STEC CO Rev 1114Reset Form Tax Ohio GovSales and

Understanding the Contractors Exemption Certificate

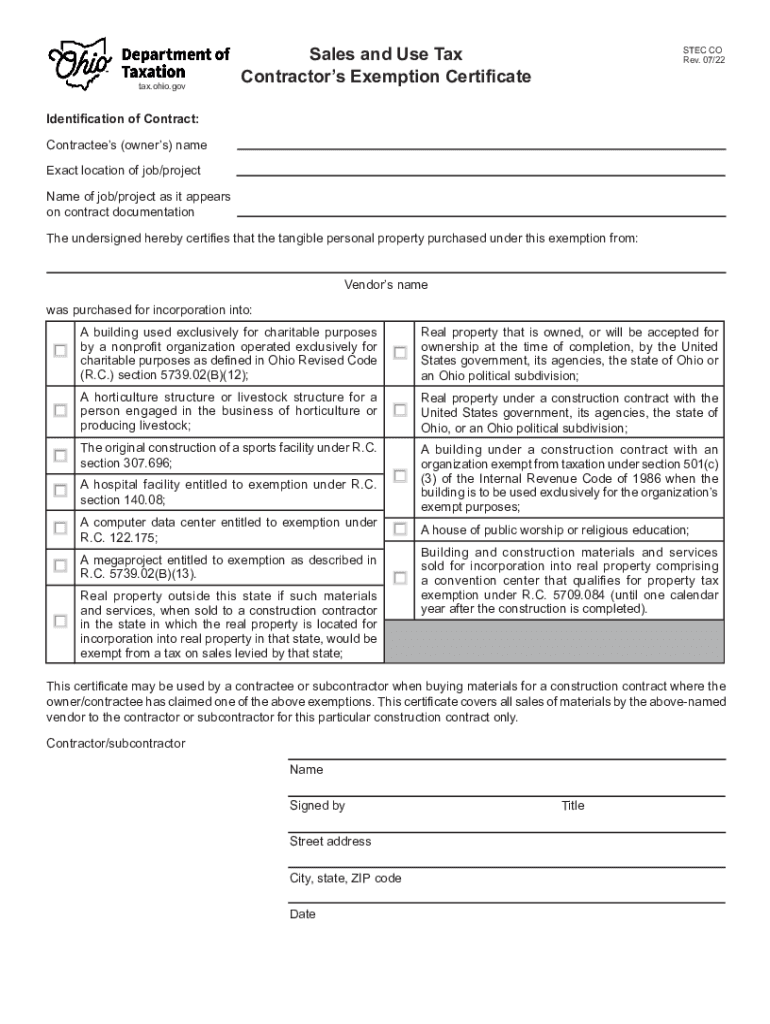

The contractors exemption certificate is a crucial document for businesses in the construction industry. It allows contractors to purchase materials without paying sales tax, provided those materials are intended for resale or incorporation into a final product. This exemption helps reduce costs for contractors, enabling them to offer competitive pricing on their services.

Eligibility Criteria for the Contractors Exemption Certificate

To qualify for the contractors exemption certificate, applicants must meet specific criteria. Generally, the applicant must be a registered contractor with a valid business license. Additionally, the materials purchased must be directly related to the construction services provided. Each state may have its own requirements, so it is essential to check local regulations to ensure compliance.

Steps to Complete the Contractors Exemption Certificate

Filling out the contractors exemption certificate involves several key steps:

- Gather necessary information, including your business name, address, and tax identification number.

- Identify the materials for which you are seeking exemption.

- Complete the certificate form accurately, ensuring all required fields are filled out.

- Sign and date the form to validate your request.

- Submit the completed certificate to your supplier or the appropriate state agency, as required.

Legal Use of the Contractors Exemption Certificate

The contractors exemption certificate serves a legal purpose in the tax system. It allows contractors to avoid paying sales tax on materials that will be used in taxable sales. Misuse of this certificate, such as using it for personal purchases or non-qualifying materials, can lead to penalties and legal repercussions. It is important for contractors to understand the legal implications of using this certificate correctly.

Required Documents for Application

When applying for the contractors exemption certificate, certain documents may be required. Commonly needed documents include:

- A copy of your business license.

- Your tax identification number.

- Proof of your status as a registered contractor.

Having these documents ready can streamline the application process and ensure compliance with state regulations.

Form Submission Methods

The contractors exemption certificate can typically be submitted through various methods, depending on state regulations. Common submission methods include:

- Online submission via the state tax authority's website.

- Mailing the completed form to the appropriate state agency.

- In-person submission at designated state offices.

Contractors should verify the preferred submission method for their state to ensure timely processing.

Quick guide on how to complete stec co rev 1114reset form tax ohio govsales and

Effortlessly Prepare STEC CO Rev 1114Reset Form Tax ohio govSales And on Any Device

Managing documents online has gained traction among businesses and individuals alike. It offers an ideal eco-friendly substitute for traditional printed and signed documentation, allowing you to access the correct forms and securely store them online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents quickly and without delays. Handle STEC CO Rev 1114Reset Form Tax ohio govSales And on any device with airSlate SignNow's Android or iOS applications and enhance any document-centric operation today.

