*13105919999*DR 1059 072023 COLORADO DEPARTMEN Form

Understanding the Colorado DR 1059 Exemption

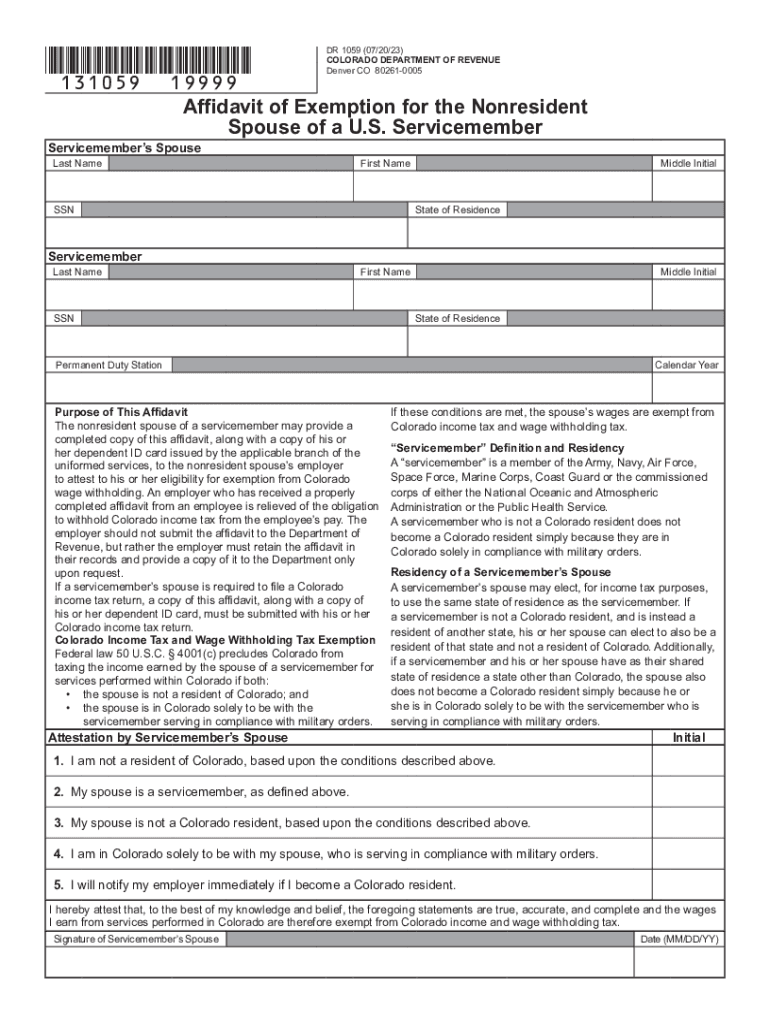

The Colorado DR 1059 exemption form is designed for servicemembers and their spouses to claim a tax exemption on certain income. This form allows eligible individuals to assert their right to exemption from Colorado state income tax based on their military status. The exemption is particularly relevant for those stationed in Colorado but whose legal residence is elsewhere. Understanding the specifics of this form can help ensure compliance and maximize tax benefits.

Eligibility Criteria for the Colorado DR 1059 Exemption

To qualify for the Colorado DR 1059 exemption, applicants must meet specific criteria. Generally, eligibility is granted to active-duty servicemembers and their spouses who are stationed in Colorado. Applicants must provide proof of military service, such as a military identification card or orders, and demonstrate that their legal residence is outside of Colorado. This exemption is crucial for avoiding unnecessary taxation on income earned while serving in the military.

Steps to Complete the Colorado DR 1059 Exemption Form

Completing the Colorado DR 1059 exemption form involves several straightforward steps:

- Gather necessary documentation, including proof of military service and residency.

- Obtain the Colorado DR 1059 form, which can be downloaded or printed from official state resources.

- Fill out the form with accurate personal details, including your name, address, and military status.

- Sign and date the form to certify the information provided is correct.

- Submit the completed form to the appropriate Colorado tax authority, either online or via mail.

Required Documents for the Colorado DR 1059 Exemption

When applying for the Colorado DR 1059 exemption, certain documents are required to support your claim. These typically include:

- A copy of military orders or a current military identification card.

- Proof of legal residence outside Colorado, such as a utility bill or lease agreement.

- Any additional documentation that may be requested by the Colorado Department of Revenue.

Form Submission Methods for the Colorado DR 1059 Exemption

The Colorado DR 1059 exemption form can be submitted through various methods to accommodate different preferences. The options include:

- Online submission via the Colorado Department of Revenue's official website.

- Mailing the completed form to the designated address provided on the form.

- In-person delivery to a local tax office, if preferred.

Legal Use of the Colorado DR 1059 Exemption

The legal framework surrounding the Colorado DR 1059 exemption is rooted in federal and state tax laws that recognize the unique circumstances of military personnel. By utilizing this exemption, servicemembers can ensure they are not unfairly taxed on income earned while serving their country. It is important to adhere to all legal requirements and maintain accurate records to support the exemption claim.

