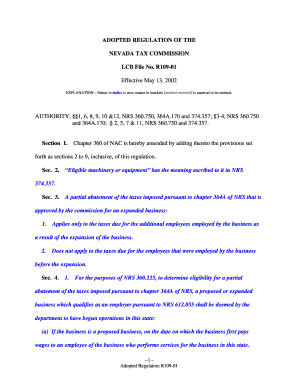

ADOPTED REGULATION of the NEVADA TAX COMMISSION Leg State Nv Form

What is the ADOPTED REGULATION OF THE NEVADA TAX COMMISSION

The ADOPTED REGULATION OF THE NEVADA TAX COMMISSION refers to the set of rules and guidelines established by the Nevada Tax Commission to govern tax administration and compliance within the state. This regulation outlines the procedures for tax collection, reporting, and enforcement, ensuring that both individuals and businesses adhere to state tax laws. It serves as a crucial framework for understanding tax obligations and rights in Nevada.

How to use the ADOPTED REGULATION OF THE NEVADA TAX COMMISSION

Utilizing the ADOPTED REGULATION involves familiarizing oneself with the specific provisions that apply to your tax situation. Taxpayers can reference the regulation to understand their responsibilities, including filing requirements and deadlines. It is essential to consult the regulation when preparing tax documents to ensure compliance with state laws and to avoid potential penalties.

Key elements of the ADOPTED REGULATION OF THE NEVADA TAX COMMISSION

Key elements of the regulation include definitions of taxable entities, tax rates, exemptions, and the processes for appeals and disputes. It also details the rights of taxpayers, such as the right to privacy and the right to contest tax assessments. Understanding these elements is vital for navigating the tax landscape in Nevada effectively.

Steps to complete the ADOPTED REGULATION OF THE NEVADA TAX COMMISSION

Completing the requirements outlined in the ADOPTED REGULATION typically involves several steps:

- Review the regulation to identify applicable tax obligations.

- Gather necessary documentation, such as income statements and expense records.

- Prepare tax forms in accordance with the guidelines provided.

- Submit the completed forms by the specified deadlines.

- Keep copies of all submitted documents for your records.

Legal use of the ADOPTED REGULATION OF THE NEVADA TAX COMMISSION

The legal use of the ADOPTED REGULATION is essential for ensuring compliance with Nevada tax laws. Taxpayers must adhere to the regulations to avoid legal repercussions, including fines and penalties. The regulation serves as a legal reference for both taxpayers and tax professionals, providing clarity on rights and obligations under state law.

Filing Deadlines / Important Dates

Filing deadlines and important dates are critical components of the ADOPTED REGULATION. Taxpayers should be aware of annual filing dates, quarterly payment deadlines, and any special dates relevant to specific tax situations. Staying informed about these dates helps prevent late submissions and associated penalties.

Required Documents

To comply with the ADOPTED REGULATION, taxpayers need to prepare several required documents. Commonly needed documents include:

- Income statements (W-2s, 1099s)

- Business expense receipts

- Previous tax returns for reference

- Any correspondence from the Nevada Tax Commission

Having these documents ready simplifies the filing process and ensures compliance with state regulations.

Quick guide on how to complete adopted regulation of the nevada tax commission leg state nv

Complete [SKS] effortlessly on any device

Managing documents online has gained popularity among businesses and individuals. It offers a perfect environmentally friendly alternative to conventional printed and signed documents, as you can access the necessary form and securely save it online. airSlate SignNow provides all the tools you need to create, modify, and electronically sign your documents quickly without delays. Manage [SKS] on any device with airSlate SignNow's Android or iOS applications and simplify any document-related task today.

How to modify and electronically sign [SKS] effortlessly

- Find [SKS] and then click Get Form to commence.

- Utilize the tools we provide to complete your document.

- Highlight pertinent sections of your documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Review the details and then click the Done button to save your adjustments.

- Choose how you wish to send your form: via email, SMS, invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device of your choice. Edit and electronically sign [SKS] to ensure excellent communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to ADOPTED REGULATION OF THE NEVADA TAX COMMISSION Leg State Nv

Create this form in 5 minutes!

How to create an eSignature for the adopted regulation of the nevada tax commission leg state nv

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the significance of the ADOPTED REGULATION OF THE NEVADA TAX COMMISSION Leg State Nv. for businesses?

