Homestead Application Form

What is the Homestead Application

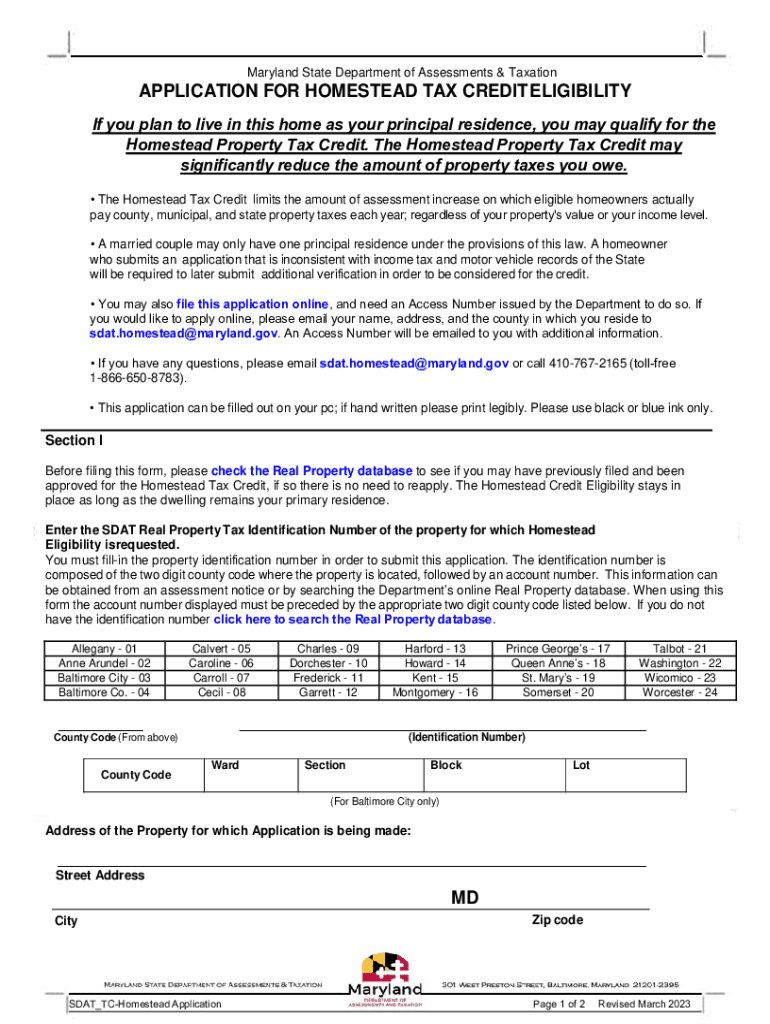

The Homestead Application is a crucial form used in Maryland to apply for the Maryland homestead tax credit. This program provides property tax relief to homeowners by limiting the assessment increase on their primary residence. By submitting this application, homeowners can ensure they receive the benefits associated with the homestead tax credit, which can significantly reduce their property tax burden.

Eligibility Criteria

To qualify for the homestead tax credit in Maryland, applicants must meet specific eligibility criteria. Homeowners must occupy the property as their principal residence and cannot own any other residential property. Additionally, the property must not have been transferred to another individual or entity within the past five years. It is essential for applicants to verify their eligibility before submitting the application to avoid delays or denials.

Steps to Complete the Homestead Application

Completing the Homestead Application involves several straightforward steps. First, homeowners should gather necessary information, including their property details and proof of residency. Next, they need to fill out the homestead tax credit application form accurately. After completing the form, applicants must submit it to their local Maryland State Department of Assessments and Taxation office. It is advisable to keep a copy of the submitted application for personal records.

Required Documents

When applying for the Maryland homestead tax credit, certain documents are required to support the application. Homeowners typically need to provide a government-issued identification that verifies their identity and residency. Additionally, proof of property ownership, such as a deed or mortgage statement, may be necessary. Ensuring all required documents are included can facilitate a smoother application process.

Form Submission Methods

The homestead tax credit application can be submitted through various methods to accommodate different preferences. Homeowners may choose to submit the application online through the Maryland State Department of Assessments and Taxation website. Alternatively, they can mail the completed form to their local office or deliver it in person. Each method has its advantages, and homeowners should select the one that best fits their needs.

Filing Deadlines / Important Dates

Understanding the filing deadlines for the homestead tax credit application is crucial for homeowners. Typically, applications must be submitted by a specific date to be considered for the current tax year. It is essential to check the Maryland State Department of Assessments and Taxation website for the most current deadlines and any updates regarding the application process. Missing the deadline may result in the loss of potential tax benefits.

