Form RP 420 Ab Rnw 1 Renewal Application for Real Property Tax 2008

What is the Form RP 420 ab Rnw 1 Renewal Application For Real Property Tax

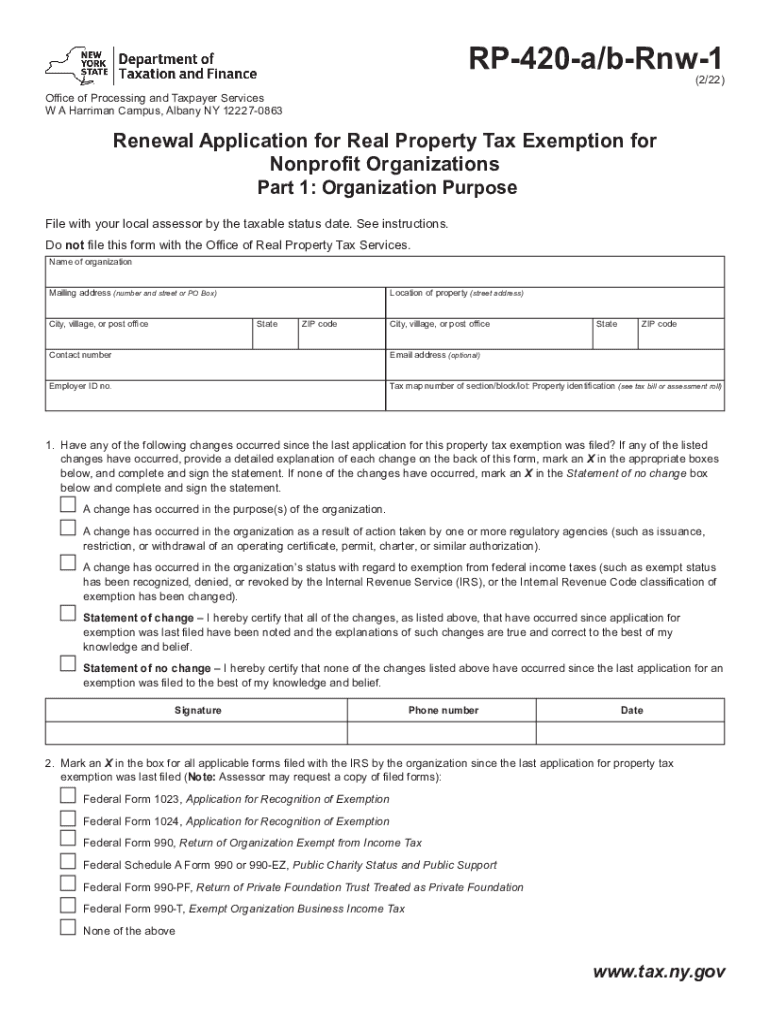

The Form RP 420 ab Rnw 1 is a renewal application specifically designed for real property tax exemptions in the United States. This form allows property owners to apply for continued eligibility for tax benefits associated with their properties. Typically, it is used by individuals or entities that have previously qualified for certain exemptions and wish to maintain those benefits. The form gathers essential information about the property and the owner to ensure compliance with state and local tax regulations.

Steps to complete the Form RP 420 ab Rnw 1 Renewal Application For Real Property Tax

Completing the Form RP 420 ab Rnw 1 involves several key steps to ensure accuracy and compliance. First, gather all necessary documentation, including proof of ownership and previous exemption approvals. Next, fill out the form with accurate details regarding the property, including its address, type, and any relevant tax identification numbers. It is crucial to review the form for completeness and correctness before submission. Finally, submit the completed form to the appropriate local tax authority by the specified deadline.

Eligibility Criteria

To qualify for the benefits associated with the Form RP 420 ab Rnw 1, applicants must meet specific eligibility criteria. Generally, the property must be used for qualifying purposes, such as residential or agricultural use. Additionally, the owner must demonstrate continued ownership and occupancy of the property. Each state may have unique requirements, so it is important for applicants to review local regulations to ensure they meet all necessary conditions for renewal.

Required Documents

When completing the Form RP 420 ab Rnw 1, applicants must provide several supporting documents. These typically include proof of ownership, such as a deed or title, and any previous exemption letters issued by the tax authority. Additional documentation may be required to verify the property's use and the owner's eligibility. It is advisable to check with local tax offices for a comprehensive list of required documents to avoid delays in processing the application.

Filing Deadlines / Important Dates

Filing deadlines for the Form RP 420 ab Rnw 1 vary by state and local jurisdiction. Generally, property owners must submit their renewal applications by a specific date each year to maintain their tax exemptions. Missing the deadline can result in the loss of benefits for that tax year. It is essential for applicants to be aware of these dates and plan accordingly to ensure timely submission.

Form Submission Methods

The Form RP 420 ab Rnw 1 can typically be submitted through various methods, depending on local regulations. Common submission options include online filing through the local tax authority's website, mailing a physical copy of the form, or delivering it in person to the appropriate office. Each method may have specific instructions, so it is important to follow the guidelines provided by the local tax authority for the chosen submission method.

Quick guide on how to complete form rp 420 ab rnw 1 renewal application for real property tax

Easily Manage Form RP 420 ab Rnw 1 Renewal Application For Real Property Tax on Any Device

Digital document management has gained signNow traction among businesses and individuals. It offers an ideal environmentally friendly alternative to conventional printed and signed paperwork, allowing you to locate the necessary form and securely save it online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents quickly without delays. Handle Form RP 420 ab Rnw 1 Renewal Application For Real Property Tax on any device using the airSlate SignNow Android or iOS applications and enhance any document-related process today.

