Refer to the Instructions for Information About Each

Understanding the Idaho Exemption

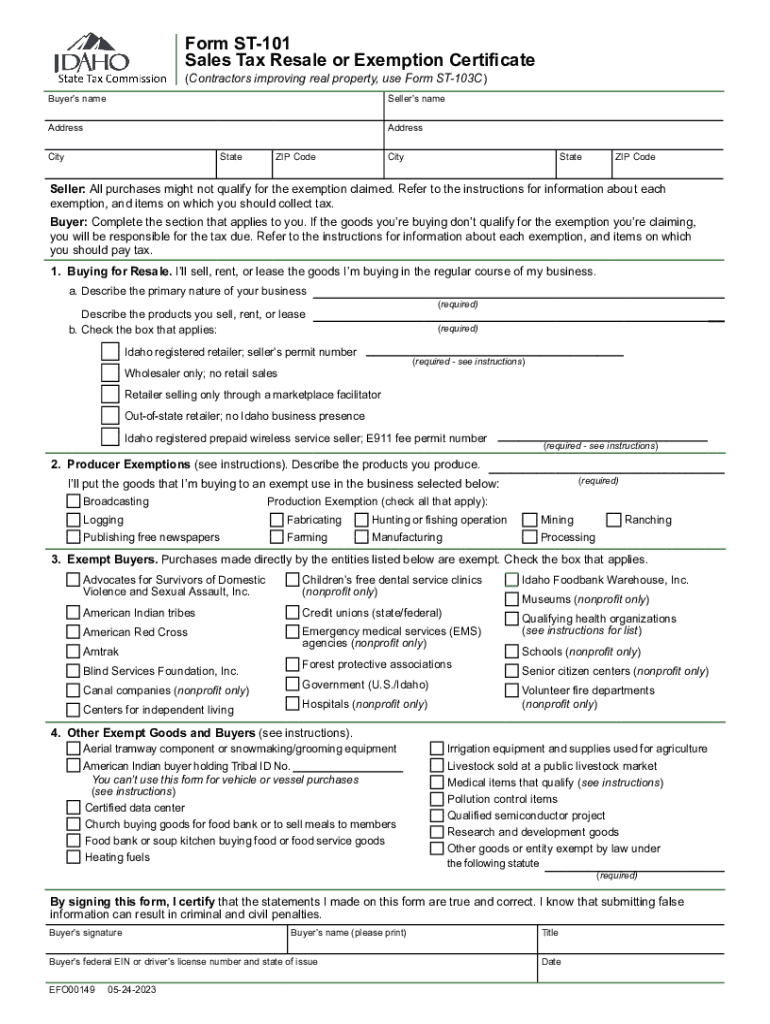

The Idaho exemption refers to a specific provision that allows certain individuals or entities to avoid paying sales tax on qualifying purchases. This exemption is particularly relevant for non-profit organizations, government entities, and specific types of sales, such as resale transactions. Understanding the criteria and eligibility for these exemptions is crucial for compliance and financial planning.

Eligibility Criteria for Idaho Exemption

To qualify for the Idaho exemption, applicants must meet specific criteria. Generally, eligible entities include:

- Non-profit organizations recognized by the IRS.

- Government agencies and instrumentalities.

- Businesses purchasing goods for resale, provided they hold a valid Idaho resale certificate.

It is essential to ensure that the purchases align with the intended use outlined in the exemption guidelines to avoid penalties.

Steps to Complete the Idaho Sales Tax Exemption Form

Filling out the Idaho sales tax exemption form, commonly known as the ST-101, involves several straightforward steps:

- Obtain the ST-101 form, which can be found on the Idaho State Tax Commission website.

- Fill in the required information, including the name and address of the purchaser and the type of exemption being claimed.

- Provide details about the items being purchased and their intended use.

- Sign and date the form to certify the accuracy of the information provided.

Ensure that all information is accurate to prevent delays or issues with the exemption claim.

Required Documents for Idaho Exemption

When applying for the Idaho exemption, certain documents may be required to support your application. These typically include:

- A completed ST-101 form.

- Proof of eligibility, such as IRS determination letters for non-profits.

- Any additional documentation that verifies the intended use of the exempted purchases.

Having these documents ready can streamline the approval process and facilitate compliance with state regulations.

Form Submission Methods

The Idaho sales tax exemption form can be submitted through various methods, including:

- Online submission via the Idaho State Tax Commission's e-file system.

- Mailing the completed form to the appropriate department.

- In-person submission at local tax commission offices.

Choosing the right submission method can depend on your preference and the urgency of your exemption request.

Legal Use of the Idaho Exemption

The legal use of the Idaho exemption is strictly governed by state tax laws. Misuse of the exemption, such as claiming it for non-qualifying purchases, can result in penalties. It is vital to understand the regulations surrounding the exemption to ensure compliance and avoid potential legal issues. Always refer to the Idaho State Tax Commission for the most current guidelines and legal requirements.

