Transitioning to the Michigan Corporate Income Tax Form

Understanding the Michigan Corporate Income Tax

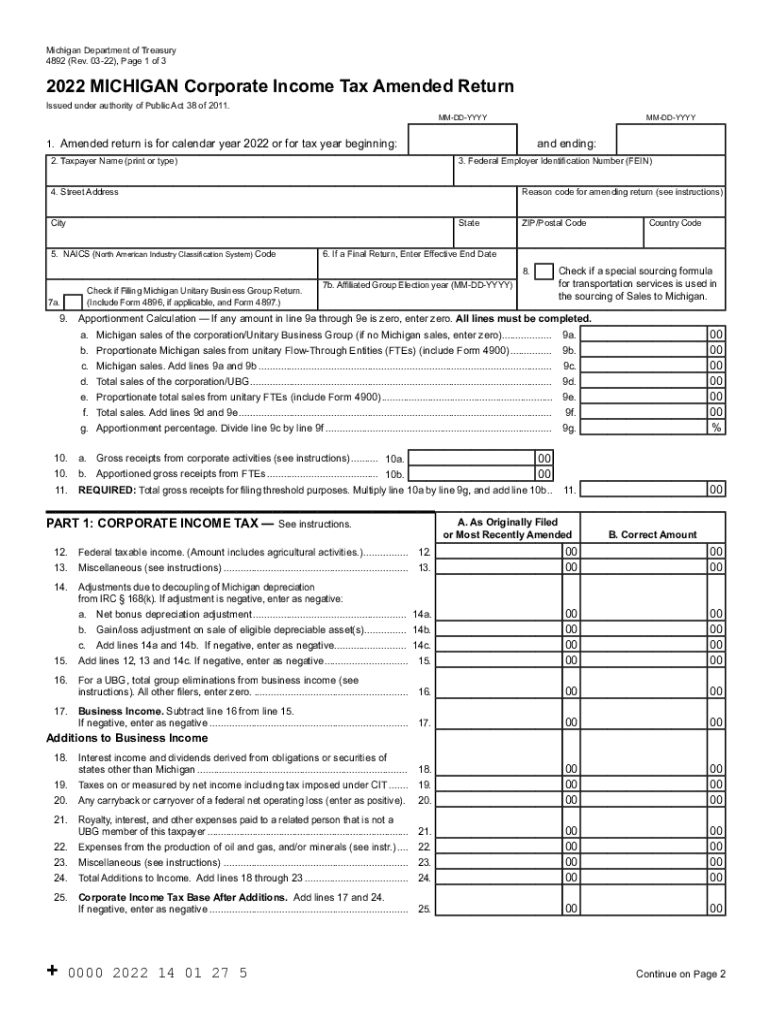

The Michigan Corporate Income Tax (CIT) is a tax imposed on corporations operating in Michigan. This tax replaced the Michigan Business Tax and is designed to simplify the tax structure for businesses. The CIT applies to corporations that are subject to the tax based on their gross receipts. It is essential for businesses to understand how this tax affects their financial obligations and compliance requirements.

Steps to Complete the Michigan Corporate Income Tax Form

Completing the Michigan Corporate Income Tax form involves several key steps:

- Gather necessary financial documents, including profit and loss statements and balance sheets.

- Determine your gross receipts for the tax year, as this will affect your tax calculation.

- Fill out the appropriate sections of the form, ensuring all information is accurate and complete.

- Review the form for any errors or omissions before submission.

- Submit the form by the designated deadline to avoid penalties.

Filing Deadlines and Important Dates

It is crucial to be aware of the filing deadlines for the Michigan Corporate Income Tax. Typically, the tax return is due on the last day of the fourth month following the end of the corporation's tax year. For most corporations operating on a calendar year, this means the return is due by April fifteenth. Late submissions may incur penalties and interest, so timely filing is essential.

Required Documents for Filing

When filing the Michigan Corporate Income Tax, businesses must prepare and submit several key documents:

- Completed CIT form, including all relevant schedules.

- Financial statements, such as income statements and balance sheets.

- Documentation supporting any deductions or credits claimed.

- Proof of payment for any estimated tax payments made during the year.

Form Submission Methods

Businesses can submit the Michigan Corporate Income Tax form through various methods. The options include:

- Online submission through the Michigan Department of Treasury's e-filing system.

- Mailing a paper form to the appropriate tax office.

- In-person submission at designated tax offices, if necessary.

Penalties for Non-Compliance

Failure to comply with the Michigan Corporate Income Tax requirements can lead to significant penalties. These may include:

- Late filing penalties, which can be a percentage of the unpaid tax.

- Interest on any unpaid tax amount, accruing from the due date.

- Potential legal action for persistent non-compliance, which could result in further financial consequences.

