Sales or Use Tax Exemption CertificateMotor Vehicles Form

What is the Sales Or Use Tax Exemption Certificate for Motor Vehicles

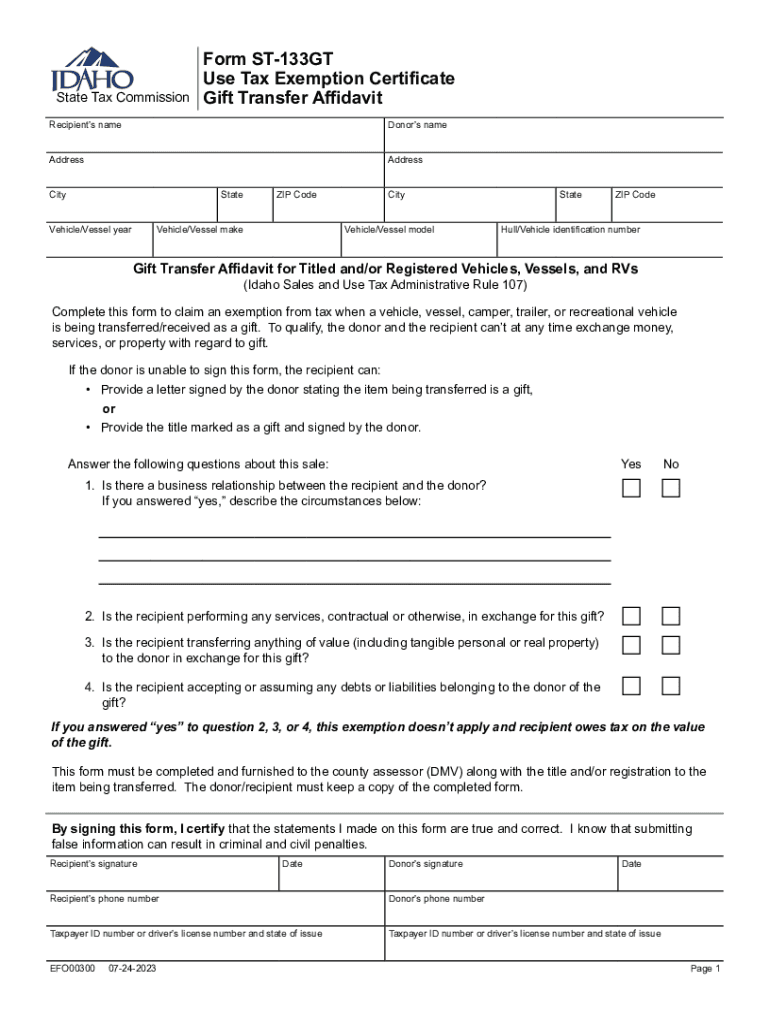

The Sales Or Use Tax Exemption Certificate for Motor Vehicles is a legal document that allows certain buyers to purchase vehicles without paying sales tax. This exemption is typically granted to specific entities, such as government agencies, non-profit organizations, or individuals who qualify under certain criteria. The form serves to verify the buyer's eligibility for the exemption and must be presented at the time of purchase.

How to Use the Sales Or Use Tax Exemption Certificate for Motor Vehicles

To use the Sales Or Use Tax Exemption Certificate for Motor Vehicles, the buyer must complete the form accurately, providing necessary details such as the buyer's name, address, and the reason for the exemption. This form should be submitted to the seller at the time of the vehicle purchase. It is essential to ensure that all information is correct to avoid any issues with tax authorities.

Steps to Complete the Sales Or Use Tax Exemption Certificate for Motor Vehicles

Completing the Sales Or Use Tax Exemption Certificate involves several key steps:

- Obtain the form from a reliable source, such as the state’s Department of Motor Vehicles (DMV) or tax authority.

- Fill in the required fields, including personal or organizational information and the reason for the exemption.

- Review the form for accuracy to ensure all information is correct.

- Sign and date the certificate before presenting it to the seller.

Eligibility Criteria for the Sales Or Use Tax Exemption Certificate for Motor Vehicles

Eligibility for the Sales Or Use Tax Exemption Certificate varies by state but generally includes criteria such as:

- Purchases made by government entities or agencies.

- Non-profit organizations that meet specific qualifications.

- Individuals who can demonstrate a valid reason for exemption, such as certain disability statuses.

It is important to check state-specific regulations to confirm eligibility requirements.

Legal Use of the Sales Or Use Tax Exemption Certificate for Motor Vehicles

The legal use of the Sales Or Use Tax Exemption Certificate is governed by state laws. Buyers must use the certificate only for eligible purchases and ensure that the information provided is truthful. Misuse of the certificate can lead to penalties, including fines or back taxes owed. Understanding the legal implications is crucial for both buyers and sellers to avoid complications.

Required Documents for the Sales Or Use Tax Exemption Certificate for Motor Vehicles

When applying for or using the Sales Or Use Tax Exemption Certificate, certain documents may be required, including:

- Proof of eligibility, such as a tax-exempt status letter for non-profits.

- Identification documents to verify the identity of the buyer.

- Any additional documentation that supports the reason for the exemption.

Having these documents ready can streamline the process and ensure compliance with state regulations.

Quick guide on how to complete sales or use tax exemption certificatemotor vehicles

Complete Sales Or Use Tax Exemption CertificateMotor Vehicles effortlessly on any device

Web-based document management has gained signNow popularity among organizations and individuals. It serves as an excellent eco-friendly alternative to conventional printed and signed documents, allowing you to locate the appropriate form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents promptly without any delays. Manage Sales Or Use Tax Exemption CertificateMotor Vehicles on any platform using airSlate SignNow's Android or iOS applications and enhance any document-driven process today.

The easiest way to modify and electronically sign Sales Or Use Tax Exemption CertificateMotor Vehicles with ease

- Locate Sales Or Use Tax Exemption CertificateMotor Vehicles and click on Get Form to begin.

- Use the tools we provide to complete your document.

- Emphasize important parts of the documents or redact confidential information with the tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Select how you wish to send your form—via email, text message (SMS), invite link, or download it to your computer.

Eliminate concerns about missing or lost documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your document management needs with just a few clicks from any device of your choice. Modify and electronically sign Sales Or Use Tax Exemption CertificateMotor Vehicles and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the sales or use tax exemption certificatemotor vehicles

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the st 133gt use in airSlate SignNow?

The st 133gt use in airSlate SignNow refers to the specific functionalities and features designed to streamline document workflows. It enables users to send, sign, and manage documents electronically, making the entire process efficient and hassle-free.

-

How does airSlate SignNow enhance the st 133gt use experience?

airSlate SignNow enhances the st 133gt use experience by offering a user-friendly interface and a variety of tools for document management. These features allow users to easily create, send, and track documents, ensuring a smooth e-signature process.

-

What are the pricing options available for st 133gt use?

airSlate SignNow offers several pricing plans tailored for different business needs, all compatible with st 133gt use. The plans range from a basic tier that includes essential features to advanced plans that offer comprehensive tools for larger organizations.

-

Can st 133gt use integrate with other applications?

Yes, st 133gt use in airSlate SignNow supports seamless integration with various applications such as CRM, project management, and cloud storage platforms. This allows businesses to streamline their workflows and improve efficiency across all processes.

-

What benefits does st 133gt use provide for businesses?

The benefits of st 133gt use include faster document turnaround times, enhanced security for sensitive information, and improved collaboration among team members. These advantages make airSlate SignNow a valuable tool for organizations aiming to optimize their document workflows.

-

Is there a mobile app for st 133gt use?

Yes, airSlate SignNow offers a mobile app that allows users to access st 133gt use on the go. This ensures that team members can send, sign, and manage documents anytime, anywhere, enhancing productivity and flexibility.

-

How secure is the st 133gt use process in airSlate SignNow?

The st 133gt use process in airSlate SignNow is designed with security in mind, featuring advanced encryption and compliance with industry standards. This ensures that all documents are protected and confidential information remains secure throughout the signing process.

Get more for Sales Or Use Tax Exemption CertificateMotor Vehicles

Find out other Sales Or Use Tax Exemption CertificateMotor Vehicles

- Sign Hawaii Orthodontists Claim Free

- Sign Nevada Plumbing Job Offer Easy

- Sign Nevada Plumbing Job Offer Safe

- Sign New Jersey Plumbing Resignation Letter Online

- Sign New York Plumbing Cease And Desist Letter Free

- Sign Alabama Real Estate Quitclaim Deed Free

- How Can I Sign Alabama Real Estate Affidavit Of Heirship

- Can I Sign Arizona Real Estate Confidentiality Agreement

- How Do I Sign Arizona Real Estate Memorandum Of Understanding

- Sign South Dakota Plumbing Job Offer Later

- Sign Tennessee Plumbing Business Letter Template Secure

- Sign South Dakota Plumbing Emergency Contact Form Later

- Sign South Dakota Plumbing Emergency Contact Form Myself

- Help Me With Sign South Dakota Plumbing Emergency Contact Form

- How To Sign Arkansas Real Estate Confidentiality Agreement

- Sign Arkansas Real Estate Promissory Note Template Free

- How Can I Sign Arkansas Real Estate Operating Agreement

- Sign Arkansas Real Estate Stock Certificate Myself

- Sign California Real Estate IOU Safe

- Sign Connecticut Real Estate Business Plan Template Simple