Federal PLUS Loan for Parents CollateralCredit Requirements Form

What is the Federal PLUS Loan For Parents Collateral Credit Requirements

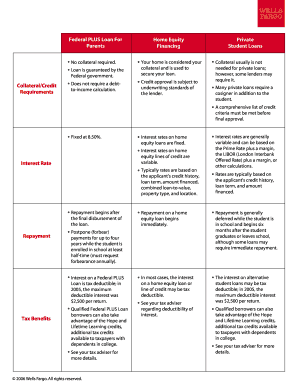

The Federal PLUS Loan for Parents is a federal loan program that enables parents of dependent undergraduate students to borrow funds to help cover educational expenses. This loan is not based on financial need but does require a credit check. The collateral credit requirements primarily assess the borrower's credit history and score to determine eligibility. Specifically, parents must have a credit history that does not include adverse credit, which may include recent delinquencies, defaults, or bankruptcy. A positive credit history is crucial for securing this loan to ensure that parents can manage repayment effectively.

Eligibility Criteria

To qualify for the Federal PLUS Loan for Parents, certain eligibility criteria must be met. Borrowers must be the biological or adoptive parents of a dependent undergraduate student who is enrolled at least half-time in an eligible program. Additionally, the borrower must be a U.S. citizen or an eligible non-citizen. A satisfactory credit history is essential, as any adverse credit may disqualify the applicant. Importantly, there is no set limit on the amount that can be borrowed, but it cannot exceed the cost of attendance minus any other financial aid received by the student.

Application Process & Approval Time

The application process for the Federal PLUS Loan for Parents involves several steps. First, parents must complete the Free Application for Federal Student Aid (FAFSA) to determine their child's eligibility for federal student aid. Afterward, they can apply for the PLUS Loan through the U.S. Department of Education's website. The application requires the borrower's personal information and details about the student. Approval typically occurs quickly, often within a few days, provided the credit check does not reveal any adverse credit. If approved, parents will receive a loan agreement outlining the terms and conditions.

Required Documents

- Social Security number or Alien Registration number

- Driver's license or state ID number

- Financial information, including income and assets

- Information about the student, such as their Social Security number and school details

Having these documents ready can streamline the application process and help ensure that all required information is submitted accurately.

Steps to Complete the Federal PLUS Loan For Parents Collateral Credit Requirements

Completing the Federal PLUS Loan application involves several key steps:

- Complete the FAFSA to establish eligibility for federal aid.

- Visit the U.S. Department of Education's website to access the PLUS Loan application.

- Fill out the application form with accurate personal and financial information.

- Submit the application and await the credit check results.

- If approved, review and sign the Master Promissory Note (MPN) to finalize the loan.

Following these steps ensures that parents can effectively navigate the application process and secure the necessary funding for their child's education.

Legal Use of the Federal PLUS Loan For Parents Collateral Credit Requirements

The Federal PLUS Loan for Parents is governed by specific legal guidelines that dictate its use. Funds from this loan must be used solely for educational expenses related to the student’s attendance at an eligible institution. This includes tuition, room and board, books, and other necessary supplies. Misuse of the loan funds can lead to legal consequences, including penalties or the requirement to repay the loan immediately. It is essential for borrowers to understand these regulations to ensure compliance and maintain eligibility for future federal aid.

Quick guide on how to complete federal plus loan for parents collateralcredit requirements

Prepare Federal PLUS Loan For Parents CollateralCredit Requirements effortlessly on any device

Managing documents online has gained popularity among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed documents, as you can easily locate the correct form and securely store it online. airSlate SignNow gives you all the tools necessary to create, modify, and eSign your documents swiftly without delays. Manage Federal PLUS Loan For Parents CollateralCredit Requirements on any device with airSlate SignNow's Android or iOS applications and enhance any document-centric procedure today.

The easiest method to modify and eSign Federal PLUS Loan For Parents CollateralCredit Requirements without any hassle

- Locate Federal PLUS Loan For Parents CollateralCredit Requirements and click on Get Form to commence.

- Utilize the tools we provide to complete your document.

- Highlight relevant sections of your documents or obscure sensitive details with tools that airSlate SignNow offers specifically for that purpose.

- Generate your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review the information and click on the Done button to save your changes.

