Florida Sales Tax Rules 2022

Understanding Florida Sales Tax Rules

The Florida Sales Tax Rules govern the collection and remittance of sales tax on goods and services sold within the state. The general sales tax rate in Florida is six percent, but local jurisdictions may impose additional taxes, resulting in varying rates across different areas. Businesses must be aware of these rates and ensure compliance to avoid penalties.

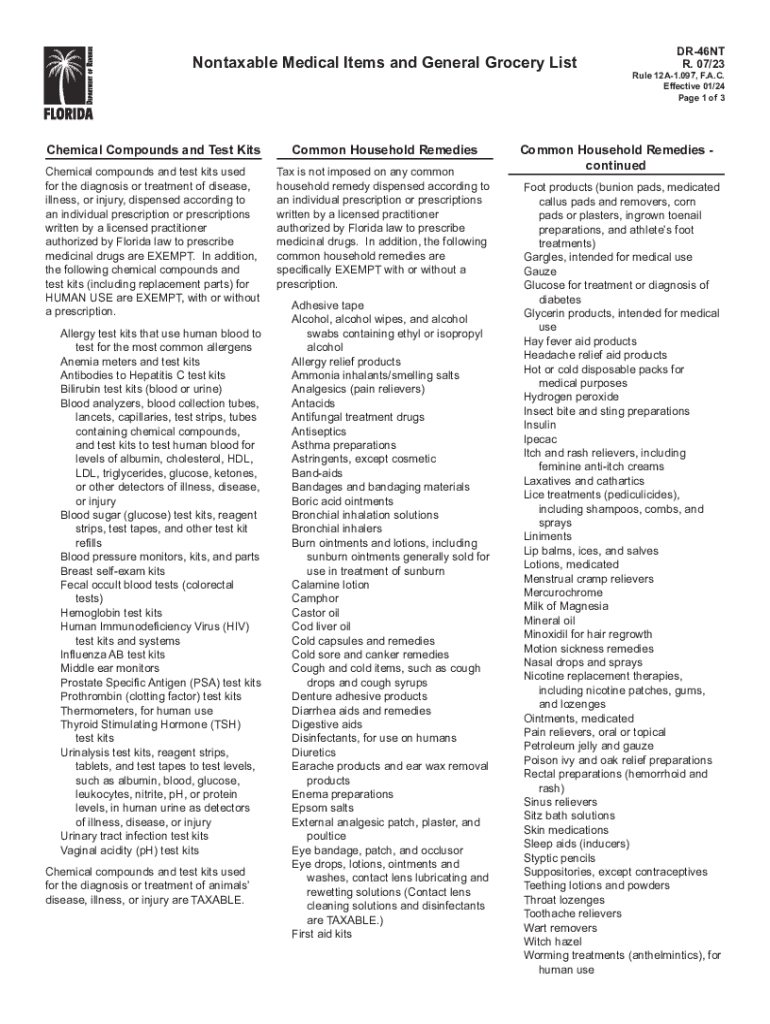

Sales tax applies to tangible personal property and certain services. Exemptions exist for specific items, such as groceries and prescription medications. Understanding what qualifies for exemption is crucial for both consumers and businesses.

How to Apply Florida Sales Tax Rules

Businesses operating in Florida must register with the Florida Department of Revenue to collect sales tax. This registration can be completed online, and it is essential to have all relevant business information ready, such as the Federal Employer Identification Number (FEIN) and business structure details.

Once registered, businesses must collect sales tax on taxable transactions and report this tax to the state. Regular reporting periods are established based on the volume of taxable sales, which can be monthly, quarterly, or annually.

Key Elements of Florida Sales Tax Rules

Several key elements define the Florida Sales Tax Rules:

- Taxable Goods and Services: Most tangible personal property is taxable, along with certain services.

- Exemptions: Certain items, such as food and medical supplies, are exempt from sales tax.

- Local Option Taxes: Local governments may impose additional sales taxes, which vary by county.

- Filing Requirements: Businesses must file sales tax returns according to their assigned reporting schedule.

Filing Deadlines and Important Dates

Filing deadlines for sales tax returns in Florida depend on the reporting frequency assigned to a business. Monthly filers must submit their returns by the 20th of the following month. Quarterly filers have until the 20th of the month following the end of the quarter, while annual filers must submit their returns by April 30 of the following year.

It is essential for businesses to keep track of these deadlines to avoid late fees and penalties. Regular reminders and calendar alerts can help ensure timely submissions.

Penalties for Non-Compliance

Failure to comply with Florida Sales Tax Rules can result in significant penalties. Businesses that do not collect or remit sales tax may face fines, interest on unpaid taxes, and potential legal action from the state. Additionally, late filings can incur penalties based on the amount of tax due.

To mitigate these risks, businesses should maintain accurate records, regularly review their tax obligations, and seek professional guidance when necessary.