The ADOPTED REGULATION OF THE NEVADA TAX COMMISSION Leg State Nv. outlines essential guidelines that affect business operations, tax compliance, and eSignature legality. Understanding these regulations helps businesses ensure they comply with state laws while executing documents electronically.

-

How does airSlate SignNow ensure compliance with the ADOPTED REGULATION OF THE NEVADA TAX COMMISSION Leg State Nv.?

airSlate SignNow is designed to comply with state regulations, including the ADOPTED REGULATION OF THE NEVADA TAX COMMISSION Leg State Nv. Our platform offers legal and enforceable eSignatures, ensuring that your documents meet the necessary legal standards.

-

What are the pricing plans for airSlate SignNow in relation to the ADOPTED REGULATION OF THE NEVADA TAX COMMISSION Leg State Nv.?

airSlate SignNow offers flexible pricing plans tailored to your business needs, accommodating the requirements set forth in the ADOPTED REGULATION OF THE NEVADA TAX COMMISSION Leg State Nv. Whether you're a small business or a large enterprise, there’s a plan that aligns with your signing needs.

-

What features does airSlate SignNow provide for compliance with the ADOPTED REGULATION OF THE NEVADA TAX COMMISSION Leg State Nv.?

airSlate SignNow includes features such as customizable templates, secure cloud storage, and detailed audit trails that are compliant with the ADOPTED REGULATION OF THE NEVADA TAX COMMISSION Leg State Nv. These features enhance document security and streamline your signing process.

-

Can airSlate SignNow integrate with other software while adhering to the ADOPTED REGULATION OF THE NEVADA TAX COMMISSION Leg State Nv.?

Yes, airSlate SignNow offers seamless integrations with various applications, enabling businesses to operate efficiently while staying compliant with the ADOPTED REGULATION OF THE NEVADA TAX COMMISSION Leg State Nv. This flexibility allows for a tailored workflow that meets organizational needs.

-

What are the benefits of using airSlate SignNow concerning the ADOPTED REGULATION OF THE NEVADA TAX COMMISSION Leg State Nv.?

Using airSlate SignNow can signNowly improve your document workflow while ensuring compliance with the ADOPTED REGULATION OF THE NEVADA TAX COMMISSION Leg State Nv. The platform enhances operational efficiency, reduces turnaround times for signing, and minimizes the risk of non-compliance.

-

Is it easy to get started with airSlate SignNow in light of the ADOPTED REGULATION OF THE NEVADA TAX COMMISSION Leg State Nv.?

Getting started with airSlate SignNow is simple and user-friendly, even when considering the requirements of the ADOPTED REGULATION OF THE NEVADA TAX COMMISSION Leg State Nv. Our intuitive interface allows users to quickly create, send, and sign documents without extensive training.

Get more for ADOPTED REGULATION OF THE NEVADA TAX COMMISSION Leg State Nv

Find out other ADOPTED REGULATION OF THE NEVADA TAX COMMISSION Leg State Nv

- How To Electronic signature Indiana Real Estate Quitclaim Deed

- Electronic signature North Carolina Plumbing Business Letter Template Easy

- Electronic signature Kansas Real Estate Residential Lease Agreement Simple

- How Can I Electronic signature North Carolina Plumbing Promissory Note Template

- Electronic signature North Dakota Plumbing Emergency Contact Form Mobile

- Electronic signature North Dakota Plumbing Emergency Contact Form Easy

- Electronic signature Rhode Island Plumbing Business Plan Template Later

- Electronic signature Louisiana Real Estate Quitclaim Deed Now

- Electronic signature Louisiana Real Estate Quitclaim Deed Secure

- How Can I Electronic signature South Dakota Plumbing Emergency Contact Form

- Electronic signature South Dakota Plumbing Emergency Contact Form Myself

- Electronic signature Maryland Real Estate LLC Operating Agreement Free

- Electronic signature Texas Plumbing Quitclaim Deed Secure

- Electronic signature Utah Plumbing Last Will And Testament Free

- Electronic signature Washington Plumbing Business Plan Template Safe

- Can I Electronic signature Vermont Plumbing Affidavit Of Heirship

- Electronic signature Michigan Real Estate LLC Operating Agreement Easy

- Electronic signature West Virginia Plumbing Memorandum Of Understanding Simple

- Electronic signature Sports PDF Alaska Fast

- Electronic signature Mississippi Real Estate Contract Online