Employee S Wisconsin Withholding Exemption Certificate Form

What is the Employee S Wisconsin Withholding Exemption Certificate

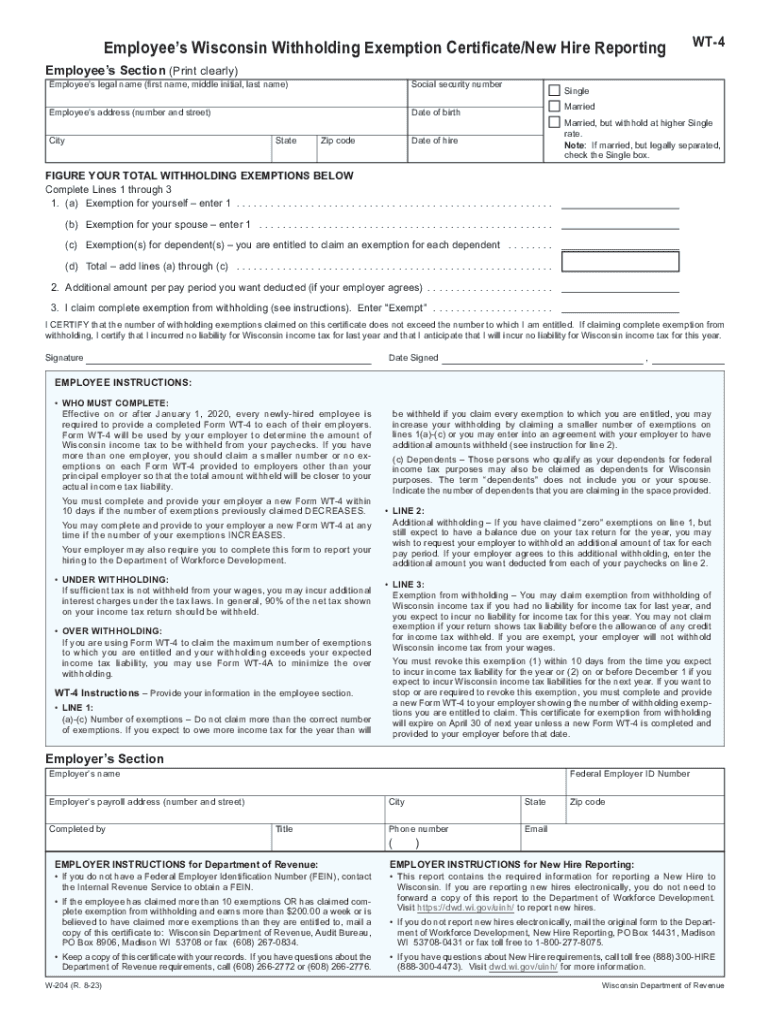

The Employee S Wisconsin Withholding Exemption Certificate is a critical document used by employees in Wisconsin to claim exemption from state income tax withholding. This certificate allows eligible employees to avoid having state taxes deducted from their paychecks, provided they meet specific criteria. Understanding the purpose and implications of this form is essential for both employees and employers to ensure compliance with state tax regulations.

How to use the Employee S Wisconsin Withholding Exemption Certificate

To use the Employee S Wisconsin Withholding Exemption Certificate, employees must complete the form accurately and submit it to their employer. This certificate must be filled out if the employee qualifies for exemption based on their tax situation. Employers are required to keep this form on file and should not withhold state income tax from the employee's wages if the exemption is valid. It is important for employees to review their eligibility each year, as changes in income or personal circumstances can affect their exemption status.

Steps to complete the Employee S Wisconsin Withholding Exemption Certificate

Completing the Employee S Wisconsin Withholding Exemption Certificate involves several straightforward steps:

- Obtain the form from your employer or download it from the Wisconsin Department of Revenue website.

- Fill in your personal information, including your name, address, and Social Security number.

- Indicate your eligibility for exemption by checking the appropriate box.

- Sign and date the form to validate your claim.

- Submit the completed form to your employer for processing.

Eligibility Criteria

To qualify for the Employee S Wisconsin Withholding Exemption Certificate, employees must meet specific criteria. Generally, individuals who had no tax liability in the previous year and expect to have none in the current year may be eligible. Additionally, certain income thresholds and filing statuses may apply. It is advisable for employees to consult the Wisconsin Department of Revenue or a tax professional to confirm their eligibility before submitting the form.

Penalties for Non-Compliance

Failure to comply with the regulations regarding the Employee S Wisconsin Withholding Exemption Certificate can result in penalties for both employees and employers. Employees who incorrectly claim exemption may face tax liabilities, including back taxes and interest. Employers who do not withhold taxes when required may also incur penalties. It is crucial for both parties to understand their responsibilities to avoid these potential consequences.

Form Submission Methods

The Employee S Wisconsin Withholding Exemption Certificate can be submitted through various methods. Employees typically provide the completed form directly to their employer, either in person or via email. Employers are responsible for maintaining these forms in their records. While electronic submission is becoming more common, it is essential to ensure that the method used complies with state regulations and employer policies.

