I 016 Schedule H, Wisconsin Homestead Credit Schedule H Wisconsin Homestead Credit Form

Understanding the I 016 Schedule H

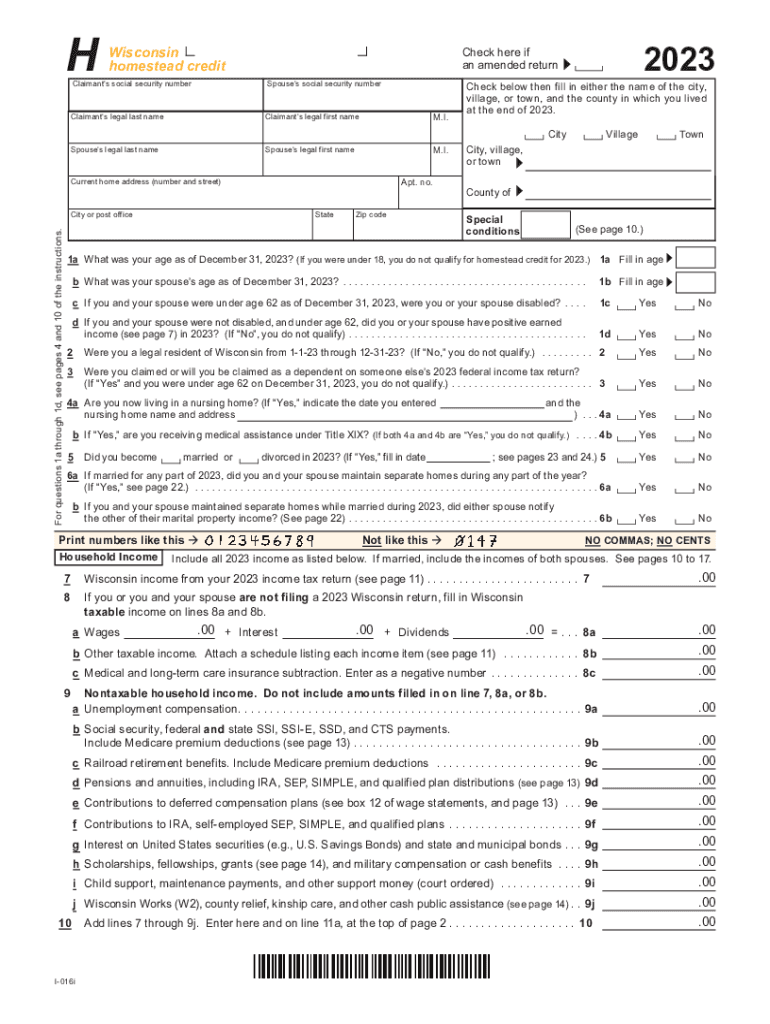

The I 016 Schedule H, also known as the Wisconsin Homestead Credit Schedule H, is a crucial form for residents of Wisconsin seeking to claim property tax relief. This form is specifically designed for individuals who own or rent their primary residence and meet certain income and residency criteria. By completing this form, eligible applicants can receive a credit that reduces their property tax burden, helping to make housing more affordable.

How to Complete the I 016 Schedule H

Filling out the I 016 Schedule H requires careful attention to detail. Applicants must provide personal information, including their name, address, and Social Security number. Additionally, it is essential to report all sources of income, including wages, pensions, and any other earnings. The form also requires information about the property, such as its assessed value and property taxes paid. Accurate completion of this form is vital to ensure eligibility for the homestead credit.

Eligibility Criteria for the Wisconsin Homestead Credit

To qualify for the Wisconsin Homestead Credit, applicants must meet specific eligibility requirements. These include being a resident of Wisconsin, occupying the property as their primary residence, and having a household income below a certain threshold. Additionally, applicants must be at least eighteen years old or be a qualified disabled individual. Understanding these criteria is essential for individuals looking to benefit from the homestead credit.

Required Documents for Submission

When submitting the I 016 Schedule H, applicants must include several supporting documents. These typically include proof of income, such as W-2 forms or tax returns, and documentation of property taxes paid. It is important to gather all necessary paperwork before submitting the form to avoid delays in processing. Ensuring that all documents are complete and accurate can significantly enhance the chances of a successful application.

Filing Deadlines for the Homestead Credit

Timely submission of the I 016 Schedule H is crucial to ensure eligibility for the credit. The filing deadline for this form typically aligns with the annual tax return deadline, which is usually April fifteenth. However, it is advisable to check for any updates or changes in deadlines each year. Filing on time helps avoid penalties and ensures that applicants receive their credits promptly.

Submission Methods for the I 016 Schedule H

Applicants have several options for submitting the I 016 Schedule H. The form can be filed online through the Wisconsin Department of Revenue's website, allowing for a quick and efficient process. Alternatively, individuals may choose to mail their completed forms to the appropriate state office or submit them in person. Understanding these submission methods can help streamline the application process.