Quick guide on how to complete transitioning to the michigan corporate income tax

Complete Transitioning To The Michigan Corporate Income Tax effortlessly on any device

Digital document management has gained traction among organizations and individuals alike. It serves as an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to find the appropriate form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents swiftly without any holdups. Manage Transitioning To The Michigan Corporate Income Tax on any device with the airSlate SignNow apps for Android or iOS and enhance any document-related process today.

The simplest method to alter and eSign Transitioning To The Michigan Corporate Income Tax with ease

- Find Transitioning To The Michigan Corporate Income Tax and click on Get Form to begin.

- Use the tools provided to complete your form.

- Highlight pertinent sections of the documents or redact sensitive information with the tools that airSlate SignNow offers specifically for this purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional ink signature.

- Review the details and click the Done button to confirm your modifications.

- Select how you would like to share your form, whether by email, SMS, invite link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tedious form searches, or errors that require printing new copies. airSlate SignNow caters to your document management needs in just a few clicks from any device you prefer. Adjust and eSign Transitioning To The Michigan Corporate Income Tax to guarantee excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the transitioning to the michigan corporate income tax

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 2022 Michigan form and why do I need it?

The 2022 Michigan form is a crucial document required for various tax and legal purposes in the state of Michigan. It's essential for ensuring compliance with local laws and regulations. airSlate SignNow simplifies the process of preparing and electronically signing these forms, making it easier for businesses and individuals to manage their documentation.

-

How does airSlate SignNow help with completing the 2022 Michigan form?

airSlate SignNow offers a user-friendly platform that allows you to quickly fill out and eSign the 2022 Michigan form. With drag-and-drop features and customizable templates, you can complete your forms efficiently. This streamlines the process, saving you time and ensuring accuracy in your submissions.

-

Is airSlate SignNow cost-effective for handling the 2022 Michigan form?

Yes, airSlate SignNow provides a cost-effective solution for managing your 2022 Michigan form. With various pricing plans, you can select the one that best fits your needs and budget. The platform offers extensive features, helping you save money on paper, ink, and postal costs.

-

Can I integrate airSlate SignNow with other software for the 2022 Michigan form?

Absolutely! airSlate SignNow supports a wide array of integrations with popular software tools, making it easy to manage your 2022 Michigan form alongside your other applications. This seamless integration enhances workflow efficiency and simplifies document management.

-

What features does airSlate SignNow provide for the 2022 Michigan form?

airSlate SignNow includes features such as templates for the 2022 Michigan form, secure cloud storage, and real-time tracking of document status. These tools help users manage their forms more effectively, ensuring that all documentation is organized and accessible when needed.

-

Is the 2022 Michigan form signing process secure with airSlate SignNow?

Yes, the signing process for the 2022 Michigan form is highly secure with airSlate SignNow. The platform employs advanced encryption technology to protect your sensitive information. Your data remains confidential and secure throughout the entire eSigning process.

-

Can I access my completed 2022 Michigan form on mobile devices?

Yes, airSlate SignNow is mobile-friendly, allowing you to access your completed 2022 Michigan form from any device. Whether you're using a smartphone or tablet, you can manage your documents on the go, making it convenient for busy professionals.

Get more for Transitioning To The Michigan Corporate Income Tax

- Musical instrument hire agreement form

- Lampq home form

- Find open co uktelfordrtiitb 623824rtiitb telfordopening times access house halesfield 17 form

- Borras park surgery form

- Identity checking form

- Frequently asked questions 1 what should i integrated h form

- Application form st marys university

- Transcript request form university of ulster ulster ac

Find out other Transitioning To The Michigan Corporate Income Tax

- Electronic signature Maine Legal Agreement Online

- Electronic signature Maine Legal Quitclaim Deed Online

- Electronic signature Missouri Non-Profit Affidavit Of Heirship Online

- Electronic signature New Jersey Non-Profit Business Plan Template Online

- Electronic signature Massachusetts Legal Resignation Letter Now

- Electronic signature Massachusetts Legal Quitclaim Deed Easy

- Electronic signature Minnesota Legal LLC Operating Agreement Free

- Electronic signature Minnesota Legal LLC Operating Agreement Secure

- Electronic signature Louisiana Life Sciences LLC Operating Agreement Now

- Electronic signature Oregon Non-Profit POA Free

- Electronic signature South Dakota Non-Profit Business Plan Template Now

- Electronic signature South Dakota Non-Profit Lease Agreement Template Online

- Electronic signature Legal Document Missouri Online

- Electronic signature Missouri Legal Claim Online

- Can I Electronic signature Texas Non-Profit Permission Slip

- Electronic signature Missouri Legal Rental Lease Agreement Simple

- Electronic signature Utah Non-Profit Cease And Desist Letter Fast

- Electronic signature Missouri Legal Lease Agreement Template Free

- Electronic signature Non-Profit PDF Vermont Online

- Electronic signature Non-Profit PDF Vermont Computer