ARIZONA FORM 140 Resident Personal Income Tax Www Aztaxes Gov

What is the Arizona Form 140 Resident Personal Income Tax wwwaztaxesgov

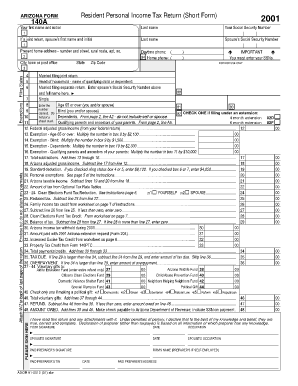

The Arizona Form 140 is the primary tax document used by residents of Arizona to report their personal income and calculate their state income tax obligations. This form is essential for individuals who earn income within the state and need to comply with Arizona tax laws. The information provided on the form helps determine the amount of tax owed or any potential refund. It includes sections for reporting various types of income, deductions, and credits available to residents.

Steps to Complete the Arizona Form 140 Resident Personal Income Tax wwwaztaxesgov

Completing the Arizona Form 140 involves several key steps to ensure accuracy and compliance:

- Gather necessary documents, including W-2s, 1099s, and any other income statements.

- Review the instructions for the form to understand the requirements and sections.

- Fill out personal information, including your name, address, and Social Security number.

- Report all sources of income as required, ensuring to include any applicable deductions.

- Calculate your tax liability based on the provided instructions and tax tables.

- Sign and date the form, confirming that the information is accurate to the best of your knowledge.

Legal Use of the Arizona Form 140 Resident Personal Income Tax wwwaztaxesgov

The Arizona Form 140 is legally binding when completed and submitted according to state regulations. To ensure its validity, it is important to comply with the Electronic Signatures in Global and National Commerce (ESIGN) Act, which recognizes electronic signatures as legally equivalent to handwritten ones. Using a trusted electronic signature solution helps maintain compliance and enhances the legal standing of the submitted form.

Filing Deadlines / Important Dates

Understanding the filing deadlines for the Arizona Form 140 is crucial for avoiding penalties. Typically, the deadline for filing your state income tax return is April 15 of the following year. However, if this date falls on a weekend or holiday, the deadline may be extended. Taxpayers can also request an extension, but it is important to note that this does not extend the time to pay any taxes owed.

Required Documents

To accurately complete the Arizona Form 140, certain documents are essential:

- W-2 forms from employers detailing annual earnings.

- 1099 forms for any freelance or contract work.

- Documentation for any other income sources, such as rental income or dividends.

- Records of deductions and credits, including receipts for medical expenses, charitable contributions, and education costs.

Form Submission Methods (Online / Mail / In-Person)

The Arizona Form 140 can be submitted through various methods to accommodate different preferences:

- Online submission through the Arizona Department of Revenue's website, which allows for faster processing.

- Mailing a paper copy of the completed form to the appropriate state address, ensuring that it is postmarked by the deadline.

- In-person submission at designated state tax offices, which may provide immediate confirmation of receipt.

Quick guide on how to complete arizona form 140 resident personal income tax www aztaxes gov

Effortlessly Prepare ARIZONA FORM 140 Resident Personal Income Tax Www aztaxes gov on Any Device

Digital document management has gained traction among businesses and individuals. It offers an excellent eco-friendly substitute for traditional printed and signed forms, allowing you to locate the appropriate template and securely store it online. airSlate SignNow provides you with all the tools necessary to create, edit, and eSign your documents swiftly without delays. Manage ARIZONA FORM 140 Resident Personal Income Tax Www aztaxes gov on any device using the airSlate SignNow Android or iOS applications and enhance any document-centric process today.

Efficiently Modify and eSign ARIZONA FORM 140 Resident Personal Income Tax Www aztaxes gov with Ease

- Obtain ARIZONA FORM 140 Resident Personal Income Tax Www aztaxes gov and then click Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Emphasize key sections of your documents or redact sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign tool, which takes seconds and has the same legal validity as a conventional ink signature.

- Review all the details and then click the Done button to save your changes.

