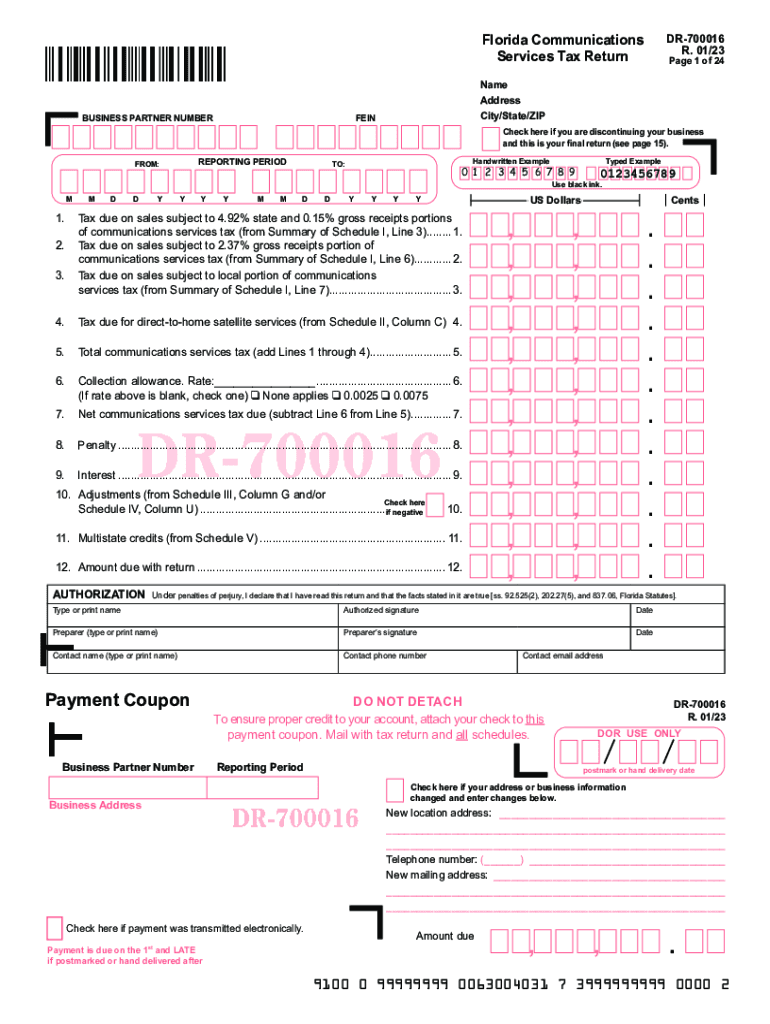

Florida Department of Revenue Communications Services Form

What is the Florida Department Of Revenue Communications Services

The Florida Department of Revenue Communications Services refers to a set of regulations and services provided by the state to manage and oversee communication-related taxes and fees. This department plays a vital role in ensuring compliance with state laws regarding the taxation of communication services, including telecommunication, cable, and satellite services. The department is responsible for collecting taxes that are imposed on these services, which are essential for funding various state programs and initiatives.

How to use the Florida Department Of Revenue Communications Services

Utilizing the Florida Department of Revenue Communications Services involves understanding the specific tax obligations associated with communication services. Businesses offering telecommunication or related services must register with the department to collect and remit the appropriate taxes. This process includes submitting necessary documentation and ensuring that all services provided are compliant with state regulations. It is crucial for businesses to stay informed about any updates or changes in tax rates or regulations to maintain compliance.

Steps to complete the Florida Department Of Revenue Communications Services

Completing the requirements for the Florida Department of Revenue Communications Services typically involves several key steps:

- Register your business with the Florida Department of Revenue to obtain a sales tax certificate.

- Determine the applicable tax rates for the communication services you provide.

- Accurately collect taxes from customers based on the services rendered.

- File tax returns regularly, detailing the collected taxes and any exemptions.

- Remit the collected taxes to the Florida Department of Revenue by the specified deadlines.

Required Documents

To effectively engage with the Florida Department of Revenue Communications Services, businesses must prepare and submit several key documents. These typically include:

- Application for a sales tax certificate, which provides the necessary business information.

- Documentation of the communication services offered, including pricing and service details.

- Records of collected taxes, which must be maintained for auditing purposes.

- Tax returns filed with the department, reflecting the business's tax obligations.

Penalties for Non-Compliance

Failure to comply with the regulations set forth by the Florida Department of Revenue Communications Services can lead to significant penalties. These may include:

- Fines for late filing or failure to file tax returns.

- Interest on unpaid taxes, which accumulates over time.

- Potential legal action against the business for continued non-compliance.

It is essential for businesses to adhere to all requirements to avoid these consequences and ensure smooth operations.

Eligibility Criteria

Eligibility to engage with the Florida Department of Revenue Communications Services typically requires businesses to meet certain criteria. These may include:

- Operating a business that provides telecommunication or related services within Florida.

- Registering with the Florida Department of Revenue to collect and remit taxes.

- Maintaining accurate records of all transactions and tax collections.

