Homeowner's Principal Residence Exemption Affidavit Dorrtownship Form

What is the Homeowner's Principal Residence Exemption Affidavit Dorrtownship

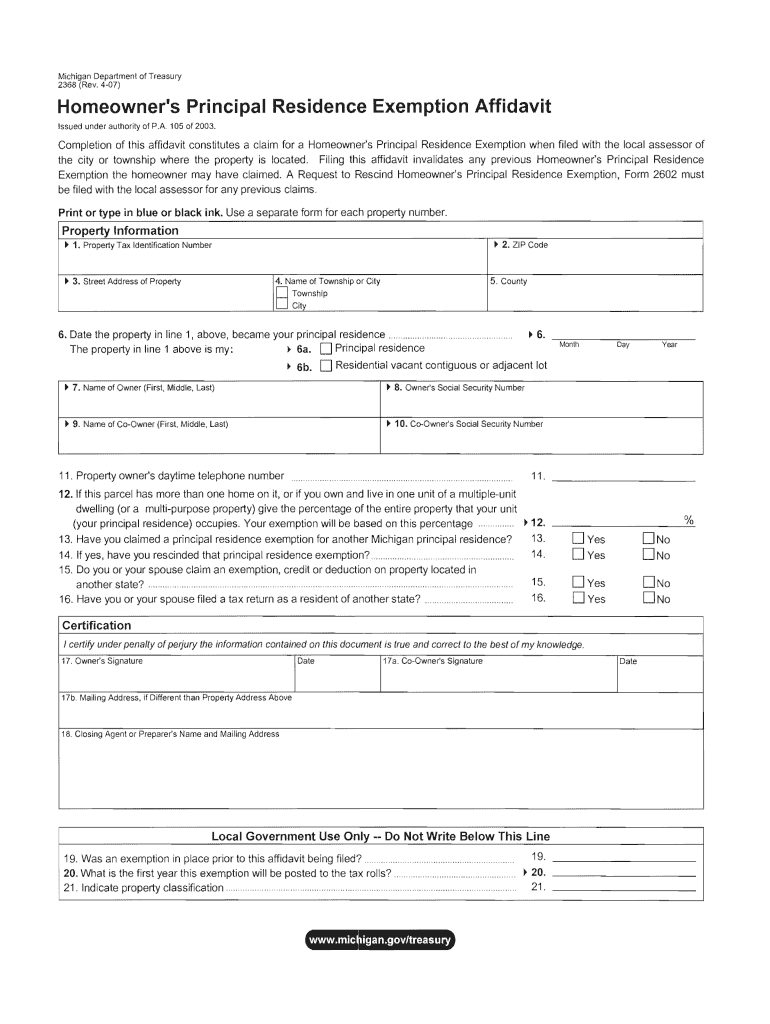

The Homeowner's Principal Residence Exemption Affidavit Dorrtownship is a legal document that allows eligible homeowners to claim an exemption on their property taxes. This exemption reduces the taxable value of a primary residence, resulting in lower property taxes. It is specifically designed for residents of Dorr Township, ensuring that they benefit from tax relief intended for homeowners who occupy their property as their main residence. Understanding this affidavit is crucial for homeowners looking to maximize their tax savings.

Key elements of the Homeowner's Principal Residence Exemption Affidavit Dorrtownship

Several key elements define the Homeowner's Principal Residence Exemption Affidavit Dorrtownship. These include:

- Eligibility Criteria: Homeowners must occupy the property as their principal residence.

- Application Information: The affidavit requires specific details about the property and the homeowner.

- Signature Requirement: Homeowners must sign the affidavit to validate the claim.

- Submission Guidelines: The completed affidavit must be submitted to the local assessor's office.

Steps to complete the Homeowner's Principal Residence Exemption Affidavit Dorrtownship

Completing the Homeowner's Principal Residence Exemption Affidavit Dorrtownship involves several straightforward steps:

- Obtain the affidavit form from the local assessor's office or their website.

- Fill out the required information, including property details and homeowner identification.

- Review the form for accuracy and completeness.

- Sign the affidavit to certify that the information provided is true.

- Submit the completed affidavit to the local assessor's office by the specified deadline.

How to obtain the Homeowner's Principal Residence Exemption Affidavit Dorrtownship

Homeowners can obtain the Homeowner's Principal Residence Exemption Affidavit Dorrtownship through various methods:

- Visit the local assessor's office in person to request a physical copy.

- Download the affidavit form from the official Dorr Township website, if available.

- Contact the assessor's office via phone or email to inquire about obtaining the form.

Legal use of the Homeowner's Principal Residence Exemption Affidavit Dorrtownship

The legal use of the Homeowner's Principal Residence Exemption Affidavit Dorrtownship is essential for homeowners seeking tax relief. By submitting this affidavit, homeowners legally declare their property as their principal residence, which is a requirement for receiving the exemption. Misrepresentation or failure to comply with the affidavit's requirements can lead to penalties, including the loss of the exemption and potential fines.

Filing Deadlines / Important Dates

Homeowners must be aware of specific filing deadlines associated with the Homeowner's Principal Residence Exemption Affidavit Dorrtownship. Typically, the affidavit must be submitted by a designated date each year to ensure that the exemption is applied to the upcoming tax year. It is advisable for homeowners to check with the local assessor's office for the exact deadlines to avoid missing the opportunity for tax relief.

Quick guide on how to complete homeowners principal residence exemption affidavit dorrtownship

Easily Prepare [SKS] on Any Device

Digital document management has gained popularity among businesses and individuals alike. It serves as an ideal eco-friendly alternative to conventional printed and signed paperwork, as you can locate the necessary form and securely store it online. airSlate SignNow provides you with all the tools required to create, modify, and electronically sign your documents swiftly and without delays. Manage [SKS] on any device using the airSlate SignNow Android or iOS applications and streamline any document-related process today.

Effortlessly Edit and Electronically Sign [SKS]

- Locate [SKS] and click Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Emphasize key sections of your documents or obscure confidential information with the tools that airSlate SignNow specifically offers for that purpose.

- Create your electronic signature with the Sign tool, which takes just seconds and holds the same legal validity as a traditional handwritten signature.

- Review all the details and click on the Done button to finalize your changes.

- Select your preferred method to send your form, whether by email, SMS, invitation link, or by downloading it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form hunting, or errors that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from your chosen device. Edit and electronically sign [SKS] and ensure outstanding communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Homeowner's Principal Residence Exemption Affidavit Dorrtownship

Create this form in 5 minutes!

How to create an eSignature for the homeowners principal residence exemption affidavit dorrtownship

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Homeowner's Principal Residence Exemption Affidavit Dorrtownship?

The Homeowner's Principal Residence Exemption Affidavit Dorrtownship is a legal document that allows homeowners to exempt a portion of their property's assessed value from property taxes. This program is designed to provide financial relief to residents by lowering their tax burden. Completing this affidavit can signNowly benefit homeowners by making them eligible for tax reductions.

-

How does airSlate SignNow assist with the Homeowner's Principal Residence Exemption Affidavit Dorrtownship?

airSlate SignNow offers a streamlined platform for completing and signing the Homeowner's Principal Residence Exemption Affidavit Dorrtownship electronically. With its user-friendly interface, homeowners can easily fill out the affidavit and securely eSign it, saving time and ensuring accuracy. This digital solution eliminates the need for physical paperwork, making the process more efficient.

-

What are the benefits of using airSlate SignNow for my Homeowner's Principal Residence Exemption Affidavit Dorrtownship?

Using airSlate SignNow for your Homeowner's Principal Residence Exemption Affidavit Dorrtownship offers various benefits, including convenience, security, and cost-effectiveness. The platform allows for quick document access and easy tracking of signatures, ensuring you never miss an important deadline. Additionally, airSlate SignNow is designed to keep your sensitive information secure during the signing process.

-

Is there a cost associated with using airSlate SignNow for the Homeowner's Principal Residence Exemption Affidavit Dorrtownship?

Yes, there is a pricing structure for using airSlate SignNow, which offers various plans to suit different needs. The cost is generally affordable and provides excellent value compared to traditional methods of document signing. Many users find that the savings in time and effort far outweigh the minimal investment required for this efficient solution.

-

Can I access airSlate SignNow from any device for my Homeowner's Principal Residence Exemption Affidavit Dorrtownship?

Absolutely! airSlate SignNow is a cloud-based platform that can be accessed from any device with internet connectivity. Whether you're using a computer, tablet, or smartphone, you can easily complete and sign your Homeowner's Principal Residence Exemption Affidavit Dorrtownship on the go. This flexibility ensures that you can manage your documents wherever you are.

-

What security features does airSlate SignNow provide for the Homeowner's Principal Residence Exemption Affidavit Dorrtownship?

airSlate SignNow provides robust security features to protect your Homeowner's Principal Residence Exemption Affidavit Dorrtownship. These include encrypted data transmission, secure cloud storage, and multi-factor authentication to ensure that your documents remain confidential and safe. By choosing airSlate SignNow, you can trust that your personal information is well protected.

-

How do I get started with airSlate SignNow for my Homeowner's Principal Residence Exemption Affidavit Dorrtownship?

Getting started with airSlate SignNow is simple! First, you need to create an account on the platform. After signing up, you can upload your Homeowner's Principal Residence Exemption Affidavit Dorrtownship and begin filling it out right away. The intuitive design guides you through the process, making it quick and efficient.

Get more for Homeowner's Principal Residence Exemption Affidavit Dorrtownship

Find out other Homeowner's Principal Residence Exemption Affidavit Dorrtownship

- eSignature Mississippi Lawers Residential Lease Agreement Later

- How To eSignature Mississippi Lawers Residential Lease Agreement

- Can I eSignature Indiana Life Sciences Rental Application

- eSignature Indiana Life Sciences LLC Operating Agreement Fast

- eSignature Kentucky Life Sciences Quitclaim Deed Fast

- Help Me With eSignature Georgia Non-Profit NDA

- How Can I eSignature Idaho Non-Profit Business Plan Template

- eSignature Mississippi Life Sciences Lease Agreement Myself

- How Can I eSignature Mississippi Life Sciences Last Will And Testament

- How To eSignature Illinois Non-Profit Contract

- eSignature Louisiana Non-Profit Business Plan Template Now

- How Do I eSignature North Dakota Life Sciences Operating Agreement

- eSignature Oregon Life Sciences Job Offer Myself

- eSignature Oregon Life Sciences Job Offer Fast

- eSignature Oregon Life Sciences Warranty Deed Myself

- eSignature Maryland Non-Profit Cease And Desist Letter Fast

- eSignature Pennsylvania Life Sciences Rental Lease Agreement Easy

- eSignature Washington Life Sciences Permission Slip Now

- eSignature West Virginia Life Sciences Quitclaim Deed Free

- Can I eSignature West Virginia Life Sciences Residential Lease Agreement