Effortlessly Modify and Electronically Sign Form RP 420 ab Rnw 1 Renewal Application For Real Property Tax

- Obtain Form RP 420 ab Rnw 1 Renewal Application For Real Property Tax and then click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize important sections of the documents or redact sensitive information with the tools that airSlate SignNow provides specifically for this purpose.

- Create your signature using the Sign feature, which takes seconds and holds the same legal validity as a traditional wet ink signature.

- Review the details and then click on the Done button to save your changes.

- Choose how you wish to share your form—via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from your preferred device. Change and electronically sign Form RP 420 ab Rnw 1 Renewal Application For Real Property Tax and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form rp 420 ab rnw 1 renewal application for real property tax

Create this form in 5 minutes!

How to create an eSignature for the form rp 420 ab rnw 1 renewal application for real property tax

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Form RP 420 ab Rnw 1 Renewal Application For Real Property Tax?

The Form RP 420 ab Rnw 1 Renewal Application For Real Property Tax is a document required for renewing property tax exemptions in New York. Completing this form accurately is essential to maintain your property tax benefits. With airSlate SignNow, you can easily prepare and submit the form.

-

How can airSlate SignNow help with the Form RP 420 ab Rnw 1 Renewal Application For Real Property Tax?

airSlate SignNow offers an easy-to-use platform that simplifies the process of filling out and eSigning the Form RP 420 ab Rnw 1 Renewal Application For Real Property Tax. You can ensure that all necessary information is included and that the form is submitted on time, which helps you avoid any tax penalties.

-

Is there a cost associated with using airSlate SignNow for the Form RP 420 ab Rnw 1 Renewal Application For Real Property Tax?

Yes, airSlate SignNow provides various pricing plans tailored to meet the needs of different users. However, the cost is quite competitive considering the ease and efficiency it brings to completing the Form RP 420 ab Rnw 1 Renewal Application For Real Property Tax, which can save you time and reduce stress.

-

What features does airSlate SignNow offer for the Form RP 420 ab Rnw 1 Renewal Application For Real Property Tax?

airSlate SignNow includes features such as document templates, eSignature capabilities, and real-time collaboration tools. These tools make it easier to manage the Form RP 420 ab Rnw 1 Renewal Application For Real Property Tax, ensuring that everyone involved has access to the necessary documents and can contribute efficiently.

-

Can I integrate airSlate SignNow with other applications for the Form RP 420 ab Rnw 1 Renewal Application For Real Property Tax?

Yes, airSlate SignNow offers integrations with various productivity and document management applications. This allows for a seamless workflow when completing the Form RP 420 ab Rnw 1 Renewal Application For Real Property Tax, as you can easily sync your documents and data across platforms.

-

How secure is my information when using airSlate SignNow to complete the Form RP 420 ab Rnw 1 Renewal Application For Real Property Tax?

Security is a top priority at airSlate SignNow. The platform employs advanced encryption methods to protect your data while you complete the Form RP 420 ab Rnw 1 Renewal Application For Real Property Tax. Additionally, access controls ensure that only authorized individuals can view or edit your documents.

-

What are the benefits of using airSlate SignNow for the Form RP 420 ab Rnw 1 Renewal Application For Real Property Tax?

Using airSlate SignNow to complete the Form RP 420 ab Rnw 1 Renewal Application For Real Property Tax offers convenience, time savings, and reduced paperwork. The platform's user-friendly interface and efficient eSignature process mean you can focus on other important tasks while ensuring your application is submitted correctly and on time.

Get more for Form RP 420 ab Rnw 1 Renewal Application For Real Property Tax

- Combat casualty assessment sheet form

- Medical informed consent for performance of procedure and tamc amedd army

- 200th mp hhc in out processing checklist pdf u s army reserve usar army form

- Instructions for nato security clearance certifica form

- Dental assistant application 249601486 form

- Military pay order no military pay orderthis info form

- 009 74 fy 24 navsea standard item fy 24 item no form

- Transition center checklist u s army garrisons form

Find out other Form RP 420 ab Rnw 1 Renewal Application For Real Property Tax

- Help Me With Electronic signature Nevada Police Living Will

- Electronic signature Real Estate Document Utah Safe

- Electronic signature Oregon Police Living Will Now

- Electronic signature Pennsylvania Police Executive Summary Template Free

- Electronic signature Pennsylvania Police Forbearance Agreement Fast

- How Do I Electronic signature Pennsylvania Police Forbearance Agreement

- How Can I Electronic signature Pennsylvania Police Forbearance Agreement

- Electronic signature Washington Real Estate Purchase Order Template Mobile

- Electronic signature West Virginia Real Estate Last Will And Testament Online

- Electronic signature Texas Police Lease Termination Letter Safe

- How To Electronic signature Texas Police Stock Certificate

- How Can I Electronic signature Wyoming Real Estate Quitclaim Deed

- Electronic signature Virginia Police Quitclaim Deed Secure

- How Can I Electronic signature West Virginia Police Letter Of Intent

- How Do I Electronic signature Washington Police Promissory Note Template

- Electronic signature Wisconsin Police Permission Slip Free

- Electronic signature Minnesota Sports Limited Power Of Attorney Fast

- Electronic signature Alabama Courts Quitclaim Deed Safe

- How To Electronic signature Alabama Courts Stock Certificate

- Can I Electronic signature Arkansas Courts Operating Agreement