Form Md 656 State of Maryland Comptroller of Maryland Offer in

What is the Form Md 656 State Of Maryland Comptroller Of Maryland Offer In

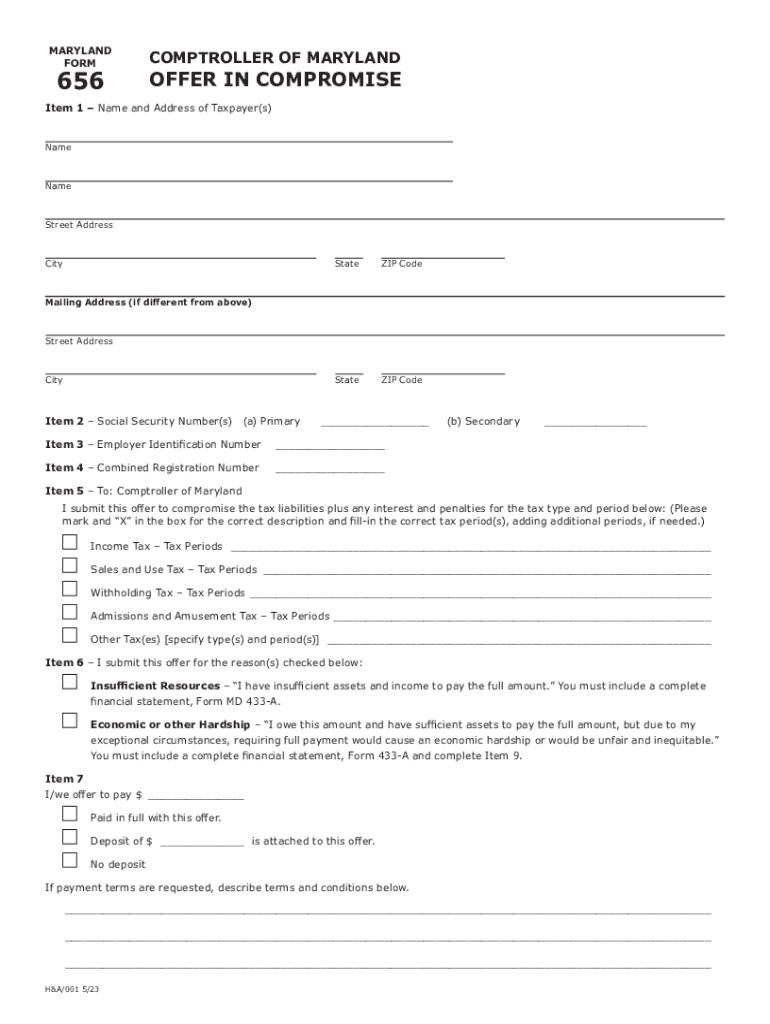

The Form Md 656, also known as the Maryland Offer in Compromise, is a crucial document used by taxpayers in Maryland who wish to settle their tax debts for less than the total amount owed. This form is specifically issued by the Comptroller of Maryland and is designed to provide a structured process for individuals and businesses facing financial difficulties. By submitting this form, taxpayers can propose a reduced payment to resolve their outstanding tax liabilities, which can significantly alleviate their financial burden.

Eligibility Criteria

To qualify for submitting the Form Md 656, taxpayers must meet specific eligibility criteria. Generally, individuals must demonstrate an inability to pay their full tax debt due to financial hardship. This includes providing detailed financial information, such as income, expenses, assets, and liabilities. Additionally, applicants must be current with all tax filings and should not be in bankruptcy proceedings. Meeting these criteria is essential for the approval of the offer in compromise.

Steps to Complete the Form Md 656 State Of Maryland Comptroller Of Maryland Offer In

Completing the Form Md 656 involves several key steps to ensure accuracy and compliance with state requirements. First, gather all necessary financial documentation, including income statements, expense records, and asset information. Next, fill out the form carefully, providing detailed information about your financial situation. It is important to clearly explain why you are unable to pay your tax debt in full. After completing the form, review it for any errors and ensure all required signatures are included before submission.

How to Obtain the Form Md 656 State Of Maryland Comptroller Of Maryland Offer In

The Form Md 656 can be obtained directly from the Comptroller of Maryland's official website or by visiting their local office. It is available in both printable and fillable formats, allowing taxpayers to choose the method that best suits their needs. Additionally, taxpayers may request a copy of the form by contacting the Comptroller's office via phone or email, ensuring they have the most current version of the form for their submission.

Form Submission Methods (Online / Mail / In-Person)

Once the Form Md 656 is completed, it can be submitted through various methods. Taxpayers have the option to file the form online through the Comptroller of Maryland's e-services portal, which provides a convenient and efficient way to submit documents. Alternatively, the form can be mailed to the designated address provided on the form or delivered in person at a local Comptroller office. Each submission method has its own processing times, so it is advisable to choose the one that best meets the taxpayer's needs.

Key Elements of the Form Md 656 State Of Maryland Comptroller Of Maryland Offer In

The Form Md 656 includes several key elements that are essential for the offer in compromise process. These elements typically include the taxpayer's personal information, a detailed account of the tax liabilities, and a comprehensive financial statement outlining income, expenses, and assets. Additionally, the form requires a narrative explaining the reason for the offer and any supporting documentation that substantiates the claim of financial hardship. Thoroughly completing these sections increases the likelihood of approval.

