Form ST 133CATS, Sales Tax Exemption Certificate Capital Asset

What is the Form ST 133CATS, Sales Tax Exemption Certificate Capital Asset

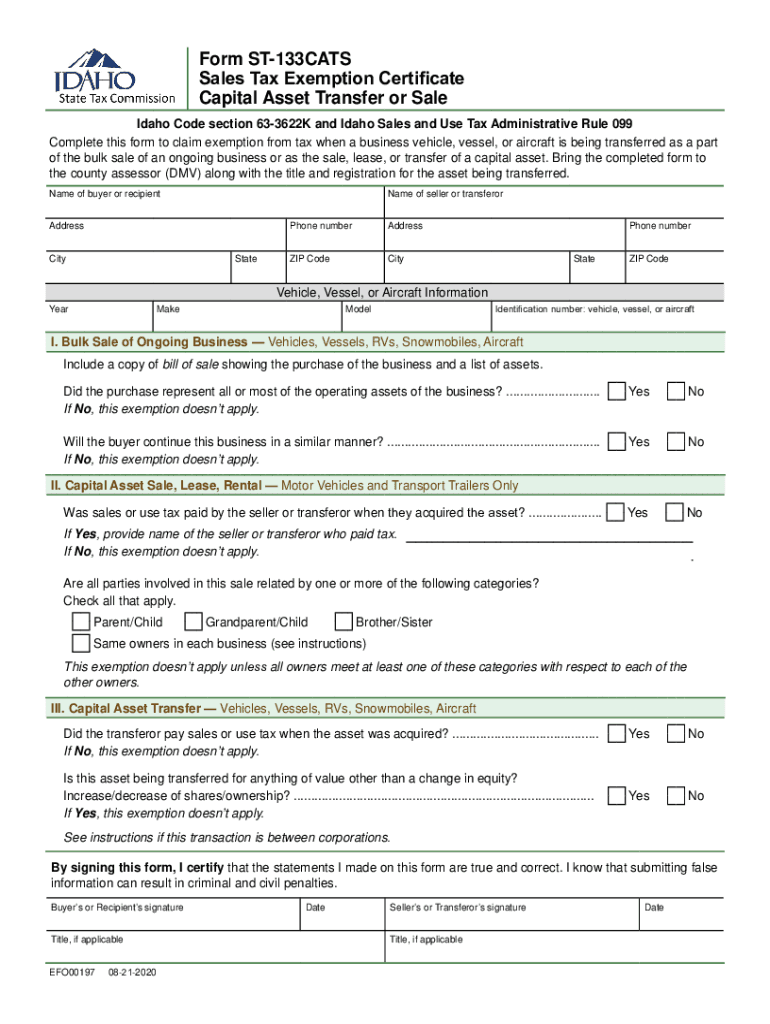

The Form ST 133CATS is a Sales Tax Exemption Certificate specifically designed for capital assets. This form allows eligible businesses to claim exemption from sales tax on purchases of capital assets, which are typically long-term investments that a business uses to produce goods or services. These assets may include equipment, machinery, and other tangible property that is essential for business operations. Understanding the purpose of this form is crucial for businesses looking to optimize their tax liabilities while remaining compliant with state tax regulations.

How to use the Form ST 133CATS, Sales Tax Exemption Certificate Capital Asset

Using the Form ST 133CATS involves several steps to ensure proper completion and submission. First, businesses must verify their eligibility for sales tax exemption based on state-specific criteria. Once eligibility is confirmed, the form should be filled out with accurate information regarding the business, including the name, address, and tax identification number. Additionally, details about the capital asset being purchased must be included, such as the description and cost. After completing the form, it should be presented to the vendor at the time of purchase to avoid sales tax charges.

Steps to complete the Form ST 133CATS, Sales Tax Exemption Certificate Capital Asset

Completing the Form ST 133CATS requires careful attention to detail. Follow these steps for accurate completion:

- Gather necessary information, including your business name, address, and tax ID number.

- Provide a detailed description of the capital asset, including its cost and purpose.

- Indicate the reason for the exemption, ensuring it aligns with state guidelines.

- Review the form for accuracy and completeness before submission.

- Sign and date the form to validate it.

Key elements of the Form ST 133CATS, Sales Tax Exemption Certificate Capital Asset

The Form ST 133CATS contains several key elements that are essential for its validity. These include:

- Business Information: Name, address, and tax identification number of the business.

- Asset Details: Description, cost, and intended use of the capital asset.

- Exemption Reason: A clear statement explaining why the exemption is applicable.

- Signature: The authorized representative of the business must sign and date the form.

Eligibility Criteria

To qualify for the exemption using the Form ST 133CATS, businesses must meet specific eligibility criteria set forth by state tax authorities. Generally, the following conditions apply:

- The business must be registered and in good standing within the state.

- The capital asset must be used directly in the production of goods or services.

- The purchase must not be for resale or personal use.

Legal use of the Form ST 133CATS, Sales Tax Exemption Certificate Capital Asset

The legal use of the Form ST 133CATS is governed by state tax laws. Businesses must ensure that they are compliant with all regulations regarding sales tax exemptions. Misuse of the form, such as claiming exemptions for ineligible purchases, can lead to penalties, including fines and back taxes. It is important for businesses to maintain accurate records of all exempt purchases and to be prepared for any audits by tax authorities.

