Arizona A1 Form

What is the Arizona A1 Form

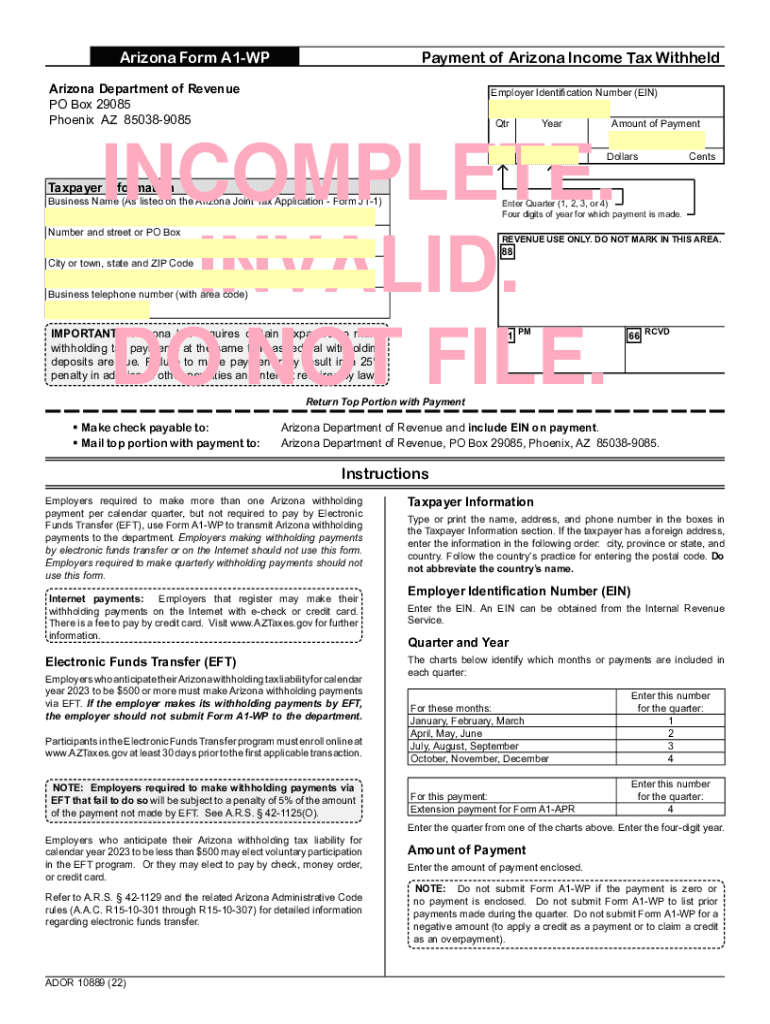

The Arizona A1 form, also known as the Arizona Form A1 WP, is a tax document used by businesses and individuals in Arizona to report income tax withholdings. This form is specifically designed for employers to report withholding on wages paid to employees. The A1 WP form is essential for ensuring compliance with Arizona state tax laws and is part of the broader tax filing requirements for individuals and entities operating within the state.

How to use the Arizona A1 Form

To use the Arizona A1 form effectively, individuals or businesses must first determine their eligibility and the specific tax obligations they need to fulfill. The form is typically filled out by employers who withhold state income tax from employee wages. Users should accurately report the total amount withheld during the tax period. It is crucial to follow the instructions provided with the form to ensure all necessary information is included, which helps in avoiding penalties or delays in processing.

Steps to complete the Arizona A1 Form

Completing the Arizona A1 form involves several key steps:

- Gather all necessary documentation, including payroll records and previous tax filings.

- Fill in the employer information, including name, address, and tax identification number.

- Report the total amount of tax withheld from employee wages for the reporting period.

- Double-check all entries for accuracy to prevent errors.

- Submit the completed form by the designated deadline, ensuring compliance with state regulations.

Legal use of the Arizona A1 Form

The Arizona A1 form is legally required for employers who withhold state income tax from their employees' wages. Proper use of this form helps ensure compliance with Arizona tax laws and regulations. Failure to file or inaccuracies in reporting can lead to penalties, including fines and increased scrutiny from tax authorities. Understanding the legal implications of the A1 WP form is essential for maintaining good standing with state tax obligations.

Filing Deadlines / Important Dates

Filing deadlines for the Arizona A1 form are crucial for compliance. Employers must submit the form according to the state’s tax calendar, which typically aligns with quarterly reporting periods. It is important to stay informed about specific deadlines to avoid late fees and penalties. Keeping track of these dates ensures that all required filings are completed on time, which is essential for maintaining compliance with Arizona tax laws.

Required Documents

When completing the Arizona A1 form, several documents may be required to ensure accurate reporting. These typically include:

- Payroll records showing wages paid and taxes withheld.

- Previous tax filings for reference.

- Employer identification number (EIN) documentation.

Having these documents ready can streamline the completion process and help prevent errors.

Form Submission Methods (Online / Mail / In-Person)

The Arizona A1 form can be submitted through various methods, providing flexibility for employers. Options typically include:

- Online submission through the Arizona Department of Revenue’s website.

