information, the chosen annuity type, premium payment details, and beneficiary designations. Additionally, applicants should be aware of any required disclosures regarding the investment, including potential risks and fees. Understanding these elements can help ensure that the application is completed correctly and efficiently.

Eligibility Criteria for Annuities

Eligibility for the Com Deferred Annuity Application typically requires applicants to be at least eighteen years old and a legal resident of the United States. Some annuity products may have additional requirements based on the applicant's financial situation or investment goals. It is advisable to consult with a financial advisor to determine the most suitable annuity options based on individual circumstances.

Obtaining the Application

The Com Deferred Annuity Application can be obtained directly from the issuing insurance company or financial institution. Many companies provide digital access to the application through their websites, allowing for easy download and completion. Alternatively, applicants may request a physical copy to be mailed to them. Ensuring that the most current version of the application is used is crucial to avoid any processing delays.

Legal Use of the Application

The Com Deferred Annuity Application is legally binding once signed and submitted. It is important for applicants to understand the implications of their commitments, including the terms of the annuity contract. Consulting with a legal advisor can provide clarity on the legal responsibilities associated with purchasing an annuity and help ensure compliance with state regulations.

Quick guide on how to complete com deferred annuity application 1 purchase g secured rate annuity g sra 1 g sra 3 g sra 5 g sra 6 g first rate annuity g fra 7

Effortlessly Prepare [SKS] on Any Device

Managing documents online has gained signNow traction among businesses and individuals alike. It presents an ideal environmentally friendly alternative to conventional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow provides you with all the tools required to create, modify, and eSign your documents rapidly without any delays. Manage [SKS] on any platform using the airSlate SignNow Android or iOS applications and enhance any document-centric process today.

How to Modify and eSign [SKS] with Ease

- Obtain [SKS] and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight pertinent sections of your documents or redact sensitive information using tools specifically provided by airSlate SignNow for this purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Review all the details and then click the Done button to save your changes.

- Select how you wish to share your form, whether by email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form navigation, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your document management needs with just a few clicks from any device of your preference. Modify and eSign [SKS] and ensure exceptional communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Com Deferred Annuity Application 1 Purchase G Secured Rate Annuity G SRA 1 G SRA 3 G SRA 5 G SRA 6 G First Rate Annuity G FRA 7

Create this form in 5 minutes!

How to create an eSignature for the com deferred annuity application 1 purchase g secured rate annuity g sra 1 g sra 3 g sra 5 g sra 6 g first rate annuity g fra 7

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Com Deferred Annuity Application 1 Purchase?

The Com Deferred Annuity Application 1 Purchase is a financial product designed to provide a secure investment option for individuals planning for retirement. It includes various plans such as G Secured Rate Annuity G SRA 1, G SRA 3, G SRA 5, G SRA 6, and others, catering to different investment needs and goals.

-

What are the benefits of choosing a G Secured Rate Annuity?

Choosing a G Secured Rate Annuity, like G SRA 1 or G SRA 3, offers stability and predictable returns as they are backed by secured rates. This means you can have peace of mind knowing your investment grows with minimal risk, making it an ideal option for conservative investors.

-

How do the G Focused Growth Annuities work?

G Focused Growth Annuities, including G FGA 5 and G FGA 6, provide an opportunity for higher growth potential through exposure to market performance while maintaining some level of protection. They are suited for individuals looking to balance growth and security in their retirement planning.

-

What is the pricing structure for the Com Deferred Annuity products?

Pricing for the Com Deferred Annuity products varies based on the specific annuity plan chosen, such as G First Rate Annuity G FRA 7 or G Principal Growth Annuity G PGA 5. Factors include age, investment amount, and desired features, so consulting with a financial advisor for personalized quotes is advisable.

-

Are there any fees associated with the Flexible Premium Annuity?

The Flexible Premium Annuity options typically come with minimal fees that may include management or service fees. It's essential to review the specific terms of the Flexible Premium plan you choose to understand all applicable costs.

-

Can I change my investment strategy after purchasing an annuity?

Yes, many options under the Com Deferred Annuity Application allow for adjustments. For instance, you may have the ability to switch between G SRA products or G PGA options to better align with your evolving financial goals.

-

What integration options are available with the airSlate SignNow platform for annuity applications?

The airSlate SignNow platform offers seamless integrations for your annuity applications, allowing for efficient document management and eSigning. This ensures that you can complete forms for products like G SRA 6 or G FGA 5 without unnecessary hassle.

Get more for Com Deferred Annuity Application 1 Purchase G Secured Rate Annuity G SRA 1 G SRA 3 G SRA 5 G SRA 6 G First Rate Annuity G FRA 7

Find out other Com Deferred Annuity Application 1 Purchase G Secured Rate Annuity G SRA 1 G SRA 3 G SRA 5 G SRA 6 G First Rate Annuity G FRA 7

- Sign Arkansas IT Consulting Agreement Computer

- Can I Sign Arkansas IT Consulting Agreement

- Sign Iowa Agile Software Development Contract Template Free

- How To Sign Oregon IT Consulting Agreement

- Sign Arizona Web Hosting Agreement Easy

- How Can I Sign Arizona Web Hosting Agreement

- Help Me With Sign Alaska Web Hosting Agreement

- Sign Alaska Web Hosting Agreement Easy

- Sign Arkansas Web Hosting Agreement Simple

- Sign Indiana Web Hosting Agreement Online

- Sign Indiana Web Hosting Agreement Easy

- How To Sign Louisiana Web Hosting Agreement

- Sign Maryland Web Hosting Agreement Now

- Sign Maryland Web Hosting Agreement Free

- Sign Maryland Web Hosting Agreement Fast

- Help Me With Sign New York Web Hosting Agreement

- Sign Connecticut Joint Venture Agreement Template Free

- Sign South Dakota Web Hosting Agreement Free

- Sign Wisconsin Web Hosting Agreement Later

- Sign Wisconsin Web Hosting Agreement Easy