Examples of Florida Sales Tax Application

Understanding how Florida Sales Tax Rules apply in real-world scenarios can clarify their implications. For instance, a retailer selling clothing must collect sales tax on each sale unless the clothing is exempt during designated tax-free weekends. Similarly, a contractor providing repair services must charge sales tax on materials used in the project but may not charge tax on labor.

These examples illustrate the importance of recognizing both taxable and exempt items within various transactions, helping businesses navigate compliance effectively.

Quick guide on how to complete florida sales tax rules

Complete Florida Sales Tax Rules effortlessly on any gadget

Online document management has gained popularity among businesses and individuals. It offers an excellent eco-friendly substitute for traditional printed and signed documents, as you can locate the necessary form and securely store it online. airSlate SignNow equips you with all the tools you require to create, modify, and eSign your documents promptly without delays. Handle Florida Sales Tax Rules on any gadget with airSlate SignNow Android or iOS applications and streamline any document-related process today.

How to modify and eSign Florida Sales Tax Rules effortlessly

- Find Florida Sales Tax Rules and then click Get Form to begin.

- Use the tools we provide to complete your document.

- Highlight important sections of your documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your signature with the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Verify all the information and then click on the Done button to save your changes.

- Select how you wish to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searching, or mistakes that require printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Edit and eSign Florida Sales Tax Rules and maintain effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct florida sales tax rules

Create this form in 5 minutes!

How to create an eSignature for the florida sales tax rules

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are the key Florida Sales Tax Rules that businesses should know?

The Florida Sales Tax Rules outline how sales tax is applied to various goods and services in the state. Businesses should be aware of the rates, exemptions, and compliance requirements to avoid penalties. Understanding these rules is crucial for accurate pricing and customer service.

-

How can airSlate SignNow assist with managing Florida Sales Tax compliance?

airSlate SignNow offers features that streamline documentation processes, including contracts or invoices that require compliance with Florida Sales Tax Rules. By using our eSignature platform, businesses can ensure that all tax-related documents are prepared and signed efficiently, reducing the risk of non-compliance.

-

Are there specific features in airSlate SignNow related to sales tax documentation?

Yes, airSlate SignNow includes features for creating, editing, and securely signing tax-related documents that adhere to Florida Sales Tax Rules. These features help businesses quickly generate invoices that reflect accurate sales tax calculations, ensuring your documents meet state regulations.

-

How does pricing work for airSlate SignNow regarding Florida Sales Tax compliance?

Our pricing model is transparent and designed to provide value regardless of your business size. While our prices don’t include sales tax, understanding Florida Sales Tax Rules can help you budget accurately when accounting for any additional costs related to tax compliance.

-

Can airSlate SignNow integrate with accounting software for Florida Sales Tax reporting?

Absolutely! airSlate SignNow easily integrates with various accounting software tools that provide reporting on Florida Sales Tax Rules. This ensures that your sales tax calculations and records align seamlessly with your overall financial management system.

-

What is the benefit of using airSlate SignNow for businesses managing Florida Sales Tax?

Using airSlate SignNow helps businesses manage their documentation needs effectively while ensuring compliance with Florida Sales Tax Rules. Our platform reduces the administrative burden, allowing you to focus more on growth while remaining compliant with state tax regulations.

-

How do I create compliant sales tax documents in airSlate SignNow?

Creating compliant sales tax documents in airSlate SignNow is straightforward. You can utilize our templates, which allow you to input necessary information according to Florida Sales Tax Rules, ensuring that all your documents are accurate and ready for signature.

Get more for Florida Sales Tax Rules

- Lidocaine patch prior authorization request form

- Program change faculty data form maryland board of nursing mbon

- Application for readmission or intra mercer university www2 mercer form

- Nutrition intake form 2 atlanta infertility

- Carteira consular form

- Poster submission form excipientfest

- Real estate investment llc operating agreement template form

- Real estate investment operating agreement template form

Find out other Florida Sales Tax Rules

- eSign Business Operations PPT New Hampshire Safe

- Sign Rhode Island Courts Warranty Deed Online

- Sign Tennessee Courts Residential Lease Agreement Online

- How Do I eSign Arkansas Charity LLC Operating Agreement

- eSign Colorado Charity LLC Operating Agreement Fast

- eSign Connecticut Charity Living Will Later

- How Can I Sign West Virginia Courts Quitclaim Deed

- Sign Courts Form Wisconsin Easy

- Sign Wyoming Courts LLC Operating Agreement Online

- How To Sign Wyoming Courts Quitclaim Deed

- eSign Vermont Business Operations Executive Summary Template Mobile

- eSign Vermont Business Operations Executive Summary Template Now

- eSign Virginia Business Operations Affidavit Of Heirship Mobile

- eSign Nebraska Charity LLC Operating Agreement Secure

- How Do I eSign Nevada Charity Lease Termination Letter

- eSign New Jersey Charity Resignation Letter Now

- eSign Alaska Construction Business Plan Template Mobile

- eSign Charity PPT North Carolina Now

- eSign New Mexico Charity Lease Agreement Form Secure

- eSign Charity PPT North Carolina Free