Quick guide on how to complete employee s wisconsin withholding exemption certificate

Prepare Employee S Wisconsin Withholding Exemption Certificate effortlessly on any device

Digital document management has gained traction among businesses and individuals. It offers a superb eco-friendly substitute to conventional printed and signed documents, allowing you to access the correct form and securely save it online. airSlate SignNow provides you with all the resources you require to create, modify, and eSign your documents swiftly without interruptions. Handle Employee S Wisconsin Withholding Exemption Certificate on any device using the airSlate SignNow Android or iOS applications and simplify any document-related tasks today.

The easiest method to alter and eSign Employee S Wisconsin Withholding Exemption Certificate seamlessly

- Find Employee S Wisconsin Withholding Exemption Certificate and click Get Form to begin.

- Make use of the tools available to complete your form.

- Highlight important sections of your documents or obscure sensitive data with tools that airSlate SignNow specifically provides for that purpose.

- Generate your eSignature using the Sign tool, which takes only seconds and holds the same legal validity as a conventional ink signature.

- Review the details and click the Done button to save your modifications.

- Select your preferred method of submitting your form, whether by email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Alter and eSign Employee S Wisconsin Withholding Exemption Certificate and guarantee effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the employee s wisconsin withholding exemption certificate

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Wisconsin new hire reporting?

Wisconsin new hire reporting is a requirement for employers to report information about newly hired employees to the state. This process helps in tracking employment for child support enforcement and ensures that workers are accurately counted. Utilizing airSlate SignNow can streamline this reporting process with efficient document management.

-

How does airSlate SignNow assist in Wisconsin new hire reporting?

airSlate SignNow provides an intuitive platform for managing the required documentation for Wisconsin new hire reporting. Users can easily create, send, and eSign forms that adhere to state regulations. This not only saves time but also reduces the risk of errors in reporting.

-

What features does airSlate SignNow offer for new hire reporting?

With airSlate SignNow, you gain access to features such as customizable templates, real-time status tracking, and secure eSigning. These tools are specifically designed to simplify Wisconsin new hire reporting, allowing for quick submissions and efficient record-keeping. The user-friendly interface ensures that all team members can utilize these capabilities effectively.

-

Is airSlate SignNow affordable for small businesses handling Wisconsin new hire reporting?

Yes, airSlate SignNow offers competitive pricing models that cater to small businesses managing Wisconsin new hire reporting. By providing cost-effective solutions, airSlate SignNow helps you focus on compliance and growth without straining your budget. You can choose a plan that best fits your business size and needs.

-

Can airSlate SignNow integrate with other HR systems for new hire reporting?

Absolutely! airSlate SignNow integrates seamlessly with various HR and payroll systems. This feature allows for automatic data transfer and reporting, making Wisconsin new hire reporting even more efficient. You can connect your existing tools without any hassle, ensuring smooth operational workflows.

-

What are the benefits of using airSlate SignNow for Wisconsin new hire reporting?

The primary benefits include enhanced efficiency, compliance assurance, and reduced paperwork. Using airSlate SignNow for Wisconsin new hire reporting minimizes administrative burdens, allowing your HR team to focus on more strategic tasks. Additionally, with comprehensive audit trails, you can easily maintain compliance with state laws.

-

How secure is the information shared via airSlate SignNow for new hire reporting?

Security is a top priority for airSlate SignNow. All data shared for Wisconsin new hire reporting is protected with advanced encryption and access controls, ensuring that sensitive information remains safe. You can trust that your documents are stored securely, meeting the highest industry standards.

Get more for Employee S Wisconsin Withholding Exemption Certificate

- Victoria hospital montreal topics by science gov form

- Algonquin international student form

- Reconnection waiver innpower form

- Statement of extra provincial registration taber licensing ampamp registry form

- Appointment of an agent form appointment of an agent

- Quotform no 16 see rule 311a part a certificate under section webtel

- Dsw form

- Eligibility certificate form

Find out other Employee S Wisconsin Withholding Exemption Certificate

- How To Sign Alaska Insurance Promissory Note Template

- Sign Arizona Insurance Moving Checklist Secure

- Sign New Mexico High Tech Limited Power Of Attorney Simple

- Sign Oregon High Tech POA Free

- Sign South Carolina High Tech Moving Checklist Now

- Sign South Carolina High Tech Limited Power Of Attorney Free

- Sign West Virginia High Tech Quitclaim Deed Myself

- Sign Delaware Insurance Claim Online

- Sign Delaware Insurance Contract Later

- Sign Hawaii Insurance NDA Safe

- Sign Georgia Insurance POA Later

- How Can I Sign Alabama Lawers Lease Agreement

- How Can I Sign California Lawers Lease Agreement

- Sign Colorado Lawers Operating Agreement Later

- Sign Connecticut Lawers Limited Power Of Attorney Online

- Sign Hawaii Lawers Cease And Desist Letter Easy

- Sign Kansas Insurance Rental Lease Agreement Mobile

- Sign Kansas Insurance Rental Lease Agreement Free

- Sign Kansas Insurance Rental Lease Agreement Fast

- Sign Kansas Insurance Rental Lease Agreement Safe