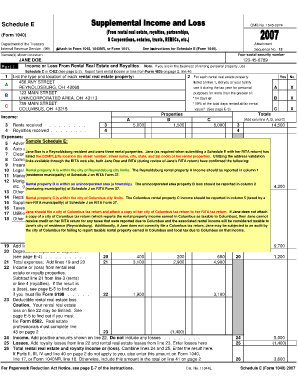

Sample Schedule E Form

What is the Sample Schedule E

The Sample Schedule E is a tax form used by individuals to report income or loss from rental real estate, royalties, partnerships, S corporations, estates, trusts, and residual interests in real estate mortgage investment conduits (REMICs). This form is essential for taxpayers who earn income from these sources, as it provides a structured way to report earnings and expenses associated with property and business interests. Understanding the purpose and requirements of the Sample Schedule E is crucial for accurate tax reporting and compliance with IRS regulations.

Steps to Complete the Sample Schedule E

Completing the Sample Schedule E involves several key steps to ensure accurate reporting of income and expenses. Begin by gathering all necessary documentation, including rental agreements, income statements, and expense receipts. Next, fill out the form by entering your income in Part I, detailing the rental properties or business interests. In Part II, report any deductions related to these properties or businesses, such as mortgage interest, repairs, and depreciation. Be sure to review your entries for accuracy before submitting the form with your tax return.

Legal Use of the Sample Schedule E

The Sample Schedule E is legally recognized as a valid document for reporting income and expenses related to rental properties and other business activities. To ensure its legal standing, it must be completed accurately and submitted in accordance with IRS guidelines. Utilizing a reliable eSignature platform, like signNow, can help maintain the integrity of the document by providing secure digital signatures and maintaining compliance with relevant eSignature laws, such as ESIGN and UETA.

IRS Guidelines

The IRS provides specific guidelines for completing and filing the Sample Schedule E. These guidelines include instructions on how to report various types of income, allowable deductions, and the proper way to categorize your properties or business interests. Familiarizing yourself with these guidelines is essential to avoid errors that could lead to penalties or audits. The IRS also updates these guidelines periodically, so staying informed about any changes is important for compliance.

Filing Deadlines / Important Dates

Filing deadlines for the Sample Schedule E align with the overall tax return deadlines for individuals. Typically, taxpayers must file their federal income tax returns, including the Schedule E, by April fifteenth of each year. If additional time is needed, taxpayers can request an extension, but it is important to remember that any taxes owed are still due by the original deadline. Keeping track of these dates is crucial to avoid late fees and penalties.

Required Documents

To complete the Sample Schedule E accurately, several documents are required. These include income statements from rental properties, records of expenses incurred, and any relevant agreements or contracts. Additionally, documentation supporting deductions, such as receipts for repairs or improvements, should be collected. Having these documents organized and readily available will facilitate a smoother completion process and ensure compliance with IRS requirements.

Examples of Using the Sample Schedule E

Common scenarios for using the Sample Schedule E include reporting income from rental properties, partnerships, and S corporations. For instance, a landlord who rents out residential properties would report rental income and associated expenses, such as property management fees and maintenance costs. Similarly, a partner in a business would report their share of the partnership's income or losses. Understanding these examples can help taxpayers accurately complete the form based on their specific financial situations.

Quick guide on how to complete sample schedule e

Effortlessly Prepare Sample Schedule E on Any Device

Managing documents online has gained popularity among businesses and individuals. It offers an excellent eco-friendly alternative to traditional printed and signed documents, allowing you to locate the right form and securely preserve it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents quickly and without delays. Handle Sample Schedule E on any device using airSlate SignNow's Android or iOS applications and enhance any document-driven process today.

The Easiest Way to Modify and eSign Sample Schedule E Effortlessly

- Find Sample Schedule E and click on Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize relevant sections of the documents or obscure sensitive information using tools that airSlate SignNow specifically offers for that purpose.

- Create your signature using the Sign feature, which takes mere seconds and carries the same legal standing as a conventional wet ink signature.

- Review all the information and click on the Done button to save your changes.

- Select your preferred method for delivering your form, whether by email, SMS, or invite link, or download it to your computer.

No more concerns about lost or misplaced documents, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you choose. Modify and eSign Sample Schedule E and ensure outstanding communication at any point in your form preparation workflow with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the sample schedule e

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a sample schedule e in airSlate SignNow?

A sample schedule e in airSlate SignNow refers to a predefined template that outlines the essential items and timelines for electronic signing. It streamlines the process of sending documents for signatures, making it quicker and more efficient for businesses.

-

How does airSlate SignNow enhance the use of a sample schedule e?

AirSlate SignNow enhances the use of a sample schedule e by providing a user-friendly interface and customizable options. This platform allows users to tailor their scheduling needs while ensuring that all interactions are secure and legally binding.

-

What are the pricing options for using a sample schedule e with airSlate SignNow?

Pricing for using a sample schedule e with airSlate SignNow varies based on your chosen plan. You can choose from flexible monthly or yearly subscriptions that cater to businesses of all sizes, ensuring cost-effective solutions for electronic signing.

-

What features are included with the sample schedule e?

The features included with a sample schedule e in airSlate SignNow consist of document templates, audit trails, and automated reminders. These functionalities help streamline the signing process and enhance user productivity, addressing the needs of clients effectively.

-

Can I integrate airSlate SignNow with other tools while using a sample schedule e?

Yes, airSlate SignNow offers seamless integrations with various business tools, enhancing the utility of a sample schedule e. Customers can connect it with CRM systems, cloud storage, and other applications to create a cohesive workflow.

-

What are the benefits of using a sample schedule e in airSlate SignNow?

Using a sample schedule e in airSlate SignNow provides businesses with streamlined document management and faster turnaround times for signatures. It reduces paperwork and increases productivity, allowing companies to focus on core operations.

-

Is it possible to customize a sample schedule e in airSlate SignNow?

Absolutely! airSlate SignNow allows users to fully customize a sample schedule e according to their workflow needs. Adjustments can be made to format, content, and signing order, making it adaptable for diverse business requirements.

Get more for Sample Schedule E

- In service training evaluation form juvenile justice

- Clutter diet donation tracking sheet form

- Life hazard use certificate of registration form

- Building warrant of fitness form 12 pdf

- Talaq form

- Ra 010 notice of remote appearance judicial council forms

- Employee hipaa agreement template form

- Hvac commercial service contract template form

Find out other Sample Schedule E

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors