Draft Form 763, Virginia Nonresident Income Tax Return Virginia Nonresident Income Tax Return

Understanding the Virginia Nonresident Income Tax Return (Form 763)

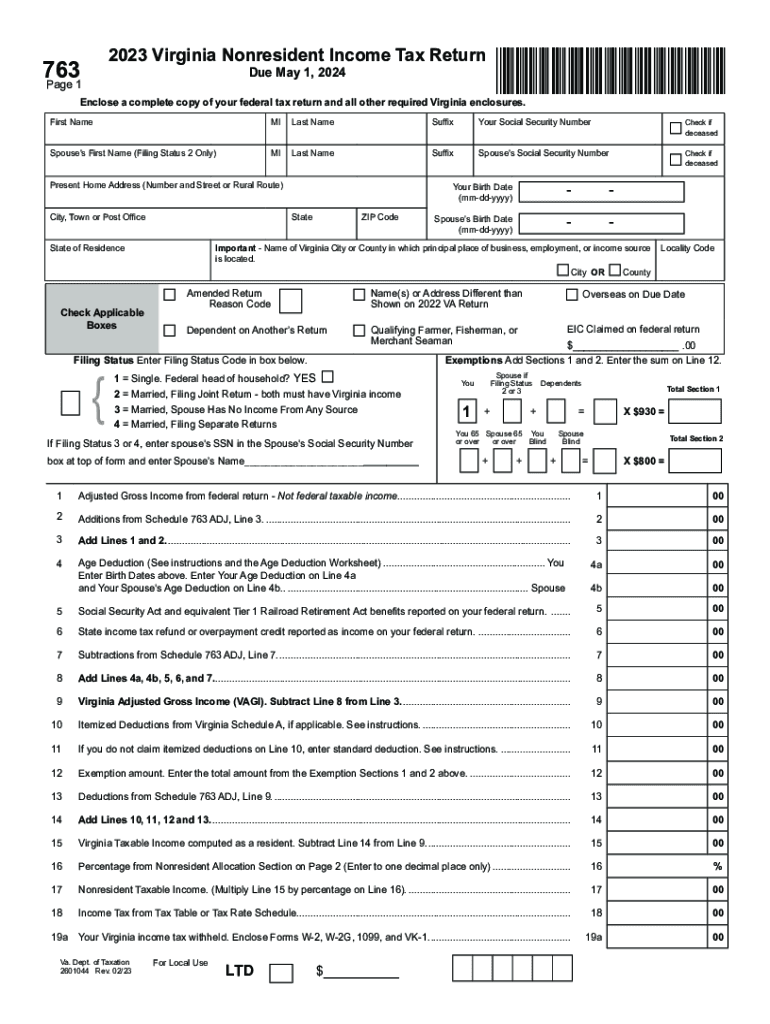

The Virginia nonresident tax form, officially known as Form 763, is designed for individuals who earn income in Virginia but reside in another state. This form allows nonresidents to report their Virginia-source income and calculate the appropriate tax owed to the state. It is essential for ensuring compliance with Virginia tax laws while allowing nonresidents to fulfill their tax obligations accurately.

Steps to Complete the Virginia Nonresident Tax Form (Form 763)

Filling out the Virginia nonresident tax form involves several key steps:

- Gather necessary documentation, including W-2s, 1099s, and any other income statements.

- Begin with personal information, such as your name, address, and Social Security number.

- Report your total Virginia-source income, which may include wages, rental income, and business income.

- Calculate any deductions or credits you may be eligible for, which can reduce your taxable income.

- Determine your tax liability using the tax tables provided by the Virginia Department of Taxation.

- Complete the form by signing and dating it, ensuring all information is accurate.

How to Obtain the Virginia Nonresident Tax Form (Form 763)

The Virginia nonresident tax form can be obtained through several convenient methods:

- Visit the Virginia Department of Taxation website, where you can download the form in PDF format.

- Request a physical copy by contacting the Virginia Department of Taxation directly.

- Access the form through tax preparation software that includes Virginia tax forms.

Key Elements of the Virginia Nonresident Tax Form (Form 763)

Understanding the key elements of Form 763 is crucial for accurate completion:

- Personal Information: This section captures your identity and residency status.

- Income Reporting: You must detail all income earned in Virginia.

- Deductions and Credits: This section allows you to claim any applicable deductions or tax credits.

- Tax Calculation: This area helps you compute the total tax owed based on your reported income.

- Signature: Your signature certifies that the information provided is true and accurate.

Filing Deadlines for the Virginia Nonresident Tax Form (Form 763)

It is essential to be aware of the filing deadlines for the Virginia nonresident tax form:

- The standard filing deadline is typically May first of the year following the tax year.

- If you are unable to file by the deadline, you may request an extension, allowing additional time to submit your form.

Legal Use of the Virginia Nonresident Tax Form (Form 763)

The Virginia nonresident tax form must be used in compliance with state tax laws. It is legally binding, and any inaccuracies or omissions may result in penalties or interest charges. Nonresidents are required to file this form if they earn income in Virginia, ensuring that they contribute to the state's tax revenue fairly.

Quick guide on how to complete draft form 763 virginia nonresident income tax return virginia nonresident income tax return

Complete Draft Form 763, Virginia Nonresident Income Tax Return Virginia Nonresident Income Tax Return effortlessly on any device

Digital document management has gained traction among businesses and individuals. It offers an ideal environmentally-friendly substitute for traditional printed and signed documents, as you can easily find the appropriate form and securely store it online. airSlate SignNow supplies you with all the tools necessary to create, modify, and electronically sign your documents swiftly without delays. Manage Draft Form 763, Virginia Nonresident Income Tax Return Virginia Nonresident Income Tax Return on any device with airSlate SignNow Android or iOS applications and streamline any document-related tasks today.

How to modify and electronically sign Draft Form 763, Virginia Nonresident Income Tax Return Virginia Nonresident Income Tax Return effortlessly

- Acquire Draft Form 763, Virginia Nonresident Income Tax Return Virginia Nonresident Income Tax Return and then click Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Emphasize important parts of the documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your electronic signature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Review the details and then click on the Done button to save your modifications.

- Choose how you want to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form navigation, or mistakes that require reprinting new document copies. airSlate SignNow addresses all your document management requirements in just a few clicks from any device you prefer. Edit and electronically sign Draft Form 763, Virginia Nonresident Income Tax Return Virginia Nonresident Income Tax Return to ensure excellent communication at every stage of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the draft form 763 virginia nonresident income tax return virginia nonresident income tax return

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Virginia nonresident tax form?

The Virginia nonresident tax form is a document that nonresidents must file to report income earned within the state of Virginia. This form allows individuals to calculate their tax liability based on Virginia tax laws. It is essential for compliance and helps avoid penalties.

-

How can airSlate SignNow help with the Virginia nonresident tax form?

airSlate SignNow simplifies the process of preparing and submitting your Virginia nonresident tax form by allowing you to easily sign and send documents electronically. Its user-friendly interface streamlines document management, making it convenient to handle tax forms and other essential documents.

-

Is there a cost associated with using airSlate SignNow for the Virginia nonresident tax form?

Yes, airSlate SignNow offers several pricing plans tailored to fit different business needs. Our pricing is cost-effective and provides you with all the tools necessary to manage your Virginia nonresident tax form seamlessly. Check our website for specific plans and pricing details.

-

What features does airSlate SignNow offer for handling tax documents like the Virginia nonresident tax form?

airSlate SignNow includes features like electronic signatures, document templates, and real-time collaboration, which are perfect for handling the Virginia nonresident tax form. Additionally, you can track document status and receive notifications when your forms are signed, ensuring you stay compliant without hassle.

-

Can airSlate SignNow integrate with other tools for easier management of the Virginia nonresident tax form?

Absolutely! airSlate SignNow integrates seamlessly with various tools and platforms, which simplifies the management of your Virginia nonresident tax form. Whether you need to sync with accounting software or email tools, we support numerous integrations to enhance your workflow.

-

What are the benefits of using airSlate SignNow for my Virginia nonresident tax form?

Using airSlate SignNow for your Virginia nonresident tax form offers several benefits, including improved efficiency, reduced paperwork, and enhanced security for your sensitive information. The platform ensures that your forms are completed and filed accurately, helping you avoid costly mistakes.

-

How do I get started with airSlate SignNow for my Virginia nonresident tax form?

Getting started with airSlate SignNow is simple! Sign up for an account on our website, choose a plan that fits your needs, and start creating your Virginia nonresident tax form right away. Our user-friendly interface and support resources make it easy for you to navigate the process.

Get more for Draft Form 763, Virginia Nonresident Income Tax Return Virginia Nonresident Income Tax Return

- Developmental disabilities profile form

- Patient registration form new york doctors urgent care

- 71 prospect ave form

- Medicare open enrollment pharmacy benefit plans express scripts form

- Lincoln diagnostics llc form

- Demo form

- Authorization for release of health information montefiore nyack

- Leave without pay request form 1002 doc corporate rfmh

Find out other Draft Form 763, Virginia Nonresident Income Tax Return Virginia Nonresident Income Tax Return

- Sign Alabama Deed of Indemnity Template Later

- Sign Alabama Articles of Incorporation Template Secure

- Can I Sign Nevada Articles of Incorporation Template

- Sign New Mexico Articles of Incorporation Template Safe

- Sign Ohio Articles of Incorporation Template Simple

- Can I Sign New Jersey Retainer Agreement Template

- Sign West Virginia Retainer Agreement Template Myself

- Sign Montana Car Lease Agreement Template Fast

- Can I Sign Illinois Attorney Approval

- Sign Mississippi Limited Power of Attorney Later

- How Can I Sign Kansas Attorney Approval

- How Do I Sign New Mexico Limited Power of Attorney

- Sign Pennsylvania Car Lease Agreement Template Simple

- Sign Rhode Island Car Lease Agreement Template Fast

- Sign Indiana Unlimited Power of Attorney Online

- Can I Sign Idaho Affidavit of No Lien

- Sign New York Affidavit of No Lien Online

- How To Sign Delaware Trademark License Agreement

- How To Sign Nevada Retainer for Attorney

- How To Sign Georgia Assignment of License