Quick guide on how to complete i 016 schedule h wisconsin homestead credit schedule h wisconsin homestead credit

Complete I 016 Schedule H, Wisconsin Homestead Credit Schedule H Wisconsin Homestead Credit effortlessly on any device

Digital document management has become widespread among companies and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, as you can obtain the necessary form and securely store it online. airSlate SignNow equips you with all the resources you require to create, modify, and eSign your documents quickly without any hold-ups. Handle I 016 Schedule H, Wisconsin Homestead Credit Schedule H Wisconsin Homestead Credit on any device with airSlate SignNow Android or iOS applications and simplify any document-related process today.

How to edit and eSign I 016 Schedule H, Wisconsin Homestead Credit Schedule H Wisconsin Homestead Credit seamlessly

- Locate I 016 Schedule H, Wisconsin Homestead Credit Schedule H Wisconsin Homestead Credit and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize key sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Verify the information and click the Done button to save your modifications.

- Choose your preferred method to submit your form, whether by email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searching, or errors that require printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you prefer. Edit and eSign I 016 Schedule H, Wisconsin Homestead Credit Schedule H Wisconsin Homestead Credit and guarantee excellent communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the i 016 schedule h wisconsin homestead credit schedule h wisconsin homestead credit

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the homestead tax credit form 2023?

The homestead tax credit form 2023 is a specific document used by homeowners to apply for tax relief based on the value of their primary residence. This form helps reduce property taxes, making homeownership more affordable for eligible applicants. It is essential to complete the homestead tax credit form 2023 accurately to ensure you receive the maximum benefit.

-

How can I obtain the homestead tax credit form 2023?

You can obtain the homestead tax credit form 2023 from your local tax authority's website or office. Many states provide downloadable PDFs or online submission options for the form. Ensure you check the deadlines and requirements specific to your area when seeking the homestead tax credit form 2023.

-

What are the eligibility requirements for the homestead tax credit form 2023?

To qualify for the homestead tax credit form 2023, applicants typically need to be permanent residents and meet certain income thresholds. Additional requirements may include property ownership and occupancy as the primary residence. Make sure to review your state's criteria to determine your eligibility for the homestead tax credit form 2023.

-

How does airSlate SignNow assist with the homestead tax credit form 2023?

airSlate SignNow simplifies the process of filling out and eSigning the homestead tax credit form 2023, making it easy for homeowners to apply for tax relief. With our intuitive platform, users can complete forms efficiently and securely send them to the relevant authorities. This not only saves time but ensures that the application is processed without unnecessary delays.

-

Is there a fee to use airSlate SignNow for filing the homestead tax credit form 2023?

airSlate SignNow offers a cost-effective solution with flexible pricing plans tailored to various needs, including filing the homestead tax credit form 2023. While there may be a subscription fee associated with our services, many users find that the time and hassle saved far outweigh the costs. Be sure to check our pricing page for current offers.

-

Can I track the status of my homestead tax credit form 2023 submission with airSlate SignNow?

Yes, airSlate SignNow provides tracking features that allow you to monitor the status of your homestead tax credit form 2023 submission. You will receive notifications when your document is viewed and signed, ensuring you stay informed throughout the process. This transparency helps alleviate any concerns regarding the submission status.

-

What integrations does airSlate SignNow offer for the homestead tax credit form 2023?

airSlate SignNow integrates seamlessly with various applications, making it easy to manage and submit the homestead tax credit form 2023 alongside your other documents. Our platform connects with popular tools like Google Drive, Dropbox, and Microsoft Office, enhancing your workflow. Explore our integration options to streamline your document management.

Get more for I 016 Schedule H, Wisconsin Homestead Credit Schedule H Wisconsin Homestead Credit

- Instructions for preparation of financial statements for bank form

- Stronglink warranty application form stronglink warranty application form

- How to fill in a form f50 discontinuance mjt law youtube

- Hpcsa form 27

- Sweepstakes donor club application form

- Canada form t2151 fill and sign printable template

- How to get a tax clearance certificate50 state guide form

- Sgpi licensingdepartment of public safety form

Find out other I 016 Schedule H, Wisconsin Homestead Credit Schedule H Wisconsin Homestead Credit

- Electronic signature Pennsylvania Insurance Letter Of Intent Later

- Electronic signature Pennsylvania Insurance Quitclaim Deed Now

- Electronic signature Maine High Tech Living Will Later

- Electronic signature Maine High Tech Quitclaim Deed Online

- Can I Electronic signature Maryland High Tech RFP

- Electronic signature Vermont Insurance Arbitration Agreement Safe

- Electronic signature Massachusetts High Tech Quitclaim Deed Fast

- Electronic signature Vermont Insurance Limited Power Of Attorney Easy

- Electronic signature Washington Insurance Last Will And Testament Later

- Electronic signature Washington Insurance Last Will And Testament Secure

- Electronic signature Wyoming Insurance LLC Operating Agreement Computer

- How To Electronic signature Missouri High Tech Lease Termination Letter

- Electronic signature Montana High Tech Warranty Deed Mobile

- Electronic signature Florida Lawers Cease And Desist Letter Fast

- Electronic signature Lawers Form Idaho Fast

- Electronic signature Georgia Lawers Rental Lease Agreement Online

- How Do I Electronic signature Indiana Lawers Quitclaim Deed

- How To Electronic signature Maryland Lawers Month To Month Lease

- Electronic signature North Carolina High Tech IOU Fast

- How Do I Electronic signature Michigan Lawers Warranty Deed