Form 990 Schedule R 1 Rev Irs

What is the Form 990 Schedule R 1 Rev Irs

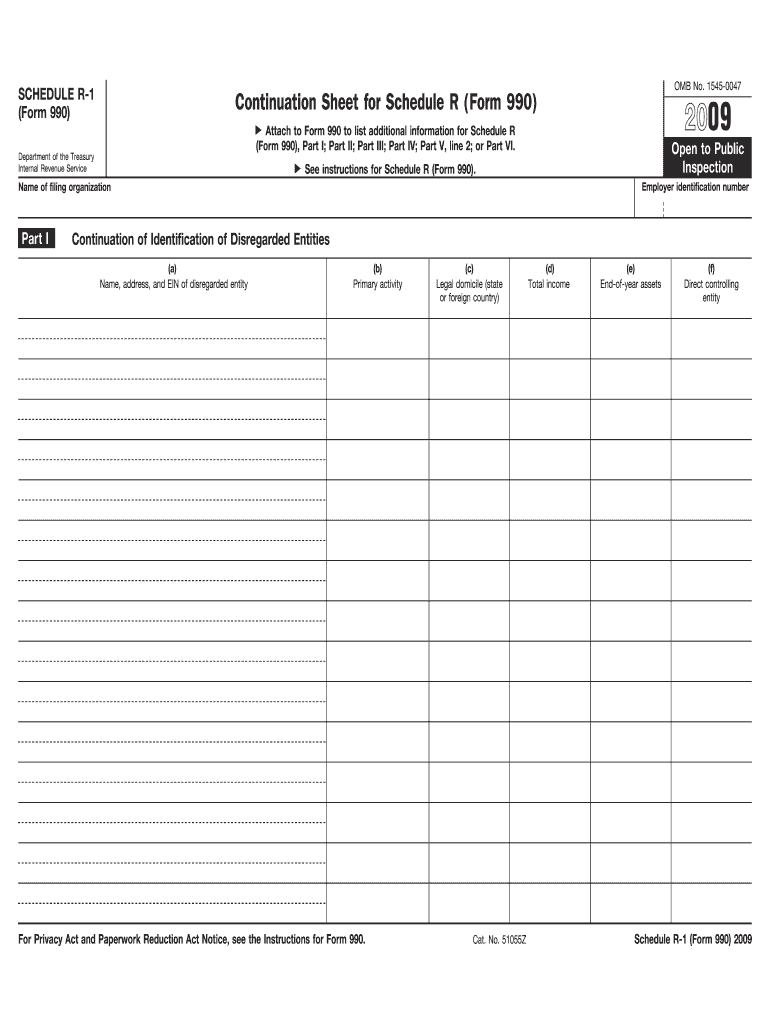

The Form 990 Schedule R is a supplemental form used by organizations to provide information about related organizations and their transactions with the filing organization. This form is part of the larger Form 990, which is required for tax-exempt organizations to report their financial information to the IRS. Schedule R specifically focuses on relationships with other organizations, allowing the IRS to assess the extent of interconnections and financial dealings that may affect tax compliance and transparency.

How to use the Form 990 Schedule R 1 Rev Irs

Using the Form 990 Schedule R involves several key steps. First, organizations must determine if they have related organizations that need to be reported. This includes any entities that control or are controlled by the filing organization, or those that are under common control. Once identified, organizations should accurately fill out the schedule by providing details about each related entity, including their names, addresses, and the nature of the relationship. It is important to ensure that all information is complete and accurate to avoid potential penalties.

Steps to complete the Form 990 Schedule R 1 Rev Irs

Completing the Form 990 Schedule R requires a systematic approach:

- Identify all related organizations that must be reported.

- Gather necessary information about each related organization, including their tax identification numbers.

- Fill out the form by providing details about the nature of the relationship with each entity.

- Review the completed schedule for accuracy and completeness.

- Attach the Schedule R to the main Form 990 before submission.

Filing Deadlines / Important Dates

The filing deadline for Form 990, including Schedule R, typically falls on the fifteenth day of the fifth month after the end of the organization’s fiscal year. For organizations operating on a calendar year, this means the due date is May fifteenth. Extensions may be available, but organizations must file Form 8868 to request additional time. It is crucial to adhere to these deadlines to avoid penalties and ensure compliance with IRS regulations.

Penalties for Non-Compliance

Failure to file Form 990 Schedule R or inaccuracies in reporting can lead to significant penalties. The IRS may impose fines for late filings, which can accumulate daily. Additionally, organizations that do not provide complete and accurate information may face further scrutiny, which can lead to audits or revocation of tax-exempt status. It is essential for organizations to prioritize compliance to avoid these financial repercussions.

