Arizona Form 290Request for Penalty AbatementTHE P

Understanding the Arizona Form 290: Request for Penalty Abatement

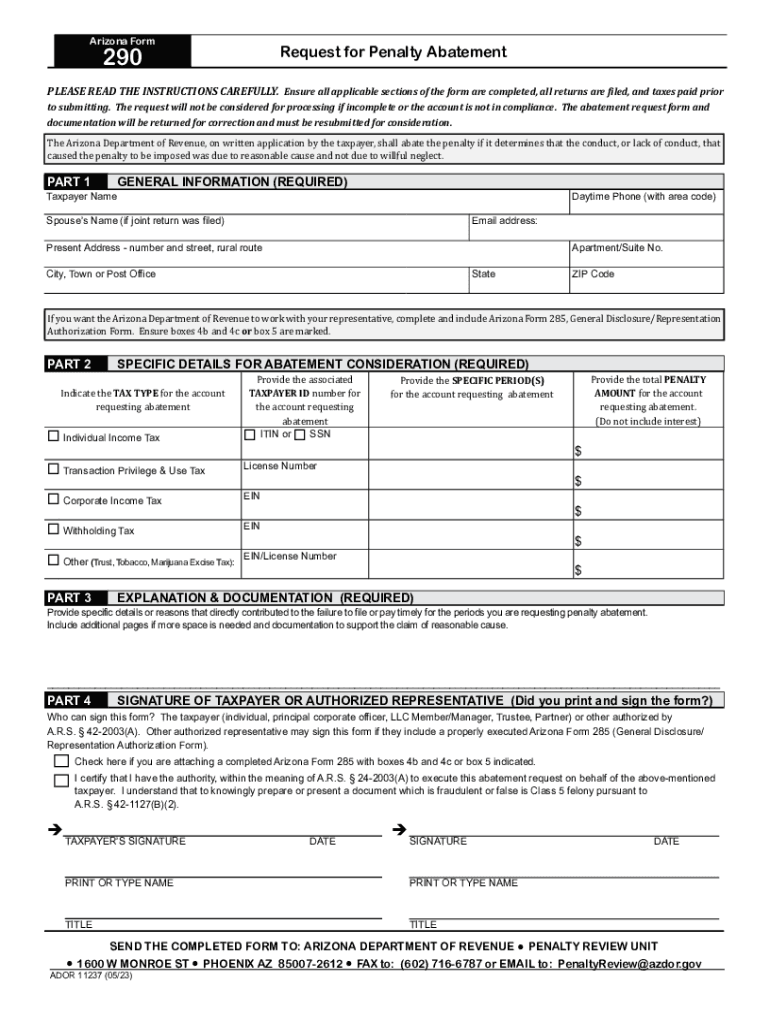

The Arizona Form 290, officially known as the Request for Penalty Abatement, is designed for taxpayers who wish to request the cancellation of penalties imposed by the Arizona Department of Revenue (ADOR). This form is particularly useful for individuals or businesses that believe they have valid reasons for not meeting tax obligations on time. Common reasons for requesting penalty abatement include circumstances such as natural disasters, serious illness, or other extenuating factors that hinder timely compliance.

Steps to Complete the Arizona Form 290

Completing the Arizona Form 290 involves several key steps to ensure accurate submission. First, gather all relevant information, including your taxpayer identification number and details about the penalties you are contesting. Next, fill out the form with precise information regarding the circumstances that led to the penalties. Be sure to include any supporting documentation that substantiates your request. After completing the form, review it for accuracy before submitting it to the appropriate ADOR office.

Eligibility Criteria for Using the Arizona Form 290

To qualify for submitting the Arizona Form 290, taxpayers must demonstrate valid reasons for their inability to meet tax obligations. Eligibility criteria typically include having a history of timely tax payments prior to the incident that caused the penalties. Additionally, taxpayers must provide evidence of circumstances beyond their control that contributed to the late payment or filing. It is essential to clearly articulate these reasons in the form to enhance the chances of approval.

Required Documents for Form 290 Submission

When submitting the Arizona Form 290, it is important to include any necessary supporting documents. This may include medical records, proof of natural disasters, or other documentation that validates your claim for penalty abatement. Providing comprehensive evidence can significantly strengthen your request and improve the likelihood of a favorable outcome. Ensure that all documents are legible and relevant to the circumstances outlined in your form.

Form Submission Methods for Arizona Form 290

Taxpayers can submit the Arizona Form 290 through various methods, including online submission, mailing, or in-person delivery. If submitting online, ensure you have access to the ADOR's e-filing system. For mail submissions, send the completed form and any supporting documents to the designated ADOR address. If you prefer to submit in person, visit your local ADOR office. Regardless of the method chosen, keep a copy of your submission for your records.

Key Elements of the Arizona Form 290

The Arizona Form 290 includes several critical elements that taxpayers must complete accurately. Key sections of the form require personal information, details about the penalties being contested, and a comprehensive explanation of the circumstances leading to the request. Additionally, taxpayers must indicate any supporting documentation being submitted. Understanding these elements is crucial for ensuring that the form is filled out correctly and completely.

