99 *2206600* Reconciliation of Maine Income Tax Form

What is the 99 *2206600* Reconciliation Of Maine Income Tax

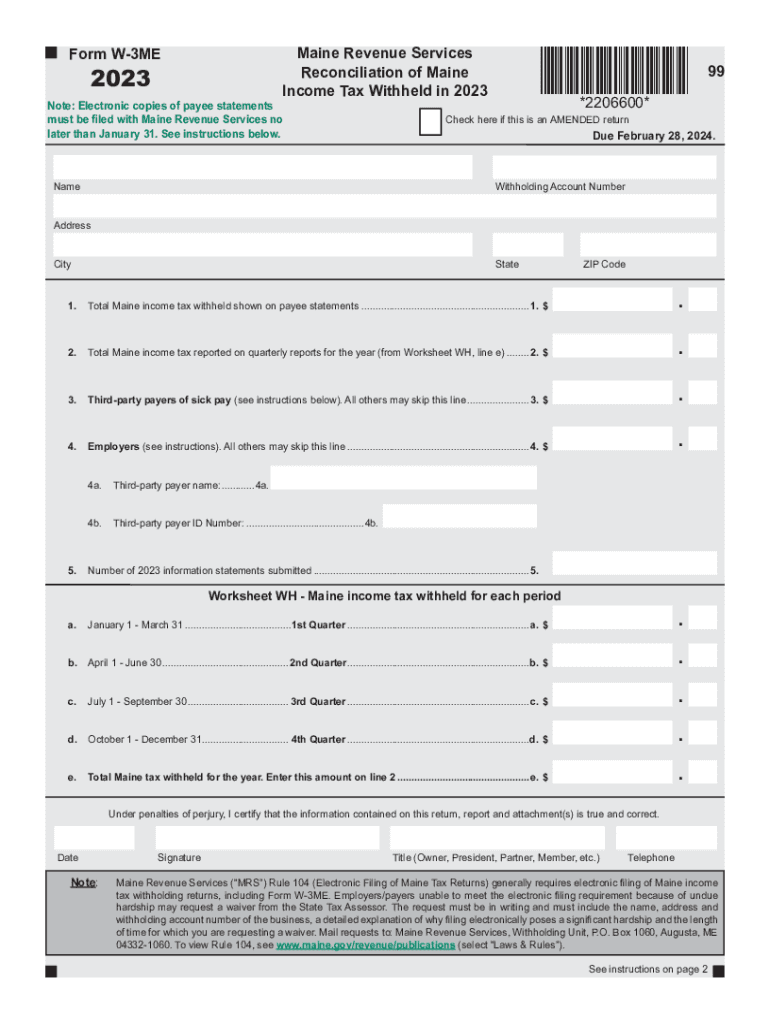

The 99 *2206600* Reconciliation Of Maine Income Tax is a crucial document used by residents of Maine to reconcile their income tax obligations. This form is specifically designed to ensure that taxpayers accurately report their income and calculate the correct amount of tax owed or refund due. It is essential for both individual and business taxpayers who have income subject to Maine state tax laws. Understanding this form helps taxpayers comply with state regulations and avoid potential penalties.

Steps to complete the 99 *2206600* Reconciliation Of Maine Income Tax

Completing the 99 *2206600* Reconciliation Of Maine Income Tax involves several key steps:

- Gather all relevant financial documents, including W-2s, 1099s, and any other income statements.

- Calculate your total income for the year, ensuring to include all sources of income.

- Determine your allowable deductions and credits, which can reduce your taxable income.

- Fill out the form accurately, ensuring that all calculations are correct and that you have included all necessary information.

- Review the completed form for any errors before submission.

- Submit the form by the deadline, either electronically or via mail, depending on your preference.

How to obtain the 99 *2206600* Reconciliation Of Maine Income Tax

Taxpayers can obtain the 99 *2206600* Reconciliation Of Maine Income Tax through various means. The form is typically available on the official Maine state tax website, where it can be downloaded in a fillable format. Additionally, taxpayers may request a physical copy of the form by contacting the Maine Revenue Services. It is advisable to ensure that you have the most current version of the form to comply with any updates in tax laws.

Filing Deadlines / Important Dates

Filing deadlines for the 99 *2206600* Reconciliation Of Maine Income Tax are crucial for compliance. Generally, the form must be submitted by April 15th of the year following the tax year. If this date falls on a weekend or holiday, the deadline may be extended to the next business day. Taxpayers should also be aware of any changes to deadlines that may occur due to state legislation or other factors.

Required Documents

To complete the 99 *2206600* Reconciliation Of Maine Income Tax accurately, taxpayers need several key documents:

- W-2 forms from employers showing annual wages and withheld taxes.

- 1099 forms for any freelance or contract work, detailing income received.

- Documentation of any deductions or credits claimed, such as receipts or statements.

- Previous year’s tax return, which can provide a reference for income and deductions.

