Get FL Tourist Development Tax Owner Application Lee County Form

What is the Get FL Tourist Development Tax Owner Application Lee County

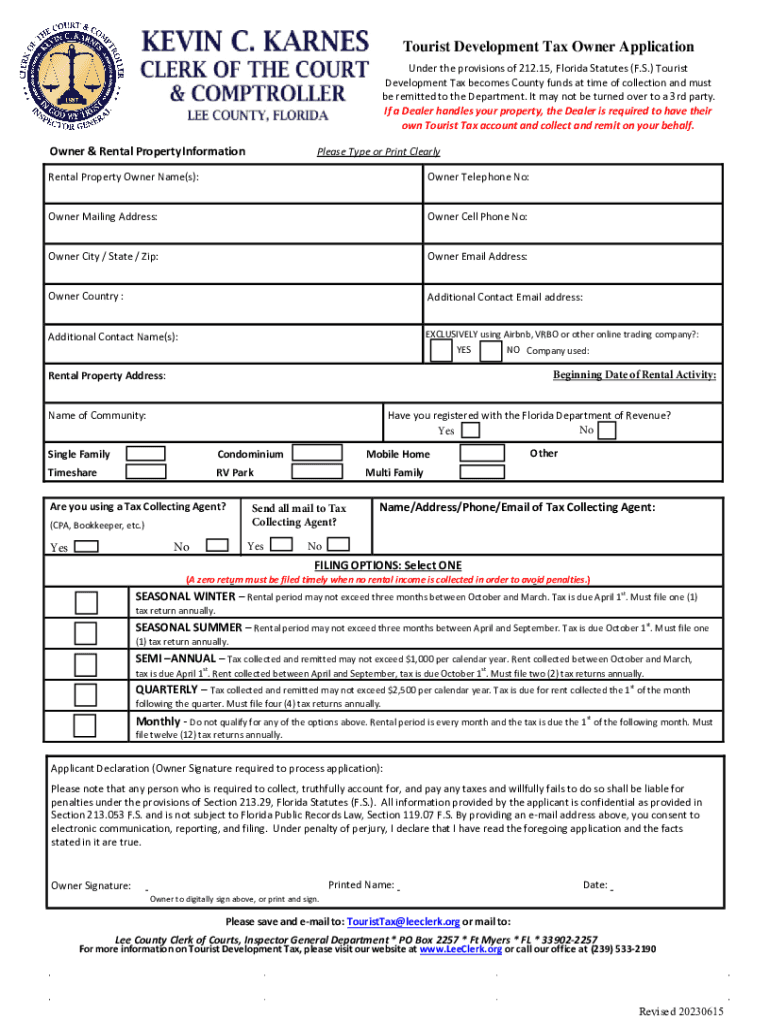

The Get FL Tourist Development Tax Owner Application for Lee County is a form that property owners must complete to apply for a tax exemption related to tourist development. This application is essential for those who rent out properties for short-term stays, as it helps establish eligibility for the tax benefits associated with the Tourist Development Tax. The tax is levied on accommodations rented for less than six months, and the application process ensures that property owners comply with local regulations while benefiting from potential tax savings.

Steps to complete the Get FL Tourist Development Tax Owner Application Lee County

Completing the Get FL Tourist Development Tax Owner Application involves several key steps:

- Gather necessary information, including property details, ownership proof, and rental history.

- Fill out the application form accurately, ensuring all required fields are completed.

- Review the application for any errors or omissions before submission.

- Submit the application through the designated method, whether online, by mail, or in person.

Following these steps carefully can help streamline the application process and avoid delays in approval.

Required Documents

To successfully complete the Get FL Tourist Development Tax Owner Application, several documents are typically required:

- Proof of property ownership, such as a deed or title.

- Tax identification number or Social Security number.

- Documentation of rental agreements or booking records.

- Any additional forms specified by the Lee County tax authority.

Having these documents ready can facilitate a smoother application process.

Eligibility Criteria

Eligibility for the Get FL Tourist Development Tax Owner Application in Lee County is generally determined by several factors:

- The property must be located within Lee County and used for short-term rentals.

- Applicants must be the legal owners of the property or have authorization from the owner.

- Compliance with local zoning laws and regulations is necessary.

Understanding these criteria is crucial for property owners to ensure they qualify for the tax benefits.

Form Submission Methods

The Get FL Tourist Development Tax Owner Application can be submitted through various methods to accommodate different preferences:

- Online submission via the official Lee County tax authority website.

- Mailing the completed form to the designated tax office address.

- In-person submission at the local tax office during business hours.

Choosing the right submission method can impact the processing time and ease of application.

Legal use of the Get FL Tourist Development Tax Owner Application Lee County

The legal use of the Get FL Tourist Development Tax Owner Application is governed by local and state laws regarding tax collection and property rental. Property owners must ensure that their application is filled out truthfully and complies with all applicable regulations. Misrepresentation or failure to adhere to the guidelines can result in penalties or denial of tax benefits. Understanding the legal implications helps property owners navigate the application process responsibly.