Quick guide on how to complete 13105919999dr 1059 072023 colorado departmen

Complete *13105919999*DR 1059 072023 COLORADO DEPARTMEN effortlessly on any device

Online document management has become increasingly favored by businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, as you can easily locate the correct form and securely keep it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents swiftly without any holdups. Manage *13105919999*DR 1059 072023 COLORADO DEPARTMEN on any device with the airSlate SignNow Android or iOS applications and simplify any document-related process today.

The easiest way to modify and eSign *13105919999*DR 1059 072023 COLORADO DEPARTMEN without stress

- Find *13105919999*DR 1059 072023 COLORADO DEPARTMEN and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight important sections of your documents or redact sensitive information using tools specifically designed for that purpose by airSlate SignNow.

- Create your signature with the Sign tool, which takes only seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Choose how you want to share your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate the hassle of lost or mislaid documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device of your choice. Modify and eSign *13105919999*DR 1059 072023 COLORADO DEPARTMEN and ensure excellent communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 13105919999dr 1059 072023 colorado departmen

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are the benefits of using airSlate SignNow for co spouse servicemembers?

AirSlate SignNow simplifies the document signing process for co spouse servicemembers by providing an intuitive interface and easy-to-use features. This allows servicemembers and their spouses to expedite vital documentation while enhancing compliance and security. Additionally, airSlate SignNow offers a cost-effective solution that is perfect for managing military-related paperwork.

-

How does airSlate SignNow ensure the security of documents for co spouse servicemembers?

Security is a top priority for airSlate SignNow when it comes to handling documents for co spouse servicemembers. The platform features advanced encryption and secure cloud storage to protect sensitive documents. Additionally, authentication measures ensure that only authorized individuals can access or sign the documents.

-

What pricing plans are available for co spouse servicemembers using airSlate SignNow?

AirSlate SignNow offers flexible pricing plans tailored to the needs of co spouse servicemembers, ensuring affordable access to e-signature solutions. Plans are designed for individual users as well as teams, providing scalability as requirements grow. Users will benefit from a free trial to explore features before committing to a subscription.

-

Can co spouse servicemembers integrate airSlate SignNow with other tools or platforms?

Yes, airSlate SignNow integrates seamlessly with many popular tools and platforms, making it easier for co spouse servicemembers to manage their workflow. Integrations with applications like Google Drive, Dropbox, and CRM systems streamline the document management process. This connectivity helps maintain an organized environment for all documentation tasks.

-

What features are specifically useful for co spouse servicemembers using airSlate SignNow?

Key features of airSlate SignNow that are especially beneficial for co spouse servicemembers include customizable templates, automated workflows, and mobile signing capabilities. These tools enhance efficiency in processing documents, whether at home or deployed. With airSlate SignNow, servicemembers can manage their paperwork on-the-go, ensuring timely completion.

-

How can co spouse servicemembers get started with airSlate SignNow?

Co spouse servicemembers can easily get started with airSlate SignNow by visiting the website and signing up for a free trial. The user-friendly setup process allows servicemembers to quickly upload documents and send them for e-signature. With robust support and resources, getting started is straightforward and hassle-free.

-

Does airSlate SignNow offer customer support for co spouse servicemembers?

Absolutely! AirSlate SignNow provides dedicated customer support for co spouse servicemembers through various channels, including phone, email, and live chat. The support team is knowledgeable about military specific needs and can assist with any questions regarding features or troubleshooting, ensuring a smooth user experience.

Get more for *13105919999*DR 1059 072023 COLORADO DEPARTMEN

- Massachusetts bcbs form

- New patient medical history form pdf family medical maternity

- Council on aging fitness program medical clearance form chicopeema

- Us script pbm for louisiana healthcare connections form

- Ulthera pdf form

- Income eligibility statement connecticut state department of sde ct form

- Youth program registration form stonington ct stonington ct

- Letter of support lloyd f moss clinic lloydfmossclinic form

Find out other *13105919999*DR 1059 072023 COLORADO DEPARTMEN

- Sign Wyoming Car Dealer Purchase Order Template Mobile

- Sign Arizona Charity Business Plan Template Easy

- Can I Sign Georgia Charity Warranty Deed

- How To Sign Iowa Charity LLC Operating Agreement

- Sign Kentucky Charity Quitclaim Deed Myself

- Sign Michigan Charity Rental Application Later

- How To Sign Minnesota Charity Purchase Order Template

- Sign Mississippi Charity Affidavit Of Heirship Now

- Can I Sign Nevada Charity Bill Of Lading

- How Do I Sign Nebraska Charity Limited Power Of Attorney

- Sign New Hampshire Charity Residential Lease Agreement Online

- Sign New Jersey Charity Promissory Note Template Secure

- How Do I Sign North Carolina Charity Lease Agreement Form

- How To Sign Oregon Charity Living Will

- Sign South Dakota Charity Residential Lease Agreement Simple

- Sign Vermont Charity Business Plan Template Later

- Sign Arkansas Construction Executive Summary Template Secure

- How To Sign Arkansas Construction Work Order

- Sign Colorado Construction Rental Lease Agreement Mobile

- Sign Maine Construction Business Letter Template Secure