Instructions for 1120S Irs Form

What is the Instructions For 1120S IRS

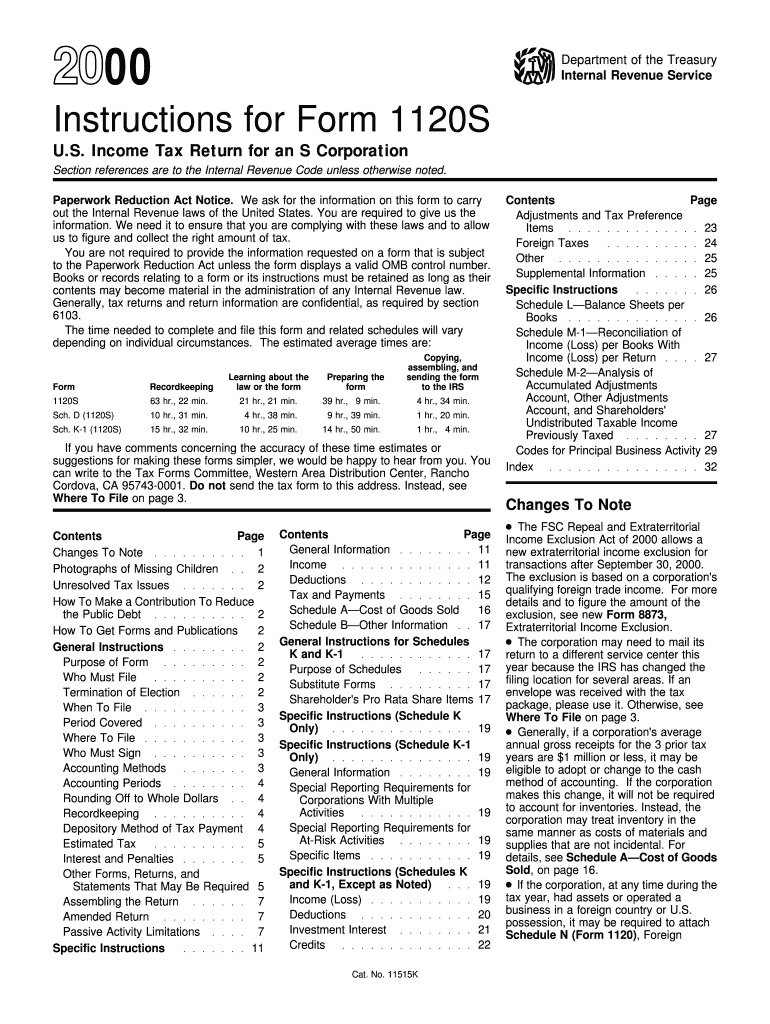

The Instructions For 1120S IRS provide detailed guidance for S corporations in the United States on how to complete Form 1120S, which is the U.S. Income Tax Return for an S Corporation. This form is essential for reporting income, deductions, gains, losses, and other tax-related information. The instructions outline the necessary steps, requirements, and specific information needed to accurately fill out the form, ensuring compliance with IRS regulations.

Steps to complete the Instructions For 1120S IRS

Completing the Instructions For 1120S IRS involves several key steps:

- Gather all necessary financial documents, including income statements, expense records, and any prior year tax returns.

- Review the eligibility criteria to confirm that your business qualifies as an S corporation.

- Follow the line-by-line instructions provided in the form to accurately report your corporation's income and deductions.

- Complete any additional schedules or forms that may be required based on your corporation's specific tax situation.

- Double-check all entries for accuracy before submission.

Key elements of the Instructions For 1120S IRS

The Instructions For 1120S IRS include several key elements that are crucial for accurate completion:

- Filing Status: Information on determining the correct filing status for your S corporation.

- Income Reporting: Guidelines on how to report various types of income, including ordinary business income and capital gains.

- Deductions: Details on allowable deductions that can reduce taxable income, such as business expenses and losses.

- Schedules: Instructions for completing additional schedules, such as Schedule K-1, which reports income distribution to shareholders.

Filing Deadlines / Important Dates

Understanding the filing deadlines for the Instructions For 1120S IRS is essential for compliance. Generally, the due date for filing Form 1120S is the fifteenth day of the third month after the end of the corporation's tax year. For corporations operating on a calendar year, this typically falls on March 15. Extensions may be available, but they require timely submission of Form 7004.

Required Documents

To complete the Instructions For 1120S IRS, you will need several important documents:

- Financial statements, including profit and loss statements and balance sheets.

- Records of all income and expenses incurred during the tax year.

- Previous year's tax returns, if applicable.

- Any additional documentation required for specific deductions or credits.

Form Submission Methods

There are multiple methods for submitting the Instructions For 1120S IRS:

- Online: Many businesses choose to file electronically using IRS e-file services or compatible tax software.

- Mail: You can also print and mail the completed form to the appropriate IRS address, which varies based on your corporation's location.