The Easiest Way to Alter and eSign STEC CO Rev 1114Reset Form Tax ohio govSales And Seamlessly

- Locate STEC CO Rev 1114Reset Form Tax ohio govSales And and click Get Form to begin.

- Use the tools we provide to complete your document.

- Emphasize important sections of the documents or conceal sensitive information with the tools that airSlate SignNow specifically offers for that purpose.

- Create your signature using the Sign feature, which takes mere seconds and carries the same legal validity as a traditional wet ink signature.

- Review all information and click on the Done button to save your modifications.

- Select your preferred method of delivering your form, whether by email, text message (SMS), invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from any chosen device. Modify and eSign STEC CO Rev 1114Reset Form Tax ohio govSales And to ensure excellent communication throughout your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the stec co rev 1114reset form tax ohio govsales and

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a contractors exemption certificate?

A contractors exemption certificate is a document that allows contractors to operate without paying sales tax on specific purchases related to their projects. This certificate is essential for contractors who want to save money on expenses directly tied to their work. Understanding how to obtain and use this certificate can signNowly benefit your business.

-

How can airSlate SignNow assist with contractors exemption certificates?

airSlate SignNow simplifies the process of sending and signing contractors exemption certificates digitally. With our eSignature solution, contractors can easily manage and execute their exemption certificates online, ensuring a fast turnaround. This convenience helps contractors focus more on their work rather than paperwork.

-

What are the pricing options for using airSlate SignNow for contractors exemption certificates?

airSlate SignNow offers flexible pricing plans to meet the needs of contractors using exemption certificates. Each plan includes robust features that enable unlimited document signing and management. You can choose a plan that fits your business needs and budget, ensuring value without compromising on quality.

-

Are there any integrations available for airSlate SignNow when handling contractors exemption certificates?

Yes, airSlate SignNow integrates seamlessly with various platforms to facilitate managing contractors exemption certificates. Tools like Google Drive, Dropbox, and CRM systems enhance your workflow, allowing easy access and storage of your important documents. These integrations make it simple to streamline the way you handle paperwork.

-

What are the benefits of using airSlate SignNow for contractors?

Using airSlate SignNow provides contractors with numerous benefits, including speed, efficiency, and reduced paperwork. Easily send, sign, and track contracts and contractors exemption certificates from any device. This streamlined approach minimizes delays and ensures compliance with tax regulations.

-

Is airSlate SignNow secure for signing contractors exemption certificates?

Absolutely, airSlate SignNow prioritizes the security of your documents, including contractors exemption certificates. Our platform utilizes advanced encryption and authentication measures to protect sensitive information. This commitment to security gives you peace of mind while managing your important contracts.

-

Can I collaborate with my team on contractors exemption certificates using airSlate SignNow?

Yes, airSlate SignNow allows for seamless collaboration among team members when handling contractors exemption certificates. Multiple users can review, edit, and sign documents simultaneously, facilitating smoother communication and quicker approvals. This feature is particularly beneficial for teams working on joint projects.

Get more for STEC CO Rev 1114Reset Form Tax ohio govSales And

- Appendix c bail bond revocation request form dochub

- The toxicity questionnaire form

- Fillable online catholicdioceseofwichita medicalvision claim form

- Patient intake form cdnvortalacom

- Claims form 591692c dartmouth

- P atient registration form pivotphysicaltherapy com

- Title of exam form

- Maternity care management notification form fax to

Find out other STEC CO Rev 1114Reset Form Tax ohio govSales And

- How Do I Electronic signature Montana Government Document

- Help Me With Electronic signature Louisiana Finance & Tax Accounting Word

- How To Electronic signature Pennsylvania Government Document

- Can I Electronic signature Texas Government PPT

- How To Electronic signature Utah Government Document

- How To Electronic signature Washington Government PDF

- How Can I Electronic signature New Mexico Finance & Tax Accounting Word

- How Do I Electronic signature New York Education Form

- How To Electronic signature North Carolina Education Form

- How Can I Electronic signature Arizona Healthcare / Medical Form

- How Can I Electronic signature Arizona Healthcare / Medical Presentation

- How To Electronic signature Oklahoma Finance & Tax Accounting PDF

- How Can I Electronic signature Oregon Finance & Tax Accounting PDF

- How To Electronic signature Indiana Healthcare / Medical PDF

- How Do I Electronic signature Maryland Healthcare / Medical Presentation

- How To Electronic signature Tennessee Healthcare / Medical Word

- Can I Electronic signature Hawaii Insurance PDF

- Help Me With Electronic signature Colorado High Tech Form

- How To Electronic signature Indiana Insurance Document

- Can I Electronic signature Virginia Education Word