Quick guide on how to complete arizona form 290request for penalty abatementthe p

Effortlessly Prepare Arizona Form 290Request For Penalty AbatementTHE P on Any Device

Managing documents online has become increasingly favored by businesses and individuals alike. It serves as an ideal eco-friendly substitute for traditional printed and signed paperwork, allowing you to obtain the necessary form and securely archive it in the cloud. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents swiftly and without delays. Handle Arizona Form 290Request For Penalty AbatementTHE P on any device using the airSlate SignNow Android or iOS applications and streamline your document-related tasks today.

The Simplest Way to Modify and eSign Arizona Form 290Request For Penalty AbatementTHE P Effortlessly

- Locate Arizona Form 290Request For Penalty AbatementTHE P and click on Get Form to initiate the process.

- Utilize the tools we provide to fill out your document.

- Emphasize important sections of the documents or redact sensitive information using tools specifically offered by airSlate SignNow for that purpose.

- Generate your eSignature with the Sign tool, which only takes moments and carries the same legal validity as a conventional handwritten signature.

- Review the details and click on the Done button to save your changes.

- Select your preferred method to send your form, whether by email, text message (SMS), invitation link, or download to your computer.

Eliminate worries about lost or mislaid documents, tedious form navigation, or mistakes requiring new copies to be printed. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Modify and eSign Arizona Form 290Request For Penalty AbatementTHE P to ensure effective communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the arizona form 290request for penalty abatementthe p

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the azdor form 290 used for?

The azdor form 290 is typically utilized for specific regulatory compliance and documentation needs. It serves as a formal request or report that can be electronically signed using airSlate SignNow, streamlining the process for businesses. By adopting this solution, companies can ensure they meet compliance standards efficiently.

-

How much does airSlate SignNow cost for using the azdor form 290?

Pricing for airSlate SignNow varies based on the plan you choose, but it remains a cost-effective solution for businesses needing to manage the azdor form 290. Monthly subscriptions start at a competitive rate, allowing organizations of all sizes to benefit from eSigning capabilities. Explore the pricing options on our website for the most accurate details.

-

What features does airSlate SignNow offer for processing the azdor form 290?

AirSlate SignNow offers a variety of features to enhance your experience with the azdor form 290, including customizable templates, real-time tracking, and automatic reminders. These features help streamline the signing process, ensuring timely completion of documents. Additionally, users benefit from a user-friendly interface that simplifies document management.

-

Can I integrate airSlate SignNow with other software to manage the azdor form 290?

Yes, airSlate SignNow supports integration with many popular applications, allowing you to manage the azdor form 290 alongside your existing workflows. Integration with platforms like Google Drive, Salesforce, and more makes document management seamless. This capability ensures that you remain efficient while handling important documents.

-

What are the benefits of using airSlate SignNow for the azdor form 290?

Using airSlate SignNow for the azdor form 290 offers numerous benefits, such as reducing paper usage and enhancing document security. The electronic signing process speeds up approvals and eliminates the hassles associated with physical signatures. Furthermore, you'll have access to audit trails that confirm document integrity and compliance.

-

Is airSlate SignNow compliant with legal standards for the azdor form 290?

Yes, airSlate SignNow complies with major legal standards, ensuring that the azdor form 290 can be signed electronically without any legal issues. Our platform adheres to laws like the ESIGN Act and UETA, ensuring that your electronically signed documents hold up in court. This compliance provides peace of mind for businesses relying on electronic signatures.

-

How do I get started with the azdor form 290 on airSlate SignNow?

Getting started with the azdor form 290 on airSlate SignNow is quick and easy. First, sign up for an account on our website, then you can create or upload your azdor form 290 template. Once that's done, you can send it out for signing and track its progress effortlessly.

Get more for Arizona Form 290Request For Penalty AbatementTHE P

- Application for disabled license plate or parking placard form

- Fidelity vehicle service contract cancellation request form

- Request for immediate threat form

- Application for lottery plate reassignment see re form

- Ais 099 approval of vehicles with regards to the protection form

- Da form 1058 r

- Dd form 3120 ampquotdod government travel charge card statement of understandingampquot

- 2523 spangdahlem air base spangdahlem af form

Find out other Arizona Form 290Request For Penalty AbatementTHE P

- How Can I eSign Wisconsin Plumbing PPT

- Can I eSign Colorado Real Estate Form

- How To eSign Florida Real Estate Form

- Can I eSign Hawaii Real Estate Word

- How Do I eSign Hawaii Real Estate Word

- How To eSign Hawaii Real Estate Document

- How Do I eSign Hawaii Real Estate Presentation

- How Can I eSign Idaho Real Estate Document

- How Do I eSign Hawaii Sports Document

- Can I eSign Hawaii Sports Presentation

- How To eSign Illinois Sports Form

- Can I eSign Illinois Sports Form

- How To eSign North Carolina Real Estate PDF

- How Can I eSign Texas Real Estate Form

- How To eSign Tennessee Real Estate Document

- How Can I eSign Wyoming Real Estate Form

- How Can I eSign Hawaii Police PDF

- Can I eSign Hawaii Police Form

- How To eSign Hawaii Police PPT

- Can I eSign Hawaii Police PPT