Nebraska Application Credit Form

What is the Nebraska Application Credit

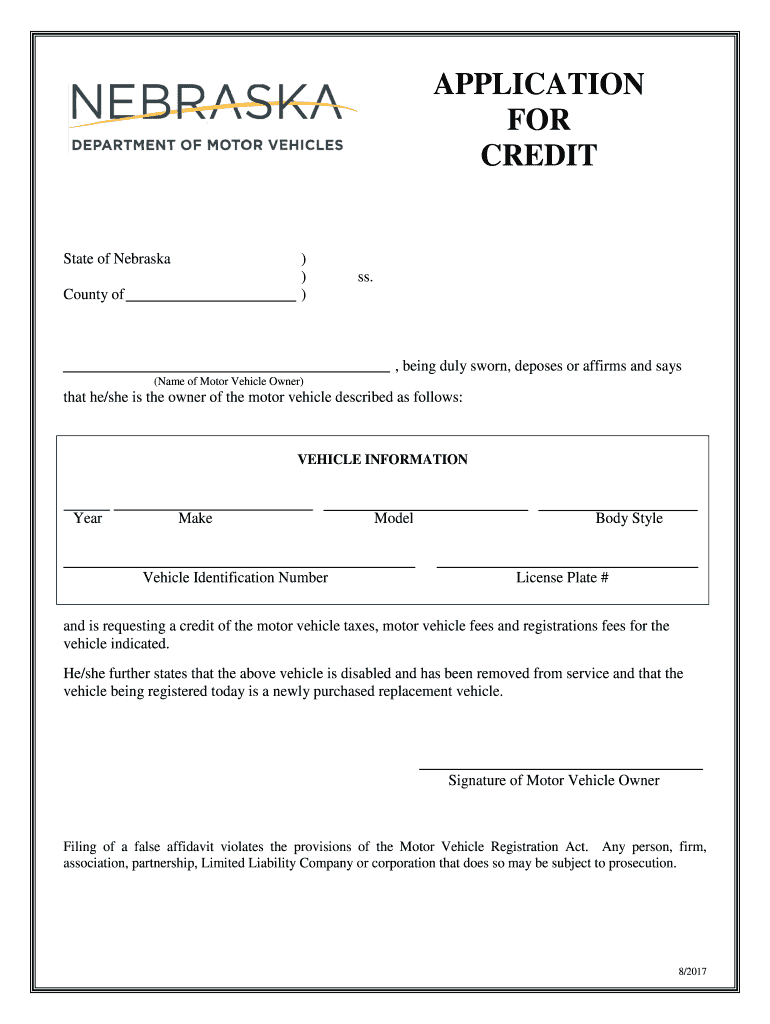

The Nebraska Application Credit is a financial tool designed to assist individuals and businesses in obtaining credit for various purposes, such as personal loans or business financing. This credit application is essential for those looking to secure funding in Nebraska, as it outlines the necessary information required by lenders to assess creditworthiness. It typically includes personal identification details, income verification, and any existing debt obligations. Understanding this form is crucial for anyone seeking financial assistance in the state.

Steps to complete the Nebraska Application Credit

Completing the Nebraska Application Credit involves several key steps to ensure accuracy and compliance. Begin by gathering all necessary documentation, including proof of identity, income statements, and any relevant financial records. Next, fill out the application form with precise information, paying close attention to sections that require detailed explanations of your financial situation. After completing the form, review it thoroughly for any errors or omissions. Finally, submit the application through the designated method, whether online, by mail, or in person, ensuring that you retain copies for your records.

Eligibility Criteria

To qualify for the Nebraska Application Credit, applicants must meet specific eligibility criteria set by lenders. Generally, this includes being a resident of Nebraska, having a stable source of income, and possessing a satisfactory credit history. Some lenders may also consider factors such as employment status, debt-to-income ratio, and the purpose of the credit. It is essential to review these criteria carefully before applying to increase the chances of approval.

How to obtain the Nebraska Application Credit

Obtaining the Nebraska Application Credit involves several steps. First, identify the lenders that offer this type of credit, which may include banks, credit unions, and online financial institutions. Once you have selected a lender, visit their website or branch to access the application form. Fill out the form with accurate information and submit it along with any required documentation. After submission, the lender will review your application and notify you of their decision, typically within a few days to a couple of weeks.

Legal use of the Nebraska Application Credit

The legal use of the Nebraska Application Credit is governed by state and federal regulations that protect both lenders and borrowers. It is essential for applicants to understand their rights and responsibilities when applying for credit. This includes ensuring that all information provided is truthful and complete, as submitting false information can lead to legal consequences. Additionally, borrowers should be aware of their rights regarding loan terms, interest rates, and the ability to dispute any discrepancies in their credit report.