Penalties for Non-Compliance

Failing to file the 99 *2206600* Reconciliation Of Maine Income Tax on time can result in significant penalties. Maine imposes late filing fees, which can accumulate over time. Additionally, taxpayers may face interest charges on any unpaid tax balances. It is essential to file on time and ensure that all information is accurate to avoid these potential consequences.

Quick guide on how to complete 99 2206600 reconciliation of maine income tax

Complete 99 *2206600* Reconciliation Of Maine Income Tax seamlessly on any device

Digital document management has gained traction among businesses and individuals. It offers an ideal eco-friendly substitute to conventional printed and signed documents, as you can easily locate the necessary form and securely keep it online. airSlate SignNow provides you with all the tools needed to create, modify, and eSign your documents promptly without any delays. Manage 99 *2206600* Reconciliation Of Maine Income Tax on any device with airSlate SignNow Android or iOS applications and enhance any document-related workflow today.

How to adjust and eSign 99 *2206600* Reconciliation Of Maine Income Tax effortlessly

- Find 99 *2206600* Reconciliation Of Maine Income Tax and then click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Highlight pertinent sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional wet ink signature.

- Review the information and then click the Done button to save your modifications.

- Choose how you wish to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate worries about lost or misplaced files, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs with just a few clicks from any device you prefer. Edit and eSign 99 *2206600* Reconciliation Of Maine Income Tax and ensure effective communication at every phase of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 99 2206600 reconciliation of maine income tax

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is maine reconciliation and how does airSlate SignNow assist with it?

Maine reconciliation refers to the process of ensuring that financial records align with bank statements in the state of Maine. AirSlate SignNow streamlines this process by allowing users to send and sign necessary documents electronically, making it easier to manage and verify financial transactions.

-

How much does airSlate SignNow cost for maine reconciliation services?

AirSlate SignNow offers competitive pricing plans that cater to various business sizes. The cost for maine reconciliation services is affordable, with options for monthly or annual subscriptions that suit your budget while providing full access to the platform's features.

-

What features does airSlate SignNow provide for maine reconciliation?

AirSlate SignNow includes features tailored for maine reconciliation, such as customizable templates, real-time tracking, and secure electronic signatures. These tools help ensure that your financial documents are completed efficiently and accurately.

-

Can airSlate SignNow's integration tools improve my maine reconciliation process?

Yes, airSlate SignNow offers numerous integrations with popular accounting and financial software that can signNowly enhance your maine reconciliation process. By integrating with your existing tools, you can automate workflows and ensure seamless data transfer, reducing manual entry and errors.

-

What are the benefits of using airSlate SignNow for maine reconciliation?

Using airSlate SignNow for maine reconciliation provides several benefits such as increased efficiency, reduced turnaround time for document signing, and enhanced security for sensitive financial information. These advantages can help businesses streamline their reconciliation processes and focus on more strategic tasks.

-

How secure is airSlate SignNow for managing maine reconciliation documents?

AirSlate SignNow employs advanced security measures to protect your maine reconciliation documents. With features like encrypted data transmission and secure storage, you can trust that your financial information is safe and compliant with relevant regulations.

-

Is there a mobile app for airSlate SignNow that supports maine reconciliation?

Yes, airSlate SignNow offers a mobile app that allows users to manage maine reconciliation tasks on the go. This app enables you to send, receive, and eSign documents from your smartphone or tablet, ensuring you can stay productive wherever you are.

Get more for 99 *2206600* Reconciliation Of Maine Income Tax

- Renewal application license no your montana boiler form

- San gabriel valley jr american football conferenc form

- 396 vehicle brake inspector qualifications doc dot ny form

- Simple interest motor vehicle contract and form

- City of pompano beach department of development services building inspections division threshold inspector application 100 w form

- Revision submittal form

- Per0118 pre contract binder rev 11 19 doc form

- This application must be completed for all construction plan submittals excluding one and two family dwellings form

Find out other 99 *2206600* Reconciliation Of Maine Income Tax

- eSign Virginia Government POA Simple

- eSign Hawaii Lawers Rental Application Fast

- eSign Hawaii Lawers Cease And Desist Letter Later

- How To eSign Hawaii Lawers Cease And Desist Letter

- How Can I eSign Hawaii Lawers Cease And Desist Letter

- eSign Hawaii Lawers Cease And Desist Letter Free

- eSign Maine Lawers Resignation Letter Easy

- eSign Louisiana Lawers Last Will And Testament Mobile

- eSign Louisiana Lawers Limited Power Of Attorney Online

- eSign Delaware Insurance Work Order Later

- eSign Delaware Insurance Credit Memo Mobile

- eSign Insurance PPT Georgia Computer

- How Do I eSign Hawaii Insurance Operating Agreement

- eSign Hawaii Insurance Stock Certificate Free

- eSign New Hampshire Lawers Promissory Note Template Computer

- Help Me With eSign Iowa Insurance Living Will

- eSign North Dakota Lawers Quitclaim Deed Easy

- eSign Ohio Lawers Agreement Computer

- eSign North Dakota Lawers Separation Agreement Online

- How To eSign North Dakota Lawers Separation Agreement