- Select your preferred method to deliver your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate the hassles of lost or misplaced documents, tedious form searching, or mistakes requiring the printing of new copies. airSlate SignNow meets your document management needs in a few clicks from any device of your choice. Edit and eSign ARIZONA FORM 140 Resident Personal Income Tax Www aztaxes gov and ensure excellent communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the arizona form 140 resident personal income tax www aztaxes gov

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is wwwaztaxesgov and how does it relate to airSlate SignNow?

wwwaztaxesgov is a platform that many users turn to for tax-related matters. By integrating airSlate SignNow, customers can easily eSign and send necessary tax documents, ensuring compliance and functionality in their tax processes.

-

What pricing options does airSlate SignNow offer for using wwwaztaxesgov?

airSlate SignNow provides various pricing plans to cater to different business needs, including options for individuals and teams. Users can select a plan that best fits their budget while utilizing wwwaztaxesgov functionalities for streamlined document management.

-

What features does airSlate SignNow provide for wwwaztaxesgov users?

airSlate SignNow offers features such as document templates, real-time collaboration, and customizable workflows. These features are designed to enhance the efficiency of managing documents linked to wwwaztaxesgov.

-

How can airSlate SignNow benefit businesses using wwwaztaxesgov?

Businesses leveraging airSlate SignNow in conjunction with wwwaztaxesgov can enjoy faster turnaround times for document approval and eSigning. This leads to enhanced productivity and allows companies to focus more on core business activities.

-

Are there integrations available for airSlate SignNow with wwwaztaxesgov?

Yes, airSlate SignNow offers integrations with various third-party applications, making it easier to manage tax documents associated with wwwaztaxesgov. These integrations enhance workflow efficiency and ensure seamless data sharing.

-

Is it easy to get started with airSlate SignNow for wwwaztaxesgov users?

Absolutely! Getting started with airSlate SignNow is a straightforward process that doesn't require extensive training. Users can quickly set up their accounts to begin managing documents related to wwwaztaxesgov efficiently.

-

What kind of support does airSlate SignNow provide for wwwaztaxesgov users?

airSlate SignNow offers comprehensive customer support, including live chat, email assistance, and an extensive knowledge base. Users of wwwaztaxesgov can rely on this support to resolve queries related to their document processes.

Get more for ARIZONA FORM 140 Resident Personal Income Tax Www aztaxes gov

- I 016a schedule h ampamp h ez instructions wisconsin homestead credit form

- I 111 form 1 instructions wisconsin income tax form 1 instructions

- Introduction to nevada commerce tax video training series form

- Partnership forms sc department of revenue

- I 041 wisconsin form w ra required attachments for electronic filing form w ra

- Form rew 5 maine gov

- Real estate withholding return for form

- Truncated taxpayer identification numbers on forms w 2 and

Find out other ARIZONA FORM 140 Resident Personal Income Tax Www aztaxes gov

- eSignature Washington Government Arbitration Agreement Simple

- Can I eSignature Massachusetts Finance & Tax Accounting Business Plan Template

- Help Me With eSignature Massachusetts Finance & Tax Accounting Work Order

- eSignature Delaware Healthcare / Medical NDA Secure

- eSignature Florida Healthcare / Medical Rental Lease Agreement Safe

- eSignature Nebraska Finance & Tax Accounting Business Letter Template Online

- Help Me With eSignature Indiana Healthcare / Medical Notice To Quit

- eSignature New Jersey Healthcare / Medical Credit Memo Myself

- eSignature North Dakota Healthcare / Medical Medical History Simple

- Help Me With eSignature Arkansas High Tech Arbitration Agreement

- eSignature Ohio Healthcare / Medical Operating Agreement Simple

- eSignature Oregon Healthcare / Medical Limited Power Of Attorney Computer

- eSignature Pennsylvania Healthcare / Medical Warranty Deed Computer

- eSignature Texas Healthcare / Medical Bill Of Lading Simple

- eSignature Virginia Healthcare / Medical Living Will Computer

- eSignature West Virginia Healthcare / Medical Claim Free

- How To eSignature Kansas High Tech Business Plan Template

- eSignature Kansas High Tech Lease Agreement Template Online

- eSignature Alabama Insurance Forbearance Agreement Safe

- How Can I eSignature Arkansas Insurance LLC Operating Agreement