Understanding these criteria is crucial for businesses to ensure compliance and avoid penalties.

Quick guide on how to complete florida department of revenue communications services

Easily prepare Florida Department Of Revenue Communications Services on any device

Digital document management has become increasingly popular among businesses and individuals alike. It offers an ideal environmentally friendly substitute to traditional printed and signed documents, as you can find the necessary form and securely store it online. airSlate SignNow provides you with all the resources required to create, modify, and eSign your documents quickly and without interruptions. Handle Florida Department Of Revenue Communications Services on any platform using airSlate SignNow's Android or iOS applications and streamline any document-related workflow today.

The simplest way to edit and eSign Florida Department Of Revenue Communications Services effortlessly

- Obtain Florida Department Of Revenue Communications Services and then click Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Highlight important sections of your documents or cover confidential details using tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature with the Sign feature, which takes mere seconds and carries the same legal standing as a conventional wet ink signature.

- Review the information and then click on the Done button to save your changes.

- Choose how you want to send your form, whether by email, SMS, invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow manages all your document administration needs in just a few clicks from your preferred device. Modify and eSign Florida Department Of Revenue Communications Services and ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the florida department of revenue communications services

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are the key features of airSlate SignNow for Florida Department Of Revenue Communications Services?

airSlate SignNow offers a range of features tailored for the Florida Department Of Revenue Communications Services, including secure eSigning, document templates, and real-time tracking. These tools help ensure compliance while streamlining your communication processes. Additionally, you can easily manage templates to fit specific requirements of the Florida Department Of Revenue.

-

How does airSlate SignNow ensure compliance with Florida Department Of Revenue Communications Services?

airSlate SignNow is designed with compliance in mind, particularly for Florida Department Of Revenue Communications Services. Our platform adheres to electronic signature laws and provides audit trails for every transaction. You can rest assured that your documents meet regulatory standards applicable to the Florida Department Of Revenue.

-

What is the pricing structure for airSlate SignNow in relation to Florida Department Of Revenue Communications Services?

The pricing for airSlate SignNow is competitive and scalable, accommodating businesses of all sizes dealing with Florida Department Of Revenue Communications Services. We offer different plans that cater to varying needs, ensuring you only pay for the features you require. Contact us for a detailed quote tailored to your specific requirements.

-

Can airSlate SignNow integrate with other systems used for Florida Department Of Revenue Communications Services?

Yes, airSlate SignNow can integrate seamlessly with various third-party applications and systems related to Florida Department Of Revenue Communications Services. This ensures you can streamline your workflow by connecting your existing tools, enhancing productivity and efficiency in handling documents.

-

What are the benefits of using airSlate SignNow for Florida Department Of Revenue Communications Services?

Using airSlate SignNow for Florida Department Of Revenue Communications Services brings numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. This platform specifically addresses the unique needs of businesses operating in Florida, ensuring your documents are processed quickly and safely. Additionally, it supports collaboration with stakeholders across various departments.

-

How user-friendly is airSlate SignNow for clients dealing with Florida Department Of Revenue Communications Services?

airSlate SignNow is designed with user experience in mind, offering an intuitive interface for clients navigating Florida Department Of Revenue Communications Services. Whether you're sending, signing, or managing documents, the platform minimizes the learning curve, making it accessible for users of all technical backgrounds.

-

What support options are available for users of airSlate SignNow in California Department Of Revenue Communications Services?

We provide comprehensive customer support for users engaging with Florida Department Of Revenue Communications Services through airSlate SignNow. Our support team is available via chat, email, and phone to assist with any queries or concerns. Additionally, we offer an extensive knowledge base and user guides to help you get the most out of the platform.

Get more for Florida Department Of Revenue Communications Services

- Coordinator coach developmentsirc form

- Weekly accountability form

- Confidential qualification report form

- Equipment appraisal template form

- South charlotte soccer association tryout registration form

- Comdata consent form prime total rewards

- Overdraft program disclosure form

- Form 710 updated 04 12 23 1 pdf

Find out other Florida Department Of Revenue Communications Services

- eSign Hawaii Sales Receipt Template Online

- eSign Utah Sales Receipt Template Free

- eSign Alabama Sales Invoice Template Online

- eSign Vermont Escrow Agreement Easy

- How Can I eSign Wisconsin Escrow Agreement

- How To eSign Nebraska Sales Invoice Template

- eSign Nebraska Sales Invoice Template Simple

- eSign New York Sales Invoice Template Now

- eSign Pennsylvania Sales Invoice Template Computer

- eSign Virginia Sales Invoice Template Computer

- eSign Oregon Assignment of Mortgage Online

- Can I eSign Hawaii Follow-Up Letter To Customer

- Help Me With eSign Ohio Product Defect Notice

- eSign Mississippi Sponsorship Agreement Free

- eSign North Dakota Copyright License Agreement Free

- How Do I eSign Idaho Medical Records Release

- Can I eSign Alaska Advance Healthcare Directive

- eSign Kansas Client and Developer Agreement Easy

- eSign Montana Domain Name Registration Agreement Now

- eSign Nevada Affiliate Program Agreement Secure