Updating Wisconsin Certificate of Exemption Status CES Form

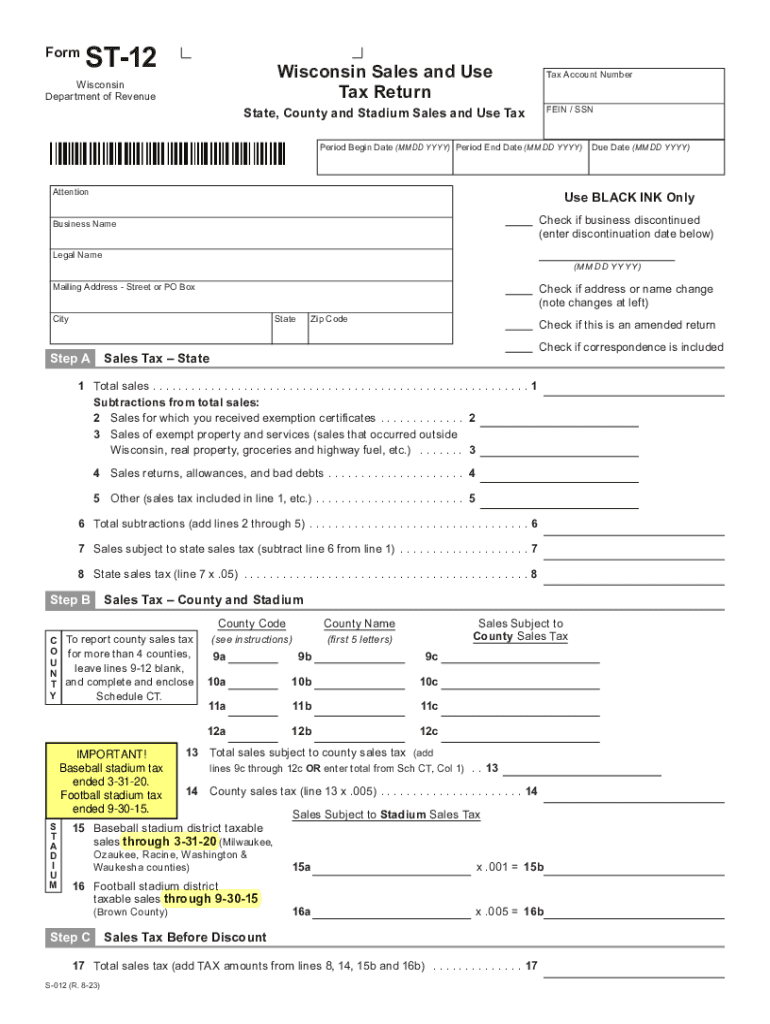

What is the Wisconsin Sales and Use Tax Return Form ST 12?

The Wisconsin Sales and Use Tax Return Form ST 12 is a crucial document for businesses operating within Wisconsin. This form is used to report and remit sales and use taxes collected from customers. It is essential for ensuring compliance with the Wisconsin Department of Revenue regulations. The ST 12 form is particularly relevant for businesses that sell tangible personal property or taxable services and are required to collect sales tax from their customers.

Steps to Complete the Wisconsin Sales and Use Tax Return Form ST 12

Completing the ST 12 form involves several key steps:

- Gather Required Information: Collect all necessary sales data, including total sales, taxable sales, and exempt sales.

- Calculate Tax Due: Use the appropriate tax rates to determine the total sales tax owed based on your taxable sales.

- Fill Out the Form: Input your calculated figures into the designated sections of the ST 12 form accurately.

- Review for Accuracy: Double-check all entries to ensure compliance and avoid errors that could lead to penalties.

- Submit the Form: Choose your preferred submission method—online, by mail, or in person—and ensure it is sent by the filing deadline.

Filing Deadlines for the Wisconsin Sales and Use Tax Return Form ST 12

Filing deadlines for the ST 12 form vary based on the frequency of your tax reporting. Typically, businesses may be required to file monthly, quarterly, or annually. It is crucial to be aware of these deadlines to avoid late fees and penalties. Monthly filers must submit their forms by the 20th of the following month, while quarterly filers have deadlines on the 20th of the month following the end of the quarter. Annual filers should submit their forms by January 31 of the following year.

Required Documents for Filing the Wisconsin Sales and Use Tax Return Form ST 12

When filing the ST 12 form, certain documents and records are necessary to support your tax return. These may include:

- Sales Records: Detailed records of all sales transactions, including invoices and receipts.

- Exemption Certificates: Documentation for any exempt sales that may apply.

- Previous Tax Returns: Copies of prior ST 12 forms for reference and consistency.

Form Submission Methods for the Wisconsin Sales and Use Tax Return Form ST 12

The ST 12 form can be submitted through various methods to accommodate different preferences:

- Online Submission: Businesses can file electronically through the Wisconsin Department of Revenue's online portal, which offers a streamlined process.

- Mail Submission: Completed forms can be printed and mailed to the appropriate address provided by the Department of Revenue.

- In-Person Filing: Some businesses may choose to submit their forms in person at designated Department of Revenue offices.