Quick guide on how to complete form st 133cats sales tax exemption certificate capital asset

Complete Form ST 133CATS, Sales Tax Exemption Certificate Capital Asset effortlessly on any device

Digital document management has gained traction among businesses and individuals. It offers an excellent eco-friendly substitute for traditional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the tools needed to create, modify, and eSign your documents rapidly without delays. Manage Form ST 133CATS, Sales Tax Exemption Certificate Capital Asset on any device using the airSlate SignNow Android or iOS applications and enhance any document-based workflow today.

The easiest way to modify and eSign Form ST 133CATS, Sales Tax Exemption Certificate Capital Asset seamlessly

- Find Form ST 133CATS, Sales Tax Exemption Certificate Capital Asset and then click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize important sections of your documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign tool, which takes moments and carries the same legal validity as a conventional wet ink signature.

- Review all the details and then click on the Done button to save your modifications.

- Choose how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, laborious form navigation, or errors that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and eSign Form ST 133CATS, Sales Tax Exemption Certificate Capital Asset and ensure outstanding communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form st 133cats sales tax exemption certificate capital asset

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form ST 133CATS, Sales Tax Exemption Certificate Capital Asset?

Form ST 133CATS, Sales Tax Exemption Certificate Capital Asset is a document used businesses to claim exemptions from sales tax on assets that are capital in nature. This form helps streamline the purchasing process for capital assets without incurring unnecessary tax costs.

-

How can airSlate SignNow assist with the Form ST 133CATS?

airSlate SignNow simplifies the completion and submission of Form ST 133CATS, Sales Tax Exemption Certificate Capital Asset by allowing users to eSign and manage documents digitally. This eliminates the need for paper documents, reduces errors, and speeds up the approval process.

-

Is there a cost associated with using airSlate SignNow for Form ST 133CATS?

Yes, airSlate SignNow offers various pricing plans tailored to different business needs. You can choose a plan that best suits your requirements for managing Form ST 133CATS, Sales Tax Exemption Certificate Capital Asset along with other document signing needs.

-

What features does airSlate SignNow offer for managing the Form ST 133CATS?

airSlate SignNow provides features such as customizable templates, secure eSigning, document tracking, and compliance verification, specifically for Form ST 133CATS, Sales Tax Exemption Certificate Capital Asset. These features enhance user experience and ensure that your documents are handled efficiently.

-

Can I integrate airSlate SignNow with other applications when processing Form ST 133CATS?

Absolutely! airSlate SignNow offers seamless integrations with various applications and platforms, which helps streamline your workflows involving Form ST 133CATS, Sales Tax Exemption Certificate Capital Asset. This integration ensures that your document management process is cohesive and efficient.

-

What are the benefits of using airSlate SignNow for Form ST 133CATS?

Using airSlate SignNow for your Form ST 133CATS, Sales Tax Exemption Certificate Capital Asset needs offers benefits such as improved efficiency, reduced processing time, and enhanced security. Additionally, it helps minimize the risks of errors and ensures compliance with state regulations.

-

Is airSlate SignNow secure for processing Form ST 133CATS?

Yes, airSlate SignNow employs advanced security measures to protect your sensitive documents, including Form ST 133CATS, Sales Tax Exemption Certificate Capital Asset. With features like encryption and secure access, we prioritize your data protection and privacy.

Get more for Form ST 133CATS, Sales Tax Exemption Certificate Capital Asset

Find out other Form ST 133CATS, Sales Tax Exemption Certificate Capital Asset

- Electronic signature Oklahoma Government RFP Later

- Electronic signature Nebraska Finance & Tax Accounting Business Plan Template Online

- Electronic signature Utah Government Resignation Letter Online

- Electronic signature Nebraska Finance & Tax Accounting Promissory Note Template Online

- Electronic signature Utah Government Quitclaim Deed Online

- Electronic signature Utah Government POA Online

- How To Electronic signature New Jersey Education Permission Slip

- Can I Electronic signature New York Education Medical History

- Electronic signature Oklahoma Finance & Tax Accounting Quitclaim Deed Later

- How To Electronic signature Oklahoma Finance & Tax Accounting Operating Agreement

- Electronic signature Arizona Healthcare / Medical NDA Mobile

- How To Electronic signature Arizona Healthcare / Medical Warranty Deed

- Electronic signature Oregon Finance & Tax Accounting Lease Agreement Online

- Electronic signature Delaware Healthcare / Medical Limited Power Of Attorney Free

- Electronic signature Finance & Tax Accounting Word South Carolina Later

- How Do I Electronic signature Illinois Healthcare / Medical Purchase Order Template

- Electronic signature Louisiana Healthcare / Medical Quitclaim Deed Online

- Electronic signature Louisiana Healthcare / Medical Quitclaim Deed Computer

- How Do I Electronic signature Louisiana Healthcare / Medical Limited Power Of Attorney

- Electronic signature Maine Healthcare / Medical Letter Of Intent Fast