- Mailing the completed form to the appropriate tax office.

- In-person submission at designated state tax offices.

Choosing the right submission method can depend on the employer’s preferences and the urgency of the filing.

Quick guide on how to complete arizona a1 form

Prepare Arizona A1 Form effortlessly on any device

Web-based document management has become increasingly popular among businesses and individuals. It serves as an ideal eco-friendly alternative to conventional printed and signed documents, as you can easily locate the necessary form and securely save it online. airSlate SignNow provides you with all the resources you need to create, edit, and electronically sign your documents swiftly without any delays. Manage Arizona A1 Form across any platform with the airSlate SignNow apps for Android or iOS and enhance any document-centric process today.

The simplest way to edit and eSign Arizona A1 Form seamlessly

- Find Arizona A1 Form and click Get Form to initiate the process.

- Utilize the tools we offer to fill out your document.

- Emphasize pertinent portions of your documents or redact sensitive information using tools specifically designed for that by airSlate SignNow.

- Create your signature with the Sign tool, which takes only seconds and carries the same legal validity as a traditional wet ink signature.

- Review all the details and click the Done button to save your modifications.

- Choose how you want to send your form—via email, text message (SMS), or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searching, or mistakes that require reprinting documents. airSlate SignNow addresses your document management needs with just a few clicks from any device you prefer. Edit and eSign Arizona A1 Form while ensuring excellent communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the arizona a1 form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is airSlate SignNow and how does it relate to a1 wp arizona?

airSlate SignNow is an innovative eSignature solution that enables businesses to send and sign documents effortlessly. In the context of a1 wp arizona, it streamlines workflows for Arizona-based transactions, allowing users to manage their documents efficiently and securely.

-

How much does airSlate SignNow cost for a1 wp arizona users?

Pricing for airSlate SignNow varies based on the selected plan, with options tailored to fit different business needs. For users searching for a1 wp arizona, there are flexible plans that provide cost-effective solutions, ensuring accessibility for businesses of all sizes.

-

What features does airSlate SignNow offer for a1 wp arizona?

airSlate SignNow offers a host of features including document templates, real-time collaboration, and secure storage. Businesses in a1 wp arizona can leverage these capabilities to enhance their document management processes and improve overall efficiency.

-

What are the benefits of using airSlate SignNow in a1 wp arizona?

Using airSlate SignNow in a1 wp arizona provides businesses with increased productivity, reduced turnaround times, and enhanced security. These benefits contribute to smoother operations and help companies stay competitive in the Arizona market.

-

Does airSlate SignNow integrate with other tools commonly used in a1 wp arizona?

Yes, airSlate SignNow integrates seamlessly with popular applications such as Google Drive, Salesforce, and Microsoft Office. This flexibility allows businesses in a1 wp arizona to streamline their workflows by connecting their essential tools effortlessly.

-

Is airSlate SignNow compliant with local regulations in a1 wp arizona?

Absolutely! airSlate SignNow is designed to comply with various legal requirements and regulations, ensuring that businesses in a1 wp arizona can use the platform confidently. This compliance helps maintain the integrity of electronic signatures within local jurisdictions.

-

Can I use airSlate SignNow for mobile signing in a1 wp arizona?

Yes, airSlate SignNow offers a robust mobile application that allows users in a1 wp arizona to sign documents on the go. This feature ensures that your signing process is convenient and accessible, regardless of your location.

Get more for Arizona A1 Form

- Contractor and subcontractor csc401 nielsen enviro form

- City of fort smith form

- Written employment and education verification bformb

- Registered tow truck operator impounded vehicle hearing request file this request with the districtmunicipal court in the form

- Subject to real estate contract template form

- Sublet room contract template form

- Sublet contract template form

- Sublett contract template form

Find out other Arizona A1 Form

- eSignature Iowa Courts Quitclaim Deed Now

- eSignature Kentucky Courts Moving Checklist Online

- eSignature Louisiana Courts Cease And Desist Letter Online

- How Can I Electronic signature Arkansas Banking Lease Termination Letter

- eSignature Maryland Courts Rental Application Now

- eSignature Michigan Courts Affidavit Of Heirship Simple

- eSignature Courts Word Mississippi Later

- eSignature Tennessee Sports Last Will And Testament Mobile

- How Can I eSignature Nevada Courts Medical History

- eSignature Nebraska Courts Lease Agreement Online

- eSignature Nebraska Courts LLC Operating Agreement Easy

- Can I eSignature New Mexico Courts Business Letter Template

- eSignature New Mexico Courts Lease Agreement Template Mobile

- eSignature Courts Word Oregon Secure

- Electronic signature Indiana Banking Contract Safe

- Electronic signature Banking Document Iowa Online

- Can I eSignature West Virginia Sports Warranty Deed

- eSignature Utah Courts Contract Safe

- Electronic signature Maine Banking Permission Slip Fast

- eSignature Wyoming Sports LLC Operating Agreement Later