Tax Year Form MW508A Annual Employer Withholding Reconciliation Report 2020

Understanding the Tax Year Form MW508A Annual Employer Withholding Reconciliation Report

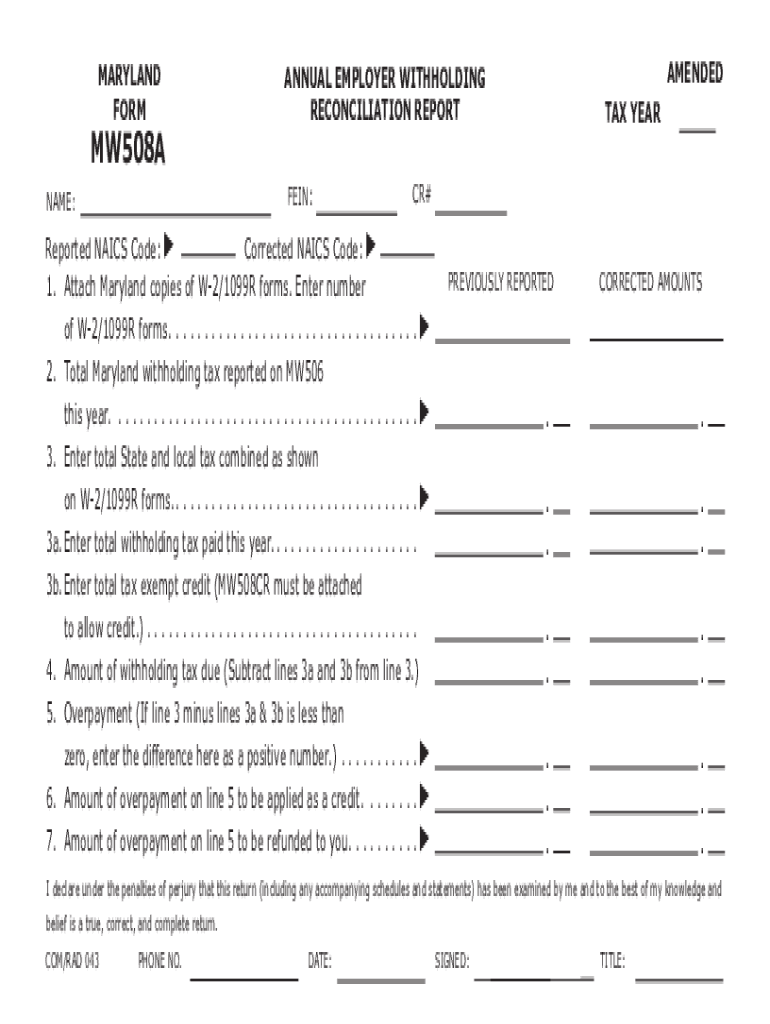

The MW508A is a crucial document for employers in Maryland, serving as the Annual Employer Withholding Reconciliation Report. This form is designed to summarize the total amount of state income tax withheld from employees throughout the tax year. Employers must file this report to ensure compliance with Maryland tax regulations and to provide necessary information to the state regarding their withholding practices.

The tax year for the MW508A typically aligns with the calendar year, running from January first to December thirty-first. This form is essential for reconciling the amounts withheld against what was actually remitted to the state, helping to identify any discrepancies that may need to be addressed.

Steps to Complete the Tax Year Form MW508A Annual Employer Withholding Reconciliation Report

Completing the MW508A involves several steps to ensure accuracy and compliance. First, gather all relevant payroll records for the year, including total wages paid and state income tax withheld. Next, fill out the form by entering the total amount of Maryland income tax withheld, along with any adjustments that may apply.

It is important to double-check all figures for accuracy. After completing the form, employers must sign and date it, certifying that the information provided is correct. Finally, submit the MW508A by the designated deadline, which is typically January thirty-first of the following year.

Obtaining the Tax Year Form MW508A Annual Employer Withholding Reconciliation Report

The MW508A form can be easily obtained through the Maryland Comptroller's website. Employers can access a fillable version of the form online, which allows for convenient completion and submission. Additionally, physical copies may be available at local tax offices or through direct request from the Comptroller's office.

Employers should ensure they are using the most current version of the form to avoid any compliance issues. It is advisable to check for any updates or changes to the form each tax year.

Filing Deadlines for the Tax Year Form MW508A Annual Employer Withholding Reconciliation Report

Timely filing of the MW508A is essential for compliance with Maryland tax regulations. The deadline for submitting the MW508A is January thirty-first of the year following the tax year being reported. Employers who fail to file by this deadline may face penalties or interest charges, making it crucial to adhere to this timeline.

In some cases, if the deadline falls on a weekend or holiday, the due date may be extended to the next business day. Employers should remain aware of these deadlines to avoid unnecessary complications.

Key Elements of the Tax Year Form MW508A Annual Employer Withholding Reconciliation Report

The MW508A includes several key elements that employers need to complete accurately. These elements typically consist of the employer's identification information, total wages paid, total Maryland income tax withheld, and any adjustments for prior periods. Employers must also provide their contact information and the signature of an authorized representative.

Each section of the form is designed to capture specific data that the Maryland Comptroller's office requires for processing. Understanding these elements ensures that employers can provide complete and accurate information, facilitating a smoother filing process.

Legal Use of the Tax Year Form MW508A Annual Employer Withholding Reconciliation Report

The MW508A serves as a legal document that employers must file to comply with Maryland state tax laws. By submitting this form, employers affirm that they have accurately reported all withholding amounts and have remitted the correct taxes to the state. Failure to file the MW508A can result in legal repercussions, including fines and penalties.