Quick guide on how to complete homestead application

Complete Homestead Application effortlessly on any gadget

Online document management has become increasingly popular among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to find the appropriate form and securely store it online. airSlate SignNow provides you with all the tools you need to create, modify, and eSign your documents swiftly and without interruptions. Manage Homestead Application across any platform with airSlate SignNow’s Android or iOS applications and simplify any document-related process today.

How to modify and eSign Homestead Application with ease

- Locate Homestead Application and click on Get Form to begin.

- Use the tools we offer to fill out your document.

- Emphasize relevant sections of the files or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your signature using the Sign tool, which takes seconds and carries the same legal standing as a conventional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Select your preferred method of sending your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misfiled documents, tedious form searching, or errors that require reprinting new copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Edit and eSign Homestead Application and ensure excellent communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the homestead application

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Maryland homestead tax credit?

The Maryland homestead tax credit is a property tax benefit that helps reduce the property taxes for eligible homeowners. By applying for this credit, homeowners can save signNowly on their annual tax bills, making it an important aspect of financial planning for residents in Maryland. This credit is designed to provide financial relief by capping the assessment increase on eligible properties.

-

Who qualifies for the Maryland homestead tax credit?

To qualify for the Maryland homestead tax credit, homeowners must occupy the property as their primary residence and cannot be receiving a similar credit on another property. Additionally, homeowners must meet certain income limits and have a qualifying ownership interest in the property. The program aims to support residents who need assistance in managing their property taxes.

-

How do I apply for the Maryland homestead tax credit?

Applying for the Maryland homestead tax credit is straightforward. Homeowners can complete the application form available on the Maryland State Department of Assessments and Taxation website, ensuring all required information is included. Keeping your application accurate and submitted on time will help secure your eligibility for this important tax relief.

-

How much can I save with the Maryland homestead tax credit?

The savings from the Maryland homestead tax credit vary by individual property assessments and tax rates. However, the credit generally caps property tax assessment increases, which can lead to substantial savings on annual property tax bills. Homeowners should consult local tax officials or the Maryland website for specific savings estimates based on their property assessment.

-

Can the Maryland homestead tax credit be applied to rental properties?

No, the Maryland homestead tax credit is exclusively available to primary residences that homeowners occupy. Rental properties or non-owner-occupied homes do not qualify for this tax relief option. It's essential for residents to maintain the correct classification of their properties to receive the Maryland homestead tax credit benefits.

-

Is there a deadline for applying for the Maryland homestead tax credit?

Yes, there are specific deadlines for applying for the Maryland homestead tax credit, which typically align with the assessment dates each year. Homeowners are encouraged to submit their applications as early as possible to ensure they do not miss out on qualifying for the upcoming tax year. Checking with local tax authorities can provide the most accurate and timely information regarding application deadlines.

-

How often do I need to reapply for the Maryland homestead tax credit?

Once granted, the Maryland homestead tax credit generally continues automatically as long as the property remains your primary residence. Homeowners are, however, required to reapply if there are changes in ownership or if the property is no longer used as the primary residence. Staying informed about your eligibility is crucial to maintaining the benefits of this tax credit.

Get more for Homestead Application

- Maricopa county state of arizona form

- Opengovny complacechijbwezhprk4craptyrjsndiiglendale city court5711 w glendale ave glendale az 85301 form

- Proof of service by fax form

- Hon steven m jaeger form

- Acknowledgement and waiver of rights violation courts state nh form

- Macomb county clerk carmella sabaughs form

- Absentee mail ballot application form

- Application for acceptance of liquified petroleum gas tank installation form

Find out other Homestead Application

- How To eSign Maryland Plumbing Document

- How Do I eSign Mississippi Plumbing Word

- Can I eSign New Jersey Plumbing Form

- How Can I eSign Wisconsin Plumbing PPT

- Can I eSign Colorado Real Estate Form

- How To eSign Florida Real Estate Form

- Can I eSign Hawaii Real Estate Word

- How Do I eSign Hawaii Real Estate Word

- How To eSign Hawaii Real Estate Document

- How Do I eSign Hawaii Real Estate Presentation

- How Can I eSign Idaho Real Estate Document

- How Do I eSign Hawaii Sports Document

- Can I eSign Hawaii Sports Presentation

- How To eSign Illinois Sports Form

- Can I eSign Illinois Sports Form

- How To eSign North Carolina Real Estate PDF

- How Can I eSign Texas Real Estate Form

- How To eSign Tennessee Real Estate Document

- How Can I eSign Wyoming Real Estate Form

- How Can I eSign Hawaii Police PDF