Penalties for Non-Compliance with the Wisconsin Sales and Use Tax Return Form ST 12

Failure to file the ST 12 form on time or inaccuracies in reporting can lead to significant penalties. Common consequences include:

- Late Fees: Businesses may incur a penalty for late submissions, which can accumulate over time.

- Interest Charges: Unpaid taxes may accrue interest until the balance is settled.

- Legal Action: Continued non-compliance can result in further legal repercussions, including audits or additional fines.

Quick guide on how to complete updating wisconsin certificate of exemption status ces

Prepare Updating Wisconsin Certificate Of Exemption Status CES effortlessly on any device

Managing documents online has gained immense popularity among enterprises and individuals alike. It serves as an excellent eco-friendly substitute for conventional printed and signed paperwork, allowing you to obtain the right format and securely store it online. airSlate SignNow equips you with all the tools necessary to create, alter, and eSign your documents swiftly without delays. Handle Updating Wisconsin Certificate Of Exemption Status CES on any platform using airSlate SignNow's Android or iOS applications and enhance any document-centric workflow today.

How to modify and eSign Updating Wisconsin Certificate Of Exemption Status CES with ease

- Find Updating Wisconsin Certificate Of Exemption Status CES and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize pertinent sections of the documents or conceal sensitive data with tools that airSlate SignNow specifically provides for that purpose.

- Create your eSignature using the Sign feature, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Review all the details and click the Done button to save your modifications.

- Choose your preferred method for sending your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate the worries of lost or misplaced documents, tiresome form searches, or mistakes requiring new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Modify and eSign Updating Wisconsin Certificate Of Exemption Status CES and ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the updating wisconsin certificate of exemption status ces

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the st 12 feature of airSlate SignNow?

The st 12 feature in airSlate SignNow refers to our unique eSigning capabilities that streamline document workflows. This functionality allows users to send, sign, and manage documents seamlessly, improving efficiency and reducing processing time. With st 12, businesses can ensure that important documents are signed quickly and securely.

-

How does airSlate SignNow's st 12 help with pricing?

The st 12 feature contributes to cost-effectiveness by reducing the need for paper-based documentation and minimizing operational costs. By using electronic signatures, businesses can save on printing, postage, and storage expenses. This means that adopting st 12 can lead to substantial cost savings over time.

-

What are the benefits of using the st 12 feature?

The st 12 feature offers multiple benefits, including enhanced workflow efficiency, improved turnaround times, and increased security. Users can track document status in real-time and receive notifications once documents are signed. This ensures that businesses can operate smoothly and meet their deadlines without delays.

-

Can I integrate st 12 with my existing software?

Absolutely! airSlate SignNow's st 12 feature seamlessly integrates with popular business applications such as Salesforce, Google Workspace, and Microsoft Teams. This integration enables users to eSign documents directly within their existing workflows, enhancing productivity and efficiency.

-

Is the st 12 feature user-friendly?

Yes, the st 12 feature is designed for ease of use, even for individuals with minimal technical experience. The intuitive interface allows users to navigate through document sending and signing processes effortlessly. airSlate SignNow ensures that adopting st 12 is a straightforward transition for all team members.

-

What types of documents can I sign using the st 12 feature?

With the st 12 feature, users can sign a wide variety of documents, including contracts, agreements, and forms. This versatility makes it suitable for industries such as legal, finance, and healthcare. No matter the document type, airSlate SignNow ensures secure and efficient eSigning.

-

How secure is the st 12 signing process?

The st 12 feature employs advanced encryption protocols to ensure that all documents signed are secure and confidential. With compliance to industry standards, airSlate SignNow provides peace of mind for users regarding their sensitive information. This commitment to security makes the st 12 signing process reliable for businesses.

Get more for Updating Wisconsin Certificate Of Exemption Status CES

- Medquest application pdf form

- Filing a complaint against a dhs worker form

- Notice of no trespass clarke county virginia clarkecounty form

- Pc350 wpi 1 application for certificate of compliance form

- Location cafeteria form

- Esthetics application dos ny form

- Va state passes camping form

- New york life surrender form

Find out other Updating Wisconsin Certificate Of Exemption Status CES

- How To Sign Arkansas Lease Renewal

- Sign Georgia Forbearance Agreement Now

- Sign Arkansas Lease Termination Letter Mobile

- Sign Oregon Lease Termination Letter Easy

- How To Sign Missouri Lease Renewal

- Sign Colorado Notice of Intent to Vacate Online

- How Can I Sign Florida Notice of Intent to Vacate

- How Do I Sign Michigan Notice of Intent to Vacate

- Sign Arizona Pet Addendum to Lease Agreement Later

- How To Sign Pennsylvania Notice to Quit

- Sign Connecticut Pet Addendum to Lease Agreement Now

- Sign Florida Pet Addendum to Lease Agreement Simple

- Can I Sign Hawaii Pet Addendum to Lease Agreement

- Sign Louisiana Pet Addendum to Lease Agreement Free

- Sign Pennsylvania Pet Addendum to Lease Agreement Computer

- Sign Rhode Island Vacation Rental Short Term Lease Agreement Safe

- Sign South Carolina Vacation Rental Short Term Lease Agreement Now

- How Do I Sign Georgia Escrow Agreement

- Can I Sign Georgia Assignment of Mortgage

- Sign Kentucky Escrow Agreement Simple