Quick guide on how to complete get fl tourist development tax owner application lee county

Effortlessly Complete Get FL Tourist Development Tax Owner Application Lee County on Any Gadget

The management of documents online has become increasingly favored by businesses and individuals alike. It serves as an excellent environmentally friendly substitute for traditional printed and signed documents, allowing you to locate the right template and securely archive it online. airSlate SignNow provides you with all the resources necessary to create, modify, and electronically sign your documents swiftly without delays. Handle Get FL Tourist Development Tax Owner Application Lee County on any device using airSlate SignNow’s Android or iOS applications and enhance any document-focused procedure today.

The Easiest Way to Alter and Electronically Sign Get FL Tourist Development Tax Owner Application Lee County with Ease

- Locate Get FL Tourist Development Tax Owner Application Lee County and click Obtain Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize key sections of your documents or conceal sensitive information using tools that airSlate SignNow supplies specifically for that purpose.

- Create your signature using the Sign feature, which takes mere seconds and holds the same legal significance as a conventional wet ink signature.

- Review all details and then click the Finish button to save your modifications.

- Choose your preferred method of submitting your form: via email, SMS, invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searching, or errors that necessitate reprinting new copies. airSlate SignNow takes care of all your document management needs in just a few clicks from any device you select. Modify and electronically sign Get FL Tourist Development Tax Owner Application Lee County to ensure outstanding communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the get fl tourist development tax owner application lee county

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the FL Tourist Development Tax Owner Application for Lee County?

The FL Tourist Development Tax Owner Application for Lee County is a document required for property owners in the area to apply for exemptions or benefits concerning the local tourist development tax. By using our services, you can easily get this application completed and submitted online.

-

How can I get the FL Tourist Development Tax Owner Application for Lee County?

You can get the FL Tourist Development Tax Owner Application for Lee County through our user-friendly platform. Simply register on airSlate SignNow, fill out the necessary details, and you will receive the application quickly and efficiently.

-

What are the costs associated with getting the FL Tourist Development Tax Owner Application for Lee County?

The cost to get the FL Tourist Development Tax Owner Application for Lee County through airSlate SignNow is competitive and cost-effective. We offer various pricing plans to accommodate different needs, ensuring that you can easily access this essential document without breaking the bank.

-

What features does airSlate SignNow offer for the application process?

airSlate SignNow provides features such as eSigning, document templates, and collaboration tools to streamline the process. By using our platform to get the FL Tourist Development Tax Owner Application for Lee County, you can complete your application quickly and securely.

-

Are there any benefits to using airSlate SignNow for this application?

Yes, using airSlate SignNow to get the FL Tourist Development Tax Owner Application for Lee County enables you to save time and reduce paperwork. Our platform is designed to simplify the process, allowing you to complete your application from the comfort of your home or office.

-

Can I integrate airSlate SignNow with other software for managing my applications?

Absolutely! airSlate SignNow offers seamless integrations with various tools and software solutions. By integrating our platform, you can further enhance your workflow when applying for the FL Tourist Development Tax Owner Application for Lee County.

-

Is customer support available if I have questions about the application process?

Yes, we offer comprehensive customer support for users who have questions or need assistance. If you need help getting the FL Tourist Development Tax Owner Application for Lee County, our support team is ready to assist you every step of the way.

Get more for Get FL Tourist Development Tax Owner Application Lee County

- Sample quiet title complaint 495567773 form

- Answer affirmative defenses court form

- Hastings shopwatch mg11 blank form

- Immigration reference letter sample letters ampampamp templates form

- Mobile home lot rental agreement pdf form

- Subcontractor39s requisition for payment haskell form

- Agreement lease parking space sample form

- Dirt bike bill of sale template form

Find out other Get FL Tourist Development Tax Owner Application Lee County

- How To Electronic signature Massachusetts Doctors Quitclaim Deed

- Electronic signature Minnesota Doctors Last Will And Testament Later

- How To Electronic signature Michigan Doctors LLC Operating Agreement

- How Do I Electronic signature Oregon Construction Business Plan Template

- How Do I Electronic signature Oregon Construction Living Will

- How Can I Electronic signature Oregon Construction LLC Operating Agreement

- How To Electronic signature Oregon Construction Limited Power Of Attorney

- Electronic signature Montana Doctors Last Will And Testament Safe

- Electronic signature New York Doctors Permission Slip Free

- Electronic signature South Dakota Construction Quitclaim Deed Easy

- Electronic signature Texas Construction Claim Safe

- Electronic signature Texas Construction Promissory Note Template Online

- How To Electronic signature Oregon Doctors Stock Certificate

- How To Electronic signature Pennsylvania Doctors Quitclaim Deed

- Electronic signature Utah Construction LLC Operating Agreement Computer

- Electronic signature Doctors Word South Dakota Safe

- Electronic signature South Dakota Doctors Confidentiality Agreement Myself

- How Do I Electronic signature Vermont Doctors NDA

- Electronic signature Utah Doctors Promissory Note Template Secure

- Electronic signature West Virginia Doctors Bill Of Lading Online