IC 004 Form PW 1 Wisconsin Nonresident Income or Franchise Tax Withholding on Pass through Entity Income

What is the Wisconsin PW 1 Form?

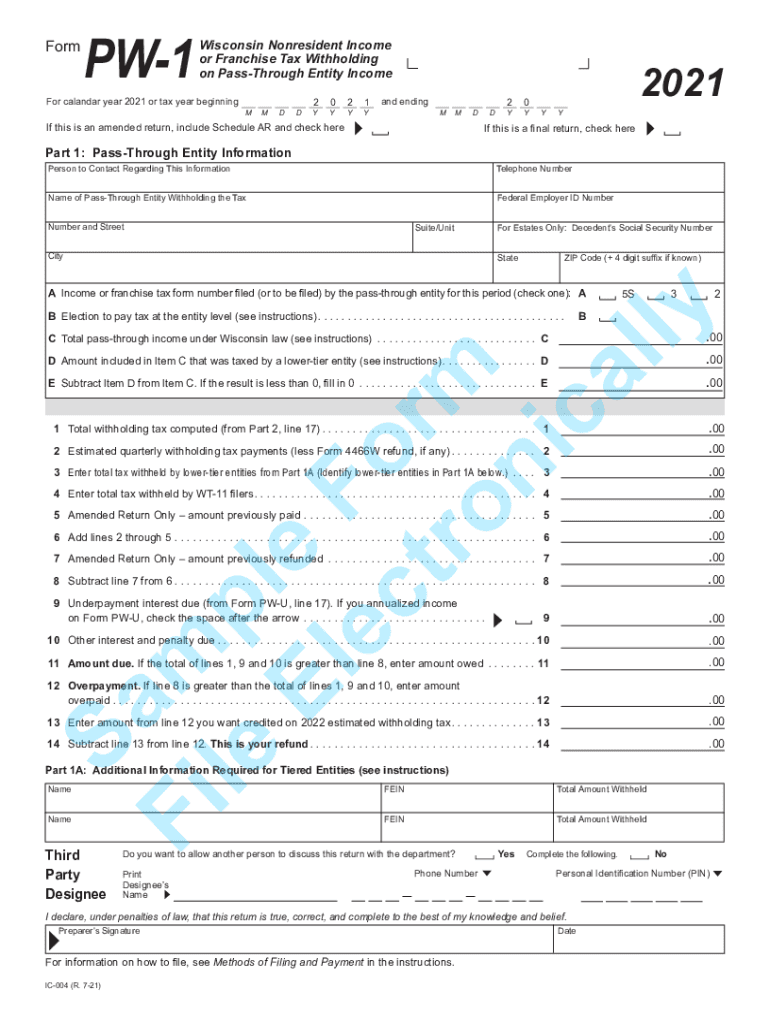

The Wisconsin PW 1 form, officially known as the IC 004 Form PW 1, pertains to nonresident income or franchise tax withholding on pass-through entity income. This form is essential for nonresident individuals or entities that receive income from Wisconsin pass-through entities, such as partnerships or S corporations. It ensures that the appropriate state taxes are withheld from the income earned in Wisconsin, complying with state tax regulations.

How to Use the Wisconsin PW 1 Form

To use the Wisconsin PW 1 form, individuals or entities must first determine their nonresident status and the income derived from Wisconsin sources. Once eligibility is confirmed, the form needs to be filled out accurately, providing details about the income received and the entity from which it is derived. After completing the form, it should be submitted to the Wisconsin Department of Revenue to ensure proper tax withholding.

Steps to Complete the Wisconsin PW 1 Form

Completing the Wisconsin PW 1 form involves several key steps:

- Gather necessary information, including your name, address, and tax identification number.

- Identify the pass-through entity from which you are receiving income.

- Detail the amount of income earned and any applicable deductions.

- Review the form for accuracy and completeness before submission.

Once completed, the form can be submitted online or via mail to the Wisconsin Department of Revenue.

Key Elements of the Wisconsin PW 1 Form

Important components of the Wisconsin PW 1 form include:

- Taxpayer Information: Name, address, and identification number.

- Entity Information: Details about the pass-through entity, including its name and tax identification number.

- Income Details: Amount of income received and any relevant deductions or credits.

These elements are crucial for ensuring accurate tax withholding and compliance with state regulations.

Filing Deadlines for the Wisconsin PW 1 Form

Filing deadlines for the Wisconsin PW 1 form are typically aligned with the tax year. Nonresidents must ensure that the form is submitted by the due date specified by the Wisconsin Department of Revenue to avoid penalties. It is advisable to check for any updates or changes to the deadlines each tax year.

Penalties for Non-Compliance with the Wisconsin PW 1 Form

Failure to comply with the requirements of the Wisconsin PW 1 form can result in significant penalties. These may include fines, interest on unpaid taxes, and potential legal repercussions. It is essential for nonresidents to understand their obligations and ensure timely and accurate filing to avoid these consequences.