- Choose how you want to send your form, via email, text message (SMS), or a shared link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or errors that necessitate printing additional copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Edit and eSign Federal PLUS Loan For Parents CollateralCredit Requirements and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the federal plus loan for parents collateralcredit requirements

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are the Federal PLUS Loan For Parents CollateralCredit Requirements?

The Federal PLUS Loan For Parents CollateralCredit Requirements primarily focus on the borrower's credit history. Parents applying for this loan must not have an adverse credit history, which typically means that they cannot have any recent bankruptcies, defaults, or delinquencies. Meeting these requirements is essential to secure funding for their child’s educational expenses.

-

How much can I borrow with the Federal PLUS Loan For Parents?

With the Federal PLUS Loan For Parents, you can borrow up to the total cost of your child’s college education, minus any other financial aid they receive. This means there is potentially no limit other than your child’s educational expenses. It’s important to review your financial needs thoroughly to determine the appropriate borrowing amount.

-

What is the interest rate for the Federal PLUS Loan For Parents?

The interest rate for the Federal PLUS Loan For Parents is set annually and is fixed for the life of the loan. As of the current academic year, the rate is typically higher than federal student loans, but it offers the advantage of deferment options while the student is in school. Always check the most recent rates to get accurate information regarding your borrowing costs.

-

What benefits do I get from applying for the Federal PLUS Loan For Parents?

Applying for the Federal PLUS Loan For Parents has several benefits, including flexible repayment options and potential deferment while your child is in school. Additionally, this loan allows you to borrow a signNow amount based on educational costs, which helps alleviate financial pressures. The benefits are designed to make it easier for parents to support their children's education.

-

Are there fees associated with the Federal PLUS Loan For Parents?

Yes, there are some fees associated with the Federal PLUS Loan For Parents, including an origination fee that is deducted from the loan amount. This fee is a percentage of the total loan before disbursement and can affect how much money your child actually receives. Be sure to factor these costs into your financial planning to avoid surprises.

-

Can I refinance my Federal PLUS Loan For Parents?

Yes, you can refinance your Federal PLUS Loan For Parents through private lenders, which may offer lower interest rates. However, refinancing into a private loan means you will lose federal protections and benefits, such as deferment and income-driven repayment plans. Carefully consider your options and consult with a financial advisor before proceeding.

-

How do I apply for the Federal PLUS Loan For Parents?

To apply for the Federal PLUS Loan For Parents, you need to complete the Free Application for Federal Student Aid (FAFSA) and then submit a Direct PLUS Loan application through the U.S. Department of Education. This process includes a credit check to ensure you meet the Federal PLUS Loan For Parents CollateralCredit Requirements. Make sure to gather all necessary documents to streamline your application.

Get more for Federal PLUS Loan For Parents CollateralCredit Requirements

- Earned form

- Delta cargo home form

- Section i requester information

- Real property acquisition handbook gsa form

- Top email signature contact details dos ampamp dontsexclaimer form

- Certificate of inspection of pressure vessels this gsa form

- 12420 reporting vehicle thefts and related offenses city of form

- Money market fund times and how they will bny mellon form

Find out other Federal PLUS Loan For Parents CollateralCredit Requirements

- Sign Connecticut Healthcare / Medical Business Plan Template Free

- Sign Indiana Healthcare / Medical Moving Checklist Safe

- Sign Wisconsin Government Cease And Desist Letter Online

- Sign Louisiana Healthcare / Medical Limited Power Of Attorney Mobile

- Sign Healthcare / Medical PPT Michigan Now

- Sign Massachusetts Healthcare / Medical Permission Slip Now

- Sign Wyoming Government LLC Operating Agreement Mobile

- Sign Wyoming Government Quitclaim Deed Free

- How To Sign Nebraska Healthcare / Medical Living Will

- Sign Nevada Healthcare / Medical Business Plan Template Free

- Sign Nebraska Healthcare / Medical Permission Slip Now

- Help Me With Sign New Mexico Healthcare / Medical Medical History

- Can I Sign Ohio Healthcare / Medical Residential Lease Agreement

- How To Sign Oregon Healthcare / Medical Living Will

- How Can I Sign South Carolina Healthcare / Medical Profit And Loss Statement

- Sign Tennessee Healthcare / Medical Business Plan Template Free

- Help Me With Sign Tennessee Healthcare / Medical Living Will

- Sign Texas Healthcare / Medical Contract Mobile

- Sign Washington Healthcare / Medical LLC Operating Agreement Now

- Sign Wisconsin Healthcare / Medical Contract Safe