Individual Underpayment of Estimated Tax Nebraska Revenue Ne Form

Understanding the Individual Underpayment of Estimated Tax in Nebraska

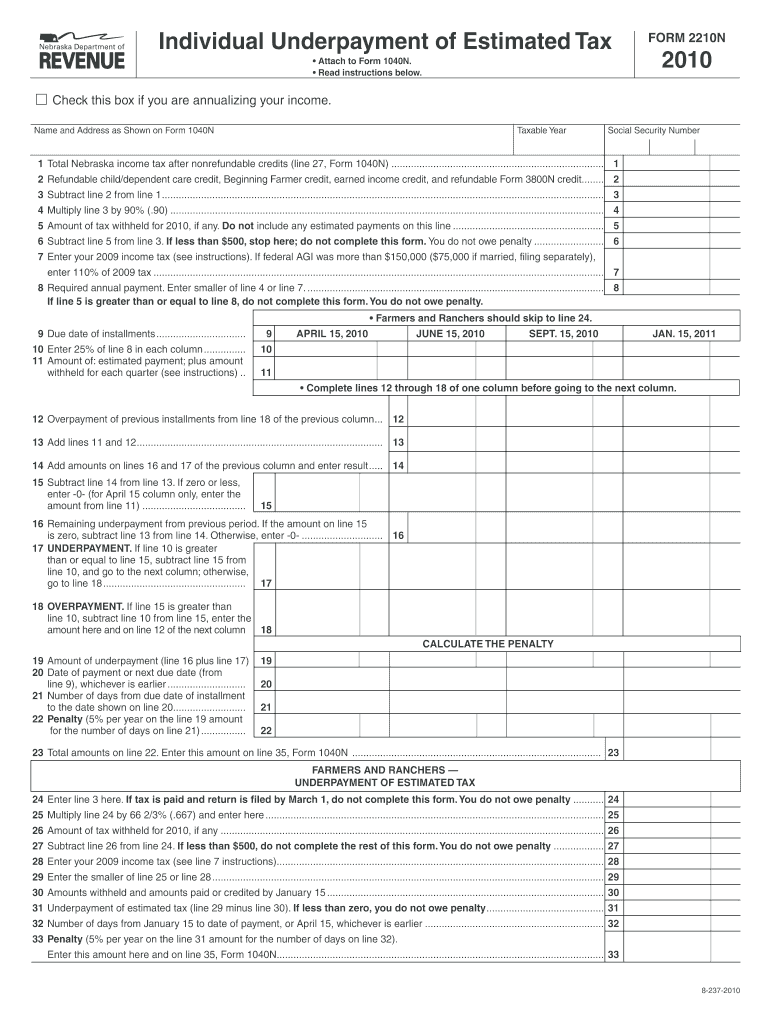

The Individual Underpayment of Estimated Tax form in Nebraska is designed for taxpayers who may not have paid enough estimated tax throughout the year. This form helps individuals calculate any underpayment penalties they might owe to the Nebraska Department of Revenue. Understanding this form is crucial for maintaining compliance with state tax laws and avoiding unnecessary penalties.

Steps to Complete the Individual Underpayment of Estimated Tax Form

Completing the Individual Underpayment of Estimated Tax form involves several key steps:

- Gather your income information, including wages, interest, and any other sources of income.

- Calculate your total tax liability for the year based on your income.

- Determine the amount of estimated tax you have already paid.

- Use the form to calculate any underpayment by comparing your total tax liability to your estimated payments.

- Complete the form accurately, ensuring all calculations are correct.

- Submit the form to the Nebraska Department of Revenue by the specified deadline.

Key Elements of the Individual Underpayment of Estimated Tax Form

This form includes several important elements that taxpayers should be aware of:

- Taxpayer identification information, including name and Social Security number.

- Calculation of total tax liability and estimated tax payments made.

- Penalties for underpayment, which are calculated based on the amount of underpayment and the duration of the underpayment period.

- Signature and date fields to validate the submission of the form.

Filing Deadlines and Important Dates

It is essential to be aware of key deadlines when dealing with the Individual Underpayment of Estimated Tax form:

- The form must typically be filed by the same deadline as your income tax return.

- Estimated tax payments are usually due quarterly, with specific due dates throughout the year.

- Late submissions may incur penalties, so timely filing is crucial.

Legal Use of the Individual Underpayment of Estimated Tax Form

This form is legally required for individuals who have not met their estimated tax payment obligations. Filing this form accurately helps taxpayers avoid legal repercussions, including fines and interest on unpaid taxes. It is important to understand the legal implications of underpayment and to use the form in accordance with Nebraska tax laws.

Examples of Using the Individual Underpayment of Estimated Tax Form

Here are a few scenarios where the Individual Underpayment of Estimated Tax form may be applicable:

- A self-employed individual who did not pay enough estimated taxes during the year.

- A retiree who receives income from investments but did not adjust their estimated tax payments accordingly.

- A student with part-time income who underestimated their tax liability and did not pay sufficient estimated taxes.

Quick guide on how to complete individual underpayment of estimated tax nebraska revenue ne

Prepare [SKS] with ease on any device

Online document management has become increasingly popular among businesses and individuals. It offers an excellent eco-friendly alternative to traditional printed and signed documents, as you can locate the appropriate form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents promptly without delays. Manage [SKS] on any platform using the airSlate SignNow Android or iOS applications and simplify any document-related task today.

The easiest way to modify and eSign [SKS] effortlessly

- Obtain [SKS] and then click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize important sections of your documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your signature using the Sign tool, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Verify all the information and then click on the Done button to save your modifications.

- Select your preferred method to deliver your form, via email, text message (SMS), or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searching, or mistakes that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from your desired device. Modify and eSign [SKS] and ensure excellent communication at any point in the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Individual Underpayment Of Estimated Tax Nebraska Revenue Ne

Create this form in 5 minutes!

How to create an eSignature for the individual underpayment of estimated tax nebraska revenue ne

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Individual Underpayment Of Estimated Tax Nebraska Revenue Ne?

The Individual Underpayment Of Estimated Tax Nebraska Revenue Ne refers to the penalties incurred by taxpayers who fail to pay enough on their estimated taxes throughout the year. Understanding this concept is crucial for Nebraska residents to manage their tax responsibilities effectively.

-

How can airSlate SignNow help with managing estimated tax payments?

airSlate SignNow provides a streamlined process for managing and signing tax documents electronically, which can aid in ensuring that all required forms related to Individual Underpayment Of Estimated Tax Nebraska Revenue Ne are submitted on time. This tool helps reduce delays and minimize the risk of incurring penalties.

-

What are the costs associated with using airSlate SignNow for tax documents?

airSlate SignNow offers an affordable pricing model that caters to various business needs, focusing on providing excellent value for managing documents related to Individual Underpayment Of Estimated Tax Nebraska Revenue Ne. Users can benefit from competitive subscription plans that ensure access to all essential features.

-

Are there any features specifically designed for tax-related documents in airSlate SignNow?

Yes, airSlate SignNow includes features tailored for tax-related documents, such as templates for common tax forms and eSignature capabilities that comply with legal standards. This can signNowly enhance the management of Individual Underpayment Of Estimated Tax Nebraska Revenue Ne paperwork.

-

Can I integrate airSlate SignNow with other software to handle tax documents?

Absolutely! airSlate SignNow offers integrations with various accounting and financial software platforms, making it easier to manage Individual Underpayment Of Estimated Tax Nebraska Revenue Ne effectively. These integrations allow for seamless data transfer and improved workflow efficiency.

-

How does using airSlate SignNow benefit businesses in handling their taxes?

Using airSlate SignNow empowers businesses to streamline their document management processes, reduce the likelihood of errors, and ensure compliance with tax regulations, including those related to Individual Underpayment Of Estimated Tax Nebraska Revenue Ne. This ultimately saves time and resources.

-

Is support available if I have questions about Individual Underpayment Of Estimated Tax Nebraska Revenue Ne?

Yes, airSlate SignNow provides customer support to help users navigate their tax queries, including issues related to Individual Underpayment Of Estimated Tax Nebraska Revenue Ne. Users can signNow out via email or chat for timely assistance.

Get more for Individual Underpayment Of Estimated Tax Nebraska Revenue Ne

Find out other Individual Underpayment Of Estimated Tax Nebraska Revenue Ne

- Electronic signature West Virginia Education Cease And Desist Letter Easy

- Electronic signature Missouri Insurance Stock Certificate Free

- Electronic signature Idaho High Tech Profit And Loss Statement Computer

- How Do I Electronic signature Nevada Insurance Executive Summary Template

- Electronic signature Wisconsin Education POA Free

- Electronic signature Wyoming Education Moving Checklist Secure

- Electronic signature North Carolina Insurance Profit And Loss Statement Secure

- Help Me With Electronic signature Oklahoma Insurance Contract

- Electronic signature Pennsylvania Insurance Letter Of Intent Later

- Electronic signature Pennsylvania Insurance Quitclaim Deed Now

- Electronic signature Maine High Tech Living Will Later

- Electronic signature Maine High Tech Quitclaim Deed Online

- Can I Electronic signature Maryland High Tech RFP

- Electronic signature Vermont Insurance Arbitration Agreement Safe

- Electronic signature Massachusetts High Tech Quitclaim Deed Fast

- Electronic signature Vermont Insurance Limited Power Of Attorney Easy

- Electronic signature Washington Insurance Last Will And Testament Later

- Electronic signature Washington Insurance Last Will And Testament Secure

- Electronic signature Wyoming Insurance LLC Operating Agreement Computer

- How To Electronic signature Missouri High Tech Lease Termination Letter