Quick guide on how to complete ic 004 form pw 1 wisconsin nonresident income or franchise tax withholding on pass through entity income

Effortlessly Prepare IC 004 Form PW 1 Wisconsin Nonresident Income Or Franchise Tax Withholding On Pass Through Entity Income on Any Device

Digital document management has become increasingly favored by companies and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to locate the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents swiftly and without delays. Manage IC 004 Form PW 1 Wisconsin Nonresident Income Or Franchise Tax Withholding On Pass Through Entity Income on any device using the airSlate SignNow applications for Android or iOS and enhance any document-centric process today.

How to Edit and Electronically Sign IC 004 Form PW 1 Wisconsin Nonresident Income Or Franchise Tax Withholding On Pass Through Entity Income with Ease

- Obtain IC 004 Form PW 1 Wisconsin Nonresident Income Or Franchise Tax Withholding On Pass Through Entity Income and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize pertinent sections of your documents or redact sensitive information with dedicated tools provided by airSlate SignNow.

- Create your signature using the Sign feature, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Verify the details and click on the Done button to save your changes.

- Select how you wish to send your form: via email, SMS, invitation link, or download it to your computer.

Eliminate the hassle of lost or misfiled documents, the frustration of searching for forms, or errors that necessitate printing new copies. airSlate SignNow meets all your document management requirements with just a few clicks from any device of your preference. Modify and electronically sign IC 004 Form PW 1 Wisconsin Nonresident Income Or Franchise Tax Withholding On Pass Through Entity Income to ensure outstanding communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the ic 004 form pw 1 wisconsin nonresident income or franchise tax withholding on pass through entity income

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Wisconsin PW 1 and how does it relate to airSlate SignNow?

Wisconsin PW 1 refers to a specific requirement for public works contracts in Wisconsin. With airSlate SignNow, contractors can easily manage and eSign documents related to Wisconsin PW 1 compliance, streamlining the process and ensuring timely submissions.

-

How can airSlate SignNow help with Wisconsin PW 1 documentation?

airSlate SignNow simplifies the management of Wisconsin PW 1 documentation by providing templates and easy eSigning capabilities. This allows businesses to reduce administrative burdens, ensuring that all documents meet the necessary legal standards for public works.

-

Is airSlate SignNow cost-effective for managing Wisconsin PW 1 forms?

Yes, airSlate SignNow offers a cost-effective solution for managing Wisconsin PW 1 forms. With flexible pricing plans, businesses can choose options that best fit their needs without incurring unnecessary expenses.

-

What features does airSlate SignNow provide for Wisconsin PW 1 compliance?

AirSlate SignNow offers a range of features for Wisconsin PW 1 compliance, including customizable templates, real-time tracking, and secure cloud storage. These features ensure that your documentation is always accessible and compliant with state regulations.

-

Can airSlate SignNow integrate with other software to support Wisconsin PW 1 processes?

Absolutely! airSlate SignNow integrates seamlessly with various productivity and project management software, making it easier to manage Wisconsin PW 1 processes alongside your existing tools. This enhances workflow efficiency and improves overall productivity.

-

What are the benefits of using airSlate SignNow for Wisconsin PW 1?

Using airSlate SignNow for Wisconsin PW 1 offers numerous benefits, including enhanced document security, quicker turnaround times for eSigning, and reduced paper usage. This results in a more efficient and environmentally-friendly way to manage public works contracts.

-

How does airSlate SignNow ensure the security of Wisconsin PW 1 documents?

airSlate SignNow employs advanced security protocols, including encryption and two-factor authentication, to ensure the safety of Wisconsin PW 1 documents. Users can trust that their sensitive information is protected throughout the signing process.

Get more for IC 004 Form PW 1 Wisconsin Nonresident Income Or Franchise Tax Withholding On Pass Through Entity Income

- Client budget worksheet hud exchange hudhre form

- Chip health insurance renewal form uhccommunityplan com

- Fence permit application boardman township form

- Township zoning appeals planning form

- Aep permit form

- Questionnaire for child swallow eval intake form

- Resident complaint form liberty township butler county

- Ice form 73 028 image73 028 pdf

Find out other IC 004 Form PW 1 Wisconsin Nonresident Income Or Franchise Tax Withholding On Pass Through Entity Income

- How Do I Electronic signature Arkansas Real Estate Word

- How Do I Electronic signature Colorado Real Estate Document

- Help Me With Electronic signature Wisconsin Legal Presentation

- Can I Electronic signature Hawaii Real Estate PPT

- How Can I Electronic signature Illinois Real Estate Document

- How Do I Electronic signature Indiana Real Estate Presentation

- How Can I Electronic signature Ohio Plumbing PPT

- Can I Electronic signature Texas Plumbing Document

- How To Electronic signature Michigan Real Estate Form

- How To Electronic signature Arizona Police PDF

- Help Me With Electronic signature New Hampshire Real Estate PDF

- Can I Electronic signature New Hampshire Real Estate Form

- Can I Electronic signature New Mexico Real Estate Form

- How Can I Electronic signature Ohio Real Estate Document

- How To Electronic signature Hawaii Sports Presentation

- How To Electronic signature Massachusetts Police Form

- Can I Electronic signature South Carolina Real Estate Document

- Help Me With Electronic signature Montana Police Word

- How To Electronic signature Tennessee Real Estate Document

- How Do I Electronic signature Utah Real Estate Form