Quick guide on how to complete refer to the instructions for information about each

Effortlessly Prepare Refer To The Instructions For Information About Each on Any Device

Digital document management has become increasingly favored by businesses and individuals alike. It offers an excellent environmentally friendly substitute to conventional printed and signed paperwork, as you can obtain the correct form and securely store it online. airSlate SignNow provides all the necessary tools to create, modify, and electronically sign your documents quickly and efficiently. Manage Refer To The Instructions For Information About Each on any device with airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

The easiest method to modify and electronically sign Refer To The Instructions For Information About Each with ease

- Obtain Refer To The Instructions For Information About Each and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize key sections of your documents or redact sensitive details using tools specifically designed for that purpose by airSlate SignNow.

- Generate your eSignature using the Sign tool, which takes seconds and possesses the same legal validity as a traditional handwritten signature.

- Review all the information and click the Done button to save your modifications.

- Decide how you wish to send your form—via email, SMS, or invitation link—or download it to your computer.

Eliminate concerns over lost or misplaced files, laborious form searching, or mistakes that require printing new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device of your choice. Alter and electronically sign Refer To The Instructions For Information About Each to ensure superb communication at any stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the refer to the instructions for information about each

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Idaho exemption in relation to electronic signatures?

The Idaho exemption refers to specific legal provisions in Idaho that allow for the use of electronic signatures in various transactions. Utilizing airSlate SignNow ensures compliance with these regulations, allowing businesses to execute documents securely and efficiently.

-

How does airSlate SignNow support the Idaho exemption requirements?

airSlate SignNow provides an easy-to-use platform that meets the Idaho exemption standards by maintaining the necessary security and verification processes for electronic signatures. This ensures that all documents signed electronically are legally binding in Idaho.

-

What are the pricing options for airSlate SignNow related to Idaho exemption?

airSlate SignNow offers flexible pricing plans that cater to businesses of all sizes looking to utilize the Idaho exemption for their electronic signatures. By choosing the right plan, you can access full features to streamline your document signing process while staying compliant with Idaho regulations.

-

What features does airSlate SignNow offer for users interested in the Idaho exemption?

AirSlate SignNow provides a range of features designed to support users interested in the Idaho exemption, including customizable templates, audit trails, and cloud storage. These features enhance the signing experience and ensure documentation is managed in compliance with Idaho's legal standards.

-

What are the benefits of using airSlate SignNow for Idaho exemption documents?

Using airSlate SignNow for Idaho exemption documents brings benefits such as reduced turnaround times for signing, enhanced security measures, and improved document tracking. Businesses can save costs and increase efficiency by digitizing their signing processes while adhering to Idaho’s legal requirements.

-

Can airSlate SignNow integrate with other software for Idaho exemption processing?

Yes, airSlate SignNow seamlessly integrates with various third-party applications to enhance your workflow when processing Idaho exemption documents. This integration allows for better data management and streamlines the document preparation and signing process for users.

-

Is airSlate SignNow suitable for small businesses looking to leverage the Idaho exemption?

Absolutely! AirSlate SignNow is designed to be a cost-effective solution for small businesses seeking to leverage the Idaho exemption. Its user-friendly interface and affordable pricing make it an ideal choice for businesses of all sizes to achieve compliance with electronic signature regulations.

Get more for Refer To The Instructions For Information About Each

Find out other Refer To The Instructions For Information About Each

- eSign Maryland High Tech Claim Fast

- eSign Maine High Tech Affidavit Of Heirship Now

- eSign Michigan Government LLC Operating Agreement Online

- eSign Minnesota High Tech Rental Lease Agreement Myself

- eSign Minnesota High Tech Rental Lease Agreement Free

- eSign Michigan Healthcare / Medical Permission Slip Now

- eSign Montana High Tech Lease Agreement Online

- eSign Mississippi Government LLC Operating Agreement Easy

- eSign Ohio High Tech Letter Of Intent Later

- eSign North Dakota High Tech Quitclaim Deed Secure

- eSign Nebraska Healthcare / Medical LLC Operating Agreement Simple

- eSign Nebraska Healthcare / Medical Limited Power Of Attorney Mobile

- eSign Rhode Island High Tech Promissory Note Template Simple

- How Do I eSign South Carolina High Tech Work Order

- eSign Texas High Tech Moving Checklist Myself

- eSign Texas High Tech Moving Checklist Secure

- Help Me With eSign New Hampshire Government Job Offer

- eSign Utah High Tech Warranty Deed Simple

- eSign Wisconsin High Tech Cease And Desist Letter Fast

- eSign New York Government Emergency Contact Form Online