- In-Person: While less common, some may opt to deliver their forms directly to an IRS office.

Quick guide on how to complete instructions for 1120s irs

Easily Prepare [SKS] on Any Device

Digital document management has become increasingly popular among businesses and individuals. It offers an excellent eco-conscious substitute for traditional printed and signed documents, as you can easily find the necessary form and securely store it online. airSlate SignNow provides you with all the resources you need to create, edit, and electronically sign your documents quickly without delays. Manage [SKS] on any device with the airSlate SignNow apps for Android or iOS and simplify any document-driven process today.

The Easiest Way to Edit and eSign [SKS] Effortlessly

- Find [SKS] and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Highlight important sections of your documents or redact sensitive information with tools that airSlate SignNow supplies specifically for this purpose.

- Create your signature using the Sign feature, which takes mere seconds and holds the same legal significance as a conventional wet ink signature.

- Review the information and click the Done button to save your modifications.

- Select how you wish to send your form, whether by email, text message (SMS), or invite link, or download it to your computer.

Wave goodbye to lost or misplaced files, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from a device of your choosing. Edit and eSign [SKS] and ensure exceptional communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Instructions For 1120S Irs

Create this form in 5 minutes!

How to create an eSignature for the instructions for 1120s irs

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are the basic Instructions For 1120S Irs filing?

The basic Instructions For 1120S Irs involve determining the eligibility of your S corporation, filling out Form 1120S accurately, and ensuring that all necessary schedules are included. It's crucial to report all business income and deductions properly to avoid potential penalties. For additional guidance, you can consult the IRS website or a tax professional.

-

How can airSlate SignNow assist with the Instructions For 1120S Irs?

airSlate SignNow streamlines the document signing process, making it easier to gather eSignatures on your completed Instructions For 1120S Irs. By using our platform, you can quickly send your forms to stakeholders, ensuring a smooth and efficient filing process. This enhances your productivity and reduces the time spent on paperwork.

-

Are there any hidden fees associated with signing Instructions For 1120S Irs using airSlate SignNow?

No, airSlate SignNow offers transparent pricing with no hidden fees for signing Instructions For 1120S Irs. Our pricing plans include all essential features needed to send and eSign documents, ensuring you know exactly what you're paying for. Review our pricing page for detailed information on different plans available.

-

What features does airSlate SignNow offer for managing Instructions For 1120S Irs?

airSlate SignNow provides a range of features designed to facilitate the management of Instructions For 1120S Irs, including customizable templates, automated reminders for signers, and secure cloud storage. These tools help you keep track of your documents and ensure compliance with IRS requirements. Our platform is easy to use and can save you and your team considerable time.

-

Is airSlate SignNow secure for submitting Instructions For 1120S Irs electronically?

Yes, airSlate SignNow utilizes bank-level security measures to ensure that your Instructions For 1120S Irs and other documents are safe. Our platform features encryption and secure document management to protect sensitive information throughout the signing process. You can trust us to safeguard your data while you focus on your business.

-

Can I integrate airSlate SignNow with other tools for Instructions For 1120S Irs?

Absolutely! airSlate SignNow integrates seamlessly with a variety of popular business tools, enhancing the workflow for Instructions For 1120S Irs. Whether you're using CRM software, cloud storage solutions, or project management tools, our integrations can help streamline your document management process efficiently.

-

What are the benefits of using airSlate SignNow for Instructions For 1120S Irs?

Using airSlate SignNow for Instructions For 1120S Irs provides numerous benefits, such as reduced paperwork time, improved accuracy, and enhanced collaboration among team members. Our platform is designed to make the signing process hassle-free, which ultimately helps ensure you meet filing deadlines. Enjoy a cost-effective solution that simplifies compliance and documentation.

Get more for Instructions For 1120S Irs

Find out other Instructions For 1120S Irs

- Can I Electronic signature Kentucky Residential lease contract

- Can I Electronic signature Nebraska Residential lease contract

- Electronic signature Utah New hire forms Now

- Electronic signature Texas Tenant contract Now

- How Do I Electronic signature Florida Home rental application

- Electronic signature Illinois Rental application Myself

- How Can I Electronic signature Georgia Rental lease form

- Electronic signature New York Rental lease form Safe

- Electronic signature Kentucky Standard rental application Fast

- Electronic signature Arkansas Real estate document Online

- Electronic signature Oklahoma Real estate document Mobile

- Electronic signature Louisiana Real estate forms Secure

- Electronic signature Louisiana Real estate investment proposal template Fast

- Electronic signature Maine Real estate investment proposal template Myself

- eSignature Alabama Pet Addendum to Lease Agreement Simple

- eSignature Louisiana Pet Addendum to Lease Agreement Safe

- eSignature Minnesota Pet Addendum to Lease Agreement Fast

- Electronic signature South Carolina Real estate proposal template Fast

- Electronic signature Rhode Island Real estate investment proposal template Computer

- How To Electronic signature Virginia Real estate investment proposal template