Quick guide on how to complete form md 656 state of maryland comptroller of maryland offer in

Effortlessly Prepare Form Md 656 State Of Maryland Comptroller Of Maryland Offer In on Any Device

Managing documents online has become increasingly popular among businesses and individuals. It serves as an excellent eco-friendly alternative to conventional printed and signed documents, as you can access the necessary forms and securely store them online. airSlate SignNow equips you with all the resources needed to create, update, and electronically sign your documents swiftly without delays. Handle Form Md 656 State Of Maryland Comptroller Of Maryland Offer In on any device using the airSlate SignNow Android or iOS applications and enhance any document-related workflow today.

The Easiest Way to Modify and Electronically Sign Form Md 656 State Of Maryland Comptroller Of Maryland Offer In Effortlessly

- Find Form Md 656 State Of Maryland Comptroller Of Maryland Offer In and click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize pertinent sections of your documents or obscure sensitive information with tools specifically designed by airSlate SignNow for that purpose.

- Create your electronic signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click the Done button to save your modifications.

- Select your preferred method of submitting your form, whether by email, text message (SMS), invite link, or download it to your computer.

Eliminate the worry of lost or misplaced files, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you choose. Revise and electronically sign Form Md 656 State Of Maryland Comptroller Of Maryland Offer In and ensure seamless communication at every stage of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form md 656 state of maryland comptroller of maryland offer in

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the form 656 Maryland and why is it important?

The form 656 Maryland is a legal document used in tax settlements, allowing taxpayers to settle their tax liabilities with the Maryland State Comptroller. It is important for individuals seeking to negotiate their tax payments, as it helps them achieve a more manageable tax situation. Using airSlate SignNow, you can easily complete and eSign this form securely.

-

How can airSlate SignNow assist with completing the form 656 Maryland?

airSlate SignNow simplifies the process of completing the form 656 Maryland by providing an intuitive interface for filling out and signing documents online. Users can access templates, collaborate in real-time, and securely eSign their forms, ensuring compliance and accuracy. This streamlines the submission process for taxpayers.

-

Is there a cost associated with using airSlate SignNow for the form 656 Maryland?

Yes, airSlate SignNow offers various pricing plans that cater to different business sizes and needs. The costs are competitive and provide excellent value, especially when dealing with important documents like the form 656 Maryland. Detailed pricing information can be found on our website, allowing you to choose the best plan for your requirements.

-

What are the benefits of using airSlate SignNow for the form 656 Maryland?

Using airSlate SignNow for the form 656 Maryland comes with numerous benefits, including enhanced security for your documents, the ability to eSign electronically, and the convenience of cloud storage. Additionally, our platform allows for easy tracking of the document's status, making the entire process faster and more efficient. This is especially crucial when handling important tax matters.

-

Can I integrate airSlate SignNow with other applications while working on the form 656 Maryland?

Absolutely! airSlate SignNow supports integration with various applications, enhancing your workflow when managing the form 656 Maryland. Whether you use CRM software, cloud storage solutions, or productivity tools, our integrations ensure a seamless experience, allowing you to connect your documents with the tools you already use.

-

How does airSlate SignNow ensure the security of my form 656 Maryland?

Security is a top priority for airSlate SignNow. We implement robust encryption protocols and secure authentication methods to protect your form 656 Maryland and other sensitive documents. Data backup and compliance with legal standards further ensure that your information remains safe.

-

Are there customer support options available for help with the form 656 Maryland?

Yes, airSlate SignNow offers comprehensive customer support options to assist you with any issues related to the form 656 Maryland. Our support team is available via chat, email, and phone, ensuring you receive timely assistance when you need it. Whether you have questions about features or need help with document submission, we're here to help.

Get more for Form Md 656 State Of Maryland Comptroller Of Maryland Offer In

- Www lawyers comtexarkanaarkansasbailey ampamp galyen attorneys at law texarkana ar law firm form

- Civil intake form

- Adoption intake form bailey amp galyen

- Traffic ticket intake form bailey amp galyen

- Texas application birth certificate online form

- Social security intake form bailey amp galyen

- Paternity intake form bailey amp galyen

- Divorce intake sheet form

Find out other Form Md 656 State Of Maryland Comptroller Of Maryland Offer In

- How Can I eSignature Florida Car Lease Agreement Template

- How To eSignature Indiana Car Lease Agreement Template

- How Can I eSignature Wisconsin Car Lease Agreement Template

- Electronic signature Tennessee House rent agreement format Myself

- How To Electronic signature Florida House rental agreement

- eSignature Connecticut Retainer Agreement Template Myself

- How To Electronic signature Alaska House rental lease agreement

- eSignature Illinois Retainer Agreement Template Free

- How Do I Electronic signature Idaho Land lease agreement

- Electronic signature Illinois Land lease agreement Fast

- eSignature Minnesota Retainer Agreement Template Fast

- Electronic signature Louisiana Land lease agreement Fast

- How Do I eSignature Arizona Attorney Approval

- How Can I eSignature North Carolina Retainer Agreement Template

- Electronic signature New York Land lease agreement Secure

- eSignature Ohio Attorney Approval Now

- eSignature Pennsylvania Retainer Agreement Template Secure

- Electronic signature Texas Land lease agreement Free

- Electronic signature Kentucky Landlord lease agreement Later

- Electronic signature Wisconsin Land lease agreement Myself