Employers should retain copies of the MW508A and any supporting documents for their records, as they may be required to provide this information in the event of an audit or inquiry from the state tax authority.

Quick guide on how to complete tax year form mw508a annual employer withholding reconciliation report

Effortlessly Prepare Tax Year Form MW508A Annual Employer Withholding Reconciliation Report on Any Device

Digital document management has gained traction among businesses and individuals alike. It offers an ideal environmentally friendly substitute for traditional printed and signed documents, allowing you to locate the appropriate form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, edit, and electronically sign your documents swiftly without delay. Manage Tax Year Form MW508A Annual Employer Withholding Reconciliation Report on any device using airSlate SignNow's Android or iOS applications and enhance your document-centric processes today.

How to Edit and Electronically Sign Tax Year Form MW508A Annual Employer Withholding Reconciliation Report with Ease

- Locate Tax Year Form MW508A Annual Employer Withholding Reconciliation Report and click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize important sections of your documents or conceal sensitive information with the tools specifically offered by airSlate SignNow for that purpose.

- Generate your eSignature using the Sign tool, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review all details and then click on the Done button to save your modifications.

- Choose your preferred method to send your form, whether by email, text message (SMS), or via an invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searches, or mistakes requiring new document printouts. airSlate SignNow meets your document management needs in just a few clicks from any device of your choosing. Edit and eSign Tax Year Form MW508A Annual Employer Withholding Reconciliation Report to ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct tax year form mw508a annual employer withholding reconciliation report

Create this form in 5 minutes!

How to create an eSignature for the tax year form mw508a annual employer withholding reconciliation report

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the mw508a and how does it relate to airSlate SignNow?

The mw508a is a powerful feature of airSlate SignNow that enables users to streamline their document signing process. It offers a secure and efficient way to send and eSign documents, which saves time and enhances productivity. By utilizing the mw508a, businesses can easily manage their signing workflows.

-

How much does the mw508a cost with airSlate SignNow?

The mw508a feature is included in the overall pricing plans of airSlate SignNow, making it a cost-effective solution for businesses. Pricing may vary based on the selected plan and the number of users. We encourage prospective customers to check our website for the most current pricing details and offers.

-

What are the key features of the mw508a?

The mw508a includes several key features such as customizable templates, real-time tracking, and advanced security for documents. These features ensure that your eSigning process is efficient and compliant with legal standards. Additionally, the mw508a provides an intuitive user interface for seamless navigation.

-

What benefits does the mw508a offer for businesses?

By using the mw508a with airSlate SignNow, businesses can signNowly reduce the turnaround time for document signing. The feature enhances collaboration by allowing multiple parties to sign documents simultaneously. Furthermore, the mw508a contributes to cost savings by minimizing paper use and speeding up workflows.

-

How does the mw508a integrate with other tools?

The mw508a integrates effortlessly with various third-party applications, enhancing its functionality and usability. This includes CRM systems, cloud storage solutions, and collaboration tools. Such integrations allow businesses to incorporate the mw508a into their existing workflows for a more cohesive experience.

-

Is the mw508a secure for handling sensitive documents?

Yes, the mw508a incorporates industry-standard security measures, including encryption and secure authentication processes. This ensures that sensitive documents are protected during the signing process. Businesses can trust the mw508a to handle their confidential information safely.

-

Can I customize the mw508a features for my organization?

Absolutely! The mw508a allows for a high level of customization, including bespoke templates and workflows tailored to your organization’s needs. This flexibility means you can optimize the airSlate SignNow experience to suit your specific operational requirements.

Get more for Tax Year Form MW508A Annual Employer Withholding Reconciliation Report

- Baffidavitb of common law bmarriageb request for enrollment of bb form

- Transfer on death deed granters as owners form

- 0630 enterprise income verification eiv system multifamily housing coordinator access authorization form paperwork reduction

- Annual electric power form

- Juvenile community service form chambers county

- Fillable online courts ky audiovideo request form courts ky fax

- Delivery discrepancy form

- Sse energy form

Find out other Tax Year Form MW508A Annual Employer Withholding Reconciliation Report

- eSign Hawaii High Tech Claim Later

- How To eSign Hawaii High Tech Confidentiality Agreement

- How Do I eSign Hawaii High Tech Business Letter Template

- Can I eSign Hawaii High Tech Memorandum Of Understanding

- Help Me With eSign Kentucky Government Job Offer

- eSign Kentucky Healthcare / Medical Living Will Secure

- eSign Maine Government LLC Operating Agreement Fast

- eSign Kentucky Healthcare / Medical Last Will And Testament Free

- eSign Maine Healthcare / Medical LLC Operating Agreement Now

- eSign Louisiana High Tech LLC Operating Agreement Safe

- eSign Massachusetts Government Quitclaim Deed Fast

- How Do I eSign Massachusetts Government Arbitration Agreement

- eSign Maryland High Tech Claim Fast

- eSign Maine High Tech Affidavit Of Heirship Now

- eSign Michigan Government LLC Operating Agreement Online

- eSign Minnesota High Tech Rental Lease Agreement Myself

- eSign Minnesota High Tech Rental Lease Agreement Free

- eSign Michigan Healthcare / Medical Permission Slip Now

- eSign Montana High Tech Lease Agreement Online

- eSign Mississippi Government LLC Operating Agreement Easy