Required Documents

When applying for the Nebraska Application Credit, several documents are typically required to verify your identity and financial status. Commonly requested documents include:

- Government-issued identification (e.g., driver's license, passport)

- Proof of income (e.g., pay stubs, tax returns)

- Bank statements

- Details of existing debts

- Social Security number

Having these documents ready can streamline the application process and improve the likelihood of approval.

Quick guide on how to complete nebraska application credit

Complete Nebraska Application Credit effortlessly on any device

Managing documents online has gained traction among both businesses and individuals. It offers an excellent eco-friendly substitute for conventional printed and signed documents, allowing you to obtain the necessary form and securely preserve it online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents quickly without delays. Handle Nebraska Application Credit on any device using airSlate SignNow's Android or iOS applications and enhance any document-related workflow today.

How to alter and eSign Nebraska Application Credit with ease

- Obtain Nebraska Application Credit and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize relevant sections of your documents or redact sensitive information using tools specifically provided by airSlate SignNow for that purpose.

- Generate your electronic signature with the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Verify all details and click on the Done button to save your changes.

- Choose how you wish to send your form, whether by email, text message (SMS), an invitation link, or download it to your computer.

Say goodbye to lost or misfiled documents, cumbersome form navigation, or mistakes that require printing new document copies. airSlate SignNow addresses all your document management requirements in just a few clicks from any device you prefer. Edit and eSign Nebraska Application Credit and ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the nebraska application credit

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a Nebraska application credit?

A Nebraska application credit is a financial support option designed to help individuals and businesses in Nebraska manage their applications for various financial services. It provides assistance with credit applications, making it easier to secure financing tailored to local needs.

-

How does airSlate SignNow facilitate the Nebraska application credit process?

airSlate SignNow streamlines the Nebraska application credit process by allowing users to electronically sign and send documents quickly. This feature eliminates the hassle of traditional paperwork and helps ensure that your credit applications are processed efficiently.

-

What pricing options are available for airSlate SignNow?

airSlate SignNow offers flexible pricing plans to cater to different business needs, including options that suit those interested in Nebraska application credit. Each plan includes essential features for document management, eSigning, and more at competitive rates.

-

What features does airSlate SignNow offer for Nebraska application credit users?

For Nebraska application credit users, airSlate SignNow provides features like secure document storage, advanced templates, and customizable workflows. These tools help simplify the application process and enhance organization during credit applications.

-

What are the benefits of using airSlate SignNow for Nebraska application credit?

Using airSlate SignNow for Nebraska application credit offers users efficiency and time savings. The platform's easy-to-use interface allows for quick document processing, reducing turnaround times and improving the overall experience for applicants.

-

Can airSlate SignNow integrate with other systems for Nebraska application credit?

Yes, airSlate SignNow seamlessly integrates with various applications that enhance the Nebraska application credit process. These integrations help consolidate your documentation and workflow, further optimizing your credit application experience.

-

Is airSlate SignNow suitable for small businesses considering Nebraska application credit?

Absolutely! airSlate SignNow is designed for businesses of all sizes, including small businesses looking for Nebraska application credit. Its user-friendly features and affordable pricing make it an excellent choice for companies needing efficient document management and eSigning.

Get more for Nebraska Application Credit

- Safety services company topic tailgate toolbox safety meetings pdf form

- K 40es form

- Octagam copay assistance form

- Division 200junior dairy cattle angi kaverman form

- Best practices for rural property appraisals texas rural form

- Junior dairy cattle entry form deadline panhandle south

- Casual employment form iserp columbia university

- Extra judicial settlement of estate with deed of absolute form

Find out other Nebraska Application Credit

- How Do I Sign Florida Doctors Word

- Can I Sign Florida Doctors Word

- How Can I Sign Illinois Doctors PPT

- How To Sign Texas Doctors PDF

- Help Me With Sign Arizona Education PDF

- How To Sign Georgia Education Form

- How To Sign Iowa Education PDF

- Help Me With Sign Michigan Education Document

- How Can I Sign Michigan Education Document

- How Do I Sign South Carolina Education Form

- Can I Sign South Carolina Education Presentation

- How Do I Sign Texas Education Form

- How Do I Sign Utah Education Presentation

- How Can I Sign New York Finance & Tax Accounting Document

- How Can I Sign Ohio Finance & Tax Accounting Word

- Can I Sign Oklahoma Finance & Tax Accounting PPT

- How To Sign Ohio Government Form

- Help Me With Sign Washington Government Presentation

- How To Sign Maine Healthcare / Medical PPT

- How Do I Sign Nebraska Healthcare / Medical Word