Idaho State Tax Exemption Policies Form

What is the Idaho State Tax Exemption Policies

The Idaho State Tax Exemption Policies provide guidelines for individuals and businesses to claim exemptions from sales tax under specific circumstances. These policies are designed to support various sectors, including agriculture, manufacturing, and certain non-profit organizations. Understanding these policies is crucial for ensuring compliance and maximizing potential savings on applicable purchases.

Eligibility Criteria

To qualify for a tax exemption in Idaho, applicants must meet specific criteria. Generally, exemptions are available for purchases related to manufacturing equipment, agricultural supplies, and certain services provided by non-profit organizations. Each exemption category has distinct requirements, so it is essential to review the guidelines thoroughly to determine eligibility.

Steps to Complete the Idaho State Tax Exemption Policies

Completing the Idaho State Tax Exemption process involves several key steps:

- Identify the appropriate exemption category based on your business or personal needs.

- Gather all required documentation to support your claim, such as proof of eligibility and purchase details.

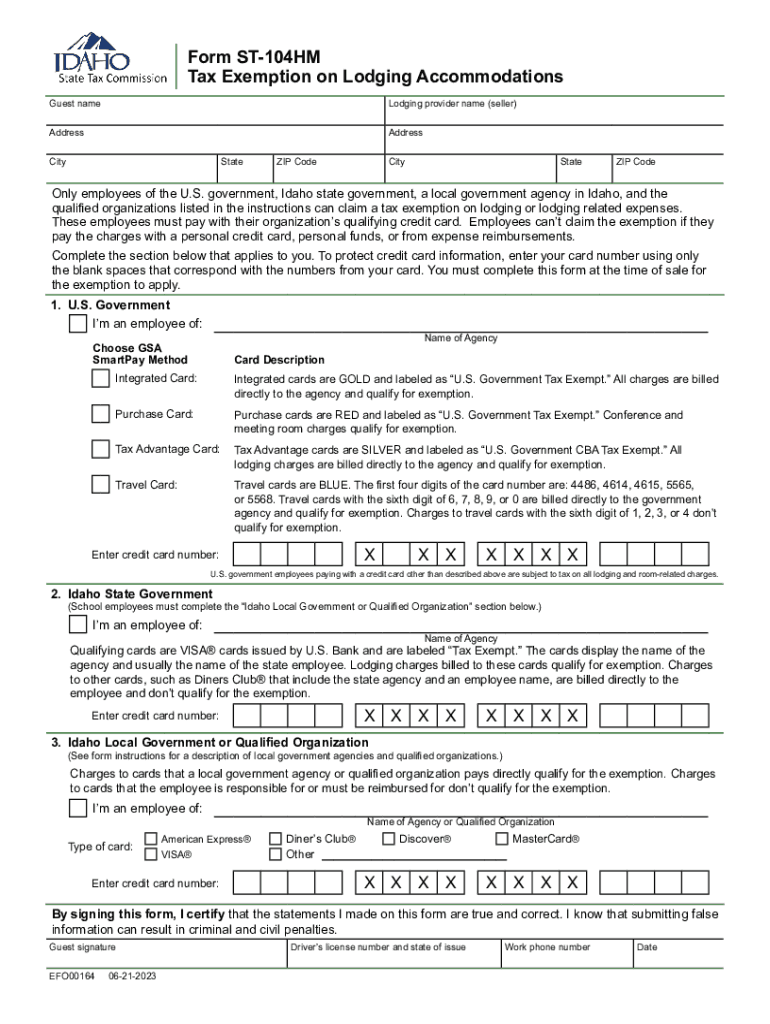

- Complete the relevant forms, including the ST-104 and any supplementary documents required for your specific exemption.

- Submit the forms through the designated channels, ensuring all information is accurate and complete.

Required Documents

When applying for an Idaho tax exemption, certain documents are necessary to substantiate your claim. These typically include:

- A completed ST-104 form, which serves as the primary exemption application.

- Supporting documentation that verifies your eligibility, such as business licenses or non-profit status.

- Invoices or receipts for purchases that you are claiming as exempt.

Form Submission Methods

Applicants can submit their exemption forms through various methods. The options include:

- Online submission via the Idaho State Tax Commission’s website, which allows for a streamlined process.

- Mailing the completed forms to the appropriate tax office, ensuring they are sent to the correct address for processing.

- In-person submission at designated tax commission offices, where individuals can receive immediate assistance.

Key Elements of the Idaho State Tax Exemption Policies

Understanding the key elements of the Idaho State Tax Exemption Policies is vital for compliance. These elements include:

- The definition of eligible items and services for tax exemption.

- The specific forms and documentation required for each exemption type.

- The timeframe for submitting exemption claims and any associated deadlines.

Quick guide on how to complete idaho state tax exemption policies

Prepare Idaho State Tax Exemption Policies easily on any device

Digital document management has become increasingly favored by businesses and individuals alike. It offers an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to access the correct form and securely save it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents quickly and efficiently. Manage Idaho State Tax Exemption Policies on any device using the airSlate SignNow Android or iOS applications and streamline your document-related processes today.

The easiest way to edit and eSign Idaho State Tax Exemption Policies effortlessly

- Obtain Idaho State Tax Exemption Policies and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize important sections of your documents or conceal sensitive information with tools offered by airSlate SignNow specifically for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review all the details and click the Done button to save your updates.

- Select your preferred method to send your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, tedious form searches, or mistakes that necessitate printing additional document copies. airSlate SignNow meets your document management requirements in just a few clicks from any device you choose. Edit and eSign Idaho State Tax Exemption Policies and ensure exceptional communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the idaho state tax exemption policies

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the pricing structure for airSlate SignNow related to Idaho lodging?

AirSlate SignNow offers flexible pricing plans that cater to different business needs, including those in the Idaho lodging sector. Our cost-effective solution ensures you get maximum value without compromising on features. Depending on the plan you choose, you can efficiently manage your document signing needs while keeping costs under control.

-

How does airSlate SignNow enhance the management of Idaho lodging contracts?

AirSlate SignNow streamlines the management of Idaho lodging contracts by allowing businesses to send, sign, and store important documents electronically. This reduces the hassle of physical paperwork and ensures that contracts are easily accessible. With features such as templates and automated workflows, managing contracts becomes seamless and efficient.

-

Can I integrate airSlate SignNow with other tools I use for Idaho lodging?

Yes, airSlate SignNow offers integrations with popular tools commonly used in the Idaho lodging industry. Whether you use property management systems, CRM, or accounting software, our platform can seamlessly integrate to enhance document workflows. This integration boosts efficiency and eliminates the need for switching between different applications.

-

What security measures are in place for airSlate SignNow users in Idaho lodging?

AirSlate SignNow prioritizes the security of your documents, especially in the Idaho lodging industry where sensitive information is often exchanged. Our platform is equipped with advanced encryption, secure cloud storage, and compliance with industry standards. This ensures that your documents remain protected throughout the signing process.

-

What benefits does airSlate SignNow offer to businesses in the Idaho lodging market?

For businesses in the Idaho lodging market, airSlate SignNow provides numerous benefits such as increased efficiency, cost savings, and improved customer satisfaction. By digitizing the document signing process, you reduce delays and enhance the guest experience. This not only benefits your operational workflow but also helps in building better client relationships.

-

How user-friendly is airSlate SignNow for those new to Idaho lodging document management?

AirSlate SignNow is designed with user-friendliness in mind, making it accessible to individuals unfamiliar with digital document management, especially in Idaho lodging. The intuitive interface guides you through the signing process, and comprehensive support resources are available. This encourages businesses to adopt electronic signing without a steep learning curve.

-

Can airSlate SignNow assist in speeding up the booking process for Idaho lodging?

Absolutely! AirSlate SignNow can signNowly speed up the booking process for Idaho lodging by enabling quick and efficient document signing. With electronic signatures, guests can sign reservation agreements and terms right from their devices, reducing wait times and enhancing overall satisfaction. This is crucial for maximizing bookings during peak seasons.

Get more for Idaho State Tax Exemption Policies

Find out other Idaho State Tax Exemption Policies

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors