4924, Withholding Certificate for Michigan Pension or Annuity Payments MI W 4P Form

Understanding the 2022 MI W-4P Form

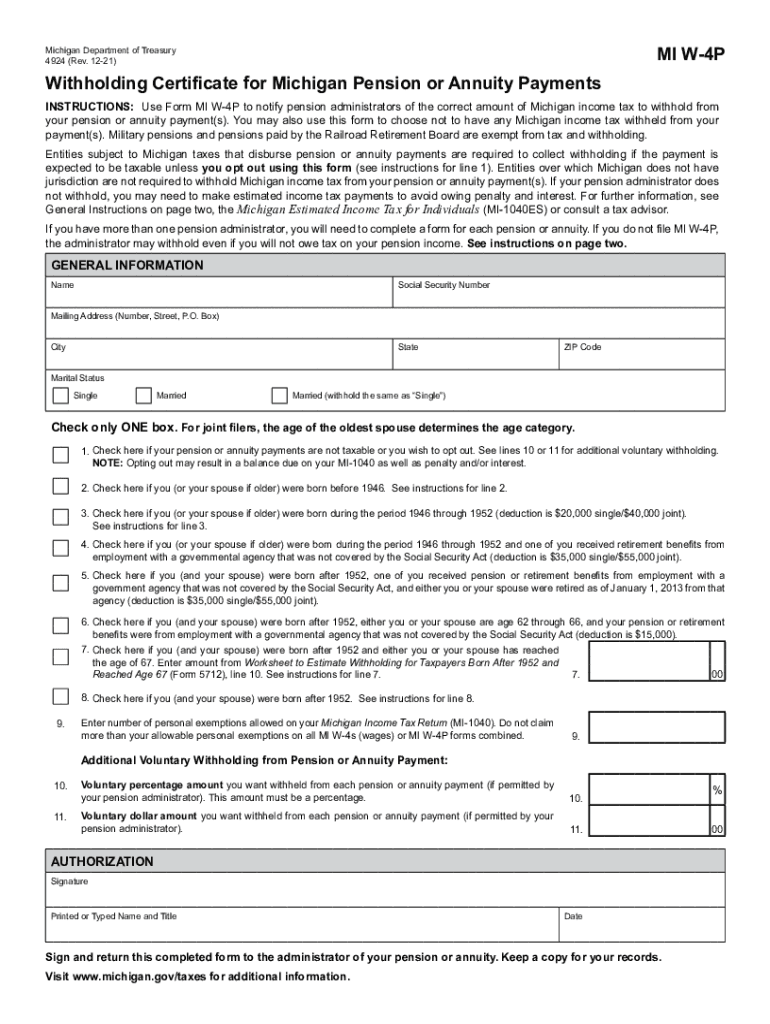

The 2022 MI W-4P form, also known as the Withholding Certificate for Michigan Pension or Annuity Payments, is essential for individuals receiving pension or annuity payments in Michigan. This form allows recipients to instruct their payers on how much state income tax to withhold from their payments. Proper completion of this form ensures that the correct amount of tax is withheld, helping to avoid underpayment penalties when filing state taxes.

Steps to Complete the 2022 MI W-4P Form

Completing the 2022 MI W-4P form involves several straightforward steps:

- Begin by entering your personal information, including your name, address, and Social Security number.

- Indicate your filing status. This can be single, married, or head of household.

- Specify the amount of withholding you desire. You can choose a specific dollar amount or allow the payer to determine the withholding based on your information.

- Sign and date the form to validate your instructions.

Ensure that all information is accurate to prevent any issues with tax withholding.

Obtaining the 2022 MI W-4P Form

The 2022 MI W-4P form can be obtained from various sources. It is available for download in PDF format from the Michigan Department of Treasury website. Additionally, many financial institutions and pension providers may provide the form directly to their clients. For those who prefer a fillable version, online platforms may offer this option, allowing for easy completion and printing.

Legal Use of the 2022 MI W-4P Form

The 2022 MI W-4P form is legally binding once completed and submitted to the payer. It is crucial for recipients of pension or annuity payments to understand that this form dictates the amount of state tax withheld from their payments. Failure to submit a properly completed form may result in excessive withholding or under-withholding, both of which can lead to complications during tax season.

Key Elements of the 2022 MI W-4P Form

Several key elements are essential to understand when filling out the 2022 MI W-4P form:

- Personal Information: Accurate details about the recipient are necessary for proper processing.

- Filing Status: This affects the withholding calculations and should reflect the recipient's current tax situation.

- Withholding Amount: Recipients can specify a dollar amount or allow the payer to determine withholding based on their tax situation.

- Signature: A valid signature is required to authenticate the form.

Examples of Using the 2022 MI W-4P Form

Consider the following scenarios where the 2022 MI W-4P form is applicable:

- A retired individual receiving monthly pension payments may use the form to adjust their withholding based on their expected tax liability.

- A person receiving annuity payments may wish to increase their withholding to avoid a tax bill at the end of the year.

- Individuals who have recently changed their filing status or income level may need to submit a new form to reflect their current situation.

Quick guide on how to complete 4924 withholding certificate for michigan pension or annuity payments mi w 4p

Effortlessly Prepare 4924, Withholding Certificate For Michigan Pension Or Annuity Payments MI W 4P on Any Device

Managing documents online has gained popularity among businesses and individuals. It offers a perfect eco-friendly substitute for conventional printed and signed paperwork, as you can obtain the necessary form and securely save it online. airSlate SignNow equips you with all the resources required to create, modify, and electronically sign your documents swiftly without delays. Manage 4924, Withholding Certificate For Michigan Pension Or Annuity Payments MI W 4P on any platform with the airSlate SignNow apps for Android or iOS and simplify any document-related tasks today.

The Easiest Way to Edit and Electronically Sign 4924, Withholding Certificate For Michigan Pension Or Annuity Payments MI W 4P with Ease

- Locate 4924, Withholding Certificate For Michigan Pension Or Annuity Payments MI W 4P and click Get Form to begin.

- Use the tools we offer to fill out your form.

- Emphasize relevant sections of your documents or redact sensitive details using tools specifically designed for this purpose by airSlate SignNow.

- Create your electronic signature with the Sign tool, which takes seconds and holds the same legal validity as a traditional wet signature.

- Review the details and click the Done button to save your changes.

- Select your preferred method to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you choose. Modify and eSign 4924, Withholding Certificate For Michigan Pension Or Annuity Payments MI W 4P to ensure seamless communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 4924 withholding certificate for michigan pension or annuity payments mi w 4p

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 2022 mi w4p form?

The 2022 mi w4p form is a Michigan state tax withholding certificate that allows employees to specify their tax withholding preferences. Completing the 2022 mi w4p ensures that your employer calculates the correct amount of state income tax to withhold from your paychecks, which can help in managing your finances effectively.

-

How can I fill out the 2022 mi w4p form using airSlate SignNow?

You can fill out the 2022 mi w4p form seamlessly with airSlate SignNow’s intuitive document editor. Simply upload the form, enter your information, and utilize our eSign feature to sign it electronically, ensuring a quick and secure process.

-

Is there a cost associated with using airSlate SignNow for the 2022 mi w4p?

airSlate SignNow offers a range of pricing plans, including a free tier for basic features. For more advanced functionalities, including the handling of forms like the 2022 mi w4p, consider our premium plans, which provide added flexibility and collaboration options.

-

What are the benefits of using airSlate SignNow for the 2022 mi w4p?

Using airSlate SignNow for the 2022 mi w4p streamlines your document signing process, reducing paperwork and enhancing efficiency. With our platform, you can track the status of your forms, collaborate with colleagues, and store essential documents securely in the cloud.

-

Can I integrate other tools with airSlate SignNow while handling the 2022 mi w4p?

Yes, airSlate SignNow offers integrations with numerous applications, enhancing your workflow management while dealing with the 2022 mi w4p. You can connect with tools like Google Drive, Zapier, and others to optimize your document processing and sharing.

-

Is it easy to correct errors on the 2022 mi w4p form in airSlate SignNow?

Absolutely! airSlate SignNow allows users to easily edit their 2022 mi w4p forms before finalizing the submission. You can make corrections, save changes, and even resend the form for electronic signatures, ensuring everything is accurate and up-to-date.

-

What security measures does airSlate SignNow implement for the 2022 mi w4p?

airSlate SignNow prioritizes your data security with features such as encryption, secure cloud storage, and multi-factor authentication. When managing sensitive documents like the 2022 mi w4p, you can trust that your information is protected against unauthorized access.

Get more for 4924, Withholding Certificate For Michigan Pension Or Annuity Payments MI W 4P

- 56 loan contract template to edit download ampamp print form

- Gifted ampamp talented nomination form alva public schools

- Maryland kinship care affidavit 402557598 form

- Sharon k harvey memorial foundation inc zeta phi beta zphib thz form

- Contact us south central iowa community foundation form

- Wichita force dance team form

- Marley cooling tower inspections checklist form marley cooling tower inspections checklist form

- Id billing number or customer id indiana state po form

Find out other 4924, Withholding Certificate For Michigan Pension Or Annuity Payments MI W 4P

- Sign Arkansas House rental lease agreement Free

- Sign Alaska Land lease agreement Computer

- How Do I Sign Texas Land lease agreement

- Sign Vermont Land lease agreement Free

- Sign Texas House rental lease Now

- How Can I Sign Arizona Lease agreement contract

- Help Me With Sign New Hampshire lease agreement

- How To Sign Kentucky Lease agreement form

- Can I Sign Michigan Lease agreement sample

- How Do I Sign Oregon Lease agreement sample

- How Can I Sign Oregon Lease agreement sample

- Can I Sign Oregon Lease agreement sample

- How To Sign West Virginia Lease agreement contract

- How Do I Sign Colorado Lease agreement template

- Sign Iowa Lease agreement template Free

- Sign Missouri Lease agreement template Later

- Sign West Virginia Lease agreement template Computer

- Sign Nevada Lease template Myself

- Sign North Carolina Loan agreement Simple

- Sign Maryland Month to month lease agreement Fast