Claim for Refund Due a Deceased Taxpayer MI 1310 Claim for Refund Due a Deceased Taxpayer MI 1310 Form

Understanding the MI 1310 Form

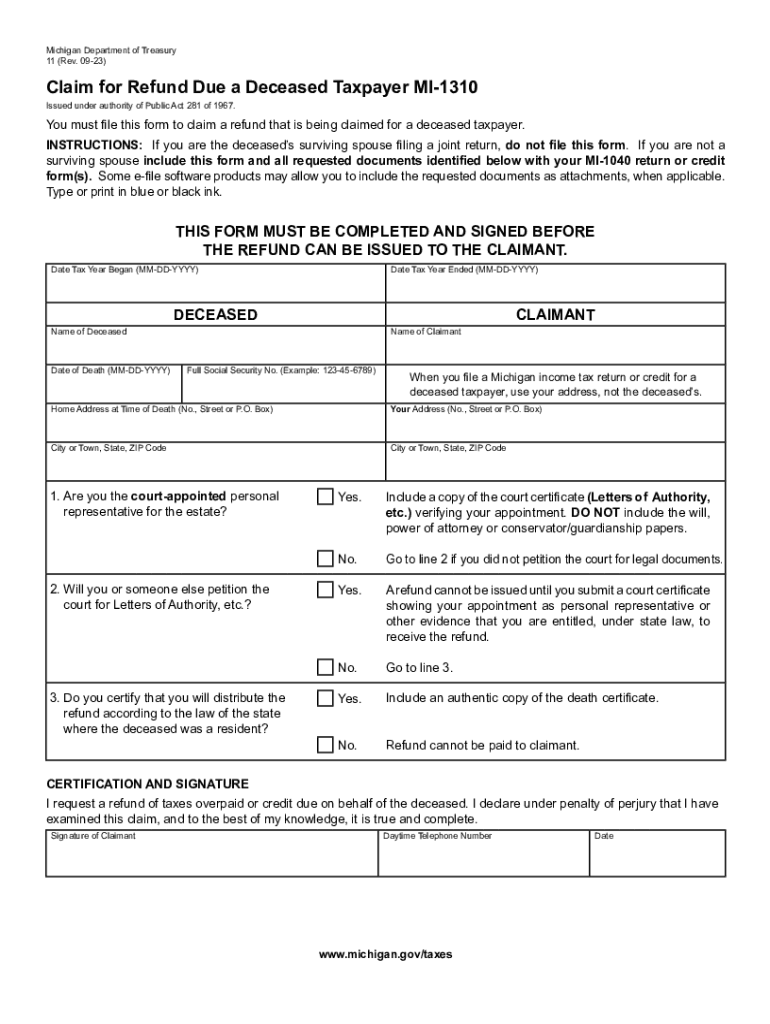

The MI 1310 form, officially known as the Claim for Refund Due a Deceased Taxpayer, is a specific tax form used in Michigan. This form allows the estate or personal representative of a deceased taxpayer to claim a refund for any overpayment of taxes made by the deceased. It is essential for ensuring that any eligible refunds are processed correctly and directed to the rightful beneficiaries or estate. The MI 1310 form is particularly relevant when the deceased individual had filed tax returns that resulted in a refund due to various factors, such as excess withholding or estimated tax payments.

Steps to Complete the MI 1310 Form

Completing the MI 1310 form involves several key steps to ensure accuracy and compliance with Michigan tax regulations. Follow these steps:

- Gather necessary documents, including the deceased's tax returns and any supporting financial information.

- Fill out the MI 1310 form with the required information, including the deceased's name, Social Security number, and details about the refund being claimed.

- Provide your information as the claimant, including your relationship to the deceased and your contact details.

- Attach any required documentation, such as a copy of the death certificate and proof of your authority to act on behalf of the estate.

- Review the completed form for accuracy, ensuring all information is correct and all necessary documents are included.

- Submit the form via mail to the appropriate Michigan Department of Treasury address, as indicated in the form instructions.

Eligibility Criteria for the MI 1310 Form

To successfully file the MI 1310 form, certain eligibility criteria must be met. These criteria include:

- The claimant must be the legal representative of the deceased taxpayer's estate, such as an executor or administrator.

- The deceased must have had a tax overpayment for the tax year in question, which can be verified through their filed tax returns.

- The claim must be submitted within the specified time frame, typically within four years from the due date of the original return.

Required Documents for Filing the MI 1310 Form

When filing the MI 1310 form, it is crucial to include specific documents to support the claim. The required documents typically include:

- A copy of the death certificate to verify the taxpayer's death.

- Proof of your authority to act on behalf of the deceased, such as letters of administration or a will.

- Copies of the deceased's tax returns for the years in which a refund is being claimed.

Filing Deadlines for the MI 1310 Form

Filing deadlines for the MI 1310 form are essential to ensure that claims are processed in a timely manner. Generally, the claim must be submitted within four years from the original due date of the tax return for which the refund is being claimed. It is advisable to check the specific deadlines for each tax year, as they may vary based on the filing date of the deceased's tax return.

Form Submission Methods

The MI 1310 form can be submitted through various methods, depending on the preference of the claimant. The available submission options include:

- Mail: The completed form and supporting documents can be mailed to the Michigan Department of Treasury at the address specified in the form instructions.

- In-Person: Claimants may also choose to submit the form in person at designated Michigan Department of Treasury offices.

Quick guide on how to complete claim for refund due a deceased taxpayer mi 1310 claim for refund due a deceased taxpayer mi 1310

Complete Claim For Refund Due A Deceased Taxpayer MI 1310 Claim For Refund Due A Deceased Taxpayer MI 1310 effortlessly on any device

Managing documents online has gained signNow traction among companies and individuals. It offers an excellent eco-friendly substitute to conventional printed and signed documents, as you can locate the appropriate form and securely keep it online. airSlate SignNow provides you with all the resources necessary to create, amend, and electronically sign your documents promptly without holdups. Tackle Claim For Refund Due A Deceased Taxpayer MI 1310 Claim For Refund Due A Deceased Taxpayer MI 1310 on any device using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

The simplest method to alter and eSign Claim For Refund Due A Deceased Taxpayer MI 1310 Claim For Refund Due A Deceased Taxpayer MI 1310 with ease

- Find Claim For Refund Due A Deceased Taxpayer MI 1310 Claim For Refund Due A Deceased Taxpayer MI 1310 and click on Get Form to commence.

- Employ the tools we offer to finish your form.

- Emphasize relevant sections of your documents or conceal sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional ink signature.

- Review the details and then click on the Done button to secure your modifications.

- Choose how you prefer to send your form, via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Modify and eSign Claim For Refund Due A Deceased Taxpayer MI 1310 Claim For Refund Due A Deceased Taxpayer MI 1310 and guarantee exceptional communication at any point in your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the claim for refund due a deceased taxpayer mi 1310 claim for refund due a deceased taxpayer mi 1310

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the michigan 1310 form?

The Michigan 1310 form is a tax document specifically designed for claiming a refund of Michigan income tax. It is typically used when a taxpayer has overpaid their taxes or is eligible for a refund due to various reasons. Understanding the details of the michigan 1310 form can help you navigate the tax filing process more efficiently.

-

How can airSlate SignNow help with the michigan 1310 form?

AirSlate SignNow provides a user-friendly platform for filling out and eSigning the michigan 1310 form. With its intuitive interface, users can easily input required information, ensuring accuracy and saving time. Additionally, the platform allows for secure storage and quick access to your tax documents.

-

Is there a cost associated with using airSlate SignNow for the michigan 1310 form?

AirSlate SignNow offers various pricing plans to accommodate different needs, making it a cost-effective solution for managing the michigan 1310 form. Whether you're an individual or a business, you can choose a plan that fits your budget and document signing frequency. A free trial is also available to explore its features.

-

What features does airSlate SignNow offer for the michigan 1310 form?

AirSlate SignNow includes features such as customizable templates, in-app signing, and document tracking which enhance the process of completing the michigan 1310 form. Users can collaborate with others by sharing documents for review and signatures. The platform also supports multiple file formats for ease of use.

-

Can I integrate airSlate SignNow with other software for the michigan 1310 form?

Yes, airSlate SignNow offers seamless integrations with various popular applications, enhancing your efficiency when managing the michigan 1310 form. Whether you're using CRM software or cloud storage solutions, you can streamline your document workflow. This allows for greater productivity and minimizes the need for manual data entry.

-

What benefits does airSlate SignNow provide when handling the michigan 1310 form?

Using airSlate SignNow for the michigan 1310 form streamlines the process of document management, making it easy to fill out and sign forms digitally. The benefits include reduced paper usage, quicker turnaround times, and enhanced security for sensitive information. Users also enjoy the convenience of accessing their forms from any device.

-

Is airSlate SignNow secure for submitting the michigan 1310 form?

Absolutely, airSlate SignNow prioritizes security and complies with industry standards to ensure that your michigan 1310 form and other documents are protected. With encryption and secure storage, users can confidently fill out and eSign their forms without worrying about data bsignNowes. Regular audits and updates strengthen system security continuously.

Get more for Claim For Refund Due A Deceased Taxpayer MI 1310 Claim For Refund Due A Deceased Taxpayer MI 1310

- Cover application and change of details formcomple

- Make the following statutory declaration form

- Goal setting form for staff

- Consent form photovideo the university of notre dame australia

- Distribution commissioning test sheet lv kiosk hpc 4dl form

- Remission of debt la trobe form

- Bfairgroundsb u18 consent form

- Www textnow commessaging texting ampamp calling app phone servicetextnow form

Find out other Claim For Refund Due A Deceased Taxpayer MI 1310 Claim For Refund Due A Deceased Taxpayer MI 1310

- Sign New Jersey Banking Separation Agreement Myself

- Sign New Jersey Banking Separation Agreement Simple

- Sign Banking Word New York Fast

- Sign New Mexico Banking Contract Easy

- Sign New York Banking Moving Checklist Free

- Sign New Mexico Banking Cease And Desist Letter Now

- Sign North Carolina Banking Notice To Quit Free

- Sign Banking PPT Ohio Fast

- Sign Banking Presentation Oregon Fast

- Sign Banking Document Pennsylvania Fast

- How To Sign Oregon Banking Last Will And Testament

- How To Sign Oregon Banking Profit And Loss Statement

- Sign Pennsylvania Banking Contract Easy

- Sign Pennsylvania Banking RFP Fast

- How Do I Sign Oklahoma Banking Warranty Deed

- Sign Oregon Banking Limited Power Of Attorney Easy

- Sign South Dakota Banking Limited Power Of Attorney Mobile

- How Do I Sign Texas Banking Memorandum Of Understanding

- Sign Virginia Banking Profit And Loss Statement Mobile

- Sign Alabama Business Operations LLC Operating Agreement Now