IRS Guidelines

The IRS provides specific guidelines for completing and filing Form 990 Schedule R. Organizations should refer to the instructions provided by the IRS for detailed requirements and examples. These guidelines outline what constitutes a related organization, how to report transactions, and the necessary disclosures. Staying informed about these guidelines is vital for maintaining compliance and ensuring that all required information is reported accurately.

Quick guide on how to complete form 990 schedule r 1 rev irs

Prepare [SKS] seamlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers an ideal environmentally friendly alternative to traditional printed and signed documents, as you can find the necessary form and securely store it online. airSlate SignNow equips you with all the tools needed to create, modify, and eSign your documents quickly without delays. Manage [SKS] on any device with airSlate SignNow Android or iOS applications and enhance any document-driven process today.

The easiest way to modify and eSign [SKS] without hassle

- Find [SKS] and click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Highlight pertinent sections of your documents or obscure confidential information with tools that airSlate SignNow provides specifically for this purpose.

- Create your signature using the Sign tool, which takes moments and bears the same legal significance as a conventional wet ink signature.

- Verify all the details and then click on the Done button to save your modifications.

- Choose how you want to share your form, via email, SMS, or invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow caters to your document management needs in just a few clicks from any device of your choosing. Edit and eSign [SKS] and ensure excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Form 990 Schedule R 1 Rev Irs

Create this form in 5 minutes!

How to create an eSignature for the form 990 schedule r 1 rev irs

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form 990 Schedule R 1 Rev Irs?

Form 990 Schedule R 1 Rev Irs is an attachment to the IRS Form 990 that provides information about a nonprofit’s relationships with other organizations and the revenue generated through those relationships. Understanding this form is essential for compliance and transparency in nonprofit financial reporting.

-

How does airSlate SignNow help with Form 990 Schedule R 1 Rev Irs?

airSlate SignNow simplifies the process of collecting eSignatures for documents related to Form 990 Schedule R 1 Rev Irs. Our platform allows you to send, receive, and store documents securely, streamlining your reporting process and ensuring timely submissions.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow offers flexible pricing plans to accommodate different organizational needs, making it a cost-effective solution for managing documents related to Form 990 Schedule R 1 Rev Irs. Pricing plans cater to small nonprofits as well as larger organizations, providing access to features that enhance operational efficiency.

-

What features does airSlate SignNow offer for document management?

airSlate SignNow includes a range of features that support document management for Form 990 Schedule R 1 Rev Irs, such as customizable templates, real-time collaboration, and secure cloud storage. These features help businesses maintain compliance and manage paperwork efficiently.

-

Can I integrate airSlate SignNow with other software?

Yes, airSlate SignNow integrates seamlessly with various third-party applications to enhance workflow efficiency related to Form 990 Schedule R 1 Rev Irs. This includes popular accounting, CRM, and document management systems, ensuring you can manage your documents efficiently without disrupting your existing processes.

-

Is airSlate SignNow suitable for large organizations managing Form 990 Schedule R 1 Rev Irs?

Absolutely! airSlate SignNow is designed to scale with your organization, making it ideal for larger nonprofits dealing with Form 990 Schedule R 1 Rev Irs. Our platform provides advanced features that help streamline document workflows and ensure compliance for high volume submissions.

-

How secure is airSlate SignNow for sensitive documents?

Security is a priority at airSlate SignNow. We utilize advanced encryption methods and comply with industry standards to ensure the protection of sensitive information, including documents related to Form 990 Schedule R 1 Rev Irs. Rest assured that your data is secure while using our platform.

Get more for Form 990 Schedule R 1 Rev Irs

Find out other Form 990 Schedule R 1 Rev Irs

- Sign Kentucky Sports Stock Certificate Later

- How Can I Sign Maine Real Estate Separation Agreement

- How Do I Sign Massachusetts Real Estate LLC Operating Agreement

- Can I Sign Massachusetts Real Estate LLC Operating Agreement

- Sign Massachusetts Real Estate Quitclaim Deed Simple

- Sign Massachusetts Sports NDA Mobile

- Sign Minnesota Real Estate Rental Lease Agreement Now

- How To Sign Minnesota Real Estate Residential Lease Agreement

- Sign Mississippi Sports Confidentiality Agreement Computer

- Help Me With Sign Montana Sports Month To Month Lease

- Sign Mississippi Real Estate Warranty Deed Later

- How Can I Sign Mississippi Real Estate Affidavit Of Heirship

- How To Sign Missouri Real Estate Warranty Deed

- Sign Nebraska Real Estate Letter Of Intent Online

- Sign Nebraska Real Estate Limited Power Of Attorney Mobile

- How Do I Sign New Mexico Sports Limited Power Of Attorney

- Sign Ohio Sports LLC Operating Agreement Easy

- Sign New Jersey Real Estate Limited Power Of Attorney Computer

- Sign New Mexico Real Estate Contract Safe

- How To Sign